Doordash Tax Form

In the ever-evolving gig economy, tax obligations have become an increasingly important aspect for those engaged in independent work. One prominent player in this domain is Doordash, a leading food delivery platform that connects customers with local restaurants and drivers. As a Doordash contractor, understanding your tax responsibilities is crucial to ensure compliance and avoid any legal pitfalls.

This comprehensive guide aims to demystify the world of Doordash tax forms, providing an in-depth analysis of the relevant tax documents, their purposes, and how to navigate them effectively. By the end of this article, you'll have a clear understanding of the tax landscape surrounding your Doordash earnings and the steps you need to take to fulfill your tax obligations accurately.

The Doordash Tax Forms Ecosystem

Doordash, like many gig economy platforms, relies on a specific set of tax forms to communicate earnings and tax-related information to both contractors and the IRS. These forms are designed to ensure accurate reporting and compliance with federal, state, and local tax regulations. Here’s a breakdown of the key tax forms you’ll encounter as a Doordash contractor.

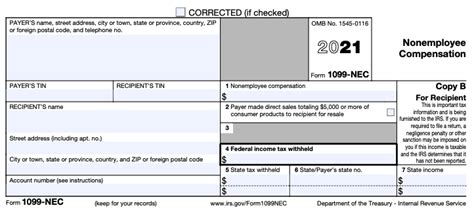

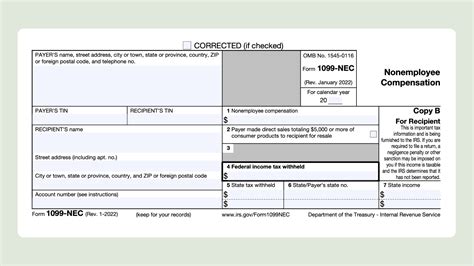

Form 1099-K: The Income Statement

Form 1099-K, also known as the Payment Card and Third Party Network Transactions form, is a critical document for Doordash contractors. This form is issued by Doordash to both contractors and the IRS, detailing the total transaction volume processed through the platform. It provides a comprehensive overview of your income generated through Doordash, making it an essential tool for tax reporting.

Key details on Form 1099-K include:

- Payer's Name and TIN: This section identifies Doordash as the payer, along with their Taxpayer Identification Number (TIN), which is typically their Employer Identification Number (EIN) or Federal Employer Identification Number (FEIN). This information ensures the form is correctly attributed to Doordash.

- Recipient's Information: Here, your personal details are listed, including your name, address, and Taxpayer Identification Number (TIN), which is usually your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) if you're a non-resident alien.

- Gross Transaction Amount: This field represents the total dollar amount of transactions processed through Doordash during the tax year. It serves as the starting point for calculating your income from Doordash work.

- Federal Income Tax Withheld: If any federal income tax was withheld from your Doordash earnings, it would be reflected in this section. This is typically applicable for those who choose to have taxes withheld from their earnings.

Form 1099-K is a crucial document for understanding your income and tax obligations. It's important to note that the IRS receives a copy of this form, so it's essential to ensure the information aligns with your tax filings.

Form W-9: Request for Taxpayer Identification Number and Certification

Form W-9 is a request for your Taxpayer Identification Number (TIN) and other relevant information. Doordash will use this form to verify your identity and tax status. It’s a critical step in the onboarding process, ensuring that Doordash has accurate information to report your earnings correctly.

Key details on Form W-9 include:

- Name and Address: You'll provide your legal name and current address, ensuring Doordash has accurate contact information.

- Taxpayer Identification Number (TIN): This is your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) if you're a non-resident alien. It's a unique identifier used for tax purposes.

- Business Name/Disregarded Entity Name: If you're operating as a sole proprietor or single-member LLC, you'll enter your business name here. For other entity types, you'll provide the legal name of the entity.

- Certification: This section requires you to certify that the TIN you provided is correct and that you are not subject to backup withholding for failure to report all interest and dividends on your tax return.

Completing Form W-9 accurately is crucial to ensure Doordash has the right information to report your earnings and to avoid any potential tax issues.

Form 8949: Sales and Other Dispositions of Capital Assets

While not directly related to Doordash income, Form 8949 is an important tax form for anyone engaged in capital gains transactions. If you sell stocks, bonds, or other capital assets, this form is used to report the sales and calculate any capital gains or losses. As a Doordash contractor, understanding capital gains and losses is essential, especially if you invest in assets that may be affected by your income.

Key details on Form 8949 include:

- Description of Property: This section requires a detailed description of the asset being sold, including the type of asset, date acquired, and cost basis.

- Date of Sale: The date the asset was sold or disposed of.

- Proceeds: The amount received from the sale of the asset.

- Cost or Other Basis: The original cost of the asset, which is used to calculate capital gains or losses.

- Gain or Loss: This field calculates the capital gain or loss based on the proceeds and cost basis.

Form 8949 is crucial for accurately reporting capital gains and losses, which can have an impact on your overall tax liability.

Understanding Your Tax Obligations

As a Doordash contractor, your tax obligations may vary depending on your income level, expenses, and personal circumstances. However, there are some common tax considerations that you should be aware of.

