Chicago Sales Tax Rate

Sales tax is a common and essential aspect of commerce, and it plays a significant role in generating revenue for local governments and municipalities. In the city of Chicago, the sales tax system is a crucial component of the city's fiscal strategy, providing funding for various public services and infrastructure development. This article aims to delve into the intricacies of the Chicago sales tax rate, exploring its history, current structure, and the impact it has on businesses and consumers within the city.

Understanding the Chicago Sales Tax Structure

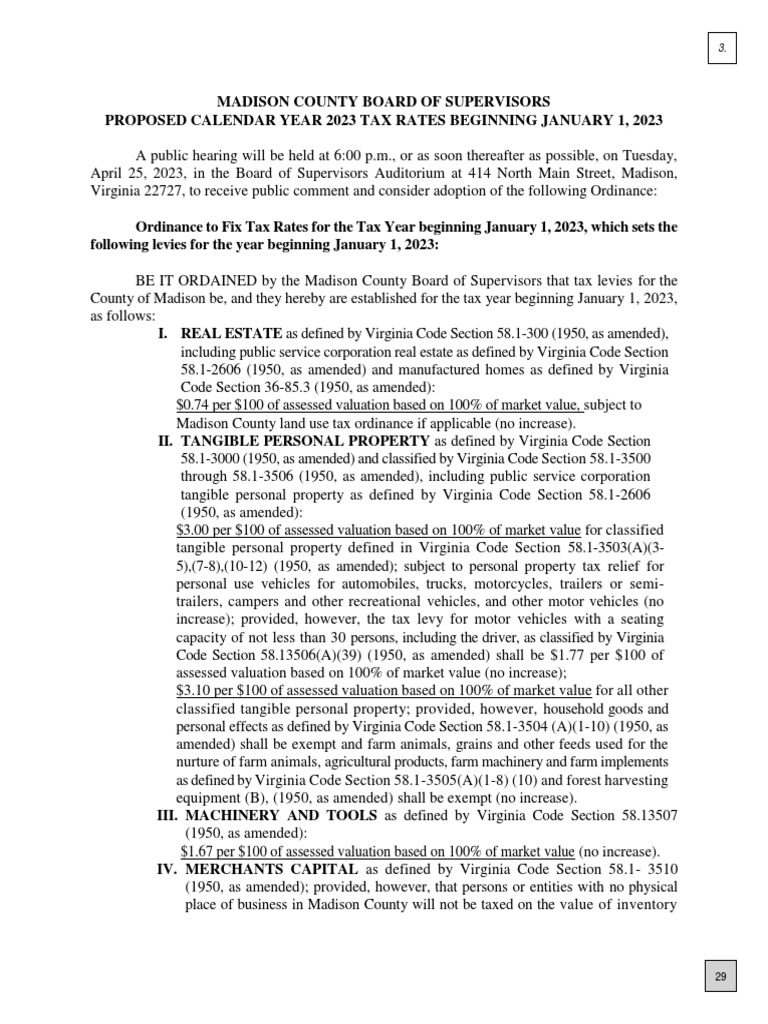

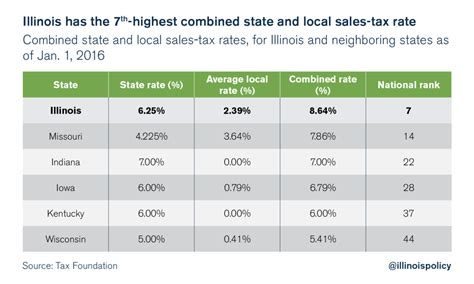

The sales tax in Chicago operates as a cumulative tax, meaning that it is applied at multiple levels, including the state, county, and municipal levels. This cumulative nature results in a composite tax rate that varies depending on the location of the sale and the type of goods or services being purchased.

The Chicago sales tax rate is composed of several components. At the state level, Illinois imposes a base sales tax rate of 6.25%, which is applied uniformly across the state. However, Chicago, being the largest city in Illinois, has its own additional tax rate on top of the state rate. The Chicago city sales tax rate is currently set at 2.25%, bringing the total combined state and city sales tax rate to 8.5% for most goods and services within the city limits.

Beyond the state and city levels, there are also special purpose taxes that can further impact the overall sales tax rate. These special taxes are typically levied to support specific initiatives or projects, such as transportation infrastructure or tourism promotion. For instance, in Chicago, there is an additional regional transportation authority tax of 1% that is applied to certain transactions, bringing the total sales tax rate to 9.5% in these cases.

Examples of Sales Tax Calculation

To illustrate how the Chicago sales tax rate works in practice, consider the following scenarios:

- If you purchase a new pair of shoes in Chicago, the sales tax rate would be 8.5% (state tax of 6.25% + city tax of 2.25%). So, for a 100 pair of shoes, you would pay a total of 108.50, including the sales tax of 8.50.</li> <li>However, if you were to buy a transit pass or a hotel stay in Chicago, the additional <em>regional transportation authority tax</em> of 1% would apply, resulting in a total sales tax rate of <strong>9.5%</strong>. In this case, for a 50 transit pass, you would pay 54.75, with 4.75 going towards sales tax.

| Item | Price | Sales Tax Rate | Sales Tax Amount | Total Cost |

|---|---|---|---|---|

| Shoes | $100 | 8.5% | $8.50 | $108.50 |

| Transit Pass | $50 | 9.5% | $4.75 | $54.75 |

Historical Perspective and Rate Changes

The sales tax rate in Chicago has undergone several changes over the years, often in response to economic conditions, budgetary needs, and policy decisions. Understanding the historical context can provide valuable insights into the evolution of the city’s fiscal landscape.

