Tax Accountants In New York

Tax accounting is a vital service for individuals and businesses alike, and in a bustling metropolis like New York City, the demand for expert tax professionals is particularly high. With its complex tax landscape and diverse business environment, NYC presents unique challenges and opportunities for tax accountants. This article aims to delve into the world of tax accounting in New York, exploring the key players, their services, and the impact they have on the city's financial ecosystem.

The Importance of Tax Accountants in New York

New York City, often referred to as the financial capital of the world, is a hub for various industries, including finance, technology, media, and entertainment. With a diverse range of businesses and individuals, the city’s tax landscape is intricate and ever-evolving. Tax accountants play a crucial role in navigating this complex terrain, ensuring compliance with state and federal tax regulations, and providing strategic financial advice to their clients.

The need for tax accountants in New York is further emphasized by the city's unique tax structures. New York State and New York City both levy income taxes, in addition to the federal income tax. Furthermore, the city imposes various other taxes, such as the unincorporated business tax and the commercial rent tax, which can be complex to navigate. Tax accountants help individuals and businesses understand and manage these taxes effectively, minimizing their tax liabilities and maximizing their financial opportunities.

Leading Tax Accounting Firms in New York

New York City is home to some of the most prestigious and renowned tax accounting firms in the country. These firms boast a wealth of experience and expertise, catering to a diverse clientele ranging from multinational corporations to high-net-worth individuals and small businesses.

Big Four Accounting Firms

The Big Four accounting firms - Deloitte, EY (Ernst & Young), KPMG, and PwC (PricewaterhouseCoopers) - are global leaders in the accounting and tax advisory space. Their New York offices are hubs of activity, providing a full suite of tax services, including tax planning, compliance, and consulting. These firms often work with large corporations and high-profile clients, offering a comprehensive understanding of complex tax structures and international tax laws.

| Big Four Firm | New York Office Location |

|---|---|

| Deloitte | 153 East 53rd Street, New York, NY 10022 |

| EY | 787 7th Avenue, New York, NY 10019 |

| KPMG | 345 Park Avenue, New York, NY 10154 |

| PwC | 300 Madison Avenue, New York, NY 10017 |

Mid-Sized and Boutique Firms

While the Big Four dominate the accounting landscape, there are numerous mid-sized and boutique firms in New York that offer specialized tax services. These firms often have a more personalized approach, catering to the unique needs of their clients. They provide expertise in specific industries or tax niches, offering tailored solutions and strategic advice.

For instance, firms like CohnReznick and Anchin, Block & Anchin have established themselves as leaders in the New York market, providing comprehensive tax services to a range of clients. These firms often have deep roots in the local community, allowing them to understand the unique challenges and opportunities faced by New York businesses.

| Mid-Sized Firm | Services |

|---|---|

| CohnReznick | Tax strategy, international tax, estate planning, and more |

| Anchin, Block & Anchin | Tax compliance, planning, and advisory services for individuals and businesses |

Specialized Tax Services

New York is also home to a plethora of specialized tax service providers. These professionals focus on specific tax niches, offering in-depth expertise and personalized solutions. For instance, Trust & Estates professionals specialize in tax planning and compliance for high-net-worth individuals and families, ensuring the efficient transfer of wealth across generations.

Additionally, Expatriate Tax Specialists cater to the unique needs of expatriates and individuals with international income sources. These professionals help clients navigate the complex world of international tax regulations, ensuring compliance and optimizing their tax strategies.

Tax Accounting Services in New York

Tax accounting services in New York encompass a wide range of offerings, designed to meet the diverse needs of the city’s residents and businesses. Here are some of the key services provided by tax accountants in the city:

Tax Preparation and Filing

The most fundamental service offered by tax accountants is tax preparation and filing. This involves gathering financial data, calculating tax liabilities, and preparing and filing tax returns with the relevant authorities. Tax accountants ensure that their clients meet all compliance requirements and take advantage of available deductions and credits.

Tax Planning and Strategy

Tax planning is a proactive approach to managing tax liabilities. Tax accountants work with their clients to develop strategies that minimize tax burdens, maximize deductions, and optimize overall financial planning. This service is particularly valuable for businesses, as it can help them structure their operations to minimize tax impact and enhance profitability.

Tax Research and Advisory

Tax accountants often provide research and advisory services, staying abreast of the latest tax laws and regulations. They help clients understand the impact of new tax policies and offer insights on how to adapt their financial strategies accordingly. This service is crucial in an environment like New York, where tax laws can change frequently.

International Tax Services

With its status as a global financial hub, New York is home to numerous multinational corporations and individuals with international income sources. Tax accountants specializing in international tax services assist clients in managing their global tax obligations. This includes structuring international transactions, understanding transfer pricing rules, and ensuring compliance with foreign tax laws.

