How To Add Tax To A Price

Taxation is an integral part of any business, and understanding how to calculate and add tax correctly is crucial for accurate pricing and compliance with legal regulations. This comprehensive guide will walk you through the process of adding tax to a price, covering the fundamentals and providing practical insights to ensure you get it right every time.

Understanding Tax Rates and Types

Before delving into the calculation process, it’s essential to grasp the different tax rates and types that may apply to your business. Tax rates can vary significantly depending on the jurisdiction, industry, and the nature of the product or service being sold. Here’s a breakdown of the key tax types you may encounter:

Sales Tax

Sales tax is a common type of tax levied on the sale of goods and services. It is typically calculated as a percentage of the purchase price and is collected by the seller at the point of sale. Sales tax rates can vary widely, from a few percent to over 10%, and they may be applied at different stages of the supply chain.

Value Added Tax (VAT)

VAT is a consumption tax that is added to the cost of a product or service at each stage of production or distribution. It is a common tax system used in many countries, especially in the European Union. VAT rates can vary, and businesses may be required to register for VAT if their turnover exceeds a certain threshold.

Excise Tax

Excise tax is a type of tax imposed on specific goods, such as alcohol, tobacco, fuel, and certain luxury items. It is often calculated as a fixed amount per unit or as a percentage of the price. Excise taxes are typically included in the final price of the product.

Customs Duty

Customs duty, or import tax, is applicable when goods are imported into a country. The tax rate can vary based on the type of goods, their origin, and the quantity imported. Customs duty is usually calculated as a percentage of the value of the goods, and it is the responsibility of the importer to pay this tax.

| Tax Type | Description |

|---|---|

| Sales Tax | Levied on sales, calculated as a percentage of the purchase price. |

| Value Added Tax (VAT) | Added at each stage of production/distribution, calculated as a percentage of the value added. |

| Excise Tax | Imposed on specific goods, calculated as a fixed amount or percentage. |

| Customs Duty | Applicable for imported goods, calculated as a percentage of the value of the goods. |

Calculating Tax: Step-by-Step Guide

Now that we’ve covered the different tax types, let’s dive into the process of calculating and adding tax to a price. Here’s a step-by-step guide to ensure accuracy:

Step 1: Identify Applicable Taxes

The first step is to determine which taxes apply to your business and the specific transaction. This may involve researching local tax laws, consulting with tax professionals, or using tax rate databases. Make sure to consider all relevant taxes, such as sales tax, VAT, or excise tax, based on your location and the nature of your business.

Step 2: Obtain Tax Rates

Once you’ve identified the applicable taxes, the next step is to obtain the current tax rates. Tax rates can change periodically, so it’s essential to stay updated. You can find tax rate information on government websites, tax authority portals, or through tax calculation tools and software.

Step 3: Calculate the Tax Amount

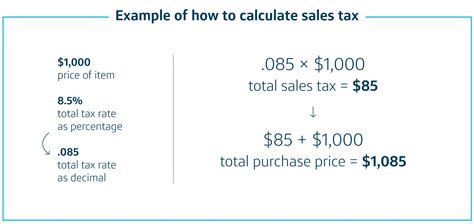

With the tax rates in hand, you can now calculate the tax amount. The calculation process will depend on the type of tax. For sales tax and excise tax, you can calculate the tax as a percentage of the price. For VAT, the calculation is based on the value added at each stage. Here’s a simple formula for calculating tax:

Tax Amount = Base Price * Tax Rate

For example, if you're selling a product with a base price of $100 and the applicable sales tax rate is 8%, the tax amount would be:

Tax Amount = $100 * 0.08 = $8

Step 4: Add the Tax to the Price

After calculating the tax amount, it’s time to add it to the base price to determine the final price inclusive of tax. Simply sum up the base price and the tax amount to get the total price. In our example, the final price would be:

Final Price = Base Price + Tax Amount = $100 + $8 = $108

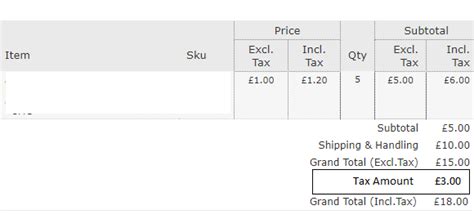

Step 5: Displaying the Tax Information

Transparency is crucial when it comes to tax information. Clearly display the tax amount and the applicable tax rate on the receipt or invoice provided to the customer. This ensures that customers understand the breakdown of the final price and helps build trust and compliance.

