State Of Idaho Taxes

Understanding the intricacies of state taxes is essential for individuals and businesses alike, especially when it comes to navigating the unique tax landscape of Idaho. This comprehensive guide will delve into the specifics of Idaho's tax system, shedding light on the various tax types, rates, and exemptions that shape the financial obligations of its residents and enterprises.

Idaho’s Tax System: An Overview

Idaho, like many other states, operates a multifaceted tax system designed to generate revenue for essential public services and infrastructure. This system encompasses a range of tax types, each serving a specific purpose in funding the state’s operations.

Income Tax

One of the primary sources of revenue for Idaho is its individual income tax. The state employs a progressive tax structure, meaning tax rates increase as income levels rise. Currently, Idaho has six tax brackets, ranging from 1.6% for the lowest income bracket to 7.4% for the highest income earners.

For businesses, Idaho imposes a corporate income tax on the profits of corporations, limited liability companies (LLCs), and other business entities. The corporate income tax rate in Idaho stands at 6.925%.

Let's delve into some real-world examples to illustrate the impact of Idaho's income tax system. Consider a single taxpayer with an annual income of $50,000. According to Idaho's tax brackets, this taxpayer would fall into the 5.9% tax bracket, resulting in an income tax liability of approximately $2,950.

On the other hand, a married couple filing jointly with a combined income of $150,000 would be subject to a higher tax rate. Their income would fall into the 7.4% tax bracket, leading to an income tax liability of around $10,410.

| Income Tax Brackets in Idaho | Tax Rate |

|---|---|

| Up to $2,175 | 1.6% |

| $2,175 to $4,000 | 2.4% |

| $4,000 to $8,000 | 3.2% |

| $8,000 to $20,000 | 4.2% |

| $20,000 to $85,000 | 5.9% |

| Over $85,000 | 7.4% |

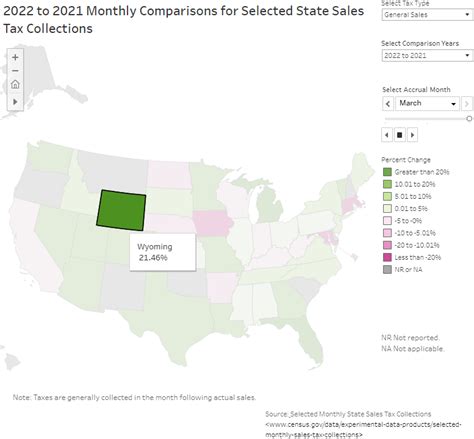

Sales and Use Tax

Idaho also collects sales tax on the sale of goods and certain services within the state. The standard sales tax rate in Idaho is 6%, which applies to most tangible personal property and certain services. However, there are exceptions and variations in tax rates depending on the type of goods or services being sold.

For instance, the sale of groceries is subject to a reduced sales tax rate of 4% in Idaho. This incentive aims to make essential food items more affordable for residents. Additionally, certain services, such as lodging and vehicle rentals, have specific tax rates that differ from the standard 6% rate.

To illustrate, let's consider a hypothetical scenario where an Idaho resident purchases a new laptop for $1,500. The standard sales tax rate of 6% would apply, resulting in a sales tax liability of $90. On the other hand, if the same resident purchases a week-long vacation package that includes hotel accommodations and rental car services, they would encounter a mix of tax rates, as these services are taxed at different rates in Idaho.

| Sales Tax Rates in Idaho | Tax Rate |

|---|---|

| Standard Rate (most goods and services) | 6% |

| Groceries | 4% |

| Lodging | 7% |

| Vehicle Rentals | 12% |

Property Tax

Property owners in Idaho are subject to property taxes, which are primarily used to fund local governments, schools, and public services. The property tax rate in Idaho varies depending on the location and the type of property.

The state of Idaho operates on a uniform property tax rate, which is set by the state legislature and applies uniformly across the state. However, individual counties and municipalities have the authority to set their own multiplier rates, which can increase or decrease the effective tax rate for property owners within their jurisdictions.

To determine the property tax liability, the assessed value of the property is multiplied by the applicable tax rate. For instance, if a homeowner's property is valued at $200,000 and the tax rate in their county is 0.7%, their annual property tax liability would be calculated as follows: $200,000 x 0.007 = $1,400.

It's important to note that Idaho offers several property tax exemptions and credits to eligible homeowners. These include homestead exemptions, which reduce the taxable value of a primary residence, and veteran's exemptions, which provide tax relief to qualifying military veterans.

| Property Tax Rates in Idaho | Tax Rate |

|---|---|

| Uniform Statewide Rate | 0.7% |

| Average County Multiplier | 1.25 |

Tax Exemptions and Incentives

Idaho’s tax system also includes a range of exemptions and incentives designed to encourage economic growth, support specific industries, and provide relief to certain taxpayers.

Sales Tax Exemptions

Idaho offers several sales tax exemptions to promote specific industries and reduce the tax burden on certain goods and services. For instance, the state exempts sales tax on certain manufacturing equipment and machinery, as well as on research and development activities.

Additionally, Idaho provides sales tax exemptions for nonprofit organizations, charitable events, and certain agricultural products. These exemptions aim to support charitable initiatives, promote economic development, and encourage agricultural production within the state.

