Connecticut Sales Tax

Connecticut's sales and use tax system is an integral part of the state's revenue collection, playing a crucial role in funding public services and infrastructure. This tax, imposed on the sale of tangible personal property and certain services, is a significant source of revenue for the state government, impacting both businesses and consumers. With a rich history and unique characteristics, Connecticut's sales tax system offers an intriguing study of economic policy and its real-world implications.

Understanding Connecticut Sales Tax

The sales tax in Connecticut is a transaction-based tax applied to the retail sale, rental, or lease of most tangible personal property and some services. It is a percentage of the purchase price that is collected by the seller and remitted to the Connecticut Department of Revenue Services (DRS). The current state sales and use tax rate is 6.35%, effective from October 1, 2023. This rate is applicable statewide and is added to the price of goods and services at the point of sale.

However, Connecticut's sales tax system is not uniform across all products and services. Certain items are exempt from sales tax, while others are subject to a reduced rate or additional surcharges. For instance, sales of prescription drugs and medical devices are exempt from sales tax, while a 1% sales tax surcharge is applied in certain municipalities to support education programs.

Sales Tax Exemptions and Special Cases

Connecticut’s sales tax system offers a range of exemptions and special cases. These include exemptions for specific industries, such as the sale of machinery used directly in manufacturing or research and development, as well as sales to certain organizations like charitable, religious, or educational institutions.

Additionally, the state provides exemptions for certain goods, such as food items for home consumption, clothing and footwear (up to $50), and newspapers and periodicals. These exemptions are designed to alleviate the tax burden on essential items and promote social equity.

| Exempt Category | Description |

|---|---|

| Manufacturing Machinery | Sales of machinery and equipment used directly in manufacturing processes are exempt. |

| Charitable Organizations | Sales to and by charitable, religious, and educational institutions are exempt from sales tax. |

| Food and Groceries | Food items intended for home consumption are exempt from sales tax. |

| Clothing and Footwear | Sales of clothing and footwear under $50 per item are exempt. |

Sales Tax Registration and Collection

Any business that sells taxable goods or services in Connecticut, or has nexus (a physical presence) in the state, is required to register with the DRS and collect sales tax from customers. This includes online retailers who ship goods to Connecticut residents, as well as businesses that provide certain taxable services remotely.

The registration process involves obtaining a Connecticut Sales and Use Tax Permit. Once registered, businesses are responsible for collecting the appropriate tax rate from customers, maintaining accurate records, and filing periodic tax returns to remit the collected tax to the DRS.

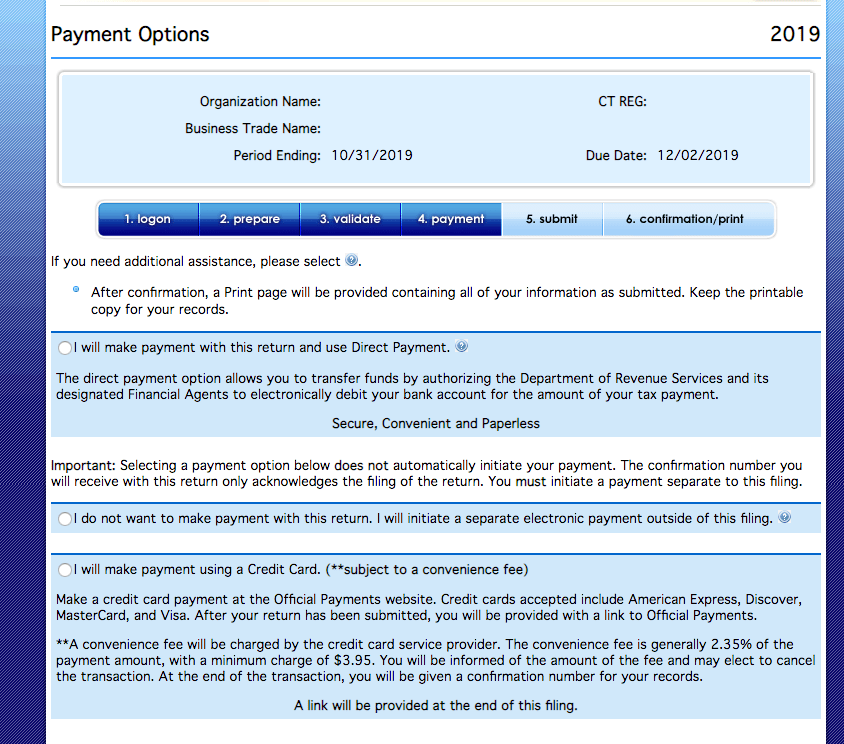

Sales Tax Filing and Payment

Connecticut’s sales tax returns are due on the 20th day of the month following the reporting period. For example, sales tax collected in January would be due on February 20th. Late filings can result in penalties and interest, so timely submission is crucial.

Businesses have the option to file and pay sales tax online through the DRS website, which provides a secure and efficient method for tax compliance. The DRS also offers resources and guidance to help businesses understand their sales tax obligations and navigate the filing process.

