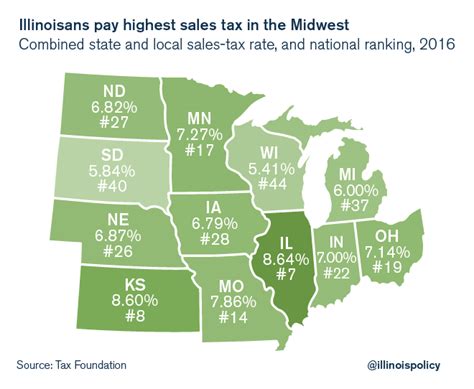

Illinois Car Sales Tax

The car sales tax in Illinois is an important consideration for anyone looking to purchase a vehicle in the state. Understanding the tax structure and how it applies to vehicle sales is crucial for both buyers and sellers. In this comprehensive guide, we will delve into the specifics of the Illinois car sales tax, exploring its rates, exemptions, and the overall process involved.

Understanding the Illinois Car Sales Tax

The Illinois car sales tax is a state-mandated tax imposed on the purchase of vehicles within the state. It is a percentage-based tax calculated on the total purchase price of the vehicle, including any additional fees and options. The revenue generated from this tax contributes to the state's infrastructure, transportation, and other public services.

Illinois, like many other states, has a graduated tax rate structure for vehicle sales. This means that the tax rate increases as the value of the vehicle increases. The graduated rates ensure that buyers of higher-priced vehicles contribute a larger portion of the tax revenue.

As of [current year], the Illinois car sales tax rates are as follows:

| Vehicle Value | Sales Tax Rate |

|---|---|

| Up to $10,000 | 6.25% |

| $10,001 - $15,000 | 6.5% |

| $15,001 - $20,000 | 6.75% |

| $20,001 - $25,000 | 7% |

| Over $25,000 | 7.25% |

These rates are subject to change, so it is advisable to check the official Illinois Department of Revenue website for the most up-to-date information.

How is the Car Sales Tax Calculated?

The car sales tax in Illinois is calculated by applying the appropriate tax rate to the total purchase price of the vehicle. This includes the base price of the car, any additional options or accessories, and the destination fee (if applicable). Let's take an example to illustrate the calculation process.

Suppose you are purchasing a new car with a base price of $22,000, and you add some optional features worth $2,500. The destination fee for this particular vehicle is $1,200. To calculate the sales tax, we sum up these amounts:

Total Purchase Price = $22,000 (base price) + $2,500 (options) + $1,200 (destination fee) = $25,700

Since the total purchase price exceeds $20,000 but is less than $25,000, the applicable tax rate is 6.75%. To find the sales tax amount, we multiply the total purchase price by the tax rate:

Sales Tax = $25,700 * 0.0675 = $1,739.25

So, in this example, the sales tax owed on the vehicle would be $1,739.25.

Exemptions and Special Considerations

While the majority of vehicle purchases in Illinois are subject to the car sales tax, there are certain exemptions and special cases to be aware of:

- Trade-Ins: If you trade in your old vehicle when purchasing a new one, the value of the trade-in is subtracted from the total purchase price before calculating the sales tax. This can result in a lower tax amount.

- Leases: When leasing a vehicle, the sales tax is typically calculated based on the monthly lease payments. The tax rate is applied to each payment, and the total tax amount is spread out over the lease term.

- Military Personnel: Active-duty military personnel stationed in Illinois are exempt from paying sales tax on vehicle purchases if they have a valid military orders letter.

- Disabled Individuals: Certain vehicles modified for disabled individuals may be exempt from sales tax. This includes vehicles equipped with special adaptive equipment or those used primarily for transportation to and from medical treatments.

- Non-Resident Purchases: If you are a non-resident of Illinois and purchase a vehicle in the state, you may be subject to use tax in your home state. The Illinois Department of Revenue has guidelines for non-resident vehicle purchases.

It is important to consult the Illinois Department of Revenue's guidelines or seek professional advice for a comprehensive understanding of these exemptions and special considerations.

The Car Sales Tax Process in Illinois

Understanding the process of paying the car sales tax is essential for a smooth transaction. Here's a step-by-step breakdown of how the car sales tax is typically handled in Illinois:

- Dealer Calculation: When purchasing a vehicle from a dealership, the dealer will calculate the sales tax based on the total purchase price. They will provide you with a breakdown of the tax amount on your purchase agreement or invoice.

