Athens Clarke County Tax

Welcome to our comprehensive guide on the Athens-Clarke County tax system, designed to provide an in-depth understanding of this essential aspect of local governance. As a resident or business owner in Athens-Clarke County, Georgia, it's crucial to have a clear grasp of the tax structure, its implications, and the benefits it brings to our community.

Athens-Clarke County, often referred to as "Clarke County" or simply "Athens," is a vibrant community located in the northeastern part of Georgia. Known for its rich history, vibrant culture, and renowned educational institutions, Athens-Clarke County is also home to a robust and diverse economy. The tax system plays a pivotal role in sustaining the county's infrastructure, public services, and community development initiatives.

Understanding the Athens-Clarke County Tax System

The Athens-Clarke County tax system is a comprehensive framework designed to collect revenue for the local government. This revenue is crucial for funding essential services and initiatives that contribute to the well-being and development of our community. From maintaining our roads and public spaces to supporting education and public safety, tax revenue is the lifeblood of our local government's operations.

The tax system in Athens-Clarke County consists of several key components, each with its own unique characteristics and impact on taxpayers. These components include property taxes, sales taxes, and various other fees and assessments. Understanding each of these components is essential for taxpayers to effectively manage their financial obligations and contribute to the growth and sustainability of our community.

Property Taxes

Property taxes are a significant source of revenue for Athens-Clarke County. These taxes are levied on real estate properties, including residential, commercial, and industrial properties. The amount of property tax owed is determined by the assessed value of the property and the applicable tax rate set by the county government.

The property tax assessment process involves a detailed evaluation of each property's characteristics, such as its size, location, improvements, and recent sales data. This information is used to determine the property's fair market value, which serves as the basis for calculating the tax liability. The tax rate, often referred to as the "millage rate," is set annually by the county government and is applied to the assessed value to arrive at the final tax amount.

| Property Type | Average Assessed Value | Average Tax Rate |

|---|---|---|

| Residential | $250,000 | 10.2 mills |

| Commercial | $500,000 | 12.5 mills |

| Industrial | $800,000 | 11.0 mills |

Property owners in Athens-Clarke County are responsible for paying their property taxes annually. The due date for property tax payments is typically in the fall, and failure to pay by the deadline may result in penalties and interest charges. Property owners can typically pay their taxes online, by mail, or in person at the county tax commissioner's office. It's important for property owners to stay informed about their tax obligations and take advantage of any available tax relief programs or exemptions to which they may be entitled.

Sales Taxes

Sales taxes are another crucial component of the Athens-Clarke County tax system. These taxes are imposed on the sale of goods and certain services within the county. The sales tax rate in Athens-Clarke County is composed of a combination of state, county, and local sales taxes, which are added to the purchase price of taxable items.

The state sales tax rate in Georgia is currently 4%, while Athens-Clarke County adds an additional 2% sales tax, bringing the total sales tax rate to 6%. This means that for every $100 spent on taxable items, $6 is collected as sales tax. The revenue generated from sales taxes contributes to various public services, including road maintenance, public safety, and education.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of Georgia | 4% |

| Athens-Clarke County | 2% |

| Total Sales Tax Rate | 6% |

It's important for businesses operating in Athens-Clarke County to understand their sales tax obligations and properly collect and remit sales taxes on all taxable transactions. Failure to comply with sales tax regulations can result in penalties and legal consequences. Additionally, consumers should be aware of the sales tax rate when making purchases to ensure they are accurately informed about the total cost of their transactions.

