Used Tesla Tax Credit

The Tesla Tax Credit has been a significant driver in the adoption of electric vehicles (EVs) and a key incentive for consumers to make the switch to sustainable transportation. This article aims to delve into the specifics of the Tesla Tax Credit, exploring its history, eligibility criteria, benefits, and the impact it has had on the electric vehicle market.

Understanding the Tesla Tax Credit

The Tesla Tax Credit, officially known as the Federal Electric Vehicle Tax Credit, is a financial incentive offered by the United States government to encourage the purchase of electric vehicles. It was introduced as part of the Energy Policy Act of 2005 and has since become a crucial component of the country’s efforts to reduce carbon emissions and promote a greener transportation system.

For Tesla, the tax credit has been instrumental in its success, allowing the company to offer its innovative electric cars at more competitive prices and attract a wider range of consumers. The credit is a direct reduction in federal taxes owed by the purchaser of a qualifying electric vehicle, making it an appealing financial benefit for those considering an EV purchase.

Eligibility and Requirements

The Tesla Tax Credit is available to individual taxpayers who purchase a new Tesla electric vehicle. To be eligible, the vehicle must meet certain criteria set by the Internal Revenue Service (IRS). These criteria include:

- Vehicle Type: Only new electric vehicles are eligible. Used vehicles or those with a substantial battery capacity upgrade do not qualify.

- Battery Capacity: The Tesla model must have a battery capacity of at least 5 kWh. Most Tesla models, such as the Model S, Model X, Model 3, and Model Y, easily meet this requirement.

- Purchase or Lease: Both buyers and lessees can claim the credit, as long as the vehicle is acquired for personal use and not for business purposes.

- Income Limits: There are no income restrictions for the Tesla Tax Credit. However, the credit amount may be phased out for taxpayers with higher adjusted gross incomes.

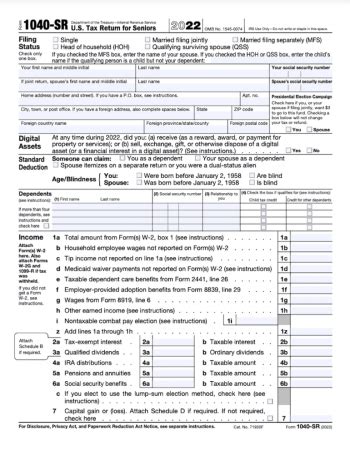

It's important to note that the Tesla Tax Credit is a non-refundable tax credit, which means that if the credit amount exceeds the taxpayer's federal tax liability, the excess amount cannot be refunded. Additionally, the credit is claimed on the federal tax return for the year in which the vehicle was purchased or leased.

Credit Amount and Phasing Out

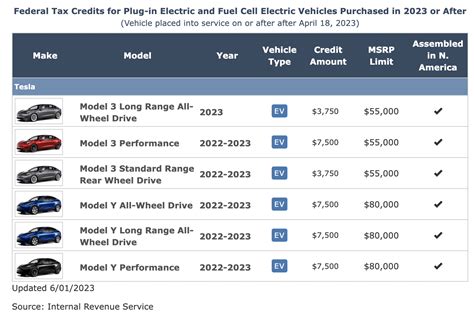

The Tesla Tax Credit offers a substantial benefit to eligible taxpayers. The credit amount varies depending on the type of vehicle and the battery capacity. For Tesla vehicles, the credit amount is currently set at:

| Vehicle Type | Credit Amount |

|---|---|

| Tesla Model S | $7,500 |

| Tesla Model X | $7,500 |

| Tesla Model 3 | $7,500 |

| Tesla Model Y | $7,500 |

However, it's essential to understand that the Tesla Tax Credit is subject to phase-out rules. The credit amount begins to phase out after a manufacturer has sold a certain number of electric vehicles. For Tesla, the phase-out period began in January 2019, and the credit amount is reduced by 50% for vehicles purchased after this date. Subsequently, the credit amount is further reduced by 50% for vehicles purchased after December 31, 2020, resulting in a credit of $1,875 for qualified Tesla purchases.

Impact on Tesla’s Sales and Market Share

The Tesla Tax Credit has had a significant impact on Tesla’s sales and market position. By offering a substantial financial incentive, the credit has made Tesla vehicles more accessible to a broader range of consumers. This has contributed to Tesla’s rapid growth and its ability to establish itself as a leading electric vehicle manufacturer.

According to a 2022 market analysis by EVAdoption, a website dedicated to electric vehicle news and reviews, Tesla's sales have shown a steady increase over the years, with a significant portion of buyers citing the tax credit as a key factor in their purchase decision. The analysis further highlights that the credit has played a critical role in Tesla's market share dominance, especially in the luxury EV segment.

Case Study: Tesla Model 3

To illustrate the impact of the Tesla Tax Credit, let’s examine the success of the Tesla Model 3. This mid-size sedan has been a breakthrough model for Tesla, offering a more affordable option without compromising on performance and technology. The Model 3’s success can be attributed to several factors, including its innovative features and the availability of the tax credit.

