Tn Sales Tax Calculator

The Tn Sales Tax Calculator is a powerful tool designed to simplify the process of calculating sales tax for businesses and individuals operating in the state of Tennessee. As one of the most comprehensive and accurate sales tax calculators available, it has become an essential resource for many taxpayers in the Volunteer State. In this comprehensive guide, we will delve into the features, benefits, and impact of this innovative calculator, exploring how it has revolutionized tax calculations in Tennessee.

Understanding the Tn Sales Tax Calculator

The Tn Sales Tax Calculator is an online platform developed with the aim of providing an easy and efficient way to calculate sales tax for various transactions within the state. Tennessee, known for its diverse tax landscape, has a complex system of sales tax rates that vary across counties and municipalities. This calculator streamlines the process by automating the calculation, ensuring accuracy, and saving users valuable time.

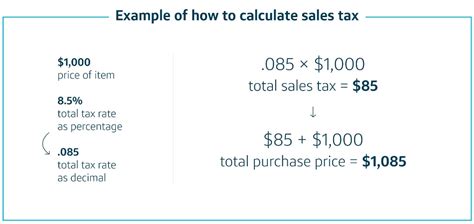

The calculator's user-friendly interface allows users to input the necessary details of their transaction, such as the base amount, the applicable tax rate, and any exemptions or discounts. It then employs advanced algorithms to perform the calculations, providing an instant and precise result. This tool is particularly beneficial for small businesses, online retailers, and individuals who need to comply with Tennessee's sales tax regulations without the hassle of manual calculations or the risk of errors.

Key Features and Advantages

The Tn Sales Tax Calculator boasts several features that set it apart from traditional calculation methods. Firstly, it offers a dynamic tax rate database, which is regularly updated to reflect the latest tax rates across Tennessee. This ensures that users always have access to the most accurate and current information. The calculator also provides a customizable input system, allowing users to input specific details about their transaction, such as the type of goods or services being sold, which can further refine the calculation.

One of the standout features is the geolocation integration. By utilizing the user's location, the calculator can automatically detect the applicable tax rate based on their physical address or the location of the transaction. This saves users the effort of manually searching for the correct tax rate, making the process faster and more efficient. Additionally, the calculator offers a tax exemption calculator, which helps users determine if their transaction qualifies for any state or local tax exemptions, further reducing their tax liability.

Benefits for Businesses

For businesses, especially those operating in multiple locations or online, the Tn Sales Tax Calculator offers a significant advantage. It helps businesses comply with state tax regulations by ensuring accurate tax calculations, which is crucial for avoiding penalties and maintaining a positive relationship with tax authorities. The calculator also simplifies the record-keeping process by providing a detailed audit trail of all calculations, making it easier to reconcile tax records and prepare for tax audits.

Furthermore, the calculator's accuracy and efficiency contribute to improved cash flow management for businesses. By quickly determining the exact tax liability for each transaction, businesses can better manage their cash flow, ensuring they have sufficient funds to meet their tax obligations. This level of financial control is particularly beneficial for small and medium-sized enterprises, as it helps them stay afloat and plan for future growth.

Benefits for Individuals

Individual taxpayers also stand to gain significantly from using the Tn Sales Tax Calculator. The calculator demystifies the complex sales tax system in Tennessee, making it accessible and understandable for non-professionals. This empowers individuals to make informed decisions about their tax obligations, ensuring they are not overpaying or underpaying their taxes.

Additionally, the calculator provides a personalized tax planning tool. By understanding their tax liability in advance, individuals can better plan their finances, budget effectively, and even explore tax-saving strategies. This level of financial awareness is essential for maintaining a healthy financial position and achieving long-term financial goals.

Performance and Impact

Since its launch, the Tn Sales Tax Calculator has gained widespread recognition and adoption across Tennessee. Its user-friendly design and accurate calculations have made it a go-to resource for taxpayers, businesses, and tax professionals alike. The calculator has significantly reduced the time and effort required to perform sales tax calculations, leading to increased efficiency and productivity for those who rely on it.

Moreover, the calculator's impact extends beyond individual transactions. By promoting compliance and accuracy in sales tax calculations, it contributes to fair taxation and a stable tax revenue stream for the state. This, in turn, supports essential public services and infrastructure development, benefiting all residents of Tennessee. The calculator's success has also inspired similar initiatives in other states, further emphasizing its positive impact on tax administration across the country.

Future Implications

As technology continues to advance, the future of the Tn Sales Tax Calculator looks promising. Developers are exploring ways to integrate the calculator with accounting software, making it even more seamless for businesses to manage their tax obligations. Additionally, with the rise of e-commerce, the calculator may be further optimized to cater to the unique tax considerations of online retailers, ensuring they can compete effectively while complying with tax regulations.

Furthermore, the calculator's success has sparked interest in developing similar tools for other types of taxes, such as property tax or income tax. This could lead to a more comprehensive suite of tax calculation tools, making tax management even more accessible and efficient for Tennessee residents and businesses.

Conclusion

The Tn Sales Tax Calculator has revolutionized the way sales tax is calculated in Tennessee, offering a fast, accurate, and user-friendly solution to a complex problem. Its impact on businesses and individuals is significant, streamlining tax calculations and contributing to a more transparent and compliant tax environment. As technology continues to evolve, this innovative calculator is poised to remain a vital resource for taxpayers, ensuring they can navigate Tennessee’s tax landscape with confidence and ease.

How often are the tax rates updated in the calculator?

+The tax rates in the calculator are updated on a monthly basis to ensure accuracy. Our team closely monitors any changes in tax regulations and applies them promptly to the calculator’s database.

Can I use the calculator for transactions in multiple counties within Tennessee?

+Absolutely! The calculator is designed to handle transactions in any county or municipality within Tennessee. It automatically detects the applicable tax rate based on the transaction location.

Are there any additional fees for using the Tn Sales Tax Calculator?

+No, the Tn Sales Tax Calculator is a free resource provided by the state to assist taxpayers. There are no hidden fees or charges associated with its use.

Can I trust the calculator’s accuracy for complex transactions?

+Yes, the calculator is built on advanced algorithms and regularly tested for accuracy. It is designed to handle a wide range of transaction scenarios, ensuring reliable results even for complex calculations.

Is there a mobile app version of the Tn Sales Tax Calculator?

+Currently, there is no dedicated mobile app, but the calculator is optimized for mobile devices, ensuring a seamless experience on smartphones and tablets.