County Of Riverside Tax

Understanding property taxes and the role of the County of Riverside's tax system is essential for homeowners and investors alike. This article aims to provide an in-depth analysis of the County of Riverside's tax process, offering a comprehensive guide to help navigate this complex but vital aspect of property ownership.

The County of Riverside Tax System: A Comprehensive Guide

In the vast landscape of Southern California, the County of Riverside stands as a beacon of opportunity and growth, boasting a thriving economy and a diverse population. However, with this prosperity comes the responsibility of managing property taxes, a crucial component of the county's fiscal framework.

The County of Riverside, nestled in the heart of California's Inland Empire, is renowned for its stunning natural landscapes, from the picturesque hills of Temecula to the sprawling desert vistas of Palm Springs. Beyond its natural beauty, the county is a hub of economic activity, attracting businesses and residents with its vibrant culture, excellent schools, and diverse housing options. Yet, as property values rise and the economy flourishes, navigating the intricacies of the county's tax system becomes increasingly important for homeowners and investors.

Property Assessment: The Foundation of Taxation

At the heart of the County of Riverside's tax system lies the concept of property assessment. This process involves evaluating the value of each property within the county, serving as the basis for determining the amount of tax due. The County Assessor's Office is tasked with this critical responsibility, ensuring fairness and accuracy in the assessment process.

The assessment process is a meticulous undertaking, considering various factors such as the property's location, size, improvements, and market conditions. The Assessor's Office employs a team of highly skilled professionals who conduct thorough inspections and utilize advanced valuation techniques to determine the assessed value of each property. This value, updated annually, forms the basis for calculating the property tax liability.

| Assessment Type | Description |

|---|---|

| Full Cash Value | Represents the property's current market value, considering all factors that influence its worth. |

| Proposition 13 Value | A unique feature of California's tax system, this value is the lower of either the Full Cash Value or the Proposition 13 value, which is the property's taxable value as of the last change in ownership plus annual inflation adjustments. |

By understanding the assessment process, property owners can gain insight into the factors influencing their tax liability and make informed decisions about their real estate investments.

Tax Rates and Calculations: Unraveling the Formula

Once the assessed value of a property is determined, the next step is to calculate the tax liability. This process involves applying the applicable tax rates, which are established by various taxing authorities within the county.

The County of Riverside, like many other counties in California, has a complex tax structure, with taxes levied by multiple entities, including the county itself, cities, special districts, and schools. Each of these entities has a specific tax rate, which, when combined, forms the overall tax rate for a particular property.

| Taxing Authority | Tax Rate (%) |

|---|---|

| County of Riverside | 1.00 |

| City of Riverside | 0.80 |

| Special Districts (e.g., Fire Protection, Water Districts) | Varies by district |

| Riverside Unified School District | 1.25 |

| Total Effective Tax Rate | 3.05 |

The total effective tax rate for a property is calculated by summing up the individual tax rates of all the applicable taxing authorities. This rate is then multiplied by the assessed value of the property to determine the annual tax liability.

For instance, if a property has an assessed value of $500,000 and a total effective tax rate of 3.05%, the annual tax liability would be $15,250 (500,000 x 0.0305). This amount is then divided into installments, with the property owner typically receiving a tax bill twice a year.

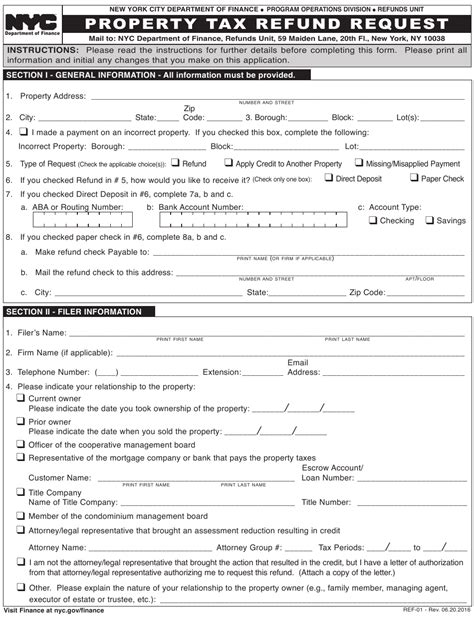

Tax Bill Breakdown: Understanding the Details

When property owners receive their tax bill, it's crucial to understand the various components that make up the total amount due. The tax bill provides a detailed breakdown of the taxes levied by each taxing authority, allowing property owners to see exactly where their tax dollars are allocated.

In addition to the base property tax, the tax bill may also include other assessments and fees. These additional charges could be related to specific services or improvements within the community, such as street lighting, pest control, or special assessments for infrastructure projects.

| Charge Type | Description | Amount |

|---|---|---|

| Base Property Tax | The standard property tax calculated based on the assessed value and tax rates. | $15,250 |

| Mello-Roos Fee | A special tax assessment for funding community facilities and infrastructure. | $1,200 |

| Community Services District Fee | Charges for local services such as park maintenance and recreation programs. | $500 |

| Total Tax Due | The sum of all charges and assessments. | $17,200 |

By analyzing the tax bill, property owners can gain insight into the various services and improvements funded by their tax dollars, ensuring transparency and accountability in the tax system.

Tax Relief Programs: Supporting Homeowners

The County of Riverside recognizes the importance of providing support to its residents, especially in the face of rising property values and tax liabilities. As such, the county offers a range of tax relief programs designed to assist homeowners and ensure that property taxes remain manageable.