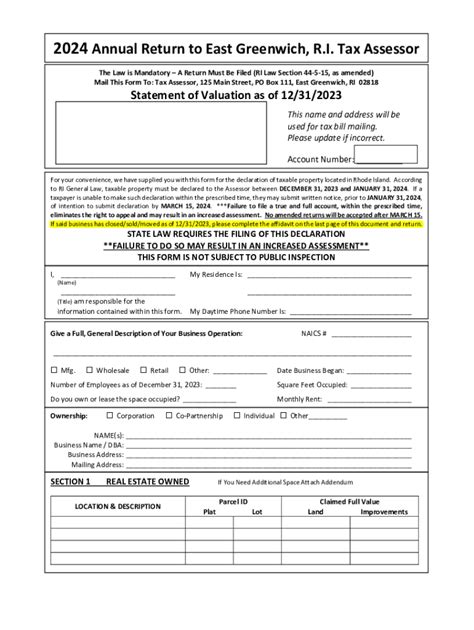

Other Fees and Assessments

In addition to property and sales taxes, Athens-Clarke County levies various other fees and assessments to support specific services and initiatives. These fees and assessments are typically tied to specific services or infrastructure projects and are often imposed on a per-user or per-transaction basis.

For instance, the county may impose fees for solid waste management, water and sewer services, or even special assessments for infrastructure improvements within certain areas. These fees and assessments help fund essential services and ensure that the costs of these services are equitably distributed among the users or beneficiaries.

| Fee/Assessment Type | Description | Average Amount |

|---|---|---|

| Solid Waste Fee | Monthly fee for waste collection and disposal | $25 per month |

| Water/Sewer Fee | Monthly fee for water and sewer services | $50 per month |

| Special Assessment | One-time assessment for road improvements | $1,000 per property |

It's important for residents and businesses to understand the various fees and assessments that may apply to them. Staying informed about these charges and their purposes helps individuals and businesses effectively manage their financial obligations and contribute to the development and maintenance of our community's infrastructure and services.

The Benefits of Athens-Clarke County Taxes

The tax revenue collected in Athens-Clarke County supports a wide range of vital services and initiatives that enhance the quality of life for residents and foster economic growth. Here are some key benefits that our community derives from the tax system:

Quality Education

A significant portion of tax revenue is allocated to education, ensuring that our schools receive the resources they need to provide high-quality education to our children. This includes funding for teachers, educational materials, infrastructure improvements, and extra-curricular activities.

Efficient Public Services

Taxes fund essential public services such as police and fire protection, emergency response, and public works. These services are vital for maintaining a safe and well-functioning community, and the tax system ensures that these services remain robust and accessible to all residents.

Community Development

Athens-Clarke County's tax revenue also supports community development initiatives. This includes funding for affordable housing programs, economic development initiatives, and infrastructure improvements. These efforts contribute to the overall well-being and sustainability of our community, making it a desirable place to live, work, and raise a family.

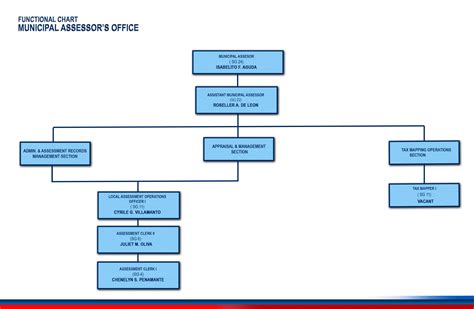

Efficient Tax Administration

The Athens-Clarke County Tax Commissioner's Office is committed to providing efficient and transparent tax administration. The office handles the collection of property taxes, vehicle taxes, and other related fees. Residents and businesses can access their tax information and make payments online, ensuring a convenient and streamlined process.

Tax Relief Programs and Exemptions

Athens-Clarke County recognizes the importance of providing tax relief to certain groups and circumstances. The county offers various tax relief programs and exemptions to ease the financial burden on eligible taxpayers. Here are some of the key tax relief initiatives:

Homestead Exemptions

Homestead exemptions are available to Athens-Clarke County homeowners who use their property as their primary residence. These exemptions reduce the assessed value of the property for tax purposes, resulting in lower property taxes. To qualify, homeowners must meet specific residency and income requirements.

