Is Car Loan Interest Tax Deductible

When it comes to managing your finances and navigating the world of taxes, it's important to understand the intricacies of loan interest deductions. One common question that arises is whether car loan interest can be claimed as a tax deduction. In this comprehensive guide, we will delve into the specifics of car loan interest and its tax implications, providing you with valuable insights and expert knowledge.

Understanding Car Loan Interest

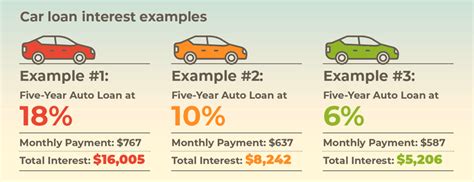

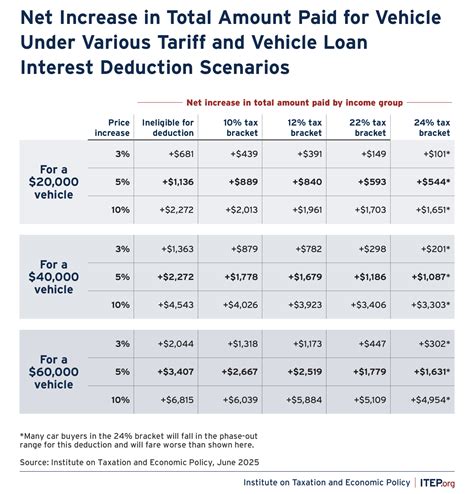

A car loan is a financial agreement between a borrower and a lender, typically a bank or financial institution, where the borrower receives funds to purchase a vehicle. The interest charged on this loan is the cost of borrowing the money, and it accumulates over the loan term until the loan is fully repaid. Car loan interest rates can vary depending on factors such as the borrower’s creditworthiness, the loan amount, and the lender’s policies.

The concept of deducting interest from taxes is based on the idea that certain expenses, including interest payments, can reduce an individual's taxable income, resulting in a lower tax liability. However, not all interest expenses are deductible, and there are specific rules and regulations surrounding tax deductions for car loan interest.

Tax Deductibility of Car Loan Interest

The tax deductibility of car loan interest depends on the purpose for which the vehicle is used. In most cases, personal car loan interest is not tax-deductible. This is because personal vehicles are considered a personal expense, and the IRS generally does not allow deductions for expenses related to personal use items.

However, there are certain scenarios where car loan interest may be deductible. Let's explore these cases in more detail.

Business Use of Vehicles

If you use your vehicle primarily for business purposes, you may be eligible to deduct a portion of the car loan interest. The IRS allows taxpayers to claim a deduction for expenses related to business-use vehicles. This includes not only interest on car loans but also other expenses such as fuel, maintenance, and insurance.

To claim this deduction, you must meet specific criteria. The vehicle must be used predominantly for business purposes, and you must maintain detailed records of its use. The IRS provides guidelines on how to calculate the deductible portion of interest and other expenses based on the percentage of business use.

Rental Property Use

If you own a rental property and use a vehicle for managing and maintaining that property, the interest on the car loan may be deductible as a business expense. Rental property owners can claim various deductions, including interest on loans taken out specifically for the rental property.

However, it's important to note that the vehicle must be used exclusively or almost exclusively for rental property-related activities. If you use the same vehicle for personal purposes as well, you will need to allocate the interest deduction based on the percentage of business use.

Self-Employment and Business Owners

Self-employed individuals and business owners may also be able to deduct car loan interest if the vehicle is used exclusively for business purposes. This includes individuals working as contractors, consultants, or sole proprietors who rely on their vehicles for business operations.

The IRS provides specific guidelines for calculating the deductible amount, which often involves tracking mileage and maintaining accurate records of business-related trips.

Specific Tax Deduction Limits

It’s worth noting that there are limits and restrictions on the amount of car loan interest that can be deducted. These limits vary depending on the type of use and the tax year. It’s crucial to consult with a tax professional or refer to the IRS guidelines to understand the specific limits applicable to your situation.

| Scenario | Tax Deductible Interest |

|---|---|

| Business Use | Up to 100% of interest on car loans used for business purposes |

| Rental Property | Interest on loans specifically for rental property use |

| Personal Use | Generally not deductible |

Maximizing Tax Benefits with Car Loan Interest Deductions

If you are eligible to deduct car loan interest, it’s essential to maximize the benefits by keeping accurate records and understanding the IRS guidelines. Here are some tips to help you make the most of this deduction:

- Maintain detailed records of your vehicle's business use, including mileage, dates, and purpose of trips.

- Consult a tax professional or accountant to ensure you are claiming the correct amount and adhering to the latest tax laws.

- Consider using tax preparation software that can help you calculate and track deductions accurately.

- Stay informed about any changes in tax regulations that may impact car loan interest deductions.

Future Implications and Considerations

The tax landscape is constantly evolving, and it’s important to stay updated on any changes that may impact car loan interest deductions. While the current tax regulations provide certain opportunities for business and rental property owners, future tax reforms could bring about adjustments or restrictions.

Additionally, the rise of electric vehicles (EVs) and their potential tax benefits is an area worth exploring. Some countries and regions offer tax incentives for purchasing and using EVs, which could further impact the tax treatment of car loan interest. Keeping an eye on these developments can help you make informed financial decisions.

Conclusion

Understanding the tax deductibility of car loan interest is crucial for maximizing your financial benefits and minimizing your tax liability. While personal car loan interest is generally not deductible, business and rental property owners have opportunities to claim deductions for their vehicles. By staying informed, maintaining accurate records, and consulting tax professionals, you can navigate the complexities of car loan interest deductions with confidence.

Frequently Asked Questions

Can I deduct car loan interest if I use my vehicle for both personal and business purposes?

+Yes, you can deduct a portion of the interest based on the percentage of business use. Keep detailed records to calculate the deductible amount accurately.

Are there any limits on the amount of car loan interest I can deduct for business use?

+Yes, there are specific limits and restrictions on deductible interest. These limits vary based on the type of use and tax year. Consult the IRS guidelines or a tax professional for precise information.

Can I deduct car loan interest if I own multiple vehicles for business purposes?

+Yes, you can deduct interest for each vehicle used for business purposes, provided you maintain accurate records for each vehicle’s business use.

How often should I review and update my records for car loan interest deductions?

+It’s recommended to review and update your records annually, especially when filing your tax returns. This ensures you have accurate and up-to-date information for claiming deductions.

Are there any alternative methods to track business vehicle use for tax deductions?

+Yes, you can use mileage tracking apps or GPS devices to record your business mileage accurately. These tools can simplify the process of calculating deductions based on mileage.