Does Kansas Have State Income Tax

When it comes to taxation, the state of Kansas has a unique approach that impacts its residents and businesses. Understanding the tax structure is crucial for individuals and companies operating within the state, as it directly affects their financial planning and strategies.

Kansas' Tax Landscape

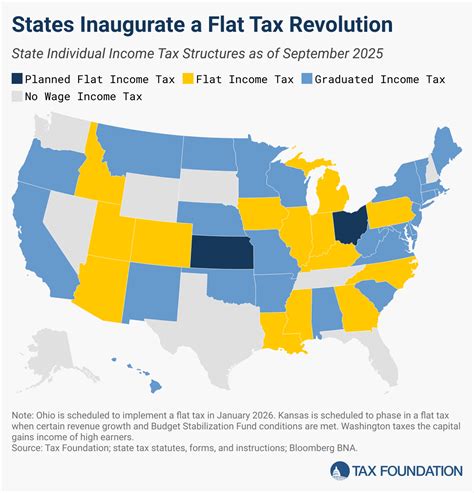

Kansas, like many other states in the US, has implemented a state income tax system to generate revenue for various governmental functions and services. This system plays a significant role in the state's economy and has undergone several reforms over the years.

The state income tax in Kansas is a crucial component of the state's overall tax strategy. It is a progressive tax, meaning that higher income levels are taxed at a higher rate compared to lower income levels. This system aims to distribute the tax burden fairly across different income groups.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $15,000 | 2.9% |

| $15,001 - $30,000 | 3.1% |

| $30,001 - $75,000 | 4.6% |

| Over $75,000 | 5.7% |

These tax rates are subject to change and are often adjusted to align with the state's fiscal needs and economic conditions. It's important for individuals and businesses to stay updated on any tax reforms to ensure accurate financial planning.

Impact on Residents and Businesses

The presence of state income tax has a direct impact on the financial lives of Kansas residents. For individuals, the tax system can influence their take-home pay and overall financial health. Understanding the tax brackets and rates is essential for effective budgeting and tax planning.

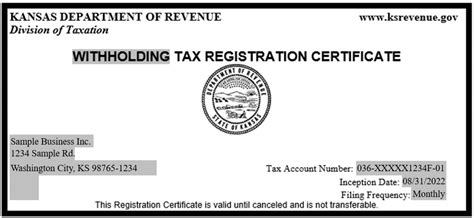

Businesses operating in Kansas also face the implications of state income tax. Corporations, partnerships, and other business entities are required to pay taxes based on their income and operations within the state. The tax system can impact a company's bottom line and influence its financial strategies, including investment decisions and expansion plans.

Tax Reform Efforts

Kansas has been active in tax reform initiatives over the past decade. These reforms aim to strike a balance between generating sufficient revenue for state services and providing a competitive tax environment for businesses and individuals.

One notable reform was the introduction of the Pass-Through Entity Tax in 2018. This tax allows certain businesses, such as sole proprietorships and partnerships, to deduct up to 25% of their business income from their state tax liability. The aim is to encourage entrepreneurship and small business growth by reducing the tax burden.

Additionally, Kansas has implemented tax incentives and credits to attract and retain businesses. These incentives often target specific industries or sectors, aiming to stimulate economic growth and job creation within the state.

Conclusion: A Complex Tax System

The state of Kansas has a multifaceted tax system, with income tax being a significant component. Understanding the tax landscape is essential for individuals and businesses operating within the state. The progressive nature of the income tax and ongoing tax reform efforts reflect Kansas' commitment to balancing fiscal responsibility and economic competitiveness.

Staying informed about tax rates, brackets, and reforms is crucial for effective financial planning and decision-making. Whether you're a resident or a business owner, staying abreast of Kansas' tax policies can help ensure compliance and maximize financial opportunities.

What is the current state income tax rate in Kansas?

+As of the latest information, the state income tax rates in Kansas range from 2.9% to 5.7%, depending on income brackets. It’s important to note that these rates are subject to change, and residents should refer to official sources for the most up-to-date information.

Are there any tax incentives for businesses in Kansas?

+Yes, Kansas offers various tax incentives and credits to attract and support businesses. These incentives are often industry-specific and designed to stimulate economic growth and job creation. It’s advisable to consult with a tax professional or refer to official sources for detailed information on these incentives.

How often are tax rates updated in Kansas?

+Tax rates in Kansas are subject to periodic updates and reforms. The state’s legislature and tax authorities assess the tax system’s effectiveness and make adjustments as needed. It’s recommended to stay updated through official channels to ensure compliance with the latest tax regulations.