Berks Earned Income Tax Bureau

Welcome to the comprehensive guide on the Berks Earned Income Tax Bureau, an essential component of the tax landscape in Berks County, Pennsylvania. This bureau plays a vital role in ensuring compliance and facilitating the efficient collection of earned income taxes for the county. In this article, we will delve into the workings of the Berks Earned Income Tax Bureau, exploring its history, services, and the impact it has on the local community.

A Legacy of Financial Stewardship: The Berks Earned Income Tax Bureau

The Berks Earned Income Tax Bureau is a dedicated entity established to manage and oversee the collection of earned income taxes within Berks County. With a rich history spanning several decades, the bureau has evolved into a pivotal institution, contributing significantly to the financial well-being of the county and its residents.

The bureau's origins can be traced back to [Year], when the Berks County Commissioners recognized the need for a centralized body to handle the complex task of collecting earned income taxes. This decision was driven by the county's commitment to financial transparency and the desire to streamline tax administration processes.

Over the years, the Berks Earned Income Tax Bureau has solidified its reputation as a trusted and efficient tax authority. It has adapted to the ever-changing tax landscape, implementing innovative technologies and processes to ensure accurate and timely tax collection. The bureau's dedication to excellence has earned it the respect of both taxpayers and government officials alike.

Services Offered by the Berks Earned Income Tax Bureau

The Berks Earned Income Tax Bureau provides a comprehensive range of services to individuals, businesses, and employers within Berks County. Here’s an overview of some of the key services they offer:

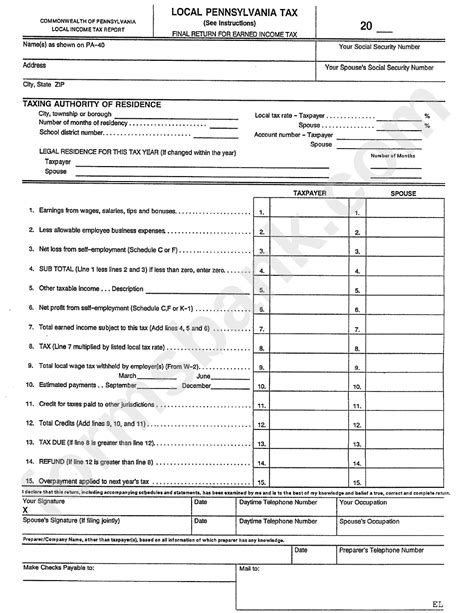

- Tax Filing and Payment: The bureau facilitates the filing and payment of earned income taxes for residents and employers. They offer various payment options, including online payment portals, direct debit, and traditional methods, ensuring convenience and accessibility for taxpayers.

- Tax Compliance Assistance: Recognizing that tax compliance can be complex, the bureau provides guidance and support to taxpayers. They offer resources, workshops, and personalized assistance to help individuals and businesses understand their tax obligations and navigate the tax filing process smoothly.

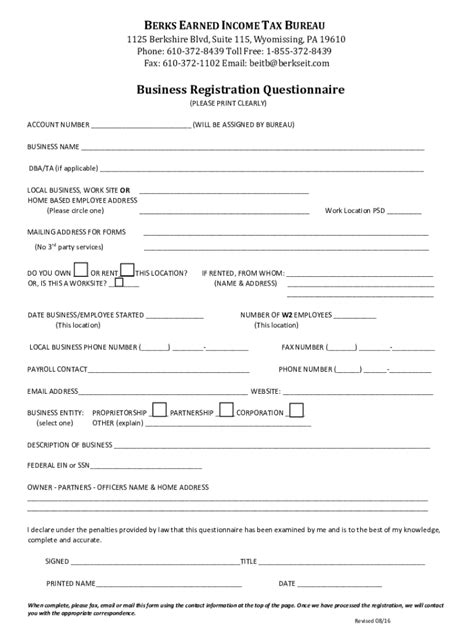

- Employer Services: Employers within Berks County rely on the bureau for accurate and timely tax withholding and reporting. The bureau provides employers with the necessary forms, guidance on tax regulations, and support to ensure compliance with state and local tax laws.

- Tax Refund Processing: For eligible taxpayers, the bureau efficiently processes tax refund claims. They strive to minimize processing times, ensuring that refunds are issued promptly and securely.

- Taxpayer Education: The Berks Earned Income Tax Bureau believes in empowering taxpayers with knowledge. They organize educational campaigns, seminars, and outreach programs to raise awareness about tax obligations, deadlines, and available resources.

Through these services, the bureau aims to create a positive and supportive tax environment, fostering a culture of compliance and financial responsibility within the community.

| Service | Description |

|---|---|

| Tax Filing Assistance | Expert guidance for accurate and timely tax filing. |

| Employer Tax Support | Comprehensive services for employers, including withholding and reporting. |

| Taxpayer Education Programs | Educational initiatives to enhance tax literacy among residents. |

| Online Payment Portal | Secure and convenient online platform for tax payments. |

The Impact on Berks County’s Financial Landscape

The establishment and effective functioning of the Berks Earned Income Tax Bureau have had a profound impact on the financial landscape of Berks County. By centralizing tax collection and administration, the bureau has brought about several notable changes and benefits.