One such program is the Homeowner's Exemption, which provides eligible homeowners with a reduction in their assessed value, resulting in a lower property tax bill. This exemption is particularly beneficial for long-term residents and can provide significant savings over time.

Additionally, the county offers the Disabled Veterans Exemption, which provides a property tax exemption for qualifying disabled veterans. This exemption not only reduces the tax burden but also recognizes the sacrifices made by those who have served our country.

| Relief Program | Description | Eligibility |

|---|---|---|

| Homeowner's Exemption | Reduces the assessed value of the primary residence by up to $7,000. | Homeowners who occupy their property as their primary residence. |

| Disabled Veterans Exemption | Provides a full or partial exemption from property taxes for qualifying disabled veterans. | Veterans with service-connected disabilities rated at 100% by the VA. |

| Senior Citizen's Exemption | Reduces the assessed value for homeowners aged 62 or older. | Homeowners who are at least 62 years old and meet certain income requirements. |

These tax relief programs demonstrate the County of Riverside's commitment to supporting its residents and ensuring that property taxes remain equitable and manageable.

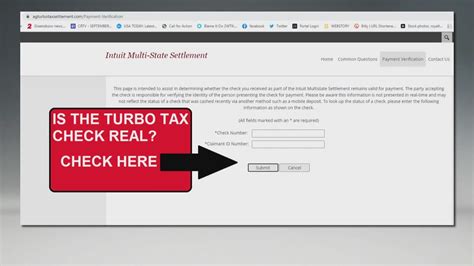

Online Services: Streamlining the Tax Process

In today's digital age, the County of Riverside has embraced technology to enhance the efficiency and convenience of its tax system. The county's official website provides a wealth of resources and tools to assist property owners in managing their tax obligations.

The online platform offers a range of services, including the ability to view and pay tax bills, check assessment information, and access detailed property records. Property owners can also sign up for email notifications to receive reminders about tax deadlines and important updates.

Furthermore, the website provides a comprehensive guide to the tax system, explaining the assessment process, tax rates, and relief programs in detail. This resource is invaluable for new homeowners and investors, helping them navigate the complexities of the tax system with ease.

Appeals and Disputes: Ensuring Fairness

While the County of Riverside strives for accuracy and fairness in its assessment process, there may be instances where property owners disagree with the assessed value of their property. In such cases, the county provides a formal appeals process to address these concerns.

The Assessment Appeals Board, an independent body, is responsible for hearing and deciding on appeals related to property assessments. Property owners who believe their property has been unfairly assessed can file an appeal within a specified timeframe, typically 60 days from the date of the assessment notice.

The appeals process is a formal proceeding, and it's essential for property owners to present a strong case supported by relevant evidence. This could include comparable sales data, professional appraisals, or other documentation demonstrating that the assessed value is excessive or inaccurate.

The Assessment Appeals Board considers each case individually, taking into account the presented evidence and the applicable laws and regulations. If the board determines that the assessment was indeed excessive, it has the authority to adjust the assessed value accordingly, providing relief to the property owner.

Future Implications and Tax Strategies

As the County of Riverside continues to grow and prosper, the tax system will play a pivotal role in shaping the future of the community. Understanding the current tax landscape and staying informed about potential changes is crucial for homeowners and investors to make informed decisions.

One key consideration is the potential impact of Proposition 13, a landmark legislation that limits property tax increases to no more than 2% per year unless there is a change in ownership. While this provision provides stability and predictability for homeowners, it also poses challenges for local governments in funding essential services.

As such, there may be ongoing discussions and proposals to modify or adjust Proposition 13 to address the changing needs of the community. Property owners and investors should stay engaged and informed about these developments, as they could have significant implications for future tax obligations.

In addition, staying informed about local initiatives and bond measures can provide insight into how tax dollars are being allocated and what future projects or services may be funded. This knowledge can help property owners understand the context of their tax obligations and make informed decisions about their real estate investments.

Lastly, seeking professional advice from tax consultants or financial advisors can provide valuable insights and strategies for managing property taxes effectively. These experts can offer personalized guidance based on an individual's unique circumstances, helping them navigate the complexities of the tax system with confidence.

Conclusion: Navigating the County of Riverside's Tax Landscape

The County of Riverside's tax system, while complex, is designed to ensure fairness and transparency in property taxation. By understanding the assessment process, tax rates, and relief programs, property owners can navigate this landscape with confidence and make informed decisions about their real estate investments.

As the county continues to thrive and evolve, staying informed and engaged in the tax system will be crucial for homeowners and investors alike. With the right knowledge and resources, navigating the County of Riverside's tax landscape can be a seamless and rewarding experience.

What is the deadline for paying property taxes in the County of Riverside?

+The first installment of property taxes is due on November 1st, while the second installment is due on February 1st of the following year. Late payments may incur penalties and interest.

How can I apply for a tax relief program, such as the Homeowner’s Exemption?

+To apply for the Homeowner’s Exemption, you can visit the County Assessor’s website or contact their office directly. They will guide you through the application process, which typically requires proof of occupancy and other relevant documentation.

Are there any penalties for late payment of property taxes?

+Yes, late payment of property taxes can result in penalties and interest charges. The specific penalties may vary depending on the amount owed and the duration of the delinquency. It’s crucial to stay informed about payment deadlines to avoid these additional costs.

How can I appeal my property assessment if I believe it is inaccurate?

+If you disagree with your property assessment, you can file an appeal with the Assessment Appeals Board. The process typically involves submitting an application, providing supporting evidence, and attending a hearing. It’s advisable to consult the County Assessor’s website for detailed instructions and guidelines.