Harris County Property Tax

Welcome to an in-depth exploration of the Harris County Property Tax system. This comprehensive guide will provide you with a detailed understanding of the property tax landscape in Harris County, Texas. From the fundamentals of property taxation to the unique aspects of Harris County's assessment process, we'll cover it all. Whether you're a homeowner, a business owner, or simply curious about the intricacies of local taxation, this article aims to demystify the process and offer valuable insights.

Understanding Property Taxes in Harris County

Property taxes are a fundamental source of revenue for local governments in the United States, and Harris County is no exception. These taxes are essential for funding various public services and infrastructure projects, including schools, roads, emergency services, and more. Understanding how property taxes work is crucial for both homeowners and businesses operating within the county.

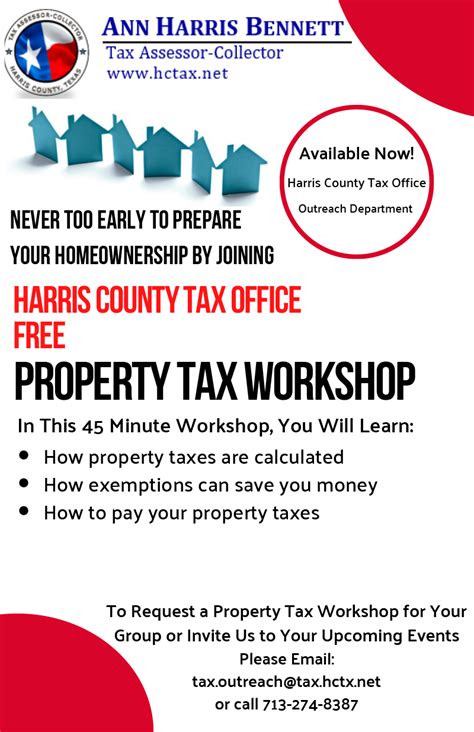

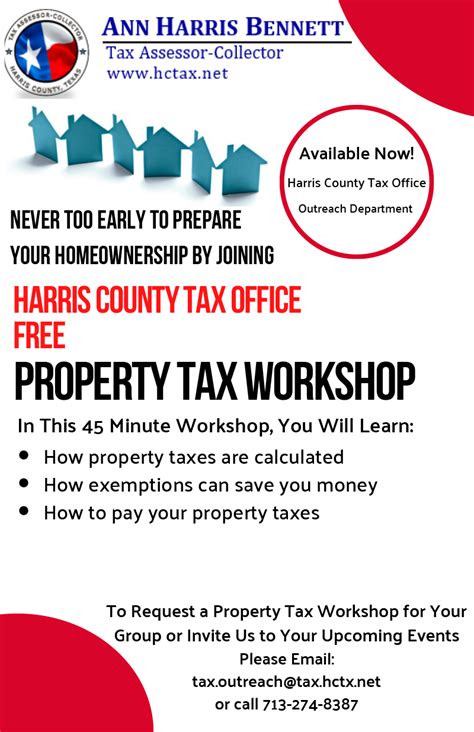

How are Property Taxes Calculated in Harris County?

The calculation of property taxes in Harris County involves a multi-step process. It begins with the appraisal of your property by the Harris County Appraisal District (HCAD). HCAD assesses the market value of your property, taking into account factors such as location, size, improvements, and recent sales of similar properties. This appraised value is then subject to various exemptions and limitations as outlined by Texas law.

Once the appraised value is established, it is multiplied by the tax rate, which is set by various taxing entities within the county. These entities include the county government, school districts, cities, and special districts. The resulting amount is your property tax bill, which is due by a specified deadline each year.

Key Factors Affecting Property Tax Bills

- Appraised Value: The higher the appraised value of your property, the higher your potential tax bill. However, it’s important to note that HCAD is required to appraise properties at their market value, ensuring fairness and consistency across the county.

- Tax Rates: Tax rates can vary significantly depending on the taxing entity. For instance, school districts often have higher tax rates compared to other entities, as they rely heavily on property taxes to fund education.

- Exemptions and Limitations: Texas offers several property tax exemptions and limitations, which can reduce the taxable value of your property. Common exemptions include the Homestead Exemption, Over-65 Exemption, and Disability Exemption. These exemptions can significantly impact your tax liability.

The Role of Harris County Appraisal District (HCAD)

The Harris County Appraisal District (HCAD) is an independent governmental body responsible for appraising properties within Harris County. Its primary function is to ensure fair and accurate assessments, which form the basis for property tax calculations.

HCAD’s Appraisal Process

HCAD employs a team of appraisers who conduct thorough evaluations of properties. They consider a range of factors, including:

- Recent Sales: HCAD closely monitors recent property sales to determine market trends and values.

- Property Characteristics: Appraisers inspect properties to assess their features, such as square footage, number of rooms, condition, and any recent improvements.

- Market Conditions: The overall real estate market in Harris County plays a significant role in determining property values.

Once the appraised value is determined, HCAD sends out Notice of Appraised Value (NOAV) to property owners. This notice provides details about the appraised value and offers an opportunity for property owners to protest the assessment if they believe it is inaccurate.

Protesting Property Values in Harris County

Property owners have the right to challenge their appraised values if they believe they are excessive or inaccurate. The protest process is a formal procedure outlined by HCAD, which involves the following steps:

- File a Protest: Property owners can file a protest with HCAD by a specified deadline. This can be done online, by mail, or in person.

- Arrange a Hearing: HCAD schedules a hearing before the Appraisal Review Board (ARB), an independent body that reviews protests. The ARB consists of local residents who are knowledgeable about property values.

- Present Your Case: During the hearing, property owners have the opportunity to present evidence and arguments supporting their claim that the appraised value is excessive.

