Tax Filing Date Canada

The tax filing date in Canada is a crucial deadline for all taxpayers, whether individuals, businesses, or organizations. This date marks the end of the tax filing season, after which any late submissions may incur penalties and interest charges. The Canada Revenue Agency (CRA) sets the tax filing deadline, which varies depending on the taxpayer's circumstances and the type of return being filed. Understanding the tax filing date and its implications is essential for ensuring compliance with Canadian tax laws and avoiding any unnecessary financial burdens.

Understanding the Tax Filing Date in Canada

The tax filing date in Canada is typically the last day of April for most taxpayers. This date applies to individuals, trusts, and graduated rates estates. For example, the filing deadline for the 2022 tax year is April 30, 2023. However, it is important to note that this date may differ for certain entities and specific tax situations.

Businesses and corporations in Canada generally have a different tax filing deadline. The default deadline for corporations is six months after their fiscal year-end. However, small business corporations with qualifying income may have a deadline of up to 18 months after their fiscal year-end. For instance, a corporation with a fiscal year ending on March 31, 2023, would typically have a tax filing deadline of September 30, 2023.

Exceptions and Special Cases

There are several exceptions and special cases regarding the tax filing date in Canada. These include:

- Partnerships: Partnerships, including joint ventures and limited partnerships, have a default filing deadline of six months after their fiscal year-end. However, partnerships with only corporate partners may have a deadline of up to 24 months after their fiscal year-end.

- Non-Resident Individuals: Non-residents of Canada who are required to file a tax return have a filing deadline of June 30 following the tax year. For example, a non-resident for the 2022 tax year would have until June 30, 2023, to file their return.

- Registered Charities and Non-Profit Organizations: Registered charities and non-profit organizations have a tax filing deadline of six months after their fiscal year-end. For instance, a charity with a fiscal year ending on December 31, 2022, would have until June 30, 2023, to file their return.

Consequences of Missing the Tax Filing Date

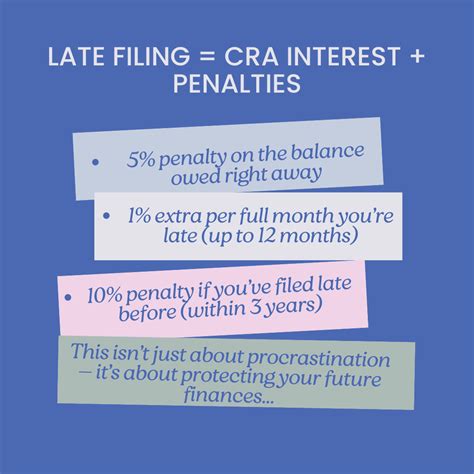

Missing the tax filing date in Canada can have significant consequences. Late filing penalties may apply, which are calculated as a percentage of the balance owing on the return. The penalty is 5% of the balance owing, plus 1% for each additional month the return is late, up to a maximum of 12 months. Interest may also be charged on any outstanding tax balance, with the interest rate set by the CRA and adjusted quarterly.

Additionally, missing the tax filing date can lead to other administrative penalties, such as the Gross Negligence Penalty, Promoter Penalty, or Repeated Late-Filing Penalty. These penalties are designed to deter taxpayers from intentionally or repeatedly missing filing deadlines and can result in substantial financial consequences.

Late Filing and Audit Risks

Filing a tax return late can increase the risk of an audit by the CRA. The CRA may select returns for review based on various factors, including late filing, high-risk industries, or suspicious activity. Late filers may be subject to more scrutiny, and the CRA may request additional information or documentation to support the late-filed return.

| Late Filing Penalty | Rate |

|---|---|

| Base Penalty | 5% of balance owing |

| Monthly Penalty | 1% of balance owing for each additional month |

| Maximum Penalty | 12 months |

Preparing for the Tax Filing Date

To ensure a smooth tax filing process and meet the deadline, taxpayers should take the following steps:

- Gather Documentation: Collect all necessary tax documents, including T4 slips, receipts, and other relevant financial information. Ensure that all information is accurate and up-to-date.

- Understand Tax Credits and Deductions: Familiarize yourself with the tax credits and deductions you may be eligible for. This can help reduce your taxable income and maximize your tax refund.

- Choose a Filing Method: Decide whether you will file your tax return manually or use tax software. Tax software can simplify the process and reduce the risk of errors.

- Seek Professional Assistance: If you have complex tax situations or are unsure about certain aspects of your return, consider consulting a tax professional. They can provide expert guidance and ensure your return is accurate and complete.

Tips for a Successful Tax Filing

Here are some additional tips to ensure a successful tax filing in Canada:

- Start early: Begin gathering your tax information and preparing your return well in advance of the deadline. This gives you time to address any potential issues and ensures a less stressful filing process.

- Keep organized records: Maintain a well-organized system for your tax-related documents. This makes it easier to locate specific information when needed and simplifies the filing process.

- Review your return: Before submitting your tax return, carefully review it for accuracy. Double-check your calculations, ensure all income and deductions are included, and verify that your personal information is correct.

- E-file whenever possible: The CRA encourages taxpayers to use electronic filing methods, as they are more secure and efficient. E-filing also provides faster refunds and reduces the risk of errors.

The Future of Tax Filing in Canada

The Canadian tax system is continuously evolving, and the CRA is implementing various initiatives to enhance the tax filing experience. One notable development is the introduction of the MyCRA Account, an online platform that allows taxpayers to access their tax information, manage their account, and view their refund status.

The CRA is also exploring the use of artificial intelligence and machine learning to improve tax administration and reduce compliance risks. These technologies can help identify potential errors, detect fraudulent activities, and streamline the tax filing process.

Conclusion

The tax filing date in Canada is a critical deadline for all taxpayers. Understanding the filing deadlines, potential penalties, and the steps to prepare for filing can help ensure compliance with Canadian tax laws. By staying informed, organizing your tax documents, and seeking professional assistance when needed, taxpayers can navigate the tax filing process successfully and avoid any unnecessary complications.

What happens if I miss the tax filing deadline in Canada?

+Missing the tax filing deadline can result in late filing penalties, interest charges, and potential audits. It is important to file your tax return by the deadline to avoid these consequences.

Can I request an extension for filing my tax return in Canada?

+Extensions for filing tax returns are granted on a case-by-case basis by the CRA. However, it is not guaranteed, and it is always best to file by the deadline to avoid any potential penalties.

Are there any online tools or resources available to help with tax filing in Canada?

+Yes, the CRA provides various online tools and resources to assist taxpayers with their tax filing. These include the MyCRA Account, tax calculators, and interactive tax assistant tools. These resources can help simplify the tax filing process and provide guidance on various tax-related matters.