Senior Property Tax Freeze

The concept of a Senior Property Tax Freeze is an increasingly important topic in the realm of senior finance and tax management. This program, designed to provide relief to older homeowners, has gained significant traction in various states across the United States. As the population ages and the cost of living rises, understanding the intricacies of the Senior Property Tax Freeze program becomes essential for seniors to make informed decisions about their financial future and homeownership.

Unraveling the Senior Property Tax Freeze

The Senior Property Tax Freeze, often referred to as a Property Tax Exemption or Assessment Freeze, is a legislative measure aimed at alleviating the financial burden of property taxes for senior citizens. It's a strategic tool that many states employ to support their aging populations and promote stable homeownership among seniors.

This program operates by capping the property tax liability for eligible senior homeowners, ensuring that their tax bill remains consistent from year to year. This is in contrast to the traditional property tax system, where tax assessments can fluctuate based on various factors, potentially leading to significant increases in tax liabilities over time.

How it Works: A Step-by-Step Guide

- Eligibility Criteria: The first step is understanding the eligibility requirements. Typically, senior citizens aged 65 or older who have owned and occupied their property for a certain period are eligible. However, specific age requirements and ownership tenure vary by state.

- Application Process: Eligible seniors must complete and submit an application to their local tax assessor's office. This application often requires proof of age, residence, and ownership, along with any other specific documentation requested by the state.

- Assessment Freeze: Once approved, the property's assessed value is frozen at the current level. This means that even if property values in the area increase, the senior's tax liability will not increase accordingly.

- Ongoing Benefits: The property tax freeze remains in effect as long as the senior continues to own and occupy the property. If the senior sells the property or no longer resides there, the freeze is lifted, and the property is reassessed at the current market value.

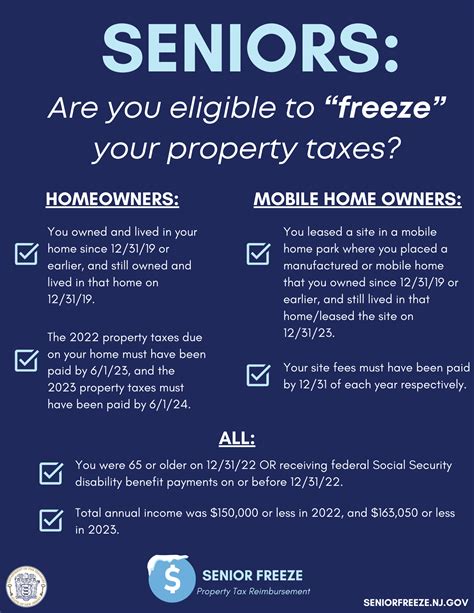

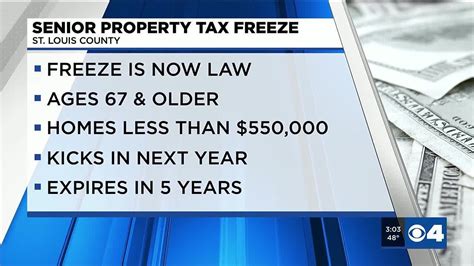

State-by-State Variations

While the fundamental concept remains consistent, the Senior Property Tax Freeze program varies significantly from state to state. Some key differences include:

| State | Age Eligibility | Ownership Tenure | Income Limit |

|---|---|---|---|

| California | 62 | 3 years | $3,175/month for single filers |

| Texas | 65 | 5 years | None |

| Florida | 65 | N/A | $2,500/month for single filers |

| New York | 65 | 4 years | $59,000 for single filers |

Note: These are simplified examples, and actual requirements may vary based on county or local regulations within each state.

The Impact on Senior Homeowners

The Senior Property Tax Freeze program has a profound impact on the financial planning and security of senior homeowners. By capping property tax liabilities, it provides a sense of financial predictability, allowing seniors to budget more effectively and plan for their long-term care and retirement needs.

Moreover, it addresses a critical issue: the potential for property taxes to spiral out of control, especially in areas with rapidly rising property values. This program ensures that seniors are not priced out of their homes due to escalating tax bills, thus promoting stability and peace of mind.

Real-Life Case Study: Mr. Johnson's Story

Consider the case of Mr. Johnson, a 72-year-old retiree living in a suburban neighborhood in Texas. Mr. Johnson has owned his home for over 30 years, and with the area's real estate market booming, his property value has increased significantly. Without the Senior Property Tax Freeze, Mr. Johnson would be facing a substantial increase in his property tax bill, potentially straining his retirement funds.

However, with the tax freeze in place, Mr. Johnson's tax liability remains stable, allowing him to continue living comfortably in his home without the fear of unexpected tax burdens. This stability has given him the confidence to plan for other retirement expenses, such as healthcare and travel, knowing that his tax obligations are predictable.

Navigating the Application Process

Applying for the Senior Property Tax Freeze can be a complex process, given the varying requirements and procedures across different states and counties. Here's a simplified breakdown to guide seniors through the process:

- Research: Begin by researching your state's specific requirements. This includes understanding the age eligibility, ownership tenure, income limits (if applicable), and any other unique criteria.

- Gather Documentation: Collect all necessary documents, such as proof of age (driver's license or birth certificate), proof of residence (utility bills or lease agreement), and proof of ownership (deed or property tax bill). Some states may also require income verification documents.

