Trump Federal Income Tax

The federal income tax returns of former President Donald Trump have been a topic of intense public interest and political controversy since his entry into politics. The release of his tax records has been a long-standing demand from various quarters, with the belief that they would provide valuable insights into his financial dealings and potential conflicts of interest.

Trump's tax records, once a closely guarded secret, have now become a significant part of the public discourse, offering a unique glimpse into the financial practices of one of the most prominent figures in recent American history. This article aims to delve deep into the world of Trump's federal income tax, exploring the key revelations, the legal and political implications, and the broader impact on the American tax system.

Unveiling the Trump Tax Records

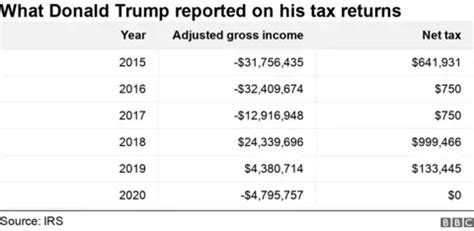

On October 1, 2021, the New York Times published an extensive investigation into Donald Trump's tax returns, spanning over two decades. The report revealed a myriad of complex financial arrangements, controversial tax strategies, and a pattern of tax avoidance that raised significant questions about the former president's compliance with the law.

Among the key findings were:

- Massive Losses and Negative Income: Trump reported hundreds of millions of dollars in losses, particularly in the early 1990s, which allowed him to avoid paying federal income taxes for over a decade. These losses were primarily attributed to the decline of his casino business and a series of bad investments.

- Aggressive Tax Strategies: Trump utilized various aggressive tax strategies, including the controversial practice of tax carryforwards, which allowed him to offset future profits with past losses, thus minimizing his tax liability. He also took advantage of a loophole that allowed him to deduct interest payments on loans from his income, further reducing his tax burden.

- Business Complexities: The tax returns revealed the intricate web of Trump's business empire, with hundreds of entities, partnerships, and limited liability companies. This complexity made it difficult to ascertain the true financial health of his businesses and his personal wealth.

The publication of these tax records sparked a fierce debate, with supporters arguing that Trump's tax strategies were legal and common among the wealthy, while critics pointed to the ethical and moral implications of a president who seemingly paid little to no federal income tax.

Legal and Ethical Considerations

The revelation of Trump's tax records raised a host of legal and ethical questions. While the tax strategies employed by Trump were not necessarily illegal, they certainly pushed the boundaries of what is considered ethical and fair.

Compliance with Tax Laws

Experts have debated the legality of Trump's tax practices. On one hand, the use of tax shelters and loopholes is a common strategy among the wealthy, and as long as these practices are within the letter of the law, they are considered legitimate. However, the sheer scale of Trump's tax avoidance, as well as the complexity of his financial arrangements, has led some experts to question whether his tax returns were fully compliant with the spirit of the tax code.

One key area of concern is the accuracy and completeness of Trump's tax returns. The Internal Revenue Service (IRS) has the power to audit tax returns and ensure compliance, but the process is often lengthy and complex. In Trump's case, the IRS conducted an audit, but the results were not made public, leaving questions about the thoroughness and effectiveness of the audit process.

Ethical and Moral Implications

Beyond the legal considerations, Trump's tax records have raised significant ethical questions. As the leader of the free world, should a president be held to a higher standard of financial transparency and ethical conduct? Many argue that a president who pays little to no federal income tax, despite immense wealth, sets a poor example for the nation and undermines the principle of equal sacrifice.

The perception of Trump as a successful businessman who paid little tax has also contributed to a growing sense of inequality and distrust in the American tax system. This has led to calls for tax reform, with a focus on closing loopholes and ensuring that the wealthy pay their fair share.

Political Fallout and Impact on Tax Policy

The release of Trump's tax records had significant political implications and shaped the narrative of his presidency. It reinforced the perception of Trump as a controversial and divisive figure, and added fuel to the ongoing debate about income inequality and tax fairness.

