Washington D.c. Sales Tax

The sales tax system in Washington, D.C., like in many other jurisdictions, is a critical component of the city's revenue generation and economic policy. This article aims to delve deep into the intricacies of Washington D.C.'s sales tax, exploring its structure, rates, applicability, and impact on businesses and consumers.

Understanding the Washington D.C. Sales Tax Landscape

Washington D.C., officially known as the District of Columbia, operates a sales and use tax system to generate revenue for the city’s operations and services. The sales tax is imposed on the sale of tangible personal property and certain services within the District. It is a crucial part of the city’s tax structure, providing a significant portion of the government’s revenue.

The sales tax in Washington D.C. is administered by the Office of Tax and Revenue, which is responsible for collecting and managing various taxes, including the sales tax. The tax system is designed to be comprehensive, covering a wide range of goods and services, while also offering specific exemptions and special provisions to certain sectors and industries.

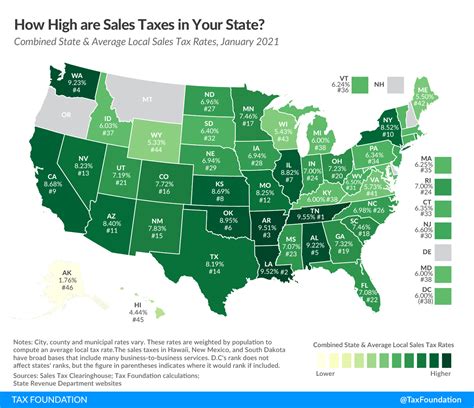

Sales Tax Rates

The sales tax rate in Washington D.C. is comprised of a city rate and a district rate. As of [current date], the city rate stands at 5.75%, while the district rate is set at 5.75%, making the total sales tax rate 11.50%. These rates are applicable to most goods and services sold within the District.

| Tax Type | Rate |

|---|---|

| City Sales Tax | 5.75% |

| District Sales Tax | 5.75% |

| Total Sales Tax | 11.50% |

It's important to note that these rates are subject to change, and businesses and consumers should stay updated with the latest tax rates to ensure compliance.

Sales Tax Exemptions and Special Provisions

While the sales tax in Washington D.C. applies to a broad range of goods and services, there are certain exemptions and special provisions in place to support specific industries and promote certain activities. These exemptions and provisions can significantly impact the tax liability of businesses and the prices paid by consumers.

- Food and Grocery Items: Most unprepared foods and groceries are exempt from sales tax. This includes fresh produce, meat, dairy products, and other staples. However, prepared foods and certain beverages like soda and beer are taxable.

- Clothing and Footwear: Washington D.C. offers a sales tax exemption on clothing and footwear items priced under $50. This provision encourages consumer spending and supports the fashion industry within the District.

- Educational and Cultural Services: Sales tax is often waived for admissions to museums, concerts, and other cultural events. This exemption promotes access to arts and education for residents and visitors alike.

- Medical Devices and Supplies: Certain medical devices and supplies, such as wheelchairs and prescription medications, are exempt from sales tax to support healthcare access and affordability.

- Construction Materials: Sales tax is not applicable to the purchase of construction materials for new home construction, encouraging homeownership and development within the District.

These exemptions and special provisions demonstrate the District's strategic approach to tax policy, using the sales tax as a tool to influence consumer behavior and support specific sectors of the economy.

Sales Tax Registration and Compliance

Businesses operating in Washington D.C. that meet certain criteria are required to register for sales tax with the Office of Tax and Revenue. The registration process involves providing detailed information about the business, including its legal structure, location, and the types of goods and services it offers. Once registered, businesses are issued a unique identification number and are responsible for collecting and remitting sales tax on all taxable sales.

Compliance with sales tax regulations is critical for businesses. Failure to comply can result in penalties, interest, and legal consequences. Businesses must accurately calculate and collect sales tax on all taxable transactions, maintain proper records, and file timely tax returns. The Office of Tax and Revenue provides resources and guidelines to help businesses understand their obligations and ensure compliance.

Sales Tax Filing and Remittance

Businesses registered for sales tax in Washington D.C. are required to file sales tax returns and remit the collected tax to the Office of Tax and Revenue on a regular basis. The filing frequency depends on the business’s sales volume and can range from monthly to annually. Businesses must report their taxable sales, calculate the applicable tax, and submit the tax payment by the due date.

The Office of Tax and Revenue offers various filing methods, including online filing through their website, which is the most common and convenient option. Businesses can also file and pay taxes by mail or in person at designated tax offices. Late filings and payments may incur penalties and interest, so timely compliance is essential.

