Hawaii State Tax Refund

Hawaii, known for its stunning beaches and tropical paradise, offers a unique tax system and provides an opportunity for residents and visitors alike to claim refunds on certain tax-related scenarios. Understanding the state's tax refund process is essential for anyone looking to maximize their financial gains. This comprehensive guide will delve into the specifics of the Hawaii State Tax Refund, covering eligibility, procedures, and strategies to ensure you receive the refund you're entitled to.

Understanding the Hawaii State Tax System

Hawaii operates on a unique tax system compared to many other states in the U.S. It is one of the few states that does not impose a personal income tax on its residents, opting instead for a general excise tax (GET) and a use tax.

General Excise Tax (GET)

The General Excise Tax is levied on the privilege of doing business in Hawaii. It applies to most transactions involving the sale of goods, services, and even certain leases. The GET is typically passed on to the consumer, appearing as a percentage added to the purchase price.

| Tax Rate | Description |

|---|---|

| 4.0% | General rate applicable to most transactions |

| 0.5% | County surcharge on Oahu |

| 0.15% | Road improvement surcharge |

| 0.15% | Mass transit surcharge |

This means that when you purchase goods or services in Hawaii, you're likely paying a GET of around 4.5% to 4.8% depending on the location. It's important to note that this tax is not just limited to retail purchases; it also applies to services like hotel stays, car rentals, and even some professional services.

Use Tax

The Use Tax is complementary to the GET and is imposed on the use, storage, or consumption of goods or services in Hawaii, even if the transaction itself took place outside the state. This tax is often overlooked but is just as important to understand, especially for businesses and individuals who make online purchases from out-of-state vendors.

For instance, if you order goods online from a company based on the mainland U.S. and have them shipped to your Hawaii address, you are liable for the Use Tax. The rate is the same as the GET, and it is the buyer's responsibility to remit this tax to the Hawaii Department of Taxation.

Eligibility for a Hawaii State Tax Refund

Not everyone who pays taxes in Hawaii is eligible for a refund. The eligibility criteria are primarily based on two factors: overpayment of taxes and specific tax scenarios.

Overpayment of Taxes

The most common scenario for a tax refund is when an individual or business has overpaid their taxes. This can happen for various reasons, such as:

- Incorrect Tax Assessment: Sometimes, businesses or individuals may be charged a higher tax rate than they should. This could be due to an error in calculation or a misunderstanding of the applicable tax rates.

- Multiple Tax Payments: If a business or individual pays taxes multiple times on the same transaction, either due to an error or a misunderstanding of the tax system, they are entitled to a refund for the overpayment.

- Tax Credits and Exemptions: Hawaii offers various tax credits and exemptions for specific circumstances. If an individual or business qualifies for these but has not received the benefit, they can claim a refund.

Specific Tax Scenarios

Apart from overpayment, there are several specific tax scenarios where a refund may be due:

- Non-Resident Taxes: Non-residents of Hawaii who pay taxes on their Hawaii-sourced income may be eligible for a refund if they've paid more than what is legally required. This includes income from work, investments, or other sources within the state.

- Sales Tax Refunds for Visitors: Visitors to Hawaii who purchase goods and pay the GET are entitled to a refund on certain items if they are not consumed or used within the state. This is particularly relevant for tourists who purchase items for personal use back home.

- Tax on Insurance Premiums: Hawaii imposes a tax on insurance premiums, but if an individual or business pays this tax and then cancels their policy, they may be eligible for a refund on the unearned portion of the tax.

The Process of Claiming a Hawaii State Tax Refund

The process of claiming a Hawaii State Tax Refund can be straightforward if you understand the steps and have the necessary documentation. Here’s a step-by-step guide to help you through the process:

Step 1: Identify the Basis for Your Refund

Before you begin the refund process, you need to identify why you believe you are entitled to a refund. Is it due to overpayment, a specific tax scenario, or a combination of both? Understanding the reason will help you gather the necessary documentation and determine the correct form to use.

Step 2: Gather Documentation

Collect all relevant documents that support your claim for a refund. This could include tax returns, receipts, invoices, cancelled checks, or any other proof of payment or entitlement. If you’re claiming a refund due to overpayment, you’ll need to provide evidence of the original payment and the reason for the overpayment.