Senior Citizen Tax Relief

Athens-Clarke County provides tax relief to senior citizens who meet certain age and income criteria. This relief program helps reduce the tax burden on our elderly residents, ensuring they can continue to live comfortably in their homes. The amount of relief is determined based on income and the assessed value of the property.

Veterans and Disability Exemptions

The county offers property tax exemptions to honorably discharged veterans and individuals with certain disabilities. These exemptions are designed to recognize the service and sacrifice of our veterans and provide support to individuals with disabilities. The exemptions can significantly reduce or eliminate property taxes for eligible individuals.

Other Tax Relief Programs

Athens-Clarke County also offers various other tax relief programs, including the Conservation Use Valuation Assessment Program and the Agricultural Current Use Valuation Assessment Program. These programs provide tax benefits to landowners who use their property for agricultural or conservation purposes, encouraging the preservation of our natural resources and supporting our local farming community.

Taxpayer Resources and Support

Athens-Clarke County is dedicated to providing comprehensive resources and support to its taxpayers. The Tax Commissioner's Office offers a range of services and tools to assist residents and businesses in navigating the tax system and ensuring compliance. Here are some key resources available to taxpayers:

Online Tax Payment Portal

The Tax Commissioner's Office provides a user-friendly online portal for taxpayers to access their tax information and make payments. This portal offers a secure and convenient way to manage tax obligations, with options for electronic payments and automated reminders for due dates.

Taxpayer Assistance Programs

The Tax Commissioner's Office offers assistance to taxpayers who may require additional support. This includes providing guidance on tax forms, answering questions about tax obligations, and helping taxpayers understand available tax relief programs. Taxpayers can access this assistance through in-person visits, phone calls, or email inquiries.

Tax Publication Resources

The Tax Commissioner's Office publishes various resources and publications to keep taxpayers informed about tax-related matters. These resources include tax guides, newsletters, and educational materials covering a range of topics, from property tax assessments to sales tax compliance. Taxpayers can access these resources on the county's website or by requesting hard copies from the Tax Commissioner's Office.

Community Outreach and Education

Athens-Clarke County is committed to community engagement and education regarding tax matters. The Tax Commissioner's Office actively participates in community events, hosting workshops and seminars to provide taxpayers with valuable information and resources. These outreach efforts aim to ensure that taxpayers are well-informed about their rights and responsibilities and can make informed decisions about their tax obligations.

Conclusion: A Community Investment

The Athens-Clarke County tax system is more than just a financial obligation; it's an investment in our community's future. The tax revenue collected is a crucial resource for maintaining and enhancing the services and infrastructure that make our community thrive. By understanding the tax system and actively participating in it, we contribute to the well-being and prosperity of Athens-Clarke County.

As we navigate the complexities of the tax system, it's essential to stay informed, seek assistance when needed, and take advantage of the available resources and support. Together, we can ensure that our tax dollars are used effectively to create a vibrant, sustainable, and thriving community for generations to come.

What is the current millage rate for property taxes in Athens-Clarke County?

+The current millage rate for Athens-Clarke County is 10.2 mills for residential properties and 12.5 mills for commercial properties. These rates are subject to change annually and are set by the county government.

How often do I need to pay my property taxes in Athens-Clarke County?

+Property taxes in Athens-Clarke County are due annually. The exact due date may vary each year, but it is typically in the fall. It’s important to stay informed about the specific due date to ensure timely payment and avoid penalties.

Are there any tax relief programs available for senior citizens in Athens-Clarke County?

+Yes, Athens-Clarke County offers tax relief programs specifically for senior citizens. These programs provide reductions in property taxes based on income and residency criteria. To learn more about eligibility and application processes, you can visit the Tax Commissioner’s Office website or contact them directly.

How can I stay informed about changes to the tax system in Athens-Clarke County?

+To stay informed about changes to the tax system, you can regularly visit the Athens-Clarke County website, where updates and announcements are posted. Additionally, you can subscribe to the Tax Commissioner’s Office newsletter or follow their social media channels for timely updates and relevant tax-related information.