Winnebago Tax Records Wi

The Winnebago Tax Records in Wisconsin provide an intriguing glimpse into the financial landscape of the region, offering valuable insights into property ownership, taxation, and economic trends. These records, meticulously maintained by the Winnebago County government, are a treasure trove for historians, researchers, and individuals seeking to understand the fiscal history of this vibrant community.

A Historical Perspective on Winnebago Tax Records

Winnebago County, located in the heart of Wisconsin, has a rich history dating back to the early 19th century. The region’s tax records, which date as far back as the mid-1800s, offer a unique perspective on the development of the county’s infrastructure, the evolution of property values, and the changing economic landscape over the years.

These records, originally handwritten and meticulously preserved, document the property holdings and associated taxes of residents and businesses within Winnebago County. They provide a detailed account of the county's economic growth, the impact of various historical events, and the changing demographics of the region.

For instance, the tax records from the late 19th century reflect the post-Civil War economic boom, showcasing the growth of agriculture, manufacturing, and transportation industries in the region. They also highlight the impact of the progressive era, with changes in tax laws and the introduction of new property assessment methods.

Evolution of Tax Assessment Techniques

Over the years, the methods used for assessing property values and determining tax rates have evolved significantly. Early records often relied on detailed descriptions of the property, including the number of buildings, acreage, and any improvements made. These descriptions were used to assign a value to the property, which was then taxed at a predetermined rate.

With advancements in technology and assessment techniques, more modern records include precise measurements, detailed land use classifications, and even aerial photographs. These improvements in data collection and analysis ensure a more accurate and equitable tax system.

| Assessment Year | Assessment Method |

|---|---|

| 1880s | Handwritten descriptions and measurements |

| 1920s | Introduction of standardized forms and valuation guides |

| 1950s | Implementation of mass appraisal techniques |

| 1980s | Incorporation of computer-assisted mass appraisal systems |

Accessing Winnebago Tax Records: A Step-by-Step Guide

Winnebago County provides convenient access to its tax records through an online portal, making it easier than ever for researchers and the general public to explore this rich historical data.

Online Access

The Winnebago County website offers an intuitive search function for tax records. Here’s a simple guide to accessing these records online:

- Visit the Winnebago County Website: Navigate to the official Winnebago County government website. Look for a section dedicated to tax records or property information.

- Search by Address or Parcel ID: You can search for tax records by entering an address or the unique Parcel Identification Number (PID) associated with the property.

- Select the Desired Year: Once you've located the property, you'll be able to view tax records for various years. Choose the year for which you want to view the tax assessment and details.

- Review the Tax Record: The online portal will display a detailed tax record, including the assessed value, tax amount, and any special assessments or exemptions applied.

The online system is designed to provide quick and easy access to current and historical tax records, making it an invaluable resource for property research, historical studies, and genealogical inquiries.

In-Person Access

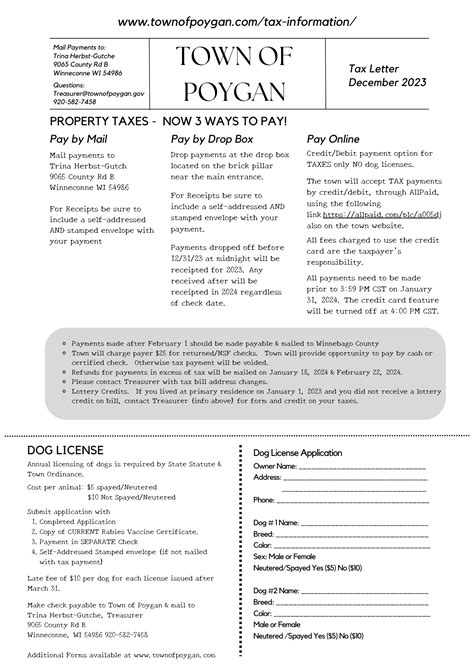

For those who prefer a more traditional approach or require assistance, Winnebago County also offers in-person access to its tax records. The County Treasurer’s Office maintains a physical archive of tax records, which can be viewed during regular business hours.

To access these records in person, you'll need to visit the County Treasurer's Office and fill out a request form. Staff members are available to assist with locating specific records and providing guidance on understanding the information contained within.

The Future of Winnebago Tax Records: Digital Preservation and Accessibility

Winnebago County recognizes the importance of preserving its historical tax records and making them accessible to a wide audience. As such, the county has undertaken a comprehensive digital preservation project to ensure the longevity and usability of these valuable records.

The project involves scanning and digitizing all existing tax records, from the earliest handwritten ledgers to more modern computerized assessments. This digital transformation not only preserves the records for future generations but also makes them more accessible and searchable.

The digital records are stored in a secure, cloud-based system, ensuring their safety and integrity. Additionally, the county is investing in advanced search and retrieval technologies, allowing users to quickly locate specific records based on various parameters, such as address, owner's name, or tax year.

Benefits of Digital Preservation

- Preservation: Digitization ensures that the records are protected from physical deterioration, damage, or loss due to natural disasters or other unforeseen events.

- Accessibility: Digital records can be accessed remotely, allowing researchers, historians, and the public to explore these valuable resources from anywhere in the world.

- Searchability: Advanced search tools make it easier to locate specific records, saving time and effort for users.

- Data Analysis: Digital records can be analyzed using advanced data analytics tools, providing insights into historical economic trends, property value fluctuations, and demographic changes.

Conclusion: Unlocking the Past, Informing the Future

Winnebago Tax Records in Wisconsin offer a fascinating journey through the county’s fiscal history, providing insights into the evolution of property values, tax systems, and economic trends. Through both online and in-person access, these records are readily available to anyone interested in exploring the past or understanding the foundations of the region’s present-day economy.

As Winnebago County continues its digital preservation efforts, these records will become even more accessible and useful, not only for historians and researchers but also for policymakers, economists, and the general public. By understanding the past, we can better plan for the future, and Winnebago Tax Records play a vital role in this process.

How often are Winnebago County tax records updated online?

+Winnebago County strives to keep its online tax records up-to-date. The records are typically updated annually, with the most recent tax assessments and changes reflected in the online system within a few months of the assessment year’s end.

Can I access historical tax records for genealogical research?

+Absolutely! Winnebago County’s tax records are an excellent resource for genealogical research. The records can provide insights into family property ownership, wealth, and the historical context in which they lived.

Are there any restrictions on accessing Winnebago Tax Records online?

+While the Winnebago County tax records are generally accessible to the public, there may be certain restrictions on viewing sensitive or confidential information. This could include information related to tax appeals, pending litigation, or personal financial details. In such cases, the records may be redacted or access may be restricted to authorized individuals.

Can I download or print Winnebago Tax Records from the online portal?

+Yes, the Winnebago County online tax record portal allows users to download and print tax records for personal use. However, it’s important to note that these records are for informational purposes only and should not be used for official or legal purposes without verification from the County Treasurer’s Office.