Step 6: Handling Rounding and Precision

When calculating tax amounts, it’s important to consider rounding rules and precision. Depending on the jurisdiction, there may be specific guidelines for rounding tax amounts. For instance, some jurisdictions require rounding to the nearest whole cent or penny. Ensure that your tax calculation and rounding processes align with local regulations to avoid any discrepancies.

Advanced Tax Considerations

While the basic tax calculation process is straightforward, there are some advanced considerations to keep in mind, especially for businesses operating in multiple jurisdictions or dealing with complex tax structures.

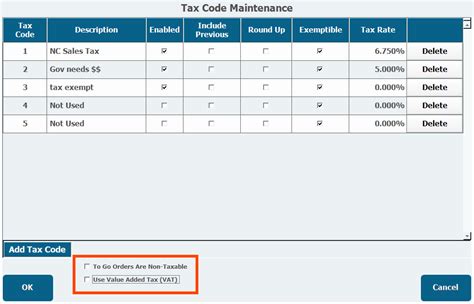

Tax Exemptions and Discounts

Tax exemptions and discounts can apply to certain products, services, or customer groups. For example, some countries offer VAT exemptions for specific industries or charitable organizations. It’s crucial to stay informed about any tax exemptions or discounts that may apply to your business and ensure that you correctly apply them when calculating tax.

Multi-Jurisdictional Tax

If your business operates in multiple locations with different tax rates, you’ll need to handle multi-jurisdictional tax calculations. This can become complex, especially when dealing with cross-border transactions. Ensure that you understand the tax regulations in each jurisdiction and calculate tax accordingly. Consider using tax calculation tools that can handle multi-jurisdictional scenarios to simplify the process.

Tax Reporting and Compliance

Accurate tax calculation is just the first step. You must also ensure that you properly report and remit the collected taxes to the relevant tax authorities. Stay updated with tax reporting deadlines and requirements, and maintain accurate records of tax transactions. Non-compliance can lead to significant penalties and legal issues, so it’s essential to maintain a robust tax reporting system.

VAT Registration and Thresholds

In many countries, businesses must register for VAT if their turnover exceeds a certain threshold. This registration process is crucial for compliance with VAT regulations. Once registered, you’ll need to charge VAT on your sales and file periodic VAT returns. Stay informed about the VAT registration process and thresholds to ensure timely registration and compliance.

Conclusion: The Importance of Accurate Tax Calculation

Adding tax to a price may seem like a simple task, but it’s a critical aspect of any business, especially when it comes to compliance and maintaining a positive relationship with customers. By understanding the different tax types, rates, and calculation methods, you can ensure accurate pricing and avoid legal pitfalls.

Remember, tax laws can be complex and subject to frequent changes. Stay informed, consult with tax professionals when needed, and utilize reliable tax calculation tools to stay on top of your tax obligations. Accurate tax calculation not only ensures compliance but also enhances your business's reputation and trustworthiness.

How often should I update my tax rates?

+Tax rates can change periodically, so it’s essential to stay updated. Check for tax rate changes at least once a year, and more frequently if you operate in an industry or location with frequent tax adjustments. Setting up alerts or subscribing to tax rate update services can help you stay informed.

Can I round tax amounts to the nearest whole number?

+Rounding rules vary by jurisdiction. Some countries require rounding to the nearest whole unit (e.g., penny, cent), while others may allow rounding to the nearest whole number. Always check the local regulations to ensure compliance with rounding rules.

What happens if I undercharge or overcharge tax by mistake?

+Mistakes can happen, but it’s important to correct them promptly. If you discover an undercharge, you may need to issue a credit or refund to the customer, and if you’ve overcharged, you should issue a refund or credit. Ensure you maintain accurate records to facilitate these corrections.

Are there any tax calculation tools or software that can help?

+Yes, there are various tax calculation tools and software available to simplify the process. These tools can handle complex tax scenarios, multiple jurisdictions, and compliance requirements. Some popular options include [Tool 1], [Tool 2], and [Tool 3]. Consider your business needs and budget when selecting a tool.