Michigan Income Tax Return Status

Michigan's income tax system is an essential component of the state's financial infrastructure, and understanding the status of your tax return is crucial for individuals and businesses alike. In this comprehensive guide, we will delve into the intricacies of the Michigan Income Tax Return Status, exploring the process, timelines, and key factors that impact the outcome. By the end of this article, you will have a clear understanding of what to expect when filing your Michigan income taxes and how to track the status of your return.

Understanding the Michigan Income Tax Return Process

Michigan, like many other states, imposes an income tax on its residents and businesses. The process of filing income taxes in Michigan involves several steps, each with its own set of requirements and deadlines. Let’s break down the key stages of the Michigan income tax return process:

Step 1: Taxable Income Determination

The first step in filing your Michigan income tax return is to determine your taxable income. This involves calculating your total income from various sources, such as wages, salaries, business income, investments, and any other taxable earnings. Michigan uses a graduated tax rate structure, which means that your tax liability increases as your income rises. It’s crucial to accurately report all income to avoid potential penalties and ensure compliance with state tax laws.

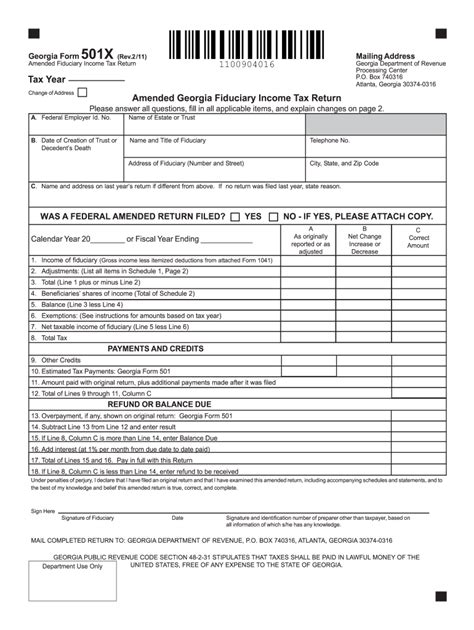

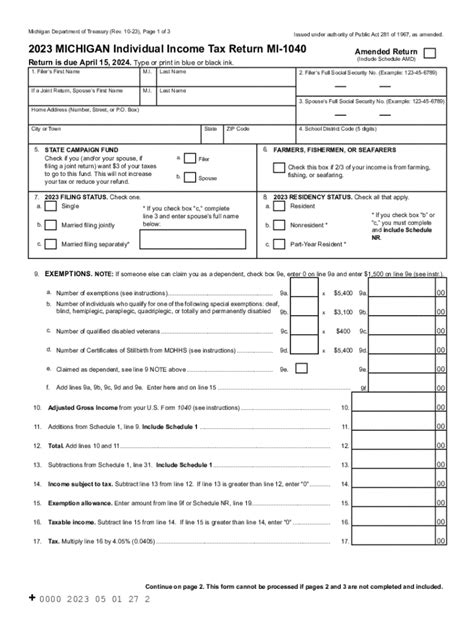

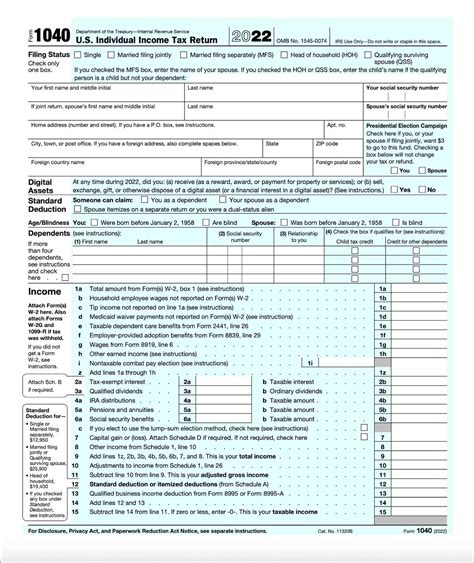

Step 2: Tax Forms and Filing Options

Michigan offers a range of tax forms to cater to different income sources and situations. The most common form for individuals is the Form 1040, which covers various types of income and deductions. For businesses, the specific form may vary depending on the business structure, such as sole proprietorships, partnerships, or corporations. Michigan also provides online filing options through its official website, offering a convenient and efficient way to submit tax returns.

Step 3: Deductions and Credits

Michigan allows taxpayers to claim deductions and credits to reduce their taxable income. Deductions can include expenses like mortgage interest, property taxes, charitable contributions, and certain business-related costs. Credits, on the other hand, provide direct reductions to the tax liability and can include credits for low-income individuals, dependents, and various tax incentives offered by the state.

Step 4: Payment Options and Deadlines

Michigan income taxes are typically due by a specific deadline, which is usually aligned with the federal tax deadline. Taxpayers have the option to pay their taxes in full at the time of filing or choose to make estimated payments throughout the year. Failure to meet the payment deadlines can result in penalties and interest charges, so it’s essential to plan and manage your payments effectively.

Tracking Your Michigan Income Tax Return Status

Once you’ve filed your Michigan income tax return, it’s natural to want to know the status of your return and any potential refund. Michigan provides several ways for taxpayers to track their return status and stay informed about the progress of their tax filing.

Online Tracking Tools

The Michigan Department of Treasury offers an online tracking system that allows taxpayers to check the status of their returns. This system provides real-time updates on the progress of your tax return, from the initial receipt of your filing to the final processing and any potential refund or balance due. To access this tool, you’ll need to provide your personal information, such as your Social Security Number or Taxpayer Identification Number, and other identifying details.

