City Of Portland Tax

Welcome to an in-depth exploration of the tax landscape in the vibrant city of Portland. This article aims to provide a comprehensive understanding of the tax system within this dynamic urban center, shedding light on its intricacies and implications for both residents and businesses. With a focus on specificity and industry relevance, we delve into the various tax categories, rates, and regulations that shape Portland's financial ecosystem.

Unraveling the Complexities of Portland’s Tax Structure

Portland, Oregon, boasts a unique and multifaceted tax system that influences the city’s economic landscape. From property taxes to income taxes and specialized levies, understanding this system is crucial for anyone navigating the city’s financial sphere. Let’s embark on a detailed journey through these tax categories, shedding light on their specific rates, purposes, and impacts.

Property Taxes: A Stable Foundation for City Services

Property taxes in Portland serve as a cornerstone of the city’s revenue generation. These taxes are assessed based on the value of both residential and commercial properties, with rates varying depending on the specific area and property type. According to the latest data, the average effective property tax rate in Portland stands at approximately 1.25%, which is calculated as a percentage of the property’s assessed value.

| Property Type | Average Tax Rate |

|---|---|

| Residential | 1.15% |

| Commercial | 1.35% |

It's important to note that property tax rates can vary significantly within the city, influenced by factors such as the presence of local improvement districts or specific city-wide initiatives. The funds generated from property taxes are vital for funding essential city services, including public safety, infrastructure maintenance, and education.

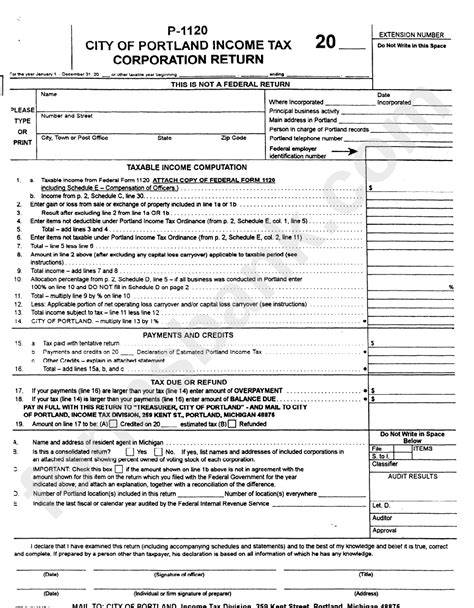

Income Taxes: Navigating Personal and Business Levies

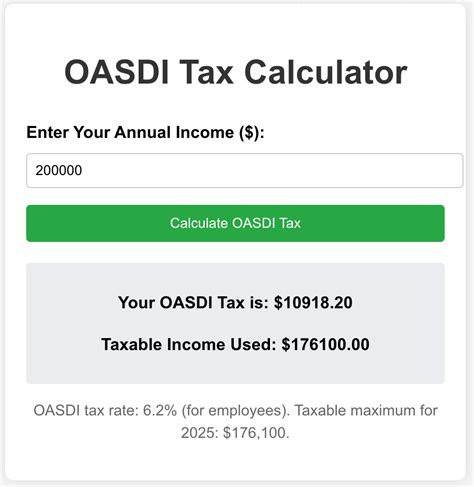

Income taxes in Portland are a critical component of the city’s revenue stream, impacting both individuals and businesses. The city operates a progressive income tax system, where tax rates increase as income levels rise. For personal income taxes, residents are subject to a flat rate of 9.9%, which applies to all taxable income, including wages, salaries, and investment earnings.

On the business front, Portland imposes a Corporate Activities Tax (CAT) on certain businesses, particularly those with gross receipts exceeding $1 million. The CAT rate is currently set at 0.57%, with provisions for small businesses to apply for exemptions. Additionally, businesses with a physical presence in Portland may also be subject to local business license fees and occupational taxes, depending on their specific industry and operations.

| Tax Type | Rate |

|---|---|

| Personal Income Tax | 9.9% |

| Corporate Activities Tax (CAT) | 0.57% |

Special Taxes and Assessments: Supporting Community Initiatives

Beyond the standard property and income taxes, Portland employs a range of special taxes and assessments to fund specific community projects and services. These taxes are often levied at the neighborhood or district level and can vary significantly across the city. Some notable examples include:

- Urban Renewal Taxes: These taxes are used to fund urban renewal projects aimed at revitalizing specific areas of the city. The rates and applicability vary based on the designated urban renewal district.

