Westchester Sales Tax

In the bustling county of Westchester, nestled in the heart of New York, sales tax regulations play a pivotal role in shaping the economic landscape. This comprehensive guide delves into the intricacies of Westchester's sales tax, offering an expert analysis of its rates, exemptions, and implications for both consumers and businesses.

Understanding Westchester’s Sales Tax Rates

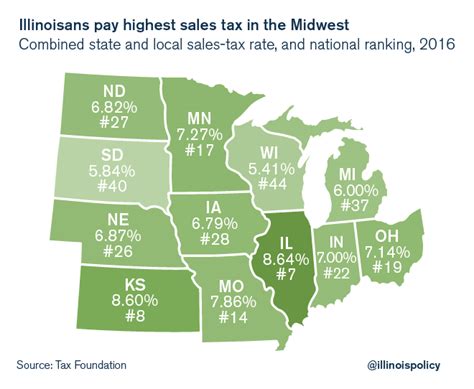

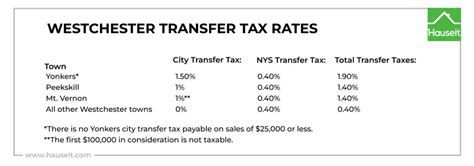

Westchester County, with its vibrant communities and thriving businesses, operates under a unique sales tax structure. The county imposes a combined sales tax rate, which includes both state and local components, resulting in a percentage that can vary depending on the specific location within the county.

| Tax Jurisdiction | Combined Sales Tax Rate |

|---|---|

| Westchester County | 8.875% |

| New York State | 4% |

| Local Tax (Westchester) | 4.875% |

The combined sales tax rate in Westchester County stands at 8.875%, consisting of a 4% state tax and a 4.875% local tax. This rate is applied to a wide range of goods and services, impacting the daily lives of residents and visitors alike.

Varying Rates within Westchester

It’s important to note that sales tax rates can differ slightly across various municipalities within Westchester County. For instance, certain cities or towns may have additional local taxes, resulting in a slightly higher sales tax burden for residents and businesses in those areas. These variations are often influenced by the specific needs and budgets of each municipality.

Sales Tax Exemptions in Westchester

While sales tax is a prevalent feature of the Westchester economy, certain goods and services are exempt from taxation. Understanding these exemptions is crucial for both consumers and businesses to navigate the sales tax landscape effectively.

Essential Exemptions

- Groceries and Food: Sales tax does not apply to essential groceries and food items, providing some relief to residents’ grocery bills.

- Prescription Drugs: Westchester County, like many other jurisdictions, exempts prescription medications from sales tax, ensuring that healthcare remains more affordable.

- Clothing and Footwear: A notable exemption is the tax-free status of clothing and footwear items, offering a benefit to shoppers during sales and everyday purchases.

- Educational Resources: Certain educational materials and supplies are exempt, supporting the county’s commitment to accessible education.

These exemptions reflect Westchester's approach to balancing revenue generation with the needs of its residents and the overall economy.

Exemptions for Businesses

Businesses operating in Westchester also benefit from specific sales tax exemptions. These exemptions are designed to encourage certain economic activities and support the local business community.

- Manufacturing: Sales tax is often waived for manufacturing equipment and supplies, promoting industrial growth in the county.

- Research and Development: Companies engaged in research and development activities may be eligible for sales tax exemptions, fostering innovation and technological advancement.

- Agricultural Inputs: Farmers and agricultural businesses can take advantage of sales tax exemptions on essential inputs, such as seeds, fertilizers, and farming equipment.

The Impact of Westchester’s Sales Tax

The sales tax regime in Westchester County has wide-ranging implications for various stakeholders, influencing consumer behavior, business strategies, and the overall economic climate.

Consumer Perspective

For consumers, the sales tax rate directly affects their purchasing power and spending habits. The 8.875% combined sales tax can impact the affordability of goods and services, especially for those on a tight budget. However, the strategic use of tax-free categories, such as groceries and clothing, allows consumers to optimize their spending and make more informed choices.

Business Strategies

Businesses operating in Westchester must navigate the sales tax landscape as part of their overall financial strategy. The tax rate can influence pricing decisions, especially for businesses that compete with online retailers or those located in regions with lower sales tax rates. Additionally, understanding sales tax exemptions can help businesses reduce their tax liabilities and optimize their operations.

Economic Effects

Westchester’s sales tax regime contributes significantly to the county’s revenue stream, funding essential public services and infrastructure projects. The tax also influences the local economy, potentially impacting job creation and business growth. Moreover, the varying rates and exemptions can shape the county’s economic landscape, encouraging specific industries and activities.

Future Implications and Trends

As Westchester County continues to evolve, the sales tax regime is likely to undergo changes and adaptations to meet the needs of a dynamic economy. Here are some potential future implications and trends to watch:

- Sales Tax Rate Adjustments: In response to economic shifts or changing public needs, the sales tax rate may be adjusted upwards or downwards. This could impact the affordability of goods and services for residents and businesses.

- Expansion of Exemptions: Westchester may consider expanding its list of sales tax exemptions to support specific industries or social causes. For instance, the county could explore exemptions for sustainable products or initiatives promoting environmental conservation.

- Technological Innovations: With the rise of e-commerce and digital transactions, Westchester may need to adapt its sales tax collection methods to ensure compliance and fairness. This could involve implementing online sales tax collection systems or exploring blockchain-based solutions.

How often does Westchester County review its sales tax rates and exemptions?

+Westchester County typically reviews its sales tax rates and exemptions on an annual basis, ensuring that they remain aligned with the county’s financial needs and economic priorities. This review process involves careful analysis of revenue trends, consumer behavior, and feedback from the business community.

Are there any ongoing initiatives to simplify the sales tax collection process in Westchester?

+Yes, Westchester County is actively exploring ways to streamline the sales tax collection process. This includes the potential adoption of modern technology solutions, such as online tax filing platforms and automated tax calculation tools, to reduce the administrative burden on businesses and improve compliance.

What steps can businesses take to ensure they are compliant with Westchester’s sales tax regulations?

+Businesses operating in Westchester can stay compliant by staying informed about the latest sales tax rates and exemptions. They should also maintain accurate records of taxable and exempt sales, ensure proper tax collection and remittance processes, and consider seeking professional advice from tax consultants or accountants to navigate the complex tax landscape effectively.