Sales Tax In San Francisco

San Francisco, the cultural and technological hub of Northern California, is renowned for its vibrant atmosphere, iconic landmarks, and diverse population. Amidst its bustling streets and innovative enterprises, understanding the nuances of sales tax becomes essential, especially for businesses and consumers alike. This article aims to delve into the intricacies of sales tax in San Francisco, offering a comprehensive guide that sheds light on applicable rates, exemptions, and relevant laws.

Sales Tax Landscape in San Francisco

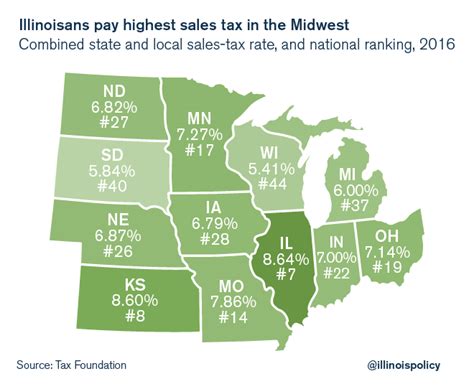

Sales tax in San Francisco operates within a complex framework, influenced by state, county, and city regulations. As of the latest update, the combined sales tax rate in San Francisco stands at 8.75%, which is the California state sales tax rate of 7.25% along with an additional 1.5% for the city and county of San Francisco.

State Sales Tax

The California State Board of Equalization sets the statewide sales tax rate, currently fixed at 7.25%. This tax is applicable to a broad range of goods and services, serving as a significant source of revenue for the state’s general fund, contributing to essential services and infrastructure projects.

San Francisco City and County Sales Tax

In addition to the state sales tax, San Francisco imposes its own local tax of 1.5%, bringing the total sales tax rate within the city to 8.75%. This local tax, known as the San Francisco General Tax, is collected to fund various city initiatives and services, playing a crucial role in maintaining the city’s renowned quality of life.

| Tax Rate | Taxing Entity |

|---|---|

| 7.25% | State of California |

| 1.5% | City and County of San Francisco |

Sales Tax Exemptions and Special Considerations

While the sales tax rate in San Francisco is generally straightforward, there are certain categories and scenarios where exemptions or special provisions apply. Understanding these exceptions is crucial for businesses and consumers to navigate the tax landscape accurately.

Food and Beverage Exemptions

A notable exemption in San Francisco’s sales tax regulations pertains to certain food and beverage items. Meals prepared and consumed on-site at restaurants or catering establishments are exempt from sales tax. This exemption applies to both dine-in and takeout options, offering a tax benefit to consumers and helping to promote the city’s vibrant culinary scene.

Clothing and Shoes Exemptions

San Francisco also offers a sales tax exemption for clothing and footwear items purchased for personal use. This exemption applies to items priced under $100, providing a significant tax relief for shoppers, especially during the city’s renowned sales events and fashion promotions.

| Category | Exemption |

|---|---|

| Meals at Restaurants | Exempt from sales tax |

| Clothing and Shoes (under $100) | Exempt from sales tax |

Online Sales and Remote Sellers

In the digital age, online sales and remote sellers have become an integral part of the retail landscape. San Francisco, along with California, has specific regulations for online sales, requiring remote sellers to collect and remit sales tax on transactions with customers in the state. This ensures fairness in the market and contributes to the city’s revenue stream.

Sales Tax Holidays

While not an annual occurrence, California and San Francisco occasionally offer sales tax holidays, during which certain categories of goods are exempt from sales tax for a limited period. These holidays, often aligned with major shopping events like back-to-school season, provide a boost to consumers and the local economy.

Compliance and Reporting for Businesses

For businesses operating in San Francisco, understanding and adhering to sales tax regulations is vital. Accurate tax collection and remittance not only ensure compliance with the law but also build trust with customers and contribute to the city’s fiscal health.

Sales Tax Registration

Businesses engaged in taxable sales in San Francisco must obtain a Seller’s Permit from the California Department of Tax and Fee Administration (CDTFA). This permit authorizes the business to collect and remit sales tax on behalf of the state and city. The application process involves providing detailed business information and complying with specific requirements.

Sales Tax Collection and Remittance

Once registered, businesses are responsible for collecting the appropriate sales tax rate from customers on taxable goods and services. The collected tax must be remitted to the CDTFA on a regular basis, typically monthly or quarterly, depending on the business’s sales volume and tax liability.

Record-Keeping and Reporting

Maintaining accurate records of sales transactions, including the tax collected, is crucial for businesses. These records must be retained for a minimum of four years, as they may be subject to audit by the CDTFA. Additionally, businesses are required to file periodic sales tax returns, providing a detailed breakdown of taxable sales and the tax collected.

Future Outlook and Potential Changes

As San Francisco continues to evolve, so too does its tax landscape. While the current sales tax rate and exemptions provide a stable framework, there are ongoing discussions and proposals that could bring about changes in the future.

Proposed Tax Increases

With the ever-increasing cost of living and infrastructure demands, there have been discussions among city officials about potential tax increases. While no concrete proposals have been tabled, the idea of raising the sales tax rate to fund specific initiatives, such as affordable housing or transportation projects, is a possibility that businesses and consumers should monitor.

E-commerce and Online Sales Taxation

The rapid growth of e-commerce has prompted discussions about the fair taxation of online sales. While California already has regulations in place, there is a growing push for more comprehensive laws that address the unique challenges posed by online retailers. This could potentially impact businesses operating solely online or those with a physical presence in San Francisco.

Exemptions and Special Programs

Conversely, there are ongoing efforts to expand tax exemptions and introduce special programs to support specific industries or initiatives. For instance, there have been proposals to offer tax incentives for green technologies or to provide tax breaks for businesses that promote local job creation. Such initiatives could provide significant benefits to targeted sectors.

Conclusion

Navigating the sales tax landscape in San Francisco requires a thorough understanding of the applicable rates, exemptions, and legal requirements. For businesses, compliance with these regulations is not only a legal obligation but also a strategic necessity to maintain a positive reputation and avoid penalties. Meanwhile, consumers benefit from a transparent and well-regulated tax system that provides clarity on pricing and potential savings.

As San Francisco continues to thrive and evolve, its sales tax policies will likely adapt to meet the changing needs of the city and its residents. Staying informed about these changes will be crucial for both businesses and consumers, ensuring they remain compliant and take advantage of any potential benefits.

What is the current sales tax rate in San Francisco?

+

As of the latest update, the combined sales tax rate in San Francisco is 8.75%, which includes the California state sales tax rate of 7.25% and an additional 1.5% for the city and county of San Francisco.

Are there any sales tax exemptions in San Francisco?

+

Yes, San Francisco offers exemptions for certain categories. Meals prepared and consumed on-site at restaurants are exempt from sales tax. Additionally, clothing and footwear items priced under $100 are also exempt.

How often do businesses need to remit sales tax in San Francisco?

+

Businesses typically remit sales tax on a monthly or quarterly basis, depending on their sales volume and tax liability. It’s crucial for businesses to maintain accurate records and file sales tax returns on time to avoid penalties.

Are there any proposed changes to the sales tax landscape in San Francisco?

+

Yes, there are ongoing discussions about potential tax increases to fund specific initiatives like affordable housing or transportation projects. Additionally, there are proposals to expand tax exemptions or introduce special programs to support certain industries.