Impact on Businesses and Consumers

Connecticut’s sales tax has a significant impact on both businesses and consumers. For businesses, the tax affects pricing strategies, cash flow, and administrative costs associated with tax compliance. It can influence competitive positioning and customer perceptions, especially when compared to neighboring states with different tax rates.

For consumers, sales tax adds to the cost of goods and services, affecting purchasing power and consumer behavior. The tax burden can be particularly noticeable for larger purchases, and consumers often factor in tax rates when making buying decisions, especially for discretionary items.

Sales Tax and Economic Development

The sales tax rate can also influence economic development and investment decisions. Lower tax rates can make a state more attractive for businesses to locate or expand, potentially leading to job creation and economic growth. Conversely, higher tax rates may drive businesses and consumers to seek out lower-tax alternatives, impacting the state’s economic competitiveness.

Connecticut's sales tax system, with its varying rates and exemptions, provides an intricate landscape for businesses and consumers to navigate. Understanding these nuances is crucial for economic actors to make informed decisions and contribute to the state's fiscal health.

Connecticut’s Sales Tax: A Comparative Analysis

When compared to other states, Connecticut’s sales tax system reveals some unique characteristics and competitive advantages. The 6.35% state sales tax rate places Connecticut in the middle range of state sales tax rates, offering a balanced approach between revenue generation and maintaining a competitive business environment.

However, it's important to note that Connecticut's sales tax system is not isolated from other state taxes. The state also levies a corporate income tax and a personal income tax, which together with sales tax contribute to Connecticut's overall tax burden.

Regional Competition and Tax Strategies

Connecticut’s sales tax rate is higher than some neighboring states, such as New Hampshire and Delaware, which have no sales tax. This can lead to cross-border shopping, where consumers choose to make purchases in lower-tax states, impacting Connecticut’s retail industry. However, Connecticut’s strategic location and strong economic base provide counterbalancing factors, attracting businesses and consumers despite the higher tax rate.

The state's tax policies, including sales tax rates and exemptions, are part of a broader economic development strategy. By offering a balanced tax structure and a supportive business environment, Connecticut aims to attract and retain businesses, drive economic growth, and generate revenue to fund essential public services.

Future Trends and Implications

The future of Connecticut’s sales tax system is shaped by a dynamic interplay of economic, technological, and policy factors. As the state continues to evolve, several key trends and implications emerge that will influence the sales tax landscape.

Online Sales and Remote Taxation

The growth of e-commerce and online sales presents a significant challenge and opportunity for Connecticut’s sales tax system. While online sales have expanded the reach of Connecticut businesses, they also present complexities in tax collection and compliance. The state has taken steps to address this, implementing laws and regulations to ensure online retailers collect and remit sales tax, even for remote sales.

However, the rapid pace of technological change and evolving consumer behaviors require ongoing adaptation. Connecticut will need to stay abreast of these changes to ensure its sales tax system remains effective and equitable, especially as more transactions move online.

Tax Policy and Economic Development

Connecticut’s sales tax system is a key component of its overall tax policy, which in turn influences economic development strategies. As the state seeks to attract and retain businesses, it must balance the need for revenue generation with creating a competitive business environment. This delicate balance often involves careful consideration of tax rates, exemptions, and incentives to foster economic growth while maintaining fiscal responsibility.

In recent years, Connecticut has focused on tax reforms and incentives to promote business investment and job creation. These efforts, coupled with a strong commitment to education and innovation, position Connecticut well for future economic growth, despite the challenges posed by a changing economic landscape.

Conclusion

Connecticut’s sales tax system is a complex yet vital component of the state’s economic landscape. It influences business decisions, consumer behavior, and the overall fiscal health of the state. By understanding the nuances of this system, businesses and consumers can navigate the tax landscape effectively, contributing to Connecticut’s vibrant economy.

As we've explored, Connecticut's sales tax system offers a balanced approach, providing revenue for essential services while maintaining a competitive business environment. However, the dynamic nature of the economy and the evolving challenges of e-commerce require ongoing adaptation and innovation. By staying informed and engaged, stakeholders can ensure Connecticut's sales tax system remains a robust and equitable component of the state's fiscal policy.

FAQ

What is the current sales tax rate in Connecticut?

+

The current state sales and use tax rate in Connecticut is 6.35%, effective from October 1, 2023.

Are there any sales tax exemptions in Connecticut?

+

Yes, Connecticut offers a range of sales tax exemptions, including sales of manufacturing machinery, sales to charitable organizations, food items for home consumption, and clothing and footwear under $50.

How often do businesses need to file sales tax returns in Connecticut?

+

Sales tax returns in Connecticut are due on the 20th day of the month following the reporting period. For example, sales tax collected in January would be due on February 20th.

What impact does Connecticut’s sales tax have on businesses and consumers?

+

For businesses, Connecticut’s sales tax affects pricing strategies, cash flow, and administrative costs. For consumers, it adds to the cost of goods and services, impacting purchasing power and buying decisions.

How does Connecticut’s sales tax compare to other states?

+

Connecticut’s 6.35% state sales tax rate places it in the middle range of state sales tax rates. However, the overall tax burden also includes corporate and personal income taxes, which should be considered in comparison to other states.