Sales Tax Sf Ca

Sales tax is an essential component of the revenue system for many states and cities, including the bustling metropolis of San Francisco, California. In this comprehensive guide, we will delve into the intricacies of sales tax in SF, exploring its structure, rates, exemptions, and implications for businesses and consumers alike. By understanding the sales tax landscape, we can navigate the fiscal responsibilities and opportunities within this vibrant city.

Understanding Sales Tax in San Francisco

Sales tax in San Francisco is a combination of state, county, and city taxes, each contributing to the overall tax rate applicable to various goods and services. This layered tax structure is designed to fund essential public services and infrastructure while ensuring a fair distribution of financial responsibilities among residents and businesses.

The State of California Sales Tax

California, the Golden State, imposes a uniform sales tax rate across all its counties. As of [current date], the state sales tax rate stands at 7.25%, a percentage that forms the base for all sales tax calculations within the state.

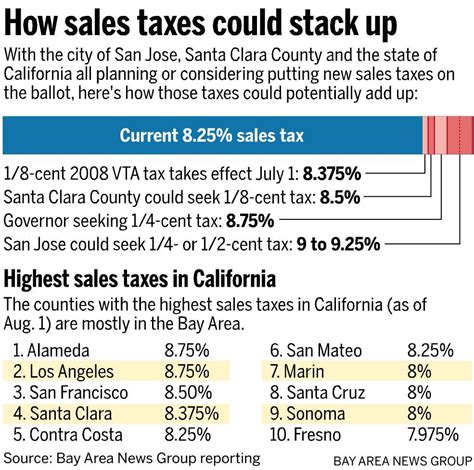

County and City Sales Tax Add-ons

On top of the state sales tax, counties and cities in California are authorized to impose additional sales taxes to address local budgetary needs. In San Francisco, the county sales tax rate is set at 0.50%, bringing the total sales tax rate for goods and services within the county to 7.75%.

However, San Francisco, being a vibrant urban center with a diverse population and robust economy, goes a step further. The city of San Francisco levies an additional 1.00% sales tax on top of the county and state rates. This supplementary city tax is dedicated to funding specific city initiatives and programs, contributing to the overall fiscal health and development of the city.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 7.25% |

| County Sales Tax (SF) | 0.50% |

| City Sales Tax (SF) | 1.00% |

| Total Sales Tax in SF | 8.75% |

With these three levels of taxation, the total sales tax rate in San Francisco amounts to 8.75%, one of the highest in the state. This elevated rate reflects the unique fiscal needs and aspirations of the city, as well as its commitment to providing a high quality of life for its residents and a vibrant business environment.

Sales Tax Exemptions and Special Cases

While sales tax is applicable to a wide range of goods and services, there are certain categories that are exempt from sales tax or subject to special provisions. Understanding these exemptions is crucial for both businesses and consumers to ensure compliance and take advantage of any applicable tax benefits.

Exempt Goods and Services

California, and by extension San Francisco, exempts certain essential goods and services from sales tax to alleviate the financial burden on residents and promote access to basic necessities. Here are some key categories that are generally exempt from sales tax:

- Groceries and Food Items: Most food products intended for home consumption, including staple groceries, are exempt from sales tax. This exemption aims to ensure that basic nutrition is accessible to all residents without added financial strain.

- Prescription Drugs: Sales tax is not applied to prescription medications, ensuring that healthcare costs remain manageable for individuals requiring essential medical treatment.

- Certain Medical Devices: Many medical devices, such as wheelchairs, crutches, and hearing aids, are exempt from sales tax, supporting individuals with special medical needs.

- Clothing and Footwear: Sales tax does not apply to clothing and footwear items priced below a certain threshold, providing a tax break for essential personal items.

- Educational Materials: Books, school supplies, and certain educational resources are exempt from sales tax, encouraging access to education and learning materials.

