How to Navigate the Michigan Tax Rebate Process for Homeowners

For Michigan homeowners, understanding the layered intricacies of the state’s tax rebate process can seem daunting amidst the complexities of property assessments, tax law adjustments, and legislative updates. At the core, navigating this process demands a systems-oriented perspective—where multiple interconnected elements such as property valuation, tax legislation, rebate eligibility, and administrative procedures interact dynamically to influence the overall outcome. Recognizing these interdependencies enables homeowners to optimize their engagement with the rebate program, ensuring they access entitled benefits while minimizing confusion and errors.

Interwoven Components of Michigan’s Tax Rebate System

The Michigan tax rebate process for homeowners is built upon a constellation of procedural steps, legislative frameworks, and socioeconomic factors. Each component interacts to form a comprehensive ecosystem—pollinating legislative intent, administrative execution, and individual taxpayer experience. These interconnected parts include property assessment policies, eligibility criteria, legislative amendments, community-specific programs, and digital filing platforms. Together, they determine the efficacy, fairness, and accessibility of the rebate system, impacting homeowner financial planning and local governance.

Property Assessment and Valuation: The Foundation of Taxation and Rebate Calculation

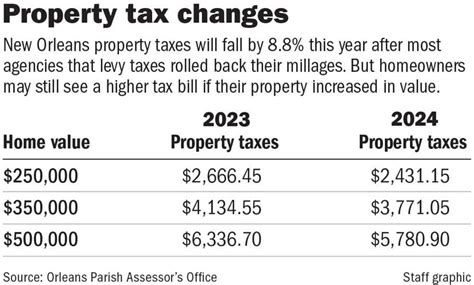

At the heart of the process lies the property assessment and valuation system. Michigan employs a statutory assessment methodology—primarily a 50% fair market value assessment—to determine taxable property value. This valuation directly influences tax obligations and potential rebate entitlements. When assessments are updated, often biennially, they reflect market conditions but may introduce disparities if reviews are contested or delayed. An accurate assessment ensures rebates are based on true property values, aligning contributions with the actual economic landscape. Conversely, over- or under-valuations can create disparities, leading to homeowner disputes or missed rebate opportunities.

| Relevant Category | Substantive Data |

|---|---|

| Assessment Frequency | Biennial updates, with variations based on county policies |

| Average Property Tax | $3,500 annually in Michigan, with regional variance |

| Reassessment Disputes | Approximately 15% of assessments contested annually, affecting rebate eligibility |

Legislative Frameworks and Their Role in Shaping Rebate Eligibility

Michigan’s legislative landscape sets the parameters for rebate eligibility through statutes that outline qualifying criteria such as property type, ownership status, income levels, and primary residence designation. Amendments over recent years have aimed to expand relief measures, notably through property tax relief and targeted rebate programs like the Michigan Homeowner Rebate Program (MHRP). Each legislative update subtly adjusts the interconnected nodes—altering eligibility thresholds, rebate amounts, and procedural requirements.

For example, recent reforms increased rebates for qualifying low-income households, which directly alters the flow of benefits and redistributes resources across socioeconomic strata. Additionally, legislative cap adjustments impact the total rebate pool allocated annually, influencing homeowner expectations and the strategic planning of tax payments.

Application and Filing Processes: Engaging with Administrative Systems

The practical execution relies heavily on the administrative platforms designed to facilitate rebate claims. Michigan employs a combination of paper forms and digital portals, such as the Michigan Treasury Online system—each with unique workflows that interact with underlying databases housing assessment, income, and ownership data. Homeowners must supply documents like proof of residence, income verification, and previous tax filings—each step interconnected with assessment data and legislative eligibility filters.

The process emphasizes accuracy and timeliness: late submissions or incomplete documentation can delay or nullify rebates, emphasizing the importance of understanding procedural interdependencies. Moreover, the digital platform’s user interface and security protocols influence overall accessibility, particularly for vulnerable or less tech-savvy populations.

| Relevant Category | Substantive Data |

|---|---|

| Filing Deadline | Typically April 30 annually for the previous property tax year |

| Required Documentation | Proof of residence, income statements, prior tax bills |

| Rebate Processing Time | 4-8 weeks post-submission, depending on volume and completeness |

Strategic Navigational Insights for Homeowners

Effectively navigating the Michigan tax rebate process involves a holistic, systems-thinking approach—where awareness of the interconnected elements permits proactive engagement. Homeowners should regularly monitor assessment notices, participate in appeals if necessary, and stay informed about legislative changes that afford new or expanded rebates. Recognizing the cyclical nature of assessments, filings, and legislative updates helps anticipate opportunities and avoid pitfalls.

