Richland County Auto Tax

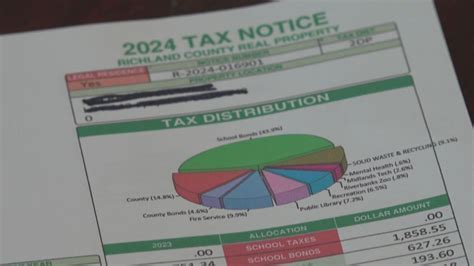

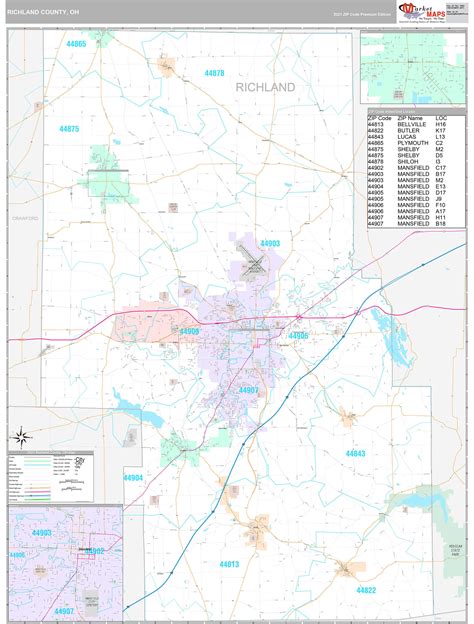

Richland County, South Carolina, imposes an annual automobile property tax, commonly referred to as the Richland County Auto Tax, on vehicles registered within its jurisdiction. This tax is an essential revenue stream for the county, contributing significantly to its overall budget. The tax is based on the value of the vehicle, its age, and its usage, and it is a key consideration for vehicle owners in the county.

Understanding the Richland County Auto Tax

The Richland County Auto Tax is an ad valorem tax, which means it is calculated based on the value of the property, in this case, the vehicle. The tax rate varies depending on the type of vehicle and its assessed value. Passenger cars, trucks, and motorcycles are subject to different tax rates and are assessed differently. Additionally, the tax liability for vehicles is determined by the location of the owner's residence rather than the vehicle's registration or usage.

The county assesses the value of vehicles annually, taking into account factors such as make, model, year, and condition. This assessed value forms the basis for calculating the auto tax. The tax rate is then applied to this assessed value to determine the tax liability for the vehicle owner.

Tax Rates and Calculations

The Richland County Auto Tax rates are set by the Richland County Council and are subject to change annually. As of the latest information available, the tax rates are as follows:

| Vehicle Type | Tax Rate |

|---|---|

| Passenger Cars | 65 mills per $1,000 of assessed value |

| Trucks and Trucks with Special Equipment | 130 mills per $1,000 of assessed value |

| Motorcycles | 35 mills per $1,000 of assessed value |

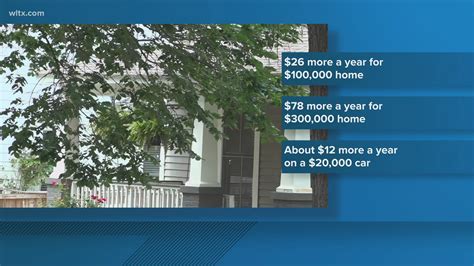

To illustrate, if a passenger car is assessed at $10,000, the auto tax calculation would be as follows: $10,000 (assessed value) x 0.065 (tax rate) = $650 in auto tax.

Exemptions and Discounts

Richland County offers certain exemptions and discounts for the auto tax to eligible vehicle owners. These include:

- Senior Citizen Discount: Vehicle owners aged 65 and older are eligible for a discount on their auto tax. The discount amount is determined based on the assessed value of the vehicle.

- Military Exemption: Active-duty military personnel and their spouses are exempt from the auto tax on one vehicle. The exemption applies to vehicles registered in the names of the service member or spouse and is valid as long as the service member remains on active duty.

- Disability Exemption: Individuals with a permanent and total disability may be eligible for an exemption from the auto tax. The disability must be certified by a licensed physician, and the exemption applies to one vehicle owned by the disabled individual.

Payment Options and Due Dates

Richland County provides several options for vehicle owners to pay their auto tax. These include online payment through the county's website, payment by mail, and in-person payment at designated locations. The county also offers the option to pay the auto tax when renewing vehicle registration.

The auto tax payment due date aligns with the vehicle registration renewal period. Vehicle owners are encouraged to pay their auto tax before the registration renewal deadline to avoid penalties and potential registration issues.

Late Payments and Penalties

Failure to pay the Richland County Auto Tax by the due date can result in penalties and additional fees. Late payments are subject to a 10% penalty, and if the tax remains unpaid after a certain period, the county may take legal action to collect the tax, including placing a lien on the vehicle or initiating court proceedings.

Assessment Appeals

Vehicle owners who believe their vehicle's assessed value is inaccurate or unfair can appeal the assessment. The Richland County Assessor's Office provides a process for taxpayers to challenge their vehicle's assessed value. The appeal process typically involves submitting documentation to support the claimed value and attending a hearing to present the case.

It is important for vehicle owners to understand that the appeal process can be complex and may require significant evidence to support a successful challenge. Engaging the services of a professional tax advisor or attorney can be beneficial in navigating the assessment appeal process.

The Impact of Auto Tax on Vehicle Ownership

The Richland County Auto Tax is a significant factor in the overall cost of vehicle ownership for residents. It is an annual expense that must be considered when budgeting for vehicle-related costs. The tax can impact the decision-making process for vehicle purchases, maintenance, and upgrades.

For example, the auto tax may influence vehicle owners to opt for more fuel-efficient or environmentally friendly vehicles, as these often have lower assessed values and, consequently, lower tax liabilities. Additionally, the tax can affect the resale value of vehicles, as buyers may consider the tax implications when purchasing a used vehicle.

Economic Impact

The auto tax also has broader economic implications for Richland County. The tax revenue generated is a significant source of funding for various county services and infrastructure projects. It contributes to the overall financial health of the county and helps maintain essential public services such as law enforcement, education, and road maintenance.

FAQs

How often is the Richland County Auto Tax assessed?

+The Richland County Auto Tax is assessed annually. The assessment is based on the value of the vehicle as of January 1st of each year.

Can I appeal my vehicle’s assessed value for auto tax purposes?

+Yes, vehicle owners have the right to appeal their vehicle’s assessed value if they believe it is inaccurate. The appeal process is handled by the Richland County Assessor’s Office and requires submitting evidence to support the claimed value.

Are there any discounts or exemptions for the Richland County Auto Tax?

+Yes, Richland County offers several discounts and exemptions. These include discounts for senior citizens, military personnel, and individuals with disabilities. It’s important to check the specific eligibility criteria for each exemption.

What happens if I don’t pay my Richland County Auto Tax on time?

+Late payment of the Richland County Auto Tax incurs a 10% penalty. If the tax remains unpaid, the county may take legal action, which could result in a lien on the vehicle or other legal consequences.

Can I pay my auto tax when I renew my vehicle registration?

+Yes, Richland County provides the option to pay your auto tax when you renew your vehicle registration. This simplifies the process and ensures you can complete both tasks simultaneously.