Step 3: Choose the Right Form

Hawaii provides various forms for different types of tax refunds. The most common forms are the Form N-1 for individuals and Form B-1 for businesses. However, there are specific forms for different tax scenarios, such as Form W-1 for non-residents or Form L-1 for tax on insurance premiums.

Ensure you select the correct form based on your circumstances. Incorrectly filling out the form or choosing the wrong one can delay your refund or even result in a denial.

Step 4: Complete the Form

Fill out the form accurately and completely. Provide all the required information, including your personal details, the reason for the refund, the amount claimed, and supporting documentation. Make sure to sign and date the form.

Step 5: Submit the Form

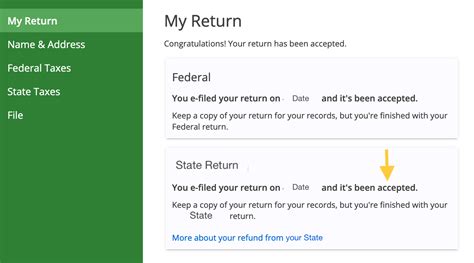

Submit your completed form along with all supporting documentation to the Hawaii Department of Taxation. You can do this online through their secure portal, by mail, or in person at one of their offices. Ensure you keep a copy of everything you submit for your records.

Step 6: Await Processing

Once your form and documentation have been submitted, the Department of Taxation will process your request. The time it takes to receive your refund can vary depending on the complexity of your claim and the volume of applications they’re processing. Typically, refunds are issued within 4-6 weeks, but it can take longer in certain circumstances.

Maximizing Your Hawaii State Tax Refund

While the process of claiming a Hawaii State Tax Refund is straightforward, there are strategies you can employ to maximize your refund. Here are some tips to consider:

Keep Accurate Records

Maintaining accurate and organized records is essential for claiming a refund. Keep all your receipts, invoices, and tax-related documents in a safe place. This will make it easier to identify potential refund opportunities and provide the necessary proof when making a claim.

Understand Tax Laws and Changes

Hawaii’s tax laws are subject to change, and staying informed about these changes can help you identify new refund opportunities or potential overpayments. Keep an eye on tax law updates, especially when preparing your tax returns or planning major purchases.

Consider Professional Help

If you’re unsure about your eligibility for a refund or need assistance with the process, consider seeking help from a tax professional. They can review your situation, identify potential refund opportunities, and ensure your claim is processed correctly.

Stay Informed About Refund Status

Once you’ve submitted your refund claim, stay informed about its status. The Hawaii Department of Taxation provides an online tool to check the status of your refund. Regularly checking this tool can help you identify any delays or issues with your claim.

Conclusion

Understanding the Hawaii State Tax system and the process of claiming refunds is crucial for residents and visitors alike. By staying informed about the tax laws, keeping accurate records, and following the correct procedures, you can ensure you receive any refunds you’re entitled to. Whether it’s due to overpayment or specific tax scenarios, the Hawaii State Tax Refund process offers an opportunity to reclaim your hard-earned money.

How long does it take to receive a Hawaii State Tax Refund?

+The time it takes to receive a Hawaii State Tax Refund can vary depending on the complexity of your claim and the volume of applications the Department of Taxation is processing. Typically, refunds are issued within 4-6 weeks, but it can take longer in certain circumstances.

What is the difference between the General Excise Tax (GET) and the Use Tax in Hawaii?

+The GET is a tax levied on the privilege of doing business in Hawaii and is typically passed on to the consumer as a percentage added to the purchase price. The Use Tax, on the other hand, is imposed on the use, storage, or consumption of goods or services in Hawaii, even if the transaction itself took place outside the state. It is the buyer’s responsibility to remit this tax to the Hawaii Department of Taxation.

Are there any tax credits or exemptions in Hawaii that can help reduce my tax liability?

+Yes, Hawaii offers various tax credits and exemptions for specific circumstances. These can include credits for energy-efficient home improvements, child and dependent care expenses, and even tax exemptions for certain military personnel. It’s important to stay informed about these credits and exemptions and ensure you meet the eligibility criteria to take advantage of them.