Arkansas Sales Tax

Sales tax is an essential component of the tax system in the United States, and each state has its own unique regulations and rates. In the state of Arkansas, sales tax plays a significant role in generating revenue for various government programs and services. This article will delve into the intricacies of Arkansas sales tax, providing a comprehensive understanding of its structure, rates, exemptions, and the impact it has on businesses and consumers.

Understanding Arkansas Sales Tax

Arkansas, like many other states, imposes a sales and use tax on the sale of tangible personal property and certain services. The state sales tax rate is established by the Arkansas Department of Finance and Administration (DFA), which is responsible for collecting and distributing these tax revenues. However, it’s important to note that Arkansas has a unique approach to sales tax, as it allows local governments to levy additional sales taxes, creating a complex web of tax rates across the state.

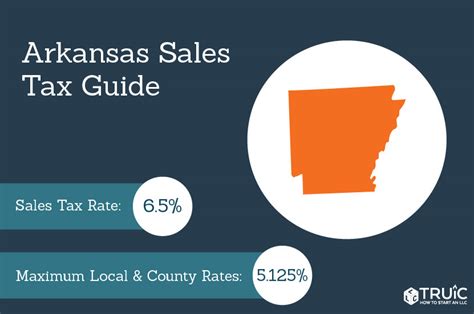

Statewide Sales Tax Rate

As of [current date], the statewide sales and use tax rate in Arkansas stands at 6.5%. This rate is applicable to most transactions, including the sale of goods and certain services. The state sales tax is a critical source of revenue, contributing significantly to the state’s budget.

Local Sales Tax Rates

In addition to the statewide rate, Arkansas allows counties and municipalities to impose their own local sales taxes. These local taxes are often used to fund specific projects or initiatives within a community. As a result, the total sales tax rate can vary significantly depending on the location of the transaction. For instance, in the city of Little Rock, the total sales tax rate is 9.25%, while in the city of Fayetteville, it is 8.75%.

| Location | Total Sales Tax Rate |

|---|---|

| Little Rock | 9.25% |

| Fayetteville | 8.75% |

| Springdale | 8.25% |

| Fort Smith | 8.5% |

| Jonesboro | 8.5% |

These local tax rates can make it challenging for businesses operating in multiple jurisdictions within Arkansas to manage their tax obligations effectively. It's crucial for businesses to stay updated on the latest tax rates to ensure compliance and avoid penalties.

Exemptions and Special Considerations

While Arkansas sales tax applies to a wide range of goods and services, there are certain exemptions and special considerations that businesses and consumers should be aware of. These exemptions can significantly impact the tax liability of a transaction.

Food and Groceries

One notable exemption in Arkansas is for unprepared food and groceries. This means that items such as fresh produce, meat, dairy, and non-prepared food items are generally exempt from sales tax. However, it’s important to note that this exemption does not apply to restaurant meals or prepared foods.

Clothing and Footwear

Arkansas also offers a sales tax exemption for certain clothing and footwear items. Specifically, clothing and footwear items priced under $100 are exempt from sales tax. This exemption provides a significant relief for consumers, especially those on a budget.

Prescription Drugs

Prescription drugs and certain medical devices are exempt from sales tax in Arkansas. This exemption aims to reduce the financial burden on individuals who require essential medications and medical supplies.

Manufacturing and Resale

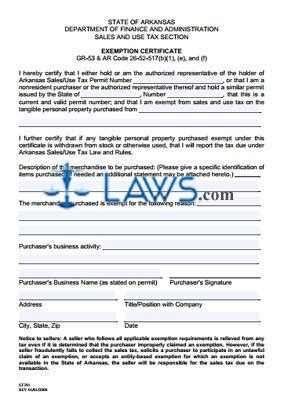

Businesses engaged in manufacturing or wholesale operations often benefit from sales tax exemptions. In Arkansas, manufacturers and wholesalers can apply for a Resale Exemption Certificate, which allows them to purchase goods for resale without paying sales tax. This exemption ensures that the tax is only applied at the final point of sale to the consumer.

Compliance and Reporting

For businesses operating in Arkansas, compliance with sales tax regulations is crucial. The Arkansas DFA provides guidelines and resources to help businesses understand their obligations. Here are some key considerations for businesses:

Registering for a Sales Tax Permit

Businesses that make taxable sales in Arkansas must obtain a Sales and Use Tax Permit from the DFA. This permit allows businesses to collect and remit sales tax on behalf of the state.