- Payment Options: The sales tax can be paid at the time of purchase, either through a separate payment or by including it in your financing agreement. Some dealerships may offer financing options that cover the sales tax.

- Registration and Title: Once the vehicle is purchased, you will need to register it with the Illinois Secretary of State's office. During the registration process, you will be required to pay the sales tax (if not already paid) and any additional fees associated with the registration.

- Documentation: Keep all the relevant documentation related to your vehicle purchase, including the bill of sale, purchase agreement, and proof of sales tax payment. These documents are important for future reference and may be required for insurance purposes or when selling the vehicle.

Tips for Managing Car Sales Tax

To ensure a smooth and efficient process when dealing with the car sales tax in Illinois, consider the following tips:

- Research: Before making a vehicle purchase, familiarize yourself with the current sales tax rates and any applicable exemptions. This knowledge can help you budget and negotiate more effectively.

- Negotiate: When negotiating the price of a vehicle, keep in mind the sales tax amount. You may be able to negotiate a better overall deal by factoring in the tax savings.

- Trade-In Strategy: If you are trading in your old vehicle, consider its value and how it affects the total purchase price. A higher trade-in value can reduce the sales tax amount.

- Consider Leasing: Leasing a vehicle may provide tax advantages, especially if you plan to drive a new car every few years. Consult a tax professional to understand the potential benefits of leasing versus buying.

- Explore Financing Options: Some dealerships offer financing options that include the sales tax in the monthly payments. This can simplify the payment process and provide a clear understanding of your total monthly commitment.

Future Implications and Considerations

The Illinois car sales tax, like any tax policy, is subject to potential changes and developments. It is important to stay informed about any proposed amendments or updates to the tax structure.

Currently, there are ongoing discussions regarding the potential expansion of sales tax to online vehicle purchases. As more transactions move online, the state may consider ways to ensure tax compliance in the digital realm. Stay tuned for any updates on this front.

Additionally, the state of Illinois has been exploring the idea of a vehicle miles traveled (VMT) tax, which would replace the traditional gas tax. While this proposal is still in its early stages, it could significantly impact the way vehicle ownership is taxed in the future. Keep an eye on any developments related to this potential shift in taxation.

Lastly, as electric vehicles (EVs) become more prevalent, there may be considerations for tax incentives or adjustments to promote their adoption. Illinois has already implemented various EV incentives, and further measures could be introduced to encourage the transition to sustainable transportation.

Conclusion

Understanding the Illinois car sales tax is crucial for anyone considering a vehicle purchase in the state. By familiarizing yourself with the tax rates, exemptions, and the overall process, you can make more informed decisions and ensure a seamless transaction. Remember to consult official resources and seek professional advice when needed to navigate the complex world of vehicle sales taxation.

Are there any special considerations for first-time car buyers in Illinois regarding sales tax?

+Yes, first-time car buyers in Illinois may qualify for certain incentives or programs. It’s advisable to check with the Illinois Department of Revenue or consult a tax professional to understand any potential benefits or exemptions available to new vehicle owners.

How often are the car sales tax rates reviewed and updated in Illinois?

+The car sales tax rates in Illinois are typically reviewed and adjusted periodically to align with economic conditions and revenue needs. While there is no set schedule, it is advisable to check for updates annually to ensure you are aware of any changes.

Are there any online resources to calculate the car sales tax accurately before making a purchase in Illinois?

+Yes, the Illinois Department of Revenue provides an online sales tax calculator on their website. This tool allows you to input the vehicle’s purchase price and location to estimate the sales tax accurately. It’s a valuable resource for pre-purchase planning.

What happens if I fail to pay the car sales tax in Illinois?

+Failing to pay the car sales tax in Illinois can result in penalties and interest charges. It may also affect your ability to register and title the vehicle. It is crucial to pay the sales tax promptly to avoid any legal consequences.

Are there any tax incentives for purchasing environmentally friendly vehicles in Illinois?

+Yes, Illinois offers various tax incentives and rebates for the purchase of electric and hybrid vehicles. These incentives can significantly reduce the overall cost of ownership. Check the Illinois Clean Energy Community Foundation’s website for the latest information on these incentives.