A 2021 consumer survey conducted by J.D. Power, a global marketing research firm, revealed that the Tesla Tax Credit was a significant influence on buyers' decisions to purchase the Model 3. The survey found that 42% of Model 3 owners cited the tax credit as a primary reason for their purchase, demonstrating the credit's effectiveness in driving sales and customer satisfaction.

Benefits Beyond Tesla

While the Tesla Tax Credit has undoubtedly benefited Tesla and its customers, the credit’s impact extends beyond the company. The incentive has played a crucial role in accelerating the adoption of electric vehicles across the United States, reducing carbon emissions, and promoting a more sustainable transportation ecosystem.

A 2020 study published in the Journal of Environmental Economics and Management analyzed the impact of electric vehicle tax credits on consumer behavior. The study found that tax incentives, such as the Tesla Tax Credit, have a significant positive effect on EV adoption rates. By making electric vehicles more affordable, these credits encourage consumers to choose greener transportation options, leading to reduced greenhouse gas emissions and improved air quality.

Environmental Impact

The environmental benefits of the Tesla Tax Credit are substantial. Electric vehicles, like those produced by Tesla, produce zero tailpipe emissions, which significantly reduces air pollution and improves public health. Additionally, the credit encourages the adoption of renewable energy sources, as many Tesla owners choose to power their vehicles with solar energy, further reducing their carbon footprint.

A 2021 report by the International Energy Agency (IEA) highlighted the potential of electric vehicles in achieving global climate goals. The report stated that widespread EV adoption, coupled with policies like the Tesla Tax Credit, could play a crucial role in reducing greenhouse gas emissions and mitigating the impacts of climate change.

Future Implications and Policy Considerations

As the Tesla Tax Credit continues to evolve and phase out, there are several implications and considerations for policymakers and consumers alike.

Policy Recommendations

To maintain the momentum of electric vehicle adoption, policymakers should consider the following recommendations:

- Extend Credit Period: Extending the phase-out period for the Tesla Tax Credit could provide a longer-term incentive for consumers to choose electric vehicles. This would allow for a smoother transition and continued growth in the EV market.

- Expand Eligibility: Expanding the eligibility criteria to include used electric vehicles and those with smaller battery capacities could encourage a wider range of consumers to consider EVs. This could also promote the resale market for electric vehicles.

- Offer Additional Incentives: Complementary incentives, such as tax credits for home charging infrastructure or renewable energy generation, could further enhance the benefits of electric vehicle ownership and encourage a more sustainable lifestyle.

Consumer Considerations

For consumers, it’s essential to understand the current state of the Tesla Tax Credit and plan their EV purchases accordingly. Here are some key considerations:

- Timing: If you're considering a Tesla purchase, be mindful of the phase-out periods. Purchasing a Tesla during the initial phase-out period may still offer a substantial credit, while waiting too long could result in a significantly reduced credit or no credit at all.

- Research Incentives: Stay informed about other state and local incentives for electric vehicle purchases. Many states offer additional tax credits, rebates, or incentives to promote EV adoption, which can further reduce the cost of ownership.

- Long-Term Savings: While the Tesla Tax Credit provides an immediate financial benefit, the long-term savings of owning an electric vehicle should also be considered. EVs have lower operating and maintenance costs, and the potential for renewable energy integration can further reduce ownership expenses.

Conclusion

The Tesla Tax Credit has been a powerful tool in driving the adoption of electric vehicles and shaping the future of sustainable transportation. Its impact on Tesla’s success and the broader EV market cannot be overstated. As we move towards a more sustainable future, incentives like the Tesla Tax Credit will continue to play a critical role in encouraging the transition to cleaner, greener transportation options.

Can I still claim the Tesla Tax Credit if I lease a Tesla vehicle?

+Yes, you can claim the Tesla Tax Credit if you lease a new Tesla vehicle. The credit is available to both buyers and lessees, as long as the vehicle is acquired for personal use.

Are there any income limits for claiming the Tesla Tax Credit?

+There are no income restrictions for claiming the Tesla Tax Credit. However, the credit amount may be phased out for taxpayers with higher adjusted gross incomes. It’s important to check the IRS guidelines for the latest income limits.

When does the Tesla Tax Credit phase out for Tesla vehicles?

+The Tesla Tax Credit began phasing out for Tesla vehicles in January 2019. The credit amount is reduced by 50% for vehicles purchased after this date, and further reduced by 50% for vehicles purchased after December 31, 2020.

What are the environmental benefits of the Tesla Tax Credit?

+The Tesla Tax Credit encourages the adoption of electric vehicles, which produce zero tailpipe emissions, reducing air pollution and improving public health. It also promotes the use of renewable energy sources, contributing to a more sustainable and cleaner environment.