Political Polarization

Trump's tax records became a rallying point for his supporters and detractors alike. While his supporters defended his tax strategies as legitimate and innovative, his critics saw it as further evidence of his disdain for the rule of law and his disregard for the common good. This deepened the political polarization that characterized his presidency.

Impact on Tax Reform

The revelation of Trump's tax practices has had a lasting impact on tax policy discussions. It has highlighted the need for comprehensive tax reform that addresses loopholes and ensures a fairer distribution of the tax burden. Many policymakers have called for a simplification of the tax code, arguing that the current system is overly complex and allows for abuse by those with the means to navigate it.

In the wake of the Trump tax revelations, several proposals for tax reform have gained traction. These include proposals to limit the use of tax carryforwards, cap the deductibility of interest payments, and introduce a minimum tax for high-income earners. While these proposals have not yet become law, they reflect a growing consensus that the tax system needs to be more transparent and equitable.

Future Implications and the Tax System

The publication of Trump's tax records has undoubtedly left a mark on the American tax system and public perception of taxation. It has shone a spotlight on the complex and often unfair nature of the tax code, and has prompted a much-needed conversation about tax reform and financial transparency.

Call for Transparency

One of the key takeaways from the Trump tax controversy is the demand for greater transparency in financial dealings, particularly for public figures. The public has a right to know how their leaders are managing their finances, and whether they are complying with the law. This has led to calls for mandatory disclosure of tax returns for all presidential candidates, as well as increased scrutiny of the financial practices of elected officials.

Impact on Public Trust

The revelation of Trump's tax records has also had a significant impact on public trust in the tax system. Many Americans feel that the tax code is biased in favor of the wealthy and powerful, and that ordinary citizens bear a disproportionate burden. This perception has contributed to a sense of disillusionment with the tax system and has fueled calls for systemic change.

Potential Reforms and Their Impact

Looking forward, there are several potential reforms that could address the issues raised by Trump's tax records. These include:

- Simplification of the Tax Code: Simplifying the tax code would make it harder for individuals and businesses to exploit loopholes and engage in aggressive tax planning. It would also make the tax system more transparent and easier for taxpayers to understand.

- Closing Loopholes: Several loopholes, such as the carried interest loophole and the tax treatment of private equity profits, have been identified as contributing to tax avoidance by the wealthy. Closing these loopholes would ensure that high-income earners pay their fair share.

- Increased IRS Funding: The IRS plays a crucial role in enforcing tax laws and ensuring compliance. However, it has faced budget cuts in recent years, making it difficult to conduct thorough audits and enforce tax laws effectively. Increased funding for the IRS could help improve tax compliance and reduce tax evasion.

Conclusion

The Trump federal income tax controversy has been a defining moment in American politics and tax policy. It has sparked a much-needed conversation about the fairness and transparency of the tax system, and has left a lasting impact on public perception of taxation and financial ethics. As the debate continues, it remains to be seen whether the lessons learned from this controversy will lead to meaningful reforms that restore public trust in the tax system and ensure a fairer distribution of the tax burden.

What are some of the key tax strategies employed by Trump that have raised concerns?

+Trump utilized several aggressive tax strategies, including tax carryforwards, which allowed him to offset future profits with past losses, and the deduction of interest payments on loans from his income. These strategies, while legal, have raised concerns about fairness and the spirit of the tax code.

How have Trump’s tax records impacted the discussion around tax reform?

+The revelation of Trump’s tax records has highlighted the need for comprehensive tax reform, with a focus on closing loopholes and ensuring a fairer distribution of the tax burden. It has also brought attention to the complexity of the tax code and the need for simplification.

What are the potential long-term effects of the Trump tax controversy on public trust in the tax system?

+The Trump tax controversy has contributed to a sense of distrust in the tax system, with many Americans feeling that the system is biased in favor of the wealthy. This has led to calls for greater transparency and a fairer tax system, which could potentially shape future tax policy and public perception of taxation.