- Complete the Application: Download and complete the application form from your local tax assessor's website or office. Ensure you fill out all sections accurately and provide all the required information and documentation.

- Submit the Application: Submit your application and supporting documents to the designated office. This can be done in person, by mail, or online, depending on the options available in your state.

- Follow Up: Keep track of the application process. Most states provide a timeline for processing applications, so be sure to follow up if you haven't received a response within the expected timeframe.

Tips for a Smooth Application Process

- Start early: Don't wait until the last minute to apply. Many states have specific application periods, and missing the deadline could result in delayed benefits.

- Seek assistance: If you're unsure about the process or have difficulty understanding the requirements, consider seeking help from a trusted friend, family member, or local community organization.

- Stay organized: Keep a record of all your application materials, including a copy of the completed application and supporting documents. This will make it easier to reference and resubmit if needed.

Maximizing Benefits and Financial Planning

While the Senior Property Tax Freeze provides significant financial relief, it's just one piece of the retirement planning puzzle. Seniors should consider the following strategies to maximize their benefits and overall financial well-being:

1. Reverse Mortgages

For seniors with substantial equity in their homes, a reverse mortgage can be a viable option to supplement retirement income. This allows homeowners to access a portion of their home's value while continuing to live in the property. However, it's crucial to consult a financial advisor to understand the implications and ensure it aligns with your long-term financial goals.

2. Home Equity Conversion Mortgages (HECM)

A Home Equity Conversion Mortgage, specifically designed for seniors, allows them to convert their home equity into cash without having to make monthly mortgage payments. This can be a valuable tool for seniors to enhance their financial flexibility and security.

3. Long-Term Care Planning

As healthcare costs continue to rise, planning for long-term care is essential. Seniors should consider their options, including home care, assisted living facilities, or nursing homes. Understanding the costs associated with these options and factoring them into their financial plans is crucial.

4. Estate Planning

Estate planning is an often-overlooked aspect of senior financial management. Creating a will, establishing power of attorney, and considering trust funds can ensure that your assets are distributed according to your wishes and provide financial protection for your loved ones.

Future Outlook and Potential Challenges

The Senior Property Tax Freeze program has gained popularity and support across the United States, but it's not without its challenges. As more seniors become eligible and apply for the program, states face increasing budgetary pressures to fund these tax breaks.

Additionally, with the aging population continuing to grow, the demand for these programs is likely to increase. This could lead to potential changes in eligibility criteria or the implementation of alternative strategies to provide tax relief for seniors. It's crucial for seniors to stay informed about any updates or changes to these programs to ensure they can continue benefiting from them.

Alternative Strategies for Tax Relief

In response to the growing demand and budgetary constraints, some states are exploring alternative strategies to provide tax relief for seniors. These include:

- Circuit Breaker Programs: These programs provide a credit or refund to low-income seniors who pay a certain percentage of their income in property taxes.

- Senior Property Tax Deferral Programs: Instead of freezing the tax liability, these programs allow seniors to defer their property taxes until they sell their home or pass away. This can provide immediate relief without impacting state budgets.

- Homestead Exemptions: Some states offer a homestead exemption, which reduces the taxable value of a property for homeowners who meet specific criteria, often including age and income requirements.

Conclusion

The Senior Property Tax Freeze program is a critical component of senior financial planning, offering a measure of stability and predictability in an often uncertain financial landscape. By understanding the intricacies of this program and exploring other financial strategies, seniors can ensure a more secure and comfortable retirement.

As we've explored, the Senior Property Tax Freeze is not a one-size-fits-all solution, and seniors must stay informed about their state's specific requirements and any potential changes to the program. With the right information and planning, seniors can make the most of this program and other financial tools to secure their financial future.

Frequently Asked Questions

How do I know if I’m eligible for the Senior Property Tax Freeze program in my state?

+

Eligibility criteria vary by state. Generally, you must be a senior citizen (typically aged 65 or older), own and occupy your property, and meet any income limits set by your state. Check your state’s official website or contact your local tax assessor’s office for specific requirements.

Can I still apply for the Senior Property Tax Freeze if I’m already retired and on a fixed income?

+

Yes, the Senior Property Tax Freeze program is designed to assist seniors on fixed incomes. However, some states may have income limits, so it’s essential to check your state’s specific requirements to ensure you meet the eligibility criteria.

What happens if I sell my home after receiving the Senior Property Tax Freeze benefit?

+

When you sell your home, the Senior Property Tax Freeze benefit typically ends. The new owner will be assessed property taxes based on the current market value, and any freeze or exemption will no longer apply.

Are there any penalties for not applying for the Senior Property Tax Freeze when I become eligible?

+

No, there are no penalties for not applying. However, by not applying, you may miss out on significant property tax savings, so it’s advisable to explore your eligibility and apply if you meet the criteria.

Can I apply for the Senior Property Tax Freeze if I’m a senior but my spouse is not yet retired?

+

Eligibility for the Senior Property Tax Freeze is often based on the age of the homeowner, not their employment status. As long as you meet the age and other requirements, you can apply even if your spouse is still working. However, specific rules may vary by state, so it’s best to check with your local tax assessor’s office.