421A Tax Abatement

The 421-a tax abatement program is a significant component of New York City's real estate landscape, offering substantial benefits to property owners and developers. With its complex nature and frequent updates, understanding this program is crucial for anyone involved in the city's real estate market. This comprehensive guide aims to delve into the intricacies of the 421-a tax abatement, providing an in-depth analysis of its mechanics, benefits, eligibility criteria, and its impact on the city's development.

Unraveling the 421-a Tax Abatement Program

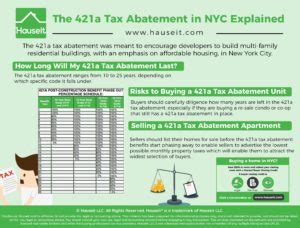

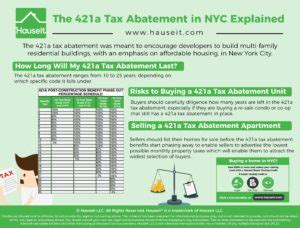

Introduced in the 1970s, the 421-a tax abatement program has been a cornerstone of New York City’s housing policies. Its primary objective is to encourage the development of affordable housing and stimulate economic growth by offering property tax exemptions to eligible projects. Over the years, the program has evolved, adapting to the city’s changing needs and market dynamics.

At its core, the 421-a program provides a partial or full exemption from the city's property taxes for a defined period. This exemption can significantly reduce the financial burden on developers, making new construction or substantial rehabilitation projects more feasible and profitable. The abatement period typically ranges from 15 to 35 years, depending on the project's location and the specific provisions outlined in the legislation.

Understanding the Eligibility Criteria

Not all development projects qualify for the 421-a tax abatement. The program has stringent eligibility requirements, which vary based on factors such as the project’s location, the type of development (new construction or rehabilitation), and the intended use of the property.

One of the key criteria is the inclusion of affordable housing units within the development. The percentage of affordable units required varies across different zones and boroughs. For instance, in Manhattan, developers might need to dedicate a higher proportion of units to affordable housing compared to Staten Island. This criterion ensures that the program's benefits are directed towards increasing the supply of affordable housing across the city.

Additionally, the program sets specific income thresholds for the residents of the affordable units. These thresholds are determined by the city's Department of Housing Preservation and Development (HPD) and are adjusted annually based on the Area Median Income (AMI). Only projects that cater to households within these income brackets are eligible for the abatement.

| Borough | Minimum Affordable Unit Percentage |

|---|---|

| Manhattan | 20% |

| Brooklyn | 15% |

| Queens | 10% |

| Bronx | 15% |

| Staten Island | 5% |

Apart from the affordable housing component, developers must also adhere to various other requirements. These may include meeting specific energy efficiency standards, providing amenities like gyms or community spaces, and ensuring the project aligns with the city's zoning regulations.

The Application Process

Navigating the application process for the 421-a tax abatement can be complex. Developers must submit a detailed proposal to the city’s Department of Finance, outlining the project’s scope, the number of affordable units, and how it meets the program’s eligibility criteria. The application must be accompanied by supporting documentation, including financial projections, architectural plans, and evidence of compliance with local laws.

Once submitted, the application undergoes a rigorous review process. The city assesses the project's viability, its alignment with the program's objectives, and its potential impact on the surrounding community. This evaluation process can take several months, and developers are often required to provide additional information or make modifications to their proposals.

Upon approval, developers receive a 421-a certificate, which outlines the specific terms and conditions of the abatement. This certificate is a crucial document, as it determines the duration and scope of the tax exemption. Developers must adhere to these terms throughout the abatement period, ensuring that the affordable units remain occupied by eligible residents and that the property is maintained according to the city's standards.

The Impact of 421-a on New York City’s Development

The 421-a tax abatement program has had a profound impact on New York City’s real estate market and its overall development trajectory. By incentivizing the creation of affordable housing, the program has contributed to the city’s efforts to address its housing crisis.

One of the most significant outcomes of the program has been the construction of thousands of affordable housing units across the city. These units cater to a diverse range of income levels, providing much-needed housing options for New Yorkers. The program has been particularly effective in revitalizing neighborhoods, attracting new residents, and fostering economic growth in previously underserved areas.

Moreover, the 421-a program has encouraged developers to explore innovative design approaches and sustainable practices. With the incentive of tax abatements, developers have been motivated to incorporate energy-efficient features, green spaces, and other environmentally friendly elements into their projects. This has not only enhanced the city's sustainability but has also improved the overall quality of life for residents.

However, the program has also faced criticism and challenges. Some critics argue that the program's benefits primarily accrue to developers, who may not always pass on the savings to residents. Additionally, there have been concerns about the program's impact on property values and the potential displacement of long-term residents. Addressing these concerns and ensuring that the program remains equitable and effective is an ongoing challenge for policymakers.

Future Prospects and Policy Updates

As the real estate market evolves and New York City’s needs change, the 421-a tax abatement program is subject to regular reviews and updates. Policymakers continuously evaluate the program’s effectiveness and make amendments to address emerging challenges and opportunities.

In recent years, there has been a push to make the program more inclusive and accessible. This has led to proposals for increased affordability requirements, particularly in high-demand neighborhoods. Additionally, there have been discussions around extending the abatement period to provide longer-term incentives for developers.

The COVID-19 pandemic has also influenced the program's future trajectory. With the economic impacts of the pandemic, policymakers are considering ways to provide additional support to developers and encourage the continued creation of affordable housing. This may involve temporary modifications to the program's eligibility criteria or the introduction of new incentives.

FAQs

What is the duration of the 421-a tax abatement period?

+The abatement period typically ranges from 15 to 35 years, depending on the project’s location and specific provisions.

How does the 421-a program encourage the development of affordable housing?

+By offering property tax exemptions, the program reduces the financial burden on developers, making it more feasible to include affordable housing units in their projects.

What are the income thresholds for residents of affordable units under the 421-a program?

+Income thresholds are determined by the city’s Department of Housing Preservation and Development (HPD) and are based on the Area Median Income (AMI). These thresholds are adjusted annually.

How has the 421-a program impacted New York City’s real estate market?

+The program has contributed to the construction of thousands of affordable housing units, revitalized neighborhoods, and encouraged sustainable development practices.

What are some of the challenges and criticisms associated with the 421-a program?

+Critics argue that the program may benefit developers more than residents, and there are concerns about its impact on property values and displacement. Policymakers are continuously working to address these challenges.