- Transportation Improvement Taxes: Dedicated taxes support transportation infrastructure upgrades, including road maintenance, public transit enhancements, and bicycle/pedestrian improvements.

- Park and Recreation Taxes: Portland's renowned parks and recreation facilities are partially funded through dedicated taxes, ensuring their maintenance and development.

The implementation of these special taxes demonstrates Portland's commitment to community development and the unique needs of its diverse neighborhoods.

Tax Exemptions and Incentives: Encouraging Growth and Sustainability

Portland recognizes the importance of fostering a business-friendly environment and encouraging sustainable practices. As such, the city offers a range of tax exemptions and incentives aimed at supporting economic growth and environmental initiatives. Some notable programs include:

- Renewable Energy Tax Credits: Businesses that invest in renewable energy systems or implement energy-efficient practices may be eligible for tax credits, reducing their overall tax liability.

- Enterprise Zone Incentives: Designated enterprise zones within Portland offer reduced tax rates and other incentives to attract new businesses and promote economic development.

- Brownfield Remediation Tax Credits: Incentives are available for businesses that invest in the remediation and redevelopment of contaminated or underutilized properties, known as brownfields.

These exemptions and incentives showcase Portland's forward-thinking approach to tax policy, aiming to balance revenue generation with the encouragement of sustainable and equitable growth.

Tax Administration and Compliance: Navigating the System

Understanding and complying with Portland’s tax regulations is crucial for both residents and businesses. The city operates a comprehensive tax administration system, overseen by the Portland Revenue Bureau, which provides resources and guidance for taxpayers. Key considerations include:

- Tax Registration: All businesses operating within Portland must register with the Revenue Bureau, obtain necessary licenses, and comply with reporting requirements.

- Tax Payment Options: The city offers various payment methods, including online payment portals, direct debit, and traditional check or cash payments.

- Tax Due Dates: Tax due dates vary depending on the tax type and the taxpayer's status. Personal income taxes, for instance, are due on April 15th each year, while property taxes have two due dates (May and November) as mentioned earlier.

For businesses, staying compliant with tax regulations is essential to avoid penalties and maintain a positive standing within the community. The Revenue Bureau provides resources and support to assist taxpayers in understanding their obligations and navigating the tax system effectively.

Future Outlook: Tax Policy in a Changing Landscape

As Portland continues to evolve and adapt to changing economic and social landscapes, its tax policies are likely to undergo adjustments. The city’s commitment to sustainability, equity, and community development is expected to influence future tax initiatives. Here are some potential trends and considerations for the future:

- Carbon Tax Proposals: With a growing focus on environmental sustainability, discussions around implementing a carbon tax or similar initiatives may gain traction. Such taxes could impact businesses and individuals alike, encouraging a shift towards more eco-friendly practices.

- Income Tax Reform: As the city's demographics and economic landscape shift, there may be calls for income tax reform to ensure fairness and adaptability to changing income levels.

- Community Investment Funds: Portland's innovative spirit may lead to the establishment of dedicated community investment funds, supported by specific taxes, aimed at addressing social issues and promoting economic inclusivity.

Staying informed about these potential changes is crucial for taxpayers to adapt their financial strategies and ensure compliance with evolving tax regulations.

What is the overall tax burden for residents in Portland?

+

The overall tax burden for residents in Portland encompasses a combination of property taxes, income taxes, and various local assessments. While specific tax rates can vary based on individual circumstances, the average effective property tax rate is approximately 1.25%, and the personal income tax rate is 9.9%. Special assessments and local improvement taxes may also apply, adding to the overall tax burden.

How do Portland’s tax rates compare to other major cities in Oregon?

+

Portland’s tax rates, particularly its property tax rate, are generally higher compared to other major cities in Oregon. For instance, cities like Eugene and Salem have lower average effective property tax rates, making them more attractive to property owners in terms of tax burden.

Are there any tax incentives for green or sustainable businesses in Portland?

+

Yes, Portland actively encourages sustainable practices and offers tax incentives for businesses that adopt renewable energy systems or implement energy-efficient measures. These incentives can reduce a business’s overall tax liability, promoting a greener and more sustainable business environment.

How often do tax rates change in Portland, and who determines these changes?

+

Tax rates in Portland can change periodically, often as a result of city council decisions or ballot measures. The Portland City Council, in collaboration with the Revenue Bureau, plays a crucial role in proposing and implementing tax rate changes, which are then subject to public review and approval.