Kentucky Inheritance Tax

The Kentucky Inheritance Tax is a complex and often misunderstood aspect of the state's estate planning and tax system. It is distinct from the federal estate tax and serves as a critical component in the overall estate planning landscape for Kentuckians. This article aims to provide a comprehensive guide to understanding the Kentucky Inheritance Tax, its implications, and how it fits into the broader estate planning framework.

Understanding the Kentucky Inheritance Tax

The Kentucky Inheritance Tax, sometimes referred to as the Kentucky Estate Recovery Program, is a state tax levied on certain individuals who inherit property from a deceased person. It is a recipient-based tax, meaning the tax is applied to the person receiving the inheritance rather than the estate itself. This differentiates it from the federal estate tax, which is levied on the transfer of assets from the deceased person’s estate.

The tax is designed to generate revenue for the state and ensure fairness in the distribution of assets. It applies to a wide range of inherited assets, including real estate, personal property, and cash. However, the tax structure and exemptions can vary based on the relationship between the deceased and the beneficiary.

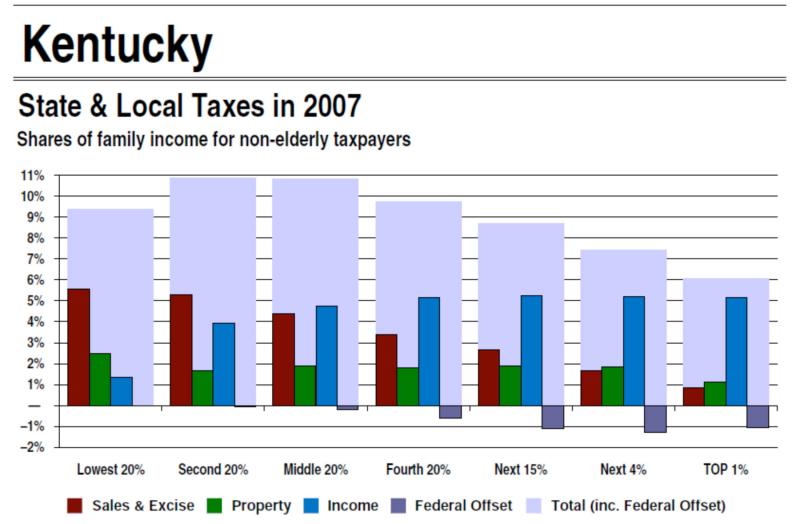

Tax Rates and Exemptions

Kentucky’s inheritance tax rates are progressive, meaning the tax rate increases as the value of the inheritance rises. The current rates are as follows:

| Relationship to Deceased | Tax Rate |

|---|---|

| Spouse | 0% |

| Direct Descendants (children, grandchildren) | 4% |

| Siblings, Nieces, Nephews, Aunts, Uncles | 6% |

| Other Relatives, Friends, Non-Relatives | 8% |

It's important to note that Kentucky offers a significant exemption for direct descendants, which means that children and grandchildren of the deceased may inherit a certain amount without paying any inheritance tax. This exemption is currently set at $1,000,000, which means that an inheritance of this amount or less from a direct descendant is exempt from the tax.

Who Pays the Tax

The Kentucky Inheritance Tax is paid by the beneficiary of the inheritance, not the estate itself. This means that the responsibility for paying the tax falls on the individual who receives the property or assets. The tax is typically due within nine months of the date of death of the decedent, and failure to pay can result in penalties and interest.

It's important for beneficiaries to be aware of their tax obligations and plan accordingly. They may need to consult with a tax professional or estate planner to understand the potential tax implications of their inheritance.

Estate Planning Strategies to Mitigate Inheritance Tax

Given the complexity of the Kentucky Inheritance Tax, effective estate planning is crucial to minimize tax burdens and ensure the smooth transfer of assets to beneficiaries. Here are some strategies that can be employed to reduce the impact of the inheritance tax:

Utilizing the Exemption

The $1,000,000 exemption for direct descendants is a powerful tool to reduce or eliminate the inheritance tax burden. By structuring the estate plan to maximize this exemption, such as through the use of trusts or other estate planning vehicles, beneficiaries can receive a substantial portion of the inheritance tax-free.

Gifting During Lifetime

Gifting assets during the lifetime of the donor is a strategy that can help reduce the value of the estate and potentially lower the inheritance tax. Kentucky, like many other states, allows for annual exclusion gifts, which means that individuals can gift a certain amount of money each year to an unlimited number of recipients without incurring gift taxes. This strategy can be particularly effective when combined with the exemption for direct descendants.

Creating Trusts

Trusts are versatile estate planning tools that can be used to minimize inheritance taxes. By establishing a trust, individuals can transfer assets during their lifetime or at death, with the trust serving as the beneficiary. Trusts can be designed to take advantage of the exemption for direct descendants or to distribute assets in a way that minimizes tax liability.

Joint Ownership

Another strategy to consider is joint ownership of assets. By owning property jointly with a spouse or other eligible individual, the property may pass to the joint owner without triggering the inheritance tax. This strategy can be particularly beneficial for couples who want to ensure that their assets pass to the surviving spouse without tax consequences.

Professional Guidance for Kentucky Inheritance Tax Planning

Navigating the complexities of the Kentucky Inheritance Tax requires a deep understanding of state tax laws and estate planning strategies. Working with a qualified estate planning attorney or certified public accountant (CPA) who specializes in estate and tax matters can be invaluable. These professionals can provide personalized advice and strategies tailored to your specific situation, helping you make informed decisions about your estate plan.

They can guide you through the process of structuring your estate to minimize tax burdens, utilizing exemptions and deductions, and ensuring that your wishes are carried out efficiently and effectively. By seeking professional guidance, you can feel confident that your estate plan is well-designed and optimized to reduce the impact of the Kentucky Inheritance Tax.

The Future of Kentucky Inheritance Tax

As with any aspect of tax law, the Kentucky Inheritance Tax is subject to change. While the current structure provides a substantial exemption for direct descendants, there is no guarantee that this will remain unchanged in the future. Keeping abreast of any legislative changes or proposed amendments to the tax code is essential for effective estate planning.

Additionally, the ongoing debate surrounding estate and inheritance taxes at the federal level can have implications for state-level taxes. While the future of these taxes remains uncertain, staying informed and proactive in your estate planning can help ensure that you are prepared for any changes that may occur.

Conclusion

Understanding the Kentucky Inheritance Tax is a critical component of effective estate planning for Kentuckians. By grasping the nuances of the tax, including its rates, exemptions, and strategies for mitigation, individuals can make informed decisions to protect their assets and ensure a smooth transfer to their beneficiaries. With the guidance of qualified professionals and a proactive approach to estate planning, Kentuckians can navigate the complexities of the Kentucky Inheritance Tax with confidence.

How often are Kentucky inheritance tax laws reviewed and updated?

+Kentucky’s inheritance tax laws are subject to review and potential updates during each legislative session. While significant changes may not occur every year, it’s important for individuals to stay informed about any amendments that could impact their estate plans.

Are there any special considerations for non-resident beneficiaries inheriting property in Kentucky?

+Yes, non-resident beneficiaries may be subject to different tax rates and requirements. It’s essential for non-residents to understand the specific rules and regulations that apply to them, as they may differ from those for Kentucky residents.

Can an estate plan be structured to completely avoid the Kentucky Inheritance Tax?

+While it’s not always possible to completely avoid the inheritance tax, a well-crafted estate plan can significantly reduce the tax burden. This often involves a combination of strategies, such as utilizing the exemption for direct descendants, making lifetime gifts, and creating trusts.