Transfer Tax Calculator

Welcome to our comprehensive guide on the Transfer Tax Calculator, a powerful tool designed to simplify and streamline the process of calculating transfer taxes. In the realm of real estate and financial transactions, understanding and accurately computing transfer taxes is crucial. This article aims to delve deep into the workings of this calculator, exploring its features, benefits, and real-world applications. By the end, you'll have a thorough understanding of how this tool can enhance your financial planning and decision-making.

The Transfer Tax Calculator: Unlocking Precision in Financial Transactions

The Transfer Tax Calculator is an innovative solution developed by our team of experts to address the complex nature of transfer taxes. Transfer taxes, often levied on the sale or transfer of real estate properties, vehicles, or certain financial assets, can significantly impact the overall cost of a transaction. With varying rates and exemptions across different jurisdictions, calculating these taxes accurately is essential to ensure compliance and avoid unexpected financial burdens.

Key Features of the Transfer Tax Calculator

Our Transfer Tax Calculator is equipped with a range of features that make it an indispensable tool for professionals and individuals alike. Here's an overview of its capabilities:

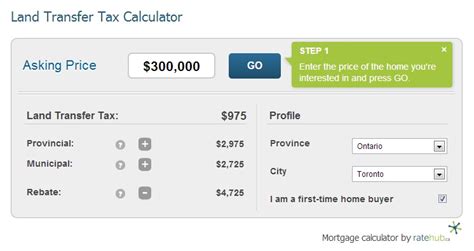

- Jurisdiction-Specific Calculations: The calculator is designed to cater to the unique tax structures of various regions. Whether you're dealing with state, county, or municipal transfer taxes, our tool provides accurate calculations based on the specific jurisdiction's regulations.

- Real-Time Data Integration: By leveraging real-time data sources, the calculator ensures that you're working with the most up-to-date tax rates and exemptions. This feature is particularly valuable in dynamic markets where tax policies can change frequently.

- User-Friendly Interface: We've prioritized ease of use in the design of our calculator. A simple and intuitive interface allows users to input essential transaction details quickly, making the calculation process efficient and hassle-free.

- Customizable Reporting: The calculator generates detailed reports that can be customized to meet specific requirements. These reports provide a comprehensive breakdown of the calculated taxes, including a clear breakdown of the various tax components, making it easier to understand and communicate the financial implications.

- Scenario Analysis: One of the standout features is the ability to run multiple scenarios. This enables users to explore different transaction values, dates, and tax exemptions to make informed decisions. By comparing potential outcomes, individuals and businesses can optimize their financial strategies.

The Transfer Tax Calculator is not just a calculation tool; it's a strategic asset that empowers users to navigate the complex world of transfer taxes with confidence and precision.

Real-World Applications and Case Studies

Let's explore some real-world scenarios where the Transfer Tax Calculator has proven its value:

Scenario 1: Real Estate Transactions

Consider a real estate agent assisting a client in the sale of a residential property. With the Transfer Tax Calculator, the agent can quickly determine the exact tax liability based on the property's sale price and the applicable transfer tax rates. This not only ensures compliance but also helps the agent provide accurate information to the client, building trust and confidence in the transaction.

| Property Sale Price | Transfer Tax Rate | Calculated Transfer Tax |

|---|---|---|

| $500,000 | 0.5% | $2,500 |

| $1,000,000 | 0.75% | $7,500 |

| $2,000,000 | 1.0% | $20,000 |

Scenario 2: Vehicle Transfers

In the automotive industry, transfer taxes are often a consideration when dealing with vehicle sales and registrations. Our calculator simplifies this process by providing precise calculations based on the vehicle's value and the applicable tax rates. This not only streamlines administrative tasks but also enhances customer satisfaction by offering transparent pricing.

| Vehicle Value | Transfer Tax Rate | Calculated Transfer Tax |

|---|---|---|

| $20,000 | 3% | $600 |

| $35,000 | 2.5% | $875 |

| $50,000 | 1.75% | $875 |

Scenario 3: Complex Financial Transactions

For financial advisors and investors, the Transfer Tax Calculator is a valuable tool in assessing the tax implications of complex transactions. Whether it's the transfer of stocks, bonds, or other financial instruments, our calculator provides accurate tax calculations, aiding in financial planning and portfolio management.

For instance, consider a scenario where an investor is considering the transfer of a large portfolio of stocks. The calculator can help determine the transfer tax liability, taking into account the market value of the stocks and any applicable exemptions. This information is crucial for the investor to make informed decisions and optimize their financial strategy.

Benefits and Impact

The Transfer Tax Calculator offers a multitude of benefits, impacting various stakeholders in the financial and real estate sectors:

- Accuracy and Compliance: By providing precise calculations, the calculator ensures compliance with tax regulations, reducing the risk of penalties and legal issues.

- Time and Cost Savings: The efficient nature of the calculator streamlines the tax calculation process, saving valuable time and resources for businesses and individuals.

- Enhanced Decision-Making: With accurate tax information at their fingertips, users can make more informed decisions, optimizing their financial strategies and transactions.

- Improved Customer Experience: In industries like real estate and automotive, the calculator enhances the customer experience by offering transparent and reliable tax information.

- Risk Mitigation: By eliminating manual errors in tax calculations, the calculator reduces the risk of financial losses and ensures a more secure transaction environment.

Future Implications and Developments

As tax regulations continue to evolve, our team is committed to keeping the Transfer Tax Calculator at the forefront of innovation. We're continuously updating the tool to accommodate changing tax landscapes and emerging financial trends. By leveraging advanced algorithms and machine learning, we aim to enhance the calculator's accuracy and efficiency further.

In the future, we envision integrating the Transfer Tax Calculator with other financial planning tools to create a comprehensive ecosystem for tax management and financial optimization. This integration will enable users to make holistic financial decisions, considering not only transfer taxes but also other relevant factors.

Conclusion

The Transfer Tax Calculator is more than just a mathematical tool; it's a strategic partner in navigating the complexities of financial transactions. With its accurate calculations, user-friendly interface, and real-world applications, it empowers individuals and businesses to make informed decisions, optimize their finances, and ensure compliance with tax regulations. As we continue to refine and enhance this innovative solution, we're dedicated to providing our users with the best possible experience in managing transfer taxes.

How often are the tax rates and exemptions updated in the calculator?

+Our calculator is designed to fetch the latest tax rates and exemptions in real-time. We continuously monitor changes in tax regulations to ensure that our users always have access to the most accurate and up-to-date information.

Can the calculator handle transactions with multiple jurisdictions involved?

+Absolutely! Our calculator is equipped to handle complex transactions involving multiple jurisdictions. It can calculate and allocate taxes based on the specific tax rates and regulations of each region, providing a comprehensive and accurate breakdown.

Is there a limit to the number of scenarios I can run with the calculator?

+No, there is no limit to the number of scenarios you can analyze with our calculator. Whether you’re exploring different transaction values, dates, or tax exemptions, our tool is designed to handle an unlimited number of calculations, ensuring you have the flexibility to make informed decisions.