- ARB’s Decision: The ARB will either uphold the original appraised value, adjust it downward, or even increase it if warranted. Their decision is final and binding.

Property Tax Rates and Revenue Allocation

The property tax rates in Harris County are set by various taxing entities, each with its own budgetary needs and priorities. These entities include:

- Harris County Government: Responsible for county-wide services such as law enforcement, courts, and county infrastructure.

- School Districts: Essential for funding public education, school districts often have higher tax rates due to the significant costs associated with education.

- Cities: Municipal governments within Harris County provide services like local police and fire departments, trash collection, and city-specific projects.

- Special Districts: These entities, such as water districts or transportation authorities, are created to address specific needs and often have dedicated tax rates.

The tax rates set by these entities are combined to form the effective tax rate, which is the rate used to calculate your property tax bill. It's important to note that tax rates can change annually, reflecting the budgetary needs and priorities of each taxing entity.

Understanding Tax Rate Calculations

To illustrate how tax rates are calculated, let’s consider a hypothetical example. Suppose a property has an appraised value of $200,000, and the effective tax rate is 2.5%. The property tax bill for this property would be calculated as follows:

| Property Appraised Value | $200,000 |

|---|---|

| Effective Tax Rate | 2.5% |

| Property Tax Bill | $5,000 |

In this example, the property owner would owe $5,000 in property taxes for the year.

Property Tax Exemptions and Limitations

Texas offers several property tax exemptions and limitations, which can significantly reduce the taxable value of your property. These incentives are designed to provide relief to specific groups of property owners and encourage certain behaviors.

Common Exemptions in Harris County

- Homestead Exemption: This exemption reduces the taxable value of your primary residence. In Harris County, the exemption is 25,000 for school taxes and an additional 3,000 for other taxes.

- Over-65 Exemption: Property owners who are 65 years or older may qualify for an exemption that limits the increase in their property’s taxable value to 10% each year, even if the market value increases more significantly.

- Disability Exemption: Disabled individuals may be eligible for an exemption that reduces their taxable value by $10,000.

- Military Exemptions: Active-duty military personnel and veterans may qualify for various exemptions, including the Military Exemption and the Disabled Veteran Exemption.

It's important to note that exemption eligibility and application processes may vary, and property owners should consult with HCAD or a tax professional for detailed information.

Property Tax Payment Options and Deadlines

Property taxes in Harris County are due by a specified deadline each year. Failure to pay by the deadline may result in penalties and interest charges. Here’s an overview of the payment process:

Payment Options

- Online Payment: Harris County offers an online payment portal, which allows property owners to pay their taxes securely and conveniently.

- Mail-in Payment: Property owners can also mail their tax payments to the Harris County Tax Office. It’s important to ensure the payment is received by the deadline to avoid late fees.

- In-Person Payment: Payment can be made in person at the Harris County Tax Office during regular business hours.

Payment Deadlines

The payment deadline for property taxes in Harris County is typically in January or February. However, it’s crucial to check the official website of the Harris County Tax Office for the exact deadline each year, as it may vary slightly.

Penalty and Interest Charges

If property taxes are not paid by the deadline, penalties and interest charges may accrue. These charges are designed to encourage timely payment and can add significantly to the overall tax liability. Property owners should prioritize timely payment to avoid these additional costs.

Future Implications and Trends in Property Taxation

The landscape of property taxation is dynamic and subject to change. Here are some key trends and future implications to consider:

Changing Market Values

Market values of properties can fluctuate over time due to various factors, including economic conditions, supply and demand, and local development projects. These changes can impact property tax bills, as the appraised value forms the basis for taxation.

Tax Rate Adjustments

Taxing entities in Harris County may adjust tax rates annually to meet their budgetary needs. While these adjustments are often modest, they can have a cumulative impact on property tax bills over time. Staying informed about tax rate changes is essential for property owners.

Exemption Eligibility

Eligibility criteria for property tax exemptions may change as Texas laws evolve. Property owners should stay updated on any changes to ensure they continue to qualify for exemptions they have relied on in the past.

Impact of Economic Cycles

Economic downturns can affect property values and, consequently, property tax revenues. During economic recessions, property values may decline, leading to reduced tax revenues for local governments. This can impact the funding of public services and infrastructure projects.

Frequently Asked Questions

How can I protest my property’s appraised value in Harris County?

+To protest your property’s appraised value, you must file a protest with the Harris County Appraisal District (HCAD) by the specified deadline. HCAD will schedule a hearing before the Appraisal Review Board (ARB), where you can present your case. It’s advisable to gather evidence, such as recent sales of similar properties, to support your claim.

What happens if I don’t pay my property taxes on time?

+Failure to pay property taxes by the deadline can result in penalties and interest charges. Additionally, the taxing entities may place a lien on your property, which could lead to foreclosure if the taxes remain unpaid. It’s crucial to prioritize timely payment to avoid these consequences.

Are there any property tax exemptions available for seniors in Harris County?

+Yes, Harris County offers the Over-65 Exemption, which limits the increase in taxable value to 10% each year for property owners aged 65 or older. This exemption helps seniors manage their property tax obligations and provides some financial relief.

How often do tax rates change in Harris County?

+Tax rates can change annually as taxing entities adjust their budgets. While these changes are often relatively small, they can accumulate over time. Property owners should stay informed about tax rate changes to understand the impact on their property tax bills.

Can I pay my property taxes in installments in Harris County?

+Harris County does not offer an official installment plan for property taxes. However, the county may consider hardship cases and work with property owners on a case-by-case basis. It’s recommended to contact the Harris County Tax Office to discuss potential payment arrangements if you’re facing financial difficulties.