Illinois Used Car Sales Tax

The topic of Illinois used car sales tax is of significant interest to both residents and businesses within the state, as it directly impacts transactions involving pre-owned vehicles. This article aims to provide a comprehensive understanding of the sales tax implications when buying or selling used cars in Illinois, ensuring clarity and transparency for all parties involved.

Understanding the Illinois Used Car Sales Tax

The Illinois Department of Revenue imposes a sales tax on the purchase of used vehicles, including cars, trucks, SUVs, and motorcycles. This tax is a crucial component of the state’s revenue system and is applicable to all transactions that take place within Illinois borders. Whether you’re a dealer selling a fleet of pre-owned cars or an individual looking to buy a second-hand vehicle, understanding the intricacies of this tax is essential.

The sales tax on used cars in Illinois is a percentage of the purchase price, and it can vary depending on the specific circumstances of the transaction. This variation is influenced by factors such as the vehicle's age, location of the sale, and the buyer's residency status. Let's delve deeper into these aspects to provide a clearer picture.

Sales Tax Rates and Calculations

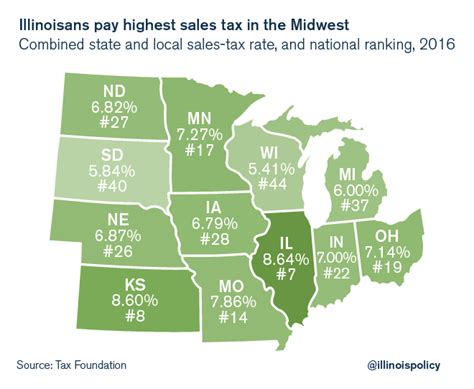

The base sales tax rate for used cars in Illinois is 6.25%. This rate is applied to the total purchase price of the vehicle, including any additional fees or charges. However, it’s important to note that this base rate can be subject to additional local sales tax surcharges, which vary across different counties and municipalities within the state. These local surcharges are typically added on top of the state sales tax and can increase the overall tax burden.

To illustrate, consider a scenario where a used car is purchased in Cook County, which has a local sales tax surcharge of 1.25%. In this case, the total sales tax applicable would be 7.5% (state tax + local surcharge). However, it's crucial to verify the specific local tax rates for the county or municipality where the transaction takes place, as these rates can vary significantly.

| Scenario | Total Sales Tax Rate |

|---|---|

| Base State Sales Tax | 6.25% |

| Local Sales Tax Surcharge (e.g., Cook County) | 1.25% |

| Total Sales Tax | 7.5% |

When calculating the sales tax, it's important to consider the total purchase price, which includes not only the vehicle's cost but also any applicable fees, such as title fees, registration fees, or dealer preparation charges. These additional fees are subject to the sales tax and should be included in the calculation.

Exemptions and Special Considerations

While the sales tax on used cars is generally applicable, there are certain exemptions and special considerations that buyers and sellers should be aware of. These exceptions can significantly impact the overall tax liability and should be carefully understood.

Vehicle Age Exemptions

One notable exemption relates to the age of the vehicle. In Illinois, used cars that are at least 20 years old are exempt from the sales tax. This exemption is based on the vehicle’s model year and can provide a significant tax benefit for buyers interested in classic or vintage cars.

For instance, if a buyer purchases a used car that was manufactured in 2004 or earlier, they would not be subject to the standard sales tax. This exemption encourages the sale and preservation of older vehicles, fostering a vibrant market for classic car enthusiasts.

Dealer-to-Dealer Sales

Another special consideration applies to dealers selling vehicles to other dealers. In such cases, the sales tax is typically not charged on the transaction. This exemption is designed to facilitate wholesale transactions between dealerships and streamline the process of moving vehicles between lots.

However, it's important to note that when a dealer sells a vehicle to a non-dealer buyer, the standard sales tax applies. This distinction is crucial for dealerships to understand, as it impacts their inventory management and sales strategies.

Out-of-State Purchases

If a vehicle is purchased out-of-state and brought into Illinois, the sales tax is still applicable. However, there are specific rules and procedures to follow in such cases. Buyers are typically required to pay the sales tax upon registering the vehicle in Illinois, even if the purchase occurred in another state.

To illustrate, consider a scenario where a resident of Illinois purchases a used car from a dealer in Indiana. Upon bringing the vehicle back to Illinois, the buyer must pay the applicable sales tax to the Illinois Department of Revenue. This ensures that all transactions involving used cars within the state are subject to the appropriate tax.

The Role of the Illinois Department of Revenue

The Illinois Department of Revenue plays a pivotal role in the administration and enforcement of the used car sales tax. They are responsible for collecting the tax, ensuring compliance, and providing guidance to taxpayers. Understanding the services and resources offered by this department can be invaluable for both buyers and sellers.

Tax Registration and Remittance

Dealers and businesses involved in the sale of used cars must register with the Illinois Department of Revenue to obtain a seller’s permit. This permit allows them to collect and remit sales tax on behalf of the state. The registration process typically involves providing business details, obtaining the necessary licenses, and understanding the tax reporting requirements.