It's important to note that while these categories are generally exempt, there may be specific conditions or limitations that apply. Additionally, certain jurisdictions may have additional exemptions or special provisions, so it's advisable to consult local tax guidelines for comprehensive information.

Special Tax Rates and Zones

San Francisco, like many other cities, has implemented special tax zones or rates for specific purposes. These initiatives aim to promote economic development, support community initiatives, or address unique fiscal needs.

For instance, the city may establish Tax Increment Financing (TIF) zones, where a portion of the sales tax revenue generated within the zone is dedicated to specific projects or infrastructure improvements. These zones can help revitalize underdeveloped areas or support community development initiatives.

Additionally, San Francisco may offer sales tax holidays, during which certain categories of goods are exempt from sales tax for a limited time. These holidays are often timed to coincide with major shopping seasons, providing consumers with an opportunity to save on essential purchases.

Compliance and Collection for Businesses

For businesses operating in San Francisco, understanding and complying with sales tax regulations is a critical aspect of fiscal responsibility. Failure to adhere to sales tax laws can result in significant penalties and legal consequences.

Sales Tax Registration and Permits

Businesses operating within San Francisco are required to obtain a seller’s permit from the California Department of Tax and Fee Administration (CDTFA). This permit authorizes the business to collect and remit sales tax on behalf of the state, county, and city.

The registration process involves providing detailed information about the business, including its legal structure, location, and the types of goods and services it offers. The CDTFA assesses this information to determine the applicable tax rates and requirements for the business.

Sales Tax Collection and Remittance

Once registered, businesses are responsible for collecting the appropriate sales tax from customers at the point of sale. This tax is typically calculated as a percentage of the total transaction amount, with the rate determined by the location of the sale and the nature of the goods or services provided.

Businesses must then remit the collected sales tax to the appropriate tax authorities on a regular basis. The frequency of remittance varies depending on the business's sales volume and tax liability. Larger businesses may be required to remit sales tax monthly or quarterly, while smaller businesses may have the option to remit annually.

Recordkeeping and Reporting

Proper recordkeeping is essential for businesses to demonstrate compliance with sales tax regulations. Businesses must maintain detailed records of all sales transactions, including the date, amount, and applicable tax rate for each sale. These records should also indicate the location of the sale and any applicable exemptions or discounts.

Additionally, businesses are required to submit periodic sales tax returns, providing a detailed report of their sales and the corresponding tax liability. These returns are typically due on the same schedule as the remittance of sales tax payments.

Consumer Perspective: Understanding Sales Tax on Purchases

For consumers in San Francisco, understanding sales tax is crucial for making informed purchasing decisions and budgeting effectively. Here’s what consumers need to know about sales tax when shopping in the city.

Calculating Sales Tax on Purchases

When making a purchase in San Francisco, consumers should expect to pay the total price of the item or service plus the applicable sales tax. The sales tax rate in San Francisco, as discussed earlier, is 8.75%.

To calculate the sales tax on a purchase, simply multiply the total price of the item by the sales tax rate. For example, if you purchase an item priced at $100, the sales tax would be calculated as follows:

$100 x 0.0875 = $8.75

So, the total cost of the item, including sales tax, would be $108.75.

Understanding Sales Tax Invoices and Receipts

When making a purchase, consumers should receive an invoice or receipt that clearly breaks down the sales tax component. This information is essential for tax compliance and can also be used for budgeting and expense tracking.

A typical sales tax invoice or receipt will include the following information:

- Itemized list of goods or services purchased.

- Quantity and price of each item.

- Total price of the transaction.

- Sales tax rate applicable to the transaction.

- Breakdown of the sales tax amount.

- Grand total, including sales tax.

Sales Tax Tips for Consumers

Here are some practical tips for consumers to navigate sales tax in San Francisco and make the most of their purchases:

- Research Sales Tax Rates: Familiarize yourself with the current sales tax rate in San Francisco to accurately budget for purchases. You can also check for any special tax rates or exemptions that may apply to your specific situation.

