Oklahoma State Sales Tax

The state of Oklahoma has a robust sales tax system in place, which plays a significant role in its economy and finances. Sales tax is an essential revenue source for the state, contributing to the funding of various public services and infrastructure projects. Understanding the nuances of Oklahoma's sales tax is crucial for both businesses and consumers, as it impacts their financial obligations and overall economic landscape.

Overview of Oklahoma Sales Tax

Oklahoma’s sales tax is a combined state and local tax, meaning the tax rate is the result of both state and local jurisdictions. The state sales tax rate is set at 4.5%, but when combined with local sales taxes, the total rate can vary across the state. These local taxes, often referred to as municipal or county sales taxes, can add up to 3.5% or more, resulting in a maximum combined rate of 8% in certain areas.

The sales tax in Oklahoma applies to most tangible personal property and some services, with certain exemptions and special rules. For instance, groceries and prescription drugs are exempt from sales tax, providing a significant relief to households. On the other hand, services like repair and maintenance, as well as admissions to entertainment events, are taxable, making them an important source of revenue for the state.

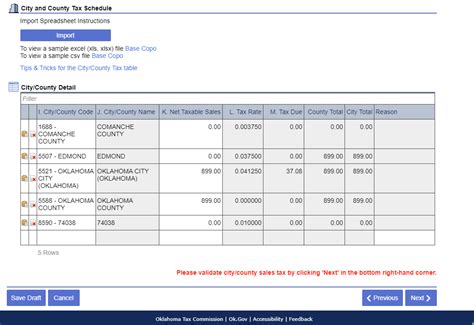

Oklahoma's sales tax system is administered by the Oklahoma Tax Commission (OTC), which is responsible for collecting and distributing the tax revenues. The OTC provides guidance and resources to businesses on sales tax compliance, including registration, filing, and remittance processes.

Sales Tax Rates Across Oklahoma

The variation in sales tax rates across Oklahoma is a result of the combined state and local tax structure. While the statewide rate remains consistent at 4.5%, the local rates can differ significantly. For instance, Oklahoma City has a combined rate of 8.5%, including a 2% local rate, while Tulsa has a combined rate of 8.1%, with a local rate of 3.6%. These differences can impact consumer spending habits and business strategies, especially for businesses with multiple locations or those catering to a regional customer base.

Here's a table outlining the sales tax rates for some of Oklahoma's major cities:

| City | State Rate | Local Rate | Combined Rate |

|---|---|---|---|

| Oklahoma City | 4.5% | 4% | 8.5% |

| Tulsa | 4.5% | 3.6% | 8.1% |

| Norman | 4.5% | 3.5% | 8% |

| Broken Arrow | 4.5% | 3.6% | 8.1% |

| Lawton | 4.5% | 3.5% | 8% |

Impact of Local Sales Tax Rates

The disparity in local sales tax rates can have a noticeable effect on both businesses and consumers. For businesses, especially those with physical stores, the local tax rates can influence their pricing strategies and overall profitability. A higher local tax rate might encourage businesses to pass on some of the tax burden to customers, impacting their competitive positioning.

For consumers, the varying tax rates can affect their purchasing decisions and overall spending. Higher tax rates might encourage consumers to shop around for better deals or even consider online purchases to avoid higher local taxes. This can impact the local economy, potentially leading to a shift in consumer behavior and market dynamics.

Sales Tax Exemptions and Special Rules

Oklahoma’s sales tax system is not a one-size-fits-all approach. It includes various exemptions and special rules that cater to specific industries and situations. These exemptions and rules can significantly impact the tax obligations of businesses and the purchasing power of consumers.

Exemptions from Sales Tax

One of the most notable exemptions in Oklahoma’s sales tax system is for groceries and prescription drugs. This exemption is a significant relief for households, as these items are essential for daily living. Other exemptions include certain agricultural equipment, aircraft parts, and some manufacturing machinery. These exemptions are designed to support specific industries and encourage economic growth in targeted sectors.

Special Rules for Sales Tax

Oklahoma has several special rules regarding sales tax, which are important for businesses to understand. One such rule is the resale exemption, which allows businesses to purchase goods tax-free if they plan to resell them. This rule is a significant benefit for retailers and wholesalers, as it simplifies their tax obligations and helps keep prices competitive.