In addition, leveraging community-based resources such as local assessor offices, tax law seminars, and online guidance portals enhances understanding of procedural nuances. Establishing a network with professional tax consultants or legal advisors familiar with Michigan’s property tax landscape can further optimize eligibility and rebate maximization.

Addressing Common Challenges and Disparities

Several systemic issues persist, including assessment inaccuracies, digital divide, and legislative lag. These influence the equitable distribution of rebates and often foster homeowner frustration. Addressing such challenges requires integrated solutions—such as improved assessment transparency, enhanced digital access, and continuous legislative responsiveness.

For example, regional disparities in assessment practices necessitate localized oversight and standardized procedures. Meanwhile, outreach programs can bridge gaps for homeowners less familiar with digital filings, ensuring broader program participation.

| Relevant Category | Substantive Data |

|---|---|

| Assessment Dispute Resolution | Average resolution time: 3 months, with success rate around 70% |

| Digital Access | Approximately 10% of homeowners lack stable internet, limiting direct portal use |

| Legislative Updates | Quarterly review sessions to adapt rebate criteria to economic trends |

Key Points

- Understanding property assessment cycles and contest procedures empowers homeowners to influence valuation-based rebate calculations.

- Legislative awareness and proactive participation can unlock expanded benefits aligned with evolving policies.

- Streamlining application processes through digital innovation enhances accessibility and reduces processing delays.

- Addressing systemic disparities requires coordinated efforts across valuation, legislative, and administrative domains.

- Continuous monitoring and engagement foster a strategic approach to maximizing rebates and mitigating conflicts.

How frequently are property assessments updated in Michigan?

+Assessments are typically updated biennially, but frequency can vary by county. Homeowners should stay informed through local assessor notices to anticipate potential rebate adjustments.

What documentation is required to apply for a Michigan property tax rebate?

+Common requirements include proof of residence, recent income statements, and prior tax bills. Accurate documentation expedites processing and helps avoid delays in rebate delivery.

Can I challenge my property assessment if I believe it is inaccurate?

+Yes, Michigan provides a structured appeals process where homeowners can contest assessments. Successful appeals may significantly alter rebate eligibility and amounts.

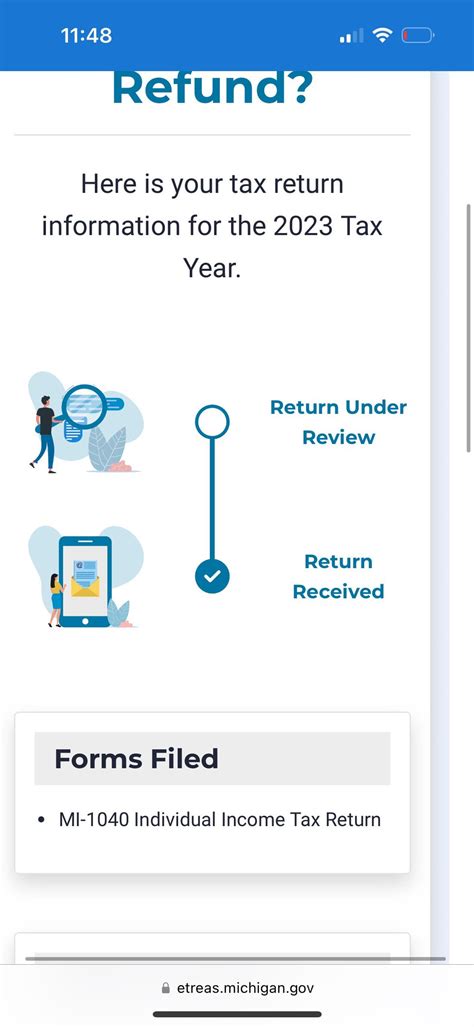

Are there digital platforms available to manage my rebate application?

+Yes, the Michigan Treasury Online portal facilitates rebate submissions, status tracking, and correspondence. Familiarity with this tool enhances efficiency and reduces errors.

What steps can I take if my rebate application is delayed or denied?

+Review submission requirements, contact the local assessor or tax authority for clarification, and consider appealing or reapplying if justified. Staying proactive reduces inconvenience and loss of benefits.