Impact on Businesses and Consumers

The sales tax in Washington D.C. has a significant impact on both businesses and consumers. For businesses, the tax adds to their operational costs and influences their pricing strategies. Businesses must carefully consider the tax implications when setting prices to remain competitive and attractive to consumers.

From a consumer perspective, the sales tax directly affects the final price paid for goods and services. Consumers must be aware of the tax rates and exemptions to make informed purchasing decisions. The tax can significantly impact the affordability of certain items, especially for low-income households.

Economic Considerations

The sales tax in Washington D.C. plays a crucial role in the city’s economic development and sustainability. The tax revenue generated supports essential public services, infrastructure projects, and social programs. It contributes to the overall fiscal health of the District, allowing for investments in education, healthcare, public safety, and other vital areas.

However, the sales tax also has the potential to influence consumer behavior and business operations. Higher sales tax rates can discourage spending, particularly for non-essential items, and may prompt consumers to make purchases outside the District to avoid the tax. This "tax leakage" can impact local businesses and reduce the overall tax base.

Businesses, especially small and medium-sized enterprises, may face challenges due to the sales tax. They must navigate the complexities of tax compliance, which can be time-consuming and resource-intensive. Additionally, the tax can impact their profitability, especially if they are unable to pass on the tax burden to consumers.

Future Implications and Policy Considerations

As Washington D.C. continues to evolve and adapt to changing economic conditions, the sales tax system will likely undergo further developments and refinements. Policy makers and tax experts are constantly evaluating the tax structure to ensure it remains fair, efficient, and aligned with the city’s economic goals.

One key consideration is the potential impact of online sales and e-commerce on the sales tax base. With the rise of online shopping, there is a risk of reduced in-person sales, which could lead to a decline in sales tax revenue. The District may need to explore ways to adapt its tax system to capture this evolving market, such as implementing a marketplace facilitator law or expanding the definition of taxable sales to include online transactions.

Additionally, the District may consider further streamlining the sales tax registration and filing process to reduce administrative burdens on businesses. Simplifying the tax system and providing clearer guidelines can enhance compliance and reduce the risk of errors and penalties.

Potential Policy Reforms

- Sales Tax Rate Adjustments: Policy makers may consider adjusting the sales tax rates to maintain a competitive position relative to neighboring jurisdictions. Lowering the tax rate could encourage consumer spending within the District, while a higher rate could generate more revenue for specific initiatives or projects.

- Broadening the Tax Base: Expanding the types of goods and services subject to sales tax can increase revenue without raising tax rates. This could include taxing previously exempted items or services, such as certain professional services or digital products.

- Implementing a Value-Added Tax (VAT): Adopting a VAT system, similar to that used in many European countries, could provide a more comprehensive and efficient tax structure. A VAT would tax goods and services at each stage of production and distribution, capturing a wider range of economic activities.

- Enhancing Tax Administration: The District can invest in modernizing its tax administration systems to improve efficiency and compliance. This could involve implementing advanced technology, such as data analytics and machine learning, to detect potential fraud and ensure accurate tax reporting.

These potential reforms aim to strike a balance between generating sufficient revenue for the District's needs and maintaining a business-friendly and consumer-friendly tax environment.

Frequently Asked Questions

What is the current sales tax rate in Washington D.C.?

+As of [current date], the sales tax rate in Washington D.C. is 11.50%, consisting of a 5.75% city rate and a 5.75% district rate.

Are there any sales tax exemptions in Washington D.C.?

+Yes, Washington D.C. offers exemptions on various goods and services, including unprepared food, clothing and footwear under $50, educational and cultural services, medical devices, and construction materials for new homes.

How often do businesses need to file sales tax returns in Washington D.C.?

+The filing frequency depends on the business’s sales volume. Businesses with higher sales volumes may need to file monthly, while those with lower volumes may file quarterly or annually. The Office of Tax and Revenue provides guidelines based on each business’s specific circumstances.

What happens if a business fails to comply with sales tax regulations in Washington D.C.?

+Non-compliance can result in penalties, interest, and legal consequences. The Office of Tax and Revenue has the authority to audit businesses and impose penalties for late filings, underreporting of sales, or failure to collect and remit sales tax. It is crucial for businesses to understand their obligations and maintain proper records.

How does Washington D.C.’s sales tax compare to other U.S. cities or states?

+Washington D.C.’s sales tax rate is relatively high compared to many other U.S. cities and states. However, it is important to consider the specific exemptions and special provisions in place, which can significantly impact the overall tax burden for businesses and consumers.