Vancouver Wa Sales Tax

Vancouver, Washington, is a vibrant city nestled in the scenic Pacific Northwest, offering a unique blend of urban living and natural beauty. One aspect that often intrigues prospective residents and businesses alike is the sales tax structure in this region. This article delves into the specifics of Vancouver's sales tax, exploring its rates, applicability, and the impact it has on the local economy.

Understanding Vancouver’s Sales Tax

The sales tax in Vancouver, WA, is a crucial component of the city’s revenue generation strategy, contributing significantly to the funding of essential public services and infrastructure projects. The tax is applied to the sale of goods and certain services within the city limits, with rates varying based on the type of transaction and the goods involved.

Current Sales Tax Rates

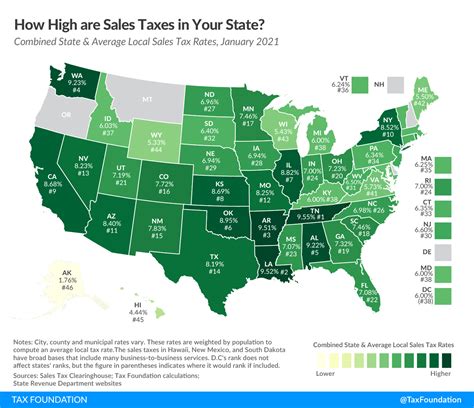

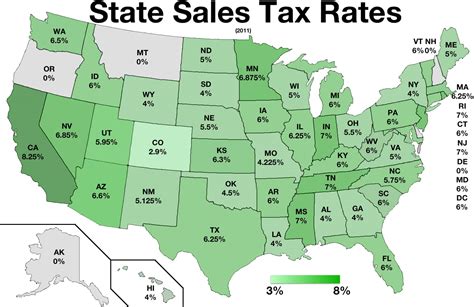

As of the latest information available, the sales tax rate in Vancouver is 8.3%. This rate comprises the state sales tax rate of 6.5%, as mandated by the State of Washington, and the local sales tax rate of 1.8%, which is imposed by the city of Vancouver. It’s important to note that sales tax rates are subject to change, so it’s advisable to refer to official sources for the most current information.

| Sales Tax Category | Rate |

|---|---|

| State Sales Tax | 6.5% |

| Local Sales Tax | 1.8% |

| Total Sales Tax | 8.3% |

Taxable Items and Exemptions

The sales tax in Vancouver applies to a wide range of goods and services, including retail purchases, restaurant meals, and certain services like admissions to entertainment events. However, there are also specific exemptions and exclusions from the sales tax. For instance, certain essential items like groceries, prescription medications, and over-the-counter drugs are generally exempt from sales tax.

Additionally, Vancouver offers a resale exemption for businesses that purchase goods for resale. This means that businesses engaged in wholesale trade or retail sales are not charged sales tax on the purchase of inventory, as long as they provide the necessary documentation to prove that the goods will be resold.

Impact on the Local Economy

The sales tax plays a pivotal role in shaping Vancouver’s economic landscape. It serves as a stable source of revenue for the city, enabling the funding of vital public services such as education, healthcare, public safety, and infrastructure development. The tax revenue contributes to maintaining and improving the city’s infrastructure, from roads and public transportation to recreational facilities and community centers.

Attracting Businesses and Promoting Economic Growth

Vancouver’s sales tax structure is designed to support economic growth and development. The city offers a competitive tax environment, which can be attractive to businesses considering relocation or expansion. By keeping the tax rates relatively low compared to other cities, Vancouver encourages business investment and job creation, fostering a thriving local economy.

Furthermore, the city's strategic location, with easy access to major transportation routes and proximity to Portland, Oregon, makes it an ideal hub for commerce and trade. The sales tax revenue generated by local businesses and consumers contributes to a virtuous cycle, where economic growth leads to increased tax revenue, which, in turn, supports further development and attracts more businesses and residents.

Community Impact and Resident Satisfaction

The sales tax not only benefits the city’s economic growth but also directly impacts the quality of life for Vancouver residents. The revenue generated is allocated to essential services that enhance community well-being. For instance, it funds public education, ensuring that local students have access to quality educational resources and opportunities. It also supports public safety initiatives, from police and fire services to emergency response systems, creating a safer environment for residents.