The city of Chicago first introduced a local sales tax in the mid-20th century, with the aim of generating additional revenue to support the growing urban population and infrastructure demands. Since then, the sales tax rate has been adjusted multiple times, typically in response to specific financial challenges or to fund major public projects.

One notable instance of a significant rate change occurred in the late 2000s. In response to a budget crisis, the city implemented a temporary increase in the sales tax rate, raising it from 2% to 2.25%. This temporary measure was designed to provide a financial boost during a challenging economic period. While the rate was intended to be temporary, it has since been maintained, reflecting the ongoing fiscal needs of the city.

Impact on Businesses and Consumers

The Chicago sales tax rate has a profound impact on both businesses and consumers within the city. For businesses, particularly those operating in the retail sector, the sales tax rate can influence pricing strategies, profit margins, and overall competitiveness. Higher sales tax rates can potentially drive up the final cost of goods, making it more challenging for businesses to remain price-competitive in the market.

On the consumer side, the sales tax rate directly affects purchasing power and spending decisions. A higher sales tax rate can make certain purchases more expensive, potentially discouraging discretionary spending and impacting consumer behavior. However, it's worth noting that sales tax is a necessary component of the city's fiscal health, contributing to the funding of essential public services and infrastructure improvements that benefit the community as a whole.

Sales Tax Exemptions and Special Cases

While the Chicago sales tax rate applies to a wide range of goods and services, there are certain exemptions and special cases to consider. Understanding these exemptions is crucial for both businesses and consumers to ensure compliance with the tax regulations.

Exempt Goods and Services

Illinois, and subsequently Chicago, provides sales tax exemptions for specific types of goods and services. These exemptions are designed to encourage certain economic activities or support specific industries. Some common examples of sales tax-exempt items in Chicago include:

- Prescription medications

- Non-prepared food items (such as groceries)

- Certain medical devices and equipment

- Residential rent payments

- Educational services and supplies

- Some agricultural products

It's important for businesses to stay informed about these exemptions to ensure they are correctly applying sales tax to their transactions. Misapplication of sales tax can lead to legal and financial consequences.

Special Cases and Tax Holidays

In addition to the standard sales tax rate and exemptions, Chicago, along with the state of Illinois, sometimes introduces special tax initiatives or events. These initiatives are often designed to stimulate the economy, promote specific industries, or provide temporary relief to consumers.

One notable example is the Back-to-School Sales Tax Holiday, which is an annual event where certain school supplies, clothing, and other back-to-school items are exempt from sales tax for a limited period. This initiative encourages families to purchase necessary school items while providing a financial incentive during a time of increased spending.

These special cases and tax holidays can provide unique opportunities for both businesses and consumers, but they also require careful attention to the specific rules and eligibility criteria to ensure compliance.

Future Outlook and Potential Changes

The sales tax landscape in Chicago is subject to ongoing evaluation and potential adjustments. As the city’s fiscal needs evolve, and as economic conditions change, the sales tax rate may be a key tool for addressing budgetary concerns or funding new initiatives.

In recent years, there has been growing discussion around the possibility of further increasing the sales tax rate, particularly to support infrastructure projects and address long-standing maintenance needs. However, such proposals often face significant public scrutiny and require careful consideration of their potential impact on businesses and consumers.

Additionally, with the rise of e-commerce and the changing nature of retail, there may be future discussions around how to effectively tax online sales and ensure a level playing field between online and brick-and-mortar businesses. These developments could have a significant impact on the sales tax system in Chicago and beyond.

Staying Informed and Engaged

For businesses and individuals operating in Chicago, staying informed about sales tax rates and regulations is crucial. The city’s Department of Finance provides official guidance and resources on sales tax, including rate updates and information on applicable exemptions. Additionally, engaging with local business associations and tax professionals can help ensure compliance and provide valuable insights into the evolving tax landscape.

As the city continues to navigate its fiscal challenges and opportunities, the sales tax rate will remain a key focus, impacting the daily lives and economic decisions of Chicagoans. Understanding this complex system is an essential part of being an informed citizen and business owner in the city.

How often does the Chicago sales tax rate change?

+The Chicago sales tax rate can change in response to budgetary needs or policy decisions. While it is not a regular occurrence, there have been instances where the rate has been adjusted, particularly during economic challenges or to fund specific initiatives. It is important to stay updated with official sources for any changes.

Are there any online resources to help calculate sales tax in Chicago?

+Yes, there are several online calculators and tools available that can assist with sales tax calculations for Chicago. These tools often consider the state, city, and any applicable special taxes. However, it is always recommended to refer to official government resources for the most accurate and up-to-date information.

What happens if I incorrectly apply sales tax to my transactions as a business owner in Chicago?

+Incorrectly applying sales tax can lead to legal and financial consequences. It is crucial for businesses to stay informed about the applicable sales tax rates and exemptions. Consulting with tax professionals or seeking guidance from the Department of Finance can help ensure compliance and avoid potential penalties.