Self-Employment Taxes

One of the key differences between traditional employment and gig economy work is the responsibility for self-employment taxes. As a Doordash contractor, you are considered self-employed, which means you’re responsible for paying both the employer and employee portions of Social Security and Medicare taxes. This is often referred to as the Self-Employment Tax, and it’s an important consideration when budgeting for your tax obligations.

The Self-Employment Tax rate is currently set at 15.3% of your net earnings from self-employment. This tax covers Social Security (12.4%) and Medicare (2.9%) contributions. To calculate your net earnings, you'll need to deduct any allowable business expenses from your gross income. Some common business expenses for Doordash contractors include vehicle maintenance and fuel costs, phone and data plans, and any tools or equipment used for deliveries.

Income Tax

In addition to self-employment taxes, you’ll also be responsible for paying federal and state income taxes on your Doordash earnings. The amount of income tax you owe will depend on your total income, deductions, and tax bracket. It’s important to note that income tax is a progressive tax, meaning the rate increases as your income rises.

To estimate your income tax liability, you can use IRS tax tables or tax software that takes into account your filing status, deductions, and credits. It's a good idea to consult a tax professional or use reliable tax preparation software to ensure accuracy.

Estimated Taxes

As a self-employed individual, you’re required to make estimated tax payments throughout the year to cover your income tax and self-employment tax obligations. These payments are typically due quarterly, and the due dates are set by the IRS. Failure to make estimated tax payments on time can result in penalties and interest.

The amount of estimated tax you owe is based on your expected income for the year, deductions, and credits. You can use IRS Form 1040-ES to calculate and pay your estimated taxes. It's a good practice to set aside a portion of your earnings each month to cover these payments and avoid any surprises come tax time.

Record-Keeping and Tax Preparation

Proper record-keeping is essential for Doordash contractors to ensure accurate tax reporting and to support any deductions or credits claimed on your tax return. Here are some tips for maintaining good records:

- Mileage Tracking: Keep a detailed log of the miles you drive for Doordash deliveries. This is crucial for claiming mileage deductions, which can significantly reduce your taxable income. There are several apps and tools available to help with mileage tracking, such as MileIQ or Everlance.

- Expense Tracking: Record all expenses related to your Doordash work, including vehicle maintenance, fuel, phone bills, and any other costs. Keep receipts and invoices for these expenses, as you may need them to substantiate your deductions.

- Income Tracking: Keep track of your Doordash earnings, including any tips or bonuses. This information will be provided on your Form 1099-K, but it's a good idea to have your own records as well.

- Tax Documents: Organize and store all your tax-related documents, including Forms 1099-K, W-9, and any other relevant forms. Keep these documents for at least three years, as the IRS may request them for audit purposes.

When it comes to tax preparation, consider using tax preparation software or consulting a tax professional. These tools can help ensure accuracy and guide you through the process of claiming deductions and credits specific to your situation.

Future Tax Considerations

As the gig economy continues to grow, tax regulations surrounding independent contractors are likely to evolve. It’s important to stay informed about any changes that may impact your tax obligations as a Doordash contractor.

One potential future consideration is the classification of gig workers as employees rather than independent contractors. While this would shift the tax burden from the contractor to the platform, it could also impact the flexibility and independence that many gig workers value. Stay tuned for any developments in this area, as it may have significant implications for your tax obligations.

Conclusion

Understanding your tax obligations as a Doordash contractor is crucial to ensure compliance and avoid any legal or financial pitfalls. By familiarizing yourself with the relevant tax forms, such as Form 1099-K and Form W-9, and staying informed about your tax responsibilities, you can navigate the tax landscape with confidence. Proper record-keeping and tax preparation will further ensure that you’re meeting your obligations accurately and efficiently.

As the gig economy continues to shape the way we work, staying informed and proactive about your tax obligations will help you make the most of your earnings while remaining compliant with the law. Remember, accurate tax reporting is not only a legal requirement but also a key aspect of financial responsibility and planning.

How do I know if I need to pay self-employment tax?

+If your net earnings from self-employment (after deducting allowable business expenses) exceed a certain threshold set by the IRS, you are generally required to pay self-employment tax. The threshold amount varies each year, so it’s important to stay informed about the current limits. It’s a good idea to consult a tax professional or use reliable tax software to determine your self-employment tax obligations accurately.

Can I deduct expenses from my Doordash income for tax purposes?

+Yes, you can deduct certain expenses related to your Doordash work from your income. These may include vehicle maintenance and fuel costs, phone and data plans, and any tools or equipment used for deliveries. It’s important to keep detailed records of these expenses and consult a tax professional to ensure you’re claiming all allowable deductions.

What if I don’t receive a Form 1099-K from Doordash?

+If you don’t receive a Form 1099-K from Doordash, it’s important to take proactive steps. First, check your Doordash account and any communication from the company to ensure the form wasn’t sent to an incorrect address or missed in your inbox. If you still can’t locate the form, contact Doordash’s support team to request a copy. It’s crucial to have this form for accurate tax reporting, so don’t delay in resolving this issue.

How do I report capital gains or losses on my tax return?

+To report capital gains or losses, you’ll need to complete Form 8949 and Schedule D. Form 8949 details each transaction, including the asset sold, date of sale, proceeds, and cost basis. Schedule D summarizes the total gains and losses and calculates your net capital gain or loss. It’s important to consult a tax professional or reliable tax software to ensure you’re reporting these transactions accurately.