Dc Tax Refund

In the world of taxes, a tax refund can be a welcome surprise for many individuals and businesses. When it comes to the District of Columbia (DC), understanding the tax refund process and the various factors that influence it is crucial. This comprehensive guide aims to explore the DC tax refund landscape, offering insights into eligibility, calculations, timelines, and strategies to maximize your refund. By delving into real-world examples and providing expert advice, we aim to demystify the process and ensure you get the most out of your DC tax refund.

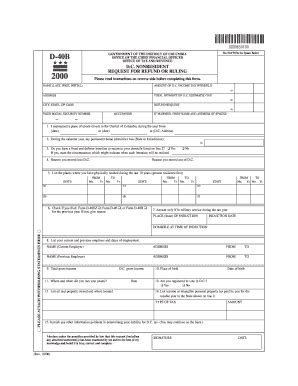

Unraveling the DC Tax Refund: A Comprehensive Guide

The DC tax refund system is a complex yet rewarding aspect of the city's tax landscape. It offers opportunities for residents and businesses to reclaim overpaid taxes, providing a financial boost. This guide will navigate through the intricacies of the DC tax refund process, shedding light on its mechanisms and potential benefits.

Eligibility Criteria and Tax Calculations

To begin, it's essential to understand the eligibility criteria for claiming a DC tax refund. Residents of the District of Columbia who have paid taxes in excess of their actual liability are generally eligible for a refund. This includes individuals, businesses, and even non-profit organizations. The refund amount is determined by the difference between the total tax paid and the actual tax liability, calculated using specific tax rates and brackets set by the DC government.

For instance, consider a hypothetical scenario where an individual with an annual income of $60,000 pays a total tax of $7,000 for the year. If their actual tax liability, based on the DC tax rates and their personal circumstances, is only $6,500, they would be entitled to a refund of $500. This calculation takes into account various factors, such as income level, deductions, and credits, making it a precise process.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $10,000 | 2% |

| $10,001 - $40,000 | 4% |

| $40,001 and above | 6% |

The Timely Process: Filing and Receiving Refunds

Once you've determined your eligibility and calculated your potential refund, the next step is to navigate the filing process. The DC Office of Tax and Revenue provides a user-friendly online platform for tax filing, allowing individuals and businesses to submit their returns electronically. This platform guides taxpayers through the process, ensuring all necessary information is provided.

Upon filing, the DC government reviews the submitted returns and processes eligible refunds within a specified timeframe. Typically, refunds are issued within 60 days of filing, although this timeline can vary based on the complexity of the return and the volume of filings received. It's crucial to keep track of this process and follow up if there are any delays.

To illustrate, imagine a small business that filed its DC tax return on March 15th, expecting a refund of $3,000. Under normal circumstances, they should receive their refund by May 15th. However, if they haven't received it by this date, they should contact the DC Office of Tax and Revenue to inquire about the status of their refund.

Maximizing Your DC Tax Refund: Strategies and Tips

While the refund process is straightforward, there are strategies taxpayers can employ to maximize their DC tax refund. Here are some expert tips:

- Keep Detailed Records: Maintain a meticulous record of all income, expenses, and deductions. This ensures accuracy during the tax calculation process and provides support if any discrepancies arise.

- Explore Deductions and Credits: DC offers various deductions and credits, such as the Earned Income Tax Credit and the Child and Dependent Care Credit. Researching and claiming these can significantly boost your refund.

- File Early: By filing your tax return early, you reduce the risk of errors and can receive your refund sooner. This is especially beneficial if you're expecting a substantial refund.

- Seek Professional Advice: For complex tax situations or if you're unsure about your eligibility, consider consulting a tax professional. They can provide personalized guidance and ensure you're taking advantage of all available benefits.

Future Implications and Changes in DC Tax Refund Policies

As with any tax system, the DC tax refund landscape is subject to change. The DC government regularly reviews and updates its tax policies, often introducing new deductions, credits, or even changing tax rates. Staying informed about these changes is essential for taxpayers to ensure they remain eligible for refunds and can take advantage of any new benefits.

For instance, in the upcoming fiscal year, the DC government is considering a proposal to expand the Earned Income Tax Credit, which could provide a significant boost to low- and moderate-income taxpayers. Such changes can have a substantial impact on refund amounts, so staying updated is crucial.

Furthermore, the DC government is exploring ways to streamline the refund process, aiming to reduce processing times and enhance transparency. These initiatives are part of a broader effort to improve taxpayer experience and ensure efficient refund distribution.

FAQs - Your DC Tax Refund Questions Answered

What is the average DC tax refund amount?

+The average DC tax refund amount can vary annually, but recent data shows an average refund of around $1,200 for individual taxpayers. This amount can be higher for businesses, depending on their tax liabilities and the deductions they claim.

Can I track the status of my DC tax refund online?

+Yes, you can track the status of your DC tax refund online through the DC Office of Tax and Revenue's website. You'll need to provide your tax identification number and other personal details to access your refund status.

What should I do if I don't receive my DC tax refund on time?

+If you don't receive your DC tax refund within the expected timeframe, it's recommended to contact the DC Office of Tax and Revenue. They can provide an update on the status of your refund and guide you through any necessary steps to resolve the delay.

Are there any penalties for claiming a DC tax refund incorrectly?

+While the DC government encourages accurate tax filing, there are no specific penalties for claiming a refund incorrectly. However, intentional misrepresentation or fraud can lead to legal consequences, so it's crucial to provide accurate information.

Can I receive my DC tax refund in the form of a direct deposit?

+Yes, the DC Office of Tax and Revenue offers the option of direct deposit for tax refunds. You can provide your bank account details during the filing process to receive your refund directly into your account.

Understanding the DC tax refund process empowers taxpayers to navigate this complex system effectively. By staying informed, utilizing available resources, and employing strategic tax planning, individuals and businesses can maximize their refunds and benefit from the financial rewards of a well-managed tax strategy.