What Is The Tax Rate On Tips

In the world of hospitality and service industries, tipping is a common practice to reward exceptional service and show appreciation. However, the question of how tips are taxed often arises, especially for those working in the industry or those curious about the financial implications of tipping. In this comprehensive guide, we will delve into the complexities of the tax rate on tips, exploring the regulations, calculations, and strategies to ensure compliance and financial well-being.

Understanding the Tip Income

Tips, also known as gratuities, are considered a form of income by tax authorities worldwide. Whether it’s a generous tip left on a restaurant bill or a tip received by a bartender, these additional earnings are subject to taxation. The treatment of tip income varies across jurisdictions, with different countries and regions adopting unique approaches to ensure tax compliance.

Reported vs. Unreported Tips

One of the challenges in taxing tips lies in the distinction between reported and unreported tips. Reported tips are those that are declared by the service worker and recorded by the employer. These tips are often included in the employee’s regular income and taxed accordingly. On the other hand, unreported tips, also known as “off-the-books” tips, are those that are not declared or recorded, potentially leading to tax evasion.

| Tip Type | Reporting Status | Tax Treatment |

|---|---|---|

| Reported Tips | Declared and Recorded | Included in Regular Income |

| Unreported Tips | Not Declared or Recorded | Potential Tax Evasion |

The Legal Obligations

Tax authorities have implemented various measures to address the issue of unreported tips. Some jurisdictions require service workers to report a certain percentage of their total sales as tips, ensuring a more accurate reflection of their income. Additionally, employers may be responsible for tracking and reporting tip income, particularly in establishments where tipping is a significant part of the business model.

Calculating the Tax Rate

The tax rate applicable to tip income varies depending on several factors, including the jurisdiction, the individual’s tax bracket, and the nature of the employment. Let’s explore the key considerations when calculating the tax rate on tips.

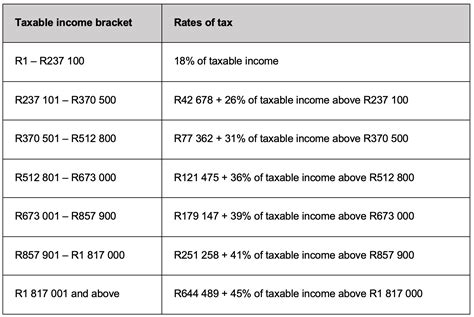

Tax Brackets and Progressive Taxation

In most tax systems, individuals are taxed based on their income levels, falling into different tax brackets. The tax rate on tip income is determined by the individual’s overall income, including their wages and reported tips. As the income increases, so does the tax rate, following a progressive taxation model.

| Income Bracket | Tax Rate |

|---|---|

| Bracket 1 (Lowest Income) | 10% |

| Bracket 2 | 15% |

| Bracket 3 | 20% |

| ... (and so on) | ... |

For instance, if an individual's total income, including reported tips, falls within the second tax bracket, their tip income would be taxed at a rate of 15%.

Withholding and Pay-As-You-Earn (PAYE) Systems

Many countries employ withholding or PAYE systems, where a portion of an employee’s income, including tips, is deducted by the employer and paid directly to the tax authority. This ensures that tax obligations are met throughout the year, rather than as a lump sum at the end of the financial year.

The amount withheld depends on the individual's tax status, employment contract, and the tax regulations in place. Employees may receive a tax refund if the withheld amount exceeds their actual tax liability, or they may need to pay additional taxes if their tip income pushes them into a higher tax bracket.

Strategies for Tip Income Management

Managing tip income effectively is crucial for service workers to ensure they are compliant with tax regulations and optimize their financial well-being. Here are some strategies to consider:

Keep Detailed Records

Maintaining accurate records of daily tips is essential. Service workers should keep a log of their tips, noting the date, amount, and source (cash, credit card, or other). This practice ensures they have a clear understanding of their tip income and can accurately report it to tax authorities.

Utilize Tip Reporting Systems

Employers in the hospitality industry often implement tip reporting systems to streamline the process of tracking and reporting tip income. These systems may include electronic record-keeping, tip pooling, and allocation mechanisms to ensure fair distribution of tips among employees. Service workers should familiarize themselves with these systems and their responsibilities.

Explore Tip-Reporting Apps

With the advancement of technology, several tip-reporting apps and platforms have emerged, offering service workers a convenient way to track and manage their tip income. These apps often integrate with banking systems, allowing for seamless reporting and tax preparation. Service workers can explore these options to find a solution that suits their needs.

Seek Professional Tax Advice

Tax regulations can be complex, and the treatment of tip income varies across jurisdictions. It is advisable for service workers to seek professional tax advice to ensure they are compliant with the latest regulations and optimize their financial strategies. A tax professional can provide personalized guidance based on the individual’s circumstances.

The Future of Tip Taxation

The taxation of tips is an evolving area of tax policy, with ongoing debates and potential reforms. As technology advances and payment methods diversify, tax authorities are exploring new ways to ensure the accurate reporting of tip income. Here are some potential future implications:

Digital Payment Systems and Tip Reporting

With the rise of digital payment systems, such as mobile wallets and contactless payments, the way tips are received and recorded is changing. Tax authorities are considering integrating these digital payment systems with tax reporting mechanisms, ensuring a more accurate and efficient tracking of tip income.

Enhanced Tip Reporting Requirements

To combat tax evasion and promote fair taxation, some jurisdictions may introduce more stringent tip reporting requirements. This could include mandatory tip declarations by service workers, increased audits, and penalties for non-compliance. Service workers should stay informed about any changes in reporting requirements to avoid legal repercussions.

The Impact of Minimum Wage Policies

In jurisdictions where minimum wage policies are in place, the taxation of tips may be influenced by the relationship between wages and tips. Some countries have implemented policies to ensure that service workers receive a minimum wage, regardless of the tips they earn. This can impact the tax treatment of tip income and the overall financial well-being of service workers.

How are unreported tips treated by tax authorities?

+Unreported tips, or “off-the-books” tips, are considered tax evasion by tax authorities. If discovered, individuals may face penalties, fines, or even criminal charges. It is important to declare all tip income accurately to avoid legal consequences.

Can I deduct any expenses related to my work when calculating my tax liability on tip income?

+In some jurisdictions, service workers may be able to deduct certain work-related expenses, such as uniforms, tools, or professional subscriptions, when calculating their tax liability. However, the deductibility of these expenses varies, and it is essential to consult with a tax professional to understand the specific rules in your region.

Are there any tax benefits or incentives for reporting tip income accurately?

+Some jurisdictions offer tax incentives or benefits to encourage accurate tip reporting. These may include tax credits, reduced tax rates, or simplified reporting processes. It is worth exploring these incentives to maximize the benefits of reporting tip income.