Financial Stability and Economic Growth

The efficient collection of earned income taxes by the bureau contributes significantly to the financial stability of Berks County. The tax revenue generated supports various essential services, infrastructure development, and initiatives that drive economic growth. The bureau’s role in ensuring a steady stream of tax revenue has enabled the county to invest in education, healthcare, public safety, and other critical areas.

Moreover, the bureau's presence has fostered a culture of financial responsibility among taxpayers. By providing clear guidelines, resources, and support, the bureau encourages voluntary compliance, leading to a more prosperous and sustainable local economy.

Streamlined Tax Administration

The Berks Earned Income Tax Bureau has revolutionized tax administration within the county. Through centralized management, the bureau has eliminated the administrative burden on taxpayers and businesses. The simplified tax filing process, combined with efficient payment options, has reduced the complexity often associated with tax compliance.

By adopting modern technologies and online platforms, the bureau has made tax filing and payment more accessible and user-friendly. This has not only improved the taxpayer experience but has also reduced the time and resources required for tax administration, allowing businesses and individuals to focus on their core activities.

Community Engagement and Support

The Berks Earned Income Tax Bureau goes beyond tax collection; it actively engages with the community to provide support and assistance. Through outreach programs, educational initiatives, and taxpayer assistance days, the bureau ensures that residents understand their tax obligations and have access to the necessary resources.

Additionally, the bureau collaborates with local businesses and organizations to promote financial literacy and economic development. By fostering strong community ties, the bureau contributes to a sense of trust and cooperation between taxpayers and the government.

Transparency and Accountability

The bureau operates with a strong emphasis on transparency and accountability. It maintains open lines of communication with taxpayers, providing clear and concise information about tax policies, rates, and procedures. The bureau’s commitment to transparency has enhanced public trust and confidence in the tax system.

Furthermore, the bureau adheres to strict guidelines and regulations, ensuring that tax collection and administration processes are fair and unbiased. This commitment to integrity has positioned the bureau as a trusted partner in the county's financial affairs.

A Glimpse into the Future: Innovations and Initiatives

As technology continues to advance and tax landscapes evolve, the Berks Earned Income Tax Bureau remains committed to staying at the forefront of innovation. Here’s a glimpse into some of the initiatives and future plans that will shape the bureau’s trajectory:

Enhanced Digital Services

The bureau recognizes the importance of digital transformation in modern tax administration. They are actively working towards enhancing their online services, making tax filing and payment even more convenient and secure. The development of a user-friendly mobile app is on the horizon, allowing taxpayers to access their accounts and manage their tax obligations on the go.

Data Analytics and Insights

By leveraging advanced data analytics, the bureau aims to gain deeper insights into tax trends and patterns within the county. This data-driven approach will enable the bureau to make informed decisions, optimize tax collection processes, and identify areas for improvement. Additionally, data analytics will assist in identifying potential fraud and ensuring fair tax practices.

Community Outreach Expansion

The bureau understands the value of community engagement and plans to expand its outreach initiatives. They aim to reach underserved communities, providing tailored support and resources to ensure equal access to tax information and assistance. By bridging the gap between taxpayers and the tax system, the bureau aims to create a more inclusive and equitable tax environment.

Partnerships for Economic Development

Recognizing the interdependence of tax revenue and economic growth, the bureau plans to strengthen its partnerships with local businesses and economic development organizations. By collaborating closely, the bureau can contribute to job creation, business growth, and overall economic prosperity within Berks County.

Conclusion: A Dedicated Partner in Tax Administration

The Berks Earned Income Tax Bureau stands as a testament to the county’s commitment to financial integrity and taxpayer support. Through its dedicated services, innovative approaches, and community engagement, the bureau has established itself as a trusted partner in tax administration.

As Berks County continues to thrive and evolve, the Berks Earned Income Tax Bureau will remain at the forefront, ensuring that the county's financial foundations remain strong and secure. The bureau's unwavering dedication to excellence and its focus on serving the community make it an indispensable asset to Berks County's financial landscape.

What is the role of the Berks Earned Income Tax Bureau in Berks County’s financial landscape?

+The Berks Earned Income Tax Bureau plays a crucial role in managing and overseeing the collection of earned income taxes within Berks County. It ensures compliance, provides taxpayer assistance, and contributes to the financial stability and economic growth of the county.

How does the bureau streamline tax administration for taxpayers and employers?

+The bureau simplifies tax administration by offering convenient online filing and payment options, providing clear guidelines, and offering personalized support. This streamlines the process, reducing complexity and saving time for taxpayers and employers.

What initiatives does the bureau have in place to support community engagement and financial literacy?

+The bureau actively engages with the community through educational campaigns, workshops, and outreach programs. They aim to enhance financial literacy, ensure equal access to tax information, and provide tailored support to underserved communities.