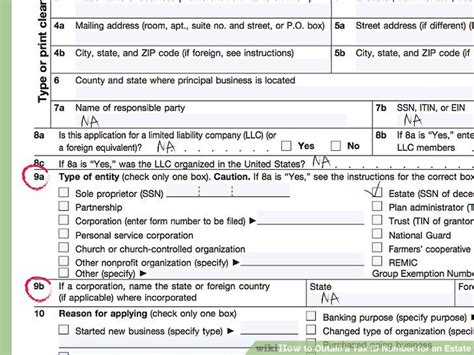

Estate and Gift Tax Planning

Tax accountants also play a vital role in estate and gift tax planning. They help individuals and families develop strategies to transfer wealth efficiently, minimizing tax liabilities and ensuring the preservation of assets for future generations. This service is particularly important for high-net-worth individuals and families in New York, given the city’s high tax rates.

The Impact of Tax Accountants on New York’s Economy

Tax accountants have a significant impact on New York’s economy, contributing to its growth and stability. By ensuring tax compliance and providing strategic financial advice, they help businesses and individuals manage their finances effectively, which in turn drives economic activity and investment.

Furthermore, tax accountants play a crucial role in attracting and retaining businesses in New York. Their expertise in navigating the city's complex tax landscape provides a competitive advantage to businesses, helping them optimize their tax strategies and remain compliant. This, in turn, encourages businesses to establish and expand their operations in the city, contributing to its economic vitality.

Case Study: Impact on Small Businesses

To illustrate the impact of tax accountants on New York’s economy, let’s consider the case of Smith & Sons Catering, a small family-owned business in Manhattan. With the guidance of their tax accountant, they were able to structure their business to take advantage of various tax incentives and deductions. This not only reduced their tax burden but also allowed them to reinvest those savings into their business, expanding their operations and creating new jobs in the community.

Additionally, the tax accountant helped Smith & Sons navigate the complex sales tax regulations in New York, ensuring they were compliant and avoiding potential penalties. This allowed the business to focus on their core operations, providing high-quality catering services to their clients without the burden of complex tax issues.

The Future of Tax Accounting in New York

As the world of finance continues to evolve, so too will the role of tax accountants in New York. With the rise of digital technologies and the increasing complexity of tax laws, tax professionals will need to adapt and innovate to stay ahead of the curve.

One key trend is the increasing use of technology in tax accounting. Tax accountants are leveraging advanced software and data analytics to streamline processes, improve accuracy, and provide more efficient services to their clients. This shift towards technology will likely continue, with tax professionals embracing automation and digital solutions to enhance their practice.

Embracing Digital Transformation

Tax accountants in New York are increasingly adopting digital tools and platforms to enhance their services. This includes the use of cloud-based accounting software, secure data storage solutions, and online tax filing systems. By embracing digital transformation, tax professionals can improve efficiency, reduce errors, and provide real-time insights to their clients.

Continuous Learning and Adaptation

The tax landscape is ever-changing, with new laws, regulations, and tax policies being introduced regularly. Tax accountants will need to stay abreast of these changes and continuously update their knowledge and skills. This will involve a commitment to lifelong learning, attending workshops, conferences, and seminars, and staying connected with industry peers and thought leaders.

Expanding Service Offerings

As the demand for tax services continues to grow, tax accountants in New York are likely to expand their service offerings. This may include providing more specialized services, such as international tax planning, estate and gift tax consulting, or tax litigation support. By diversifying their expertise, tax professionals can cater to a broader range of clients and remain competitive in the market.

Conclusion

Tax accounting is a critical service in New York, with tax professionals playing a vital role in the city’s financial ecosystem. From helping individuals and businesses navigate complex tax laws to providing strategic financial advice, tax accountants contribute to the growth and stability of the city’s economy. As the world of finance continues to evolve, tax accountants in New York will need to embrace digital transformation, continuous learning, and expanded service offerings to remain at the forefront of their industry.

How do I choose the right tax accountant for my needs in New York City?

+

When selecting a tax accountant in NYC, consider your specific needs and the services they offer. Look for professionals with experience in your industry or tax niche. Research their credentials, reviews, and client testimonials. Schedule consultations to discuss your needs and ensure a good fit.

What are the benefits of using a tax accountant in New York City for my business?

+

Using a tax accountant in NYC can provide several benefits for your business. They can help you minimize tax liabilities, maximize deductions, and ensure compliance with complex tax regulations. Tax accountants can also provide strategic financial advice, helping you make informed decisions to grow your business.

Are there any specialized tax services available for high-net-worth individuals in New York City?

+

Yes, there are specialized tax services for high-net-worth individuals in NYC. These services focus on estate planning, wealth preservation, and minimizing tax liabilities for individuals with significant assets. Tax professionals with expertise in these areas can provide tailored solutions to meet your unique needs.

What are some common challenges faced by tax accountants in New York City, and how do they overcome them?

+

Tax accountants in NYC face various challenges, including the city’s complex tax landscape, frequent changes in tax laws, and the need to stay updated with industry trends. They overcome these challenges through continuous learning, staying connected with industry peers, and embracing digital technologies to streamline their work.