Another special rule is the tax on shipping and delivery charges. In Oklahoma, these charges are taxable if they are included in the purchase price. This rule ensures that businesses accurately account for all taxable elements of a transaction, providing a fair playing field for all retailers.

The state also has specific rules for online sales, which are becoming increasingly important in today's digital economy. Under Oklahoma's click-through nexus rule, out-of-state sellers are required to collect and remit sales tax if they have an in-state presence through affiliates or other means. This rule ensures that online retailers contribute to the state's revenue stream, just like their brick-and-mortar counterparts.

Compliance and Reporting

Ensuring compliance with Oklahoma’s sales tax regulations is crucial for businesses. Non-compliance can lead to significant penalties and interest charges, not to mention the negative impact on a business’s reputation. The Oklahoma Tax Commission (OTC) provides comprehensive guidance on sales tax compliance, including registration, filing, and remittance processes.

Registration and Licensing

Businesses that are subject to Oklahoma’s sales tax must register with the OTC and obtain a Sales Tax License. This process involves filling out the appropriate forms, providing relevant business information, and understanding the tax obligations specific to the business’s industry and location.

Filing and Remittance

Once registered, businesses are required to file sales tax returns and remit the collected tax to the OTC on a regular basis. The frequency of filing and remittance depends on the business’s sales volume and can be monthly, quarterly, or annually. Late filing or non-payment can result in penalties and interest, so it’s crucial for businesses to stay on top of their tax obligations.

Sales Tax Audits

The OTC conducts regular sales tax audits to ensure compliance and to verify that businesses are correctly calculating and remitting the tax. These audits can be desk audits, where the business provides documentation to the OTC, or field audits, where OTC representatives visit the business’s location to review records and operations.

Being prepared for a sales tax audit is essential. This involves maintaining accurate records, including sales invoices, purchase orders, and tax returns. It's also beneficial to understand the audit process and to have a strategy in place to address any potential issues or discrepancies.

The Future of Oklahoma Sales Tax

As Oklahoma’s economy evolves, so too will its sales tax system. The state is continuously reviewing its tax policies to ensure they remain fair, effective, and reflective of the changing economic landscape. This includes evaluating the tax base, considering new tax exemptions, and adapting to the challenges and opportunities presented by the digital economy.

Potential Changes and Reforms

One potential area of reform is the taxation of online sales. With the rapid growth of e-commerce, there is an increasing focus on ensuring that online retailers contribute fairly to the state’s revenue stream. This could involve further refining the click-through nexus rule or implementing new measures to capture sales tax from out-of-state sellers.

Another potential area of focus is the taxation of services. As the economy becomes more service-oriented, there may be a need to review the current tax structure to ensure it captures the value added by service providers. This could involve expanding the scope of taxable services or adjusting the rates to reflect the changing nature of the economy.

The state may also consider simplifying its sales tax system to reduce compliance costs for businesses and improve efficiency in tax administration. This could involve harmonizing local sales tax rates or streamlining the registration and filing processes.

Conclusion

Oklahoma’s sales tax system is a complex yet essential part of the state’s economic framework. It plays a vital role in funding public services, infrastructure, and economic development initiatives. Understanding the nuances of this system, from the varying tax rates to the exemptions and special rules, is crucial for both businesses and consumers.

As Oklahoma's economy continues to evolve, so too will its sales tax policies. By staying informed and adapting to these changes, businesses can ensure they remain compliant, competitive, and contributing members of the state's economic ecosystem.

What is the state sales tax rate in Oklahoma?

+The state sales tax rate in Oklahoma is 4.5%.

Are there any local sales taxes in Oklahoma?

+Yes, Oklahoma has local sales taxes in addition to the state rate. These local taxes can add up to 3.5% or more, resulting in a maximum combined rate of 8% in certain areas.

What are some examples of sales tax exemptions in Oklahoma?

+Some examples of sales tax exemptions in Oklahoma include groceries, prescription drugs, certain agricultural equipment, aircraft parts, and some manufacturing machinery.

How often do businesses need to file and remit sales tax in Oklahoma?

+The frequency of filing and remittance depends on the business’s sales volume. It can be monthly, quarterly, or annually. Businesses should refer to the guidelines provided by the Oklahoma Tax Commission (OTC) for specific requirements.

What happens if a business doesn’t comply with Oklahoma’s sales tax regulations?

+Non-compliance can lead to significant penalties and interest charges. It’s crucial for businesses to understand their tax obligations and stay compliant to avoid these consequences.