Once registered, dealers are required to collect the sales tax from buyers at the time of the transaction. This tax is then remitted to the state on a regular basis, typically on a monthly or quarterly schedule. The timely and accurate remittance of sales tax is crucial to avoid penalties and maintain compliance.

Tax Reporting and Compliance

Compliance with sales tax regulations is a serious matter, and the Illinois Department of Revenue takes it very seriously. Dealers and businesses are required to maintain accurate records of all sales transactions, including the purchase price, applicable fees, and the calculated sales tax.

Regular tax reporting is essential to demonstrate compliance. Dealers must file sales tax returns, providing details of the transactions and the calculated tax amounts. These returns are typically due on a monthly or quarterly basis, depending on the business's filing frequency.

The Illinois Department of Revenue provides online filing systems and resources to assist taxpayers in meeting their reporting obligations. These systems offer a convenient and efficient way to file returns and make payments. Additionally, the department offers guidance materials, workshops, and support to help taxpayers understand and comply with the sales tax regulations.

Audit and Enforcement

To ensure compliance, the Illinois Department of Revenue conducts audits and enforcement actions. Audits are conducted to verify the accuracy of sales tax reporting and to identify any instances of non-compliance. These audits can be random or targeted, based on various factors such as transaction volume or previous compliance history.

In cases of non-compliance, the department has the authority to impose penalties and interest charges. These penalties can be significant and may include fines, late payment fees, or even legal action. Therefore, it's crucial for dealers and businesses to maintain accurate records, file timely returns, and remit sales tax accurately to avoid such consequences.

Future Implications and Industry Trends

As the automotive industry continues to evolve, so do the sales tax regulations and practices. Keeping abreast of these changes is essential for both dealers and buyers to ensure compliance and take advantage of any new opportunities.

Potential Tax Reform and Updates

The Illinois Department of Revenue periodically reviews and updates its sales tax regulations to align with changing market dynamics and technological advancements. While the base sales tax rate of 6.25% has remained stable, there have been discussions and proposals for potential changes to the tax structure.

One notable proposal is the consideration of a value-added tax (VAT) system, which would replace the current sales tax model. A VAT system would tax the value added at each stage of the production and distribution process, potentially impacting the way used car sales are taxed. While this proposal is still in the discussion phase, it highlights the need for stakeholders to stay informed and engaged with potential tax reforms.

The Rise of Online Used Car Sales

The digital age has brought about a significant shift in the way used cars are bought and sold. Online platforms and e-commerce websites have revolutionized the industry, offering buyers and sellers a convenient and efficient way to transact. However, this shift also presents unique challenges and considerations when it comes to sales tax.

When a used car is sold online, the sales tax jurisdiction becomes a critical factor. Depending on the location of the buyer and seller, different tax rates and rules may apply. For instance, if a buyer in Illinois purchases a used car from a dealer in another state, the sales tax applicable could be influenced by both the buyer's state and the seller's state.

To navigate these complexities, online platforms and dealers often utilize tax calculation tools and geolocation technology to determine the appropriate tax rates and ensure compliance. These tools help streamline the process and provide buyers with transparency regarding the tax implications of their purchases.

Electric and Hybrid Vehicles: A Tax Opportunity

The growing popularity of electric and hybrid vehicles presents a unique opportunity within the used car sales tax landscape. These vehicles often come with various tax incentives and rebates, which can significantly reduce the overall tax burden for buyers.

In Illinois, for example, there is a state rebate program for the purchase of electric vehicles. This program provides a rebate of up to $4,000 for qualified buyers, effectively reducing the sales tax liability. Additionally, there may be federal tax credits and local incentives available, further enhancing the tax benefits for buyers of electric and hybrid vehicles.

Dealers and buyers should stay informed about these incentives and ensure they are correctly applied during the sales transaction. Taking advantage of these opportunities can make the purchase of used electric or hybrid vehicles more affordable and environmentally friendly.

What happens if I forget to pay the sales tax on my used car purchase in Illinois?

+Forgetting to pay the sales tax on a used car purchase in Illinois can have serious consequences. The Illinois Department of Revenue may impose penalties and interest charges, and you may also face legal action. It’s important to understand your tax obligations and ensure timely payment to avoid these issues.

Are there any online resources or tools to help calculate the sales tax on a used car purchase in Illinois?

+Yes, there are several online resources and tax calculation tools available to assist with calculating the sales tax on a used car purchase in Illinois. These tools consider factors such as the vehicle’s purchase price, location, and any applicable local surcharges. Utilizing these resources can provide accurate tax estimates and help buyers budget effectively.

Can I negotiate the sales tax on a used car purchase in Illinois, or is it a fixed rate?

+The sales tax on a used car purchase in Illinois is generally a fixed rate determined by the state and local authorities. While the base rate of 6.25% is standard, local surcharges may vary. However, it’s important to note that the sales tax is a legal obligation, and attempting to negotiate it may not be possible or ethical. Instead, focus on negotiating the purchase price and any additional fees to get the best deal.