Additionally, the sales tax revenue is used to maintain and improve public infrastructure, such as parks, trails, and recreational facilities. These amenities promote an active and healthy lifestyle for residents and enhance the overall attractiveness of the city. By investing in these areas, Vancouver creates a vibrant and desirable community, fostering resident satisfaction and a sense of pride.

Sales Tax Compliance and Administration

Ensuring compliance with sales tax regulations is a critical aspect of doing business in Vancouver. Businesses are responsible for collecting and remitting the appropriate sales tax on taxable transactions. Failure to comply with sales tax obligations can result in penalties and legal consequences.

Registration and Reporting

Businesses operating in Vancouver must register with the Washington State Department of Revenue to obtain a Business License and a Sales Tax Permit. This registration process ensures that businesses are properly licensed and equipped to collect and remit sales tax. The sales tax permit number must be displayed at the business location and included on all sales invoices and receipts.

Registered businesses are required to file periodic sales tax returns, typically on a monthly or quarterly basis. These returns involve reporting the total taxable sales and the corresponding sales tax collected during the reporting period. The sales tax remitted is then paid to the state, with the majority of the revenue allocated to the city of Vancouver.

Sales Tax Audits and Enforcement

The Washington State Department of Revenue conducts regular audits to ensure compliance with sales tax regulations. These audits involve reviewing business records, including sales invoices, receipts, and accounting ledgers, to verify the accuracy of reported sales tax collections. Businesses found to be in violation of sales tax laws may face penalties, interest charges, and, in severe cases, criminal prosecution.

Future Implications and Potential Changes

As Vancouver continues to evolve and grow, the sales tax landscape may also undergo changes to adapt to the city’s evolving needs and economic dynamics. The city’s leaders and policymakers regularly review and assess the sales tax structure to ensure it remains competitive, fair, and aligned with the community’s interests.

Potential Tax Reforms

One potential area of reform is the exploration of a uniform sales tax rate across the state of Washington. Currently, the state sales tax rate is uniform, but local jurisdictions, including cities like Vancouver, can impose additional local sales taxes. A uniform sales tax rate could simplify the tax structure, making it more transparent and easier for businesses and consumers to understand.

Additionally, there may be considerations to adjust the sales tax rates based on the economic climate and the city's revenue needs. For instance, during economic downturns, temporary tax rate adjustments could be implemented to provide relief to businesses and consumers, while ensuring the city's financial stability.

E-Commerce and Online Sales Tax

The rise of e-commerce and online sales presents unique challenges for sales tax administration. Vancouver, like many other cities, is adapting to these changes by implementing measures to ensure that online sales are properly taxed. This includes working with online marketplaces and remote sellers to collect and remit sales tax on transactions that originate within the city limits.

The city is also actively engaged in discussions and collaborations with other local governments and state authorities to develop effective strategies for collecting sales tax from online sales. These efforts aim to ensure a level playing field for local businesses and maintain a fair tax environment for all businesses operating in the digital marketplace.

Conclusion

Vancouver’s sales tax is a crucial component of the city’s fiscal strategy, contributing to its economic vitality and the well-being of its residents. The sales tax rates, while competitive, provide a stable revenue stream for essential public services and infrastructure development. By understanding the sales tax landscape, businesses and residents can make informed decisions and contribute to the continued success and growth of Vancouver, WA.

How often do sales tax rates change in Vancouver, WA?

+

Sales tax rates can change periodically, typically to align with the city’s revenue needs and economic conditions. While there is no set schedule for changes, it is advisable to stay updated with the latest tax rates by checking official sources or consulting with tax professionals.

Are there any special tax incentives for businesses in Vancouver?

+

Vancouver offers a range of business incentives, including tax breaks and credits, to attract and support businesses. These incentives can vary based on industry, location, and other factors. It’s recommended to consult with the city’s economic development office or a tax advisor for specific information on available incentives.

How can I stay informed about sales tax changes and updates in Vancouver?

+

You can stay informed about sales tax changes by regularly checking the official websites of the Washington State Department of Revenue and the city of Vancouver. These sources provide the most up-to-date information on tax rates, regulations, and any upcoming changes. Additionally, subscribing to their newsletters or following their social media channels can ensure you receive timely updates.