Sales Tax Collection

Businesses are responsible for collecting the appropriate sales tax rate based on the location of the transaction. This includes the statewide rate and any applicable local rates. It’s essential to ensure accurate tax calculations to avoid discrepancies.

Filing and Remittance

Sales tax collected by businesses must be remitted to the DFA on a regular basis. The frequency of filing and remittance depends on the business’s sales volume. Some businesses may file monthly, while others may file quarterly or annually.

Record-Keeping

Proper record-keeping is crucial for sales tax compliance. Businesses should maintain records of all sales transactions, including the tax collected, to facilitate accurate reporting and auditing.

Impact on Businesses and Consumers

Arkansas sales tax has a significant impact on both businesses and consumers within the state. For businesses, sales tax can influence pricing strategies, cash flow management, and overall profitability. Here’s a closer look at these impacts:

Pricing and Competitiveness

Businesses must consider the impact of sales tax when setting their prices. Higher tax rates can affect a business’s ability to compete with online retailers or businesses located in states with lower tax rates. It’s crucial for businesses to strike a balance between covering their tax obligations and remaining competitive.

Cash Flow and Profit Margins

Sales tax collected by businesses is remitted to the state, which can impact a business’s cash flow. Especially for small businesses, managing cash flow while awaiting tax remittance periods can be challenging. Additionally, businesses must ensure that their profit margins account for sales tax to remain profitable.

Consumer Perspective

For consumers, sales tax is an added cost to their purchases. While exemptions and special considerations provide some relief, consumers in Arkansas may find that the varying local tax rates can impact their overall shopping experiences and budgets.

Future Implications and Potential Changes

Arkansas sales tax, like any tax system, is subject to potential changes and reforms. Here are some factors that could influence the future of sales tax in the state:

Economic Growth and Development

As Arkansas continues to attract businesses and develop its economy, the state may consider adjustments to its sales tax structure to encourage further growth. Lowering tax rates or offering incentives could be strategies to attract investment and create a more competitive business environment.

Online Sales Tax Collection

With the rise of e-commerce, states are increasingly focused on collecting sales tax from online transactions. Arkansas may explore ways to ensure that online retailers, both in-state and out-of-state, comply with sales tax regulations. This could involve implementing new laws or partnering with online marketplaces to collect and remit taxes.

Streamlining Tax Rates

The variability of local sales tax rates in Arkansas can be a challenge for both businesses and consumers. There may be a push to streamline these rates, either by reducing the number of local tax jurisdictions or by standardizing rates across the state. This could simplify tax compliance and provide a more consistent shopping experience for consumers.

Exemptions and Special Programs

Arkansas may also consider expanding or modifying its sales tax exemptions and special programs. For instance, there could be discussions about extending the clothing and footwear exemption to higher-priced items or introducing new exemptions to support specific industries or initiatives.

Conclusion

Arkansas sales tax is a complex but critical component of the state’s tax system. It impacts businesses and consumers alike, influencing pricing, cash flow, and overall financial planning. By understanding the structure, rates, and exemptions, businesses can navigate their tax obligations effectively, while consumers can make informed decisions about their purchases. As the state continues to evolve, the sales tax landscape in Arkansas may see changes that shape its economic future.

What is the current statewide sales tax rate in Arkansas?

+As of [current date], the statewide sales and use tax rate in Arkansas is 6.5%.

Are there any major sales tax exemptions in Arkansas?

+Yes, Arkansas has several notable exemptions, including unprepared food and groceries, clothing and footwear priced under $100, and prescription drugs.

How often do businesses need to file and remit sales tax in Arkansas?

+The frequency of filing and remittance depends on the business’s sales volume. Some businesses may file monthly, while others may file quarterly or annually.

What happens if a business fails to collect or remit sales tax in Arkansas?

+Businesses that fail to collect or remit sales tax may face penalties and interest charges. It’s crucial for businesses to stay compliant with sales tax regulations to avoid these consequences.

Are there any resources available to help businesses understand their sales tax obligations in Arkansas?

+Yes, the Arkansas Department of Finance and Administration (DFA) provides comprehensive guidelines and resources on its website. Businesses can find information on registering for a sales tax permit, collecting and remitting sales tax, and more.