New York Mansion Tax

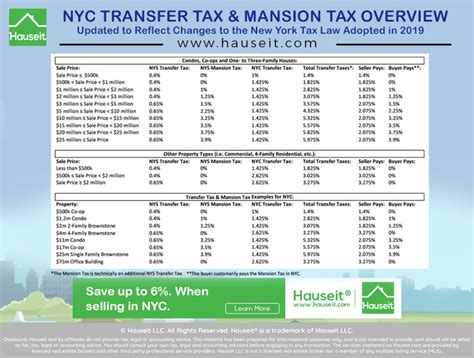

The New York Mansion Tax is a unique and significant aspect of the real estate landscape in the state of New York, particularly in the vibrant city of New York. This tax, officially known as the "New York State Real Estate Transfer Tax," applies to the sale or transfer of residential properties priced at $1 million or more, making it a key consideration for both buyers and sellers in the high-end real estate market.

Understanding the New York Mansion Tax

The Mansion Tax is a progressive tax, meaning the rate increases with the property value. It is calculated as a percentage of the total sale price, with different rates applied to different value brackets. This structure aims to ensure that those purchasing more expensive properties contribute a higher proportion of the tax.

| Property Value | Tax Rate |

|---|---|

| $1,000,000 - $1,999,999 | 0.4% |

| $2,000,000 - $4,999,999 | 0.6% |

| $5,000,000 - $9,999,999 | 0.8% |

| $10,000,000 and above | 1% |

For instance, a property sold for $2 million would incur a Mansion Tax of $12,000 (0.6% of $2 million). This tax is due upon the closing of the sale and is typically paid by the buyer, although it can be negotiated as part of the sale agreement.

Historical Context

The New York Mansion Tax has a relatively recent history, having been introduced in 2001 as a temporary measure to boost state revenue. However, it has since been renewed multiple times and is now considered a permanent fixture in the state’s tax landscape. Its initial purpose was to provide a short-term financial boost, but it has since become an integral part of New York’s revenue stream.

Impact on the Real Estate Market

The Mansion Tax has had a notable influence on the New York real estate market, particularly in the high-end segment. While it has not deterred buyers from purchasing luxury properties, it has added an additional cost that must be factored into the overall purchase price. This has led to more detailed financial planning and strategic considerations for both buyers and sellers.

Real estate agents and brokers have adapted their strategies to account for the Mansion Tax. They often incorporate it into their pricing and negotiation tactics, ensuring that clients are aware of its implications. For sellers, this may mean setting a higher asking price to accommodate the tax, while buyers may negotiate for the seller to pay a portion of the tax or have it factored into the sale price.

Exceptions and Exemptions

Like most taxes, the New York Mansion Tax comes with certain exceptions and exemptions. One notable exemption is for co-operative apartments, commonly referred known as co-ops, which are exempt from the tax. This is because co-ops are not considered real property under New York law, but rather a share of a corporation that owns the property.

There are also exemptions for transfers between spouses, transfers to charitable organizations, and certain other specific situations. However, these exemptions are subject to strict criteria and documentation requirements, and professional guidance is often necessary to navigate these complexities.

First-Time Homebuyer Exemptions

Recognizing the challenges faced by first-time homebuyers, New York offers a Mansion Tax exemption for certain purchases. To qualify, the buyer must be a resident of New York for at least one year prior to the purchase, and the property must be their primary residence. Additionally, the buyer cannot have owned another home in the previous three years. This exemption provides an incentive for first-time buyers to enter the high-end real estate market.

Strategies for Buyers and Sellers

For buyers, understanding the Mansion Tax is crucial when planning a real estate purchase. It’s essential to consider this tax when calculating the overall cost of a property. Buyers may also negotiate with the seller to include the tax in the sale price or request a price reduction to accommodate the tax. Engaging a knowledgeable real estate agent who is familiar with the Mansion Tax can provide valuable guidance throughout the process.

Sellers, on the other hand, need to factor the Mansion Tax into their asking price. They may also consider offering incentives to buyers, such as covering a portion of the tax or providing credits towards closing costs. A well-strategized marketing plan that highlights the property's unique features and potential can help offset the additional cost of the Mansion Tax.

The Future of the New York Mansion Tax

The future of the New York Mansion Tax remains an ongoing discussion point in state politics. While it has been a reliable source of revenue for the state, there are debates about its fairness and potential impact on the real estate market. Some critics argue that it discourages investment in high-end real estate, while supporters highlight its role in generating revenue for essential state services.

As New York's real estate market continues to evolve, the Mansion Tax will likely remain a significant factor in high-end property transactions. Its presence adds an additional layer of complexity to the already intricate world of New York real estate, making it a key consideration for anyone involved in the market.

Conclusion

In conclusion, the New York Mansion Tax is a unique and influential aspect of the state’s real estate landscape. Its progressive structure and significant rates have a notable impact on the high-end real estate market, influencing buying and selling strategies. With its complex rules and exceptions, the Mansion Tax requires a deep understanding from real estate professionals and buyers alike. As the real estate market continues to adapt and evolve, the New York Mansion Tax will undoubtedly remain a key consideration for those navigating the complex world of New York real estate.

How is the New York Mansion Tax calculated?

+The Mansion Tax is calculated as a percentage of the property’s sale price, with rates varying based on the property value. Properties valued at 1 million to 1.999 million are taxed at 0.4%, while those between 2 million and 4.999 million are taxed at 0.6%, and so on. For example, a 2 million property would incur a tax of 12,000 (0.6% of $2 million).

Who pays the New York Mansion Tax?

+Typically, the buyer pays the Mansion Tax. However, it can be negotiated as part of the sale agreement, with the seller potentially contributing to or covering the tax. The responsibility for paying the tax is often a key point of negotiation in high-end real estate transactions.

Are there any exemptions or exceptions to the Mansion Tax?

+Yes, there are several exemptions. Transfers between spouses, transfers to charitable organizations, and certain other specific situations are exempt from the Mansion Tax. Additionally, first-time homebuyers may be eligible for an exemption if they meet specific criteria, such as being a New York resident for at least one year prior to the purchase and not having owned another home in the previous three years.

How has the New York Mansion Tax impacted the real estate market?

+The Mansion Tax has added an additional cost consideration for buyers and sellers in the high-end real estate market. It has influenced pricing strategies and negotiation tactics, with real estate professionals adapting their approaches to accommodate this tax. Despite this, the tax has not deterred buyers from purchasing luxury properties.