- Understand Exclusions and Exemptions: Be aware of the categories of goods and services that are exempt from sales tax. This knowledge can help you plan your purchases and potentially save on essential items.

- Look for Sales Tax Holidays: Keep an eye out for sales tax holidays, which can provide an opportunity to purchase certain items without paying sales tax. These holidays are often announced in advance, so you can plan your shopping accordingly.

- Consider Online Shopping: When purchasing online, be mindful of the sales tax implications. Online retailers may charge sales tax based on the shipping destination, so ensure you understand the tax rate applicable to your location.

Future Implications and Considerations

The sales tax landscape in San Francisco is dynamic and subject to ongoing changes and considerations. As the city’s fiscal needs evolve and new initiatives emerge, the sales tax structure may adapt to meet these demands.

Potential Changes and Initiatives

Here are some potential future developments and considerations regarding sales tax in San Francisco:

- Revenue Generation for Specific Projects: The city may explore the possibility of dedicated sales tax initiatives to fund specific infrastructure projects or community development efforts. These initiatives could involve temporary tax increases or the establishment of special tax zones.

- E-Commerce and Remote Sales Tax: With the growth of e-commerce, San Francisco may need to address the collection of sales tax on remote sales, ensuring that online retailers contribute to the city's fiscal health.

- Tax Reform and Simplification: As the sales tax structure becomes more complex, there may be calls for tax reform to streamline the system and reduce compliance burdens for businesses and consumers.

- Community Engagement: The city may engage with residents and businesses to gather feedback on sales tax initiatives and ensure that tax policies align with the community's needs and aspirations.

The Impact on Businesses and Consumers

Changes to the sales tax structure can have both positive and negative implications for businesses and consumers. On the one hand, increased sales tax rates or dedicated taxes can provide much-needed revenue for essential public services and community development.

However, higher sales tax rates can also impact consumer purchasing power and business competitiveness. Businesses may need to adapt their pricing strategies or explore alternative revenue streams to remain viable in a high-tax environment. Consumers, on the other hand, may need to budget more carefully or seek out tax-saving opportunities to manage their financial obligations.

Stay Informed and Adapt

To navigate the evolving sales tax landscape in San Francisco, both businesses and consumers should stay informed about tax regulations and initiatives. This includes regularly checking for updates on sales tax rates, exemptions, and special provisions.

Businesses, in particular, should stay engaged with tax authorities and industry associations to understand the implications of any changes and adapt their operations accordingly. Consumers, too, can benefit from staying informed, allowing them to make more informed purchasing decisions and take advantage of any tax-saving opportunities.

Conclusion

Sales tax in San Francisco is a complex yet essential component of the city’s fiscal landscape. With a comprehensive understanding of the sales tax structure, rates, exemptions, and compliance requirements, businesses and consumers can navigate this intricate system with confidence.

As San Francisco continues to evolve and address its fiscal needs, the sales tax landscape will likely see further changes and initiatives. By staying informed and adaptable, businesses and consumers can ensure they remain compliant, competitive, and well-positioned to thrive in this vibrant city.

How often do businesses need to remit sales tax in San Francisco?

+The frequency of sales tax remittance depends on the business’s sales volume and tax liability. Larger businesses may be required to remit sales tax monthly or quarterly, while smaller businesses may have the option to remit annually.

Are there any online resources to help businesses understand and comply with sales tax regulations in San Francisco?

+Yes, the California Department of Tax and Fee Administration (CDTFA) provides a wealth of resources and guidelines for businesses to understand their sales tax obligations. Their website offers comprehensive information, including registration processes, tax rates, and compliance requirements.

Can consumers receive a refund for sales tax if they believe they were overcharged?

+Consumers who believe they have been overcharged for sales tax can file a claim with the CDTFA. The process involves providing detailed documentation and evidence to support the claim. If the claim is valid, consumers may receive a refund for the overcharged amount.