Income Tax Credits

To incentivize specific activities and provide relief to certain taxpayers, Idaho offers a range of income tax credits. These credits can reduce the tax liability for individuals and businesses engaged in activities such as research and development, renewable energy production, and certain job creation initiatives.

For instance, Idaho's Research and Development Tax Credit allows businesses to claim a credit against their income tax liability for qualified research expenses. This credit aims to encourage innovation and technological advancements within the state.

Similarly, the Renewable Energy Tax Credit provides a credit for the installation and use of renewable energy systems, such as solar panels and wind turbines. This credit promotes the adoption of clean energy technologies and contributes to Idaho's environmental sustainability goals.

| Income Tax Credits in Idaho | Description |

|---|---|

| Research and Development Tax Credit | Encourages innovation by providing a credit for qualified research expenses. |

| Renewable Energy Tax Credit | Promotes clean energy adoption by offering a credit for renewable energy systems. |

| Job Creation Tax Credit | Incentivizes job creation by providing a credit for new hires meeting specific criteria. |

Filing and Payment Process

Understanding the process of filing and paying taxes in Idaho is essential for taxpayers to ensure compliance and avoid penalties.

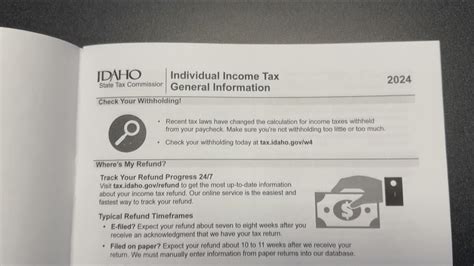

Filing Requirements

Individuals and businesses in Idaho are required to file tax returns annually, reporting their income, deductions, and credits. The due date for filing tax returns is typically April 15th, following the end of the tax year.

Idaho provides both online and paper filing options for tax returns. The Idaho State Tax Commission offers a user-friendly online filing system, allowing taxpayers to submit their returns electronically. For those who prefer traditional methods, paper forms are also available for download and can be mailed to the appropriate tax office.

It's important for taxpayers to gather all necessary documentation, such as W-2 forms, 1099 forms, and other income statements, before initiating the filing process. Accurate and complete information is crucial to ensure a smooth filing experience and avoid potential audits.

Payment Options

Idaho offers several payment options for taxpayers to fulfill their tax obligations. The state accepts payments through various methods, including:

- Online Payments: Taxpayers can make payments securely through the Idaho State Tax Commission's website using credit cards, debit cards, or electronic checks.

- Direct Debit: Idaho provides the option for taxpayers to authorize direct debit payments from their bank accounts. This automated payment method ensures timely payments without the need for manual transactions.

- Paper Checks: Traditional paper checks can be mailed to the designated tax office along with the completed tax return forms. It's essential to include the correct payment amount and the taxpayer's identification information on the check.

- Money Orders: Money orders are accepted as a form of payment and can be mailed to the tax office. Taxpayers should ensure that the money order is made payable to the Idaho State Tax Commission and includes the taxpayer's identification details.

Idaho also offers a payment plan option for taxpayers who are unable to pay their tax liabilities in full by the due date. This plan allows taxpayers to make periodic payments over a specified period, helping them manage their tax obligations more flexibly.

Conclusion

Idaho’s tax system is a comprehensive framework designed to fund the state’s operations and support its economic growth. From income taxes to sales and use taxes, property taxes, and various exemptions and incentives, Idaho’s tax landscape offers a mix of obligations and opportunities for taxpayers.

By understanding the specific tax rates, brackets, and exemptions applicable to their circumstances, individuals and businesses can navigate Idaho's tax system with confidence. This knowledge empowers taxpayers to make informed financial decisions, optimize their tax obligations, and contribute effectively to the state's economic prosperity.

Frequently Asked Questions

How does Idaho’s income tax system compare to other states?

+Idaho’s income tax system is relatively moderate compared to some other states. While it employs a progressive tax structure, the top tax rate of 7.4% is lower than many other states, making Idaho’s income tax system more favorable for high-income earners.

Are there any tax incentives for starting a business in Idaho?

+Yes, Idaho offers a range of tax incentives to encourage business growth and development. These include tax credits for research and development, renewable energy initiatives, and job creation. Additionally, Idaho has a favorable corporate income tax rate of 6.925%, which is lower than many other states.

What is the process for claiming tax refunds in Idaho?

+Taxpayers who are due a refund in Idaho can claim it through their tax return filing. If the tax return indicates a refund, the taxpayer will receive a refund check or a direct deposit, depending on the chosen payment method during filing.

Are there any property tax relief programs for senior citizens in Idaho?

+Yes, Idaho offers the Senior Citizen Property Tax Exemption, which provides a partial or full exemption from property taxes for qualifying senior citizens. To be eligible, individuals must be at least 65 years old, meet certain income requirements, and have owned and occupied the property as their primary residence for at least five years.

Can non-residents of Idaho be subject to Idaho taxes?

+Yes, non-residents of Idaho can be subject to Idaho taxes if they have income sources within the state. This includes income from investments, rentals, or business activities. Non-residents must file an Idaho non-resident tax return to report and pay taxes on Idaho-sourced income.