Michigan Tax Refund Hotline

For those who prefer a more personal approach, Michigan provides a tax refund hotline where trained professionals can assist you with your tax return status inquiries. By calling the hotline, you can speak directly to a representative who can provide you with the latest information on your return and answer any questions you may have about the process.

Estimated Refund Timelines

Understanding the typical timelines for tax return processing and refund issuance can help manage your expectations. Michigan aims to process income tax returns within a reasonable timeframe, and the speed of processing can depend on various factors, including the complexity of the return and the volume of filings received during the tax season. Generally, simple returns with no errors or complications are processed more quickly than those with additional review requirements.

Common Delays and Potential Issues

While Michigan strives to process tax returns efficiently, there can be instances of delays or issues that may impact your return status. Some common reasons for delays include errors or discrepancies in the tax return, missing or incomplete information, or ongoing audits. In such cases, the Department of Treasury may reach out to taxpayers to resolve the issue and ensure accurate processing. It’s essential to respond promptly to any such communications to avoid further delays.

Michigan Income Tax Return Status: A Real-World Example

To illustrate the process and potential outcomes, let’s consider a real-world example of a Michigan taxpayer, Jane Smith, who recently filed her income tax return.

Jane, a resident of Grand Rapids, Michigan, filed her individual income tax return on April 15th, the federal tax deadline. She used the online filing system provided by the Michigan Department of Treasury and carefully reviewed her return for accuracy before submission. Jane claimed several deductions, including mortgage interest and charitable contributions, and also qualified for a low-income tax credit.

Within a week of filing, Jane checked her tax return status using the online tracking tool. The system showed that her return had been received and was in the initial processing stage. A few days later, she received an email notification confirming that her return had been accepted and that her refund was being processed.

After approximately three weeks, Jane received her tax refund, which was directly deposited into her bank account. The entire process, from filing to receiving her refund, took less than a month, which is a testament to the efficiency of Michigan's tax return processing system.

Staying Informed and Managing Your Michigan Tax Obligations

Understanding your Michigan Income Tax Return Status is just one aspect of managing your tax obligations effectively. To ensure compliance and take advantage of any available tax benefits, it’s crucial to stay informed about the latest tax laws, regulations, and incentives offered by the state.

Stay Up-to-Date with Tax Law Changes

Tax laws and regulations can evolve over time, and staying informed about these changes is essential for accurate tax filing. Michigan regularly updates its tax guidelines, and it’s important to keep track of any amendments, new deductions, or credits that may impact your tax liability. The Michigan Department of Treasury provides resources and updates on its website to help taxpayers stay informed.

Explore Tax Incentives and Credits

Michigan offers various tax incentives and credits to support businesses and individuals. These incentives can provide significant savings and benefits to taxpayers. For instance, the state may offer tax credits for research and development activities, investments in renewable energy, or job creation initiatives. Exploring these incentives and understanding their requirements can help you maximize your tax savings and contribute to the state’s economic growth.

Consider Professional Tax Assistance

While many taxpayers choose to file their Michigan income tax returns independently, seeking professional tax assistance can be beneficial, especially for those with complex tax situations or businesses. Tax professionals, such as certified public accountants (CPAs) or enrolled agents, can provide expert guidance, ensure compliance with state tax laws, and identify potential tax-saving opportunities. They can also help with tax planning strategies to optimize your tax position throughout the year.

Plan for Future Tax Obligations

Filing your Michigan income tax return is not a one-time event; it’s an ongoing process that requires year-round planning and management. By staying organized and keeping track of your income, expenses, and deductions throughout the year, you can simplify the tax filing process and ensure accuracy. Additionally, planning for future tax obligations, such as estimated tax payments or business tax liabilities, can help you manage your finances effectively and avoid unexpected surprises during tax season.

The Impact of Michigan’s Tax System on Economic Growth

Michigan’s income tax system plays a vital role in the state’s economic landscape, influencing business decisions, investment opportunities, and overall economic growth. Let’s explore some key aspects of how Michigan’s tax system impacts the state’s economy.

Attracting Businesses and Investors

A competitive and well-structured tax system can be a significant factor in attracting businesses and investors to a state. Michigan’s tax policies, including tax incentives for businesses and favorable tax rates, contribute to making the state an attractive destination for economic activities. By offering tax benefits and a supportive business environment, Michigan can encourage entrepreneurship, job creation, and economic development.

Impact on State Revenue and Services

Income tax revenue is a crucial source of funding for various state services and infrastructure projects. The tax dollars collected by Michigan are allocated to support education, healthcare, transportation, and other essential public services. A robust tax system ensures that the state has the necessary resources to invest in its citizens’ well-being and drive economic growth. The efficient collection and management of tax revenue are vital for the state’s fiscal health and long-term sustainability.

Long-Term Economic Planning

Michigan’s tax system is not only about collecting revenue but also about fostering long-term economic planning and development. The state’s tax policies and incentives are designed to encourage sustainable growth, support innovation, and promote economic diversity. By providing a stable and predictable tax environment, Michigan can attract a diverse range of industries and ensure a resilient economy that can withstand economic fluctuations.

Future Implications and Potential Reforms

As Michigan’s economy continues to evolve, the state’s tax system may undergo reforms and adjustments to stay aligned with changing economic dynamics. Potential reforms could include simplifying tax codes, introducing new tax incentives, or reevaluating tax rates to ensure competitiveness and fairness. These reforms aim to create an environment that supports businesses, encourages investment, and ultimately drives economic growth and prosperity for Michigan’s residents.

Conclusion: Empowering Michigan Taxpayers with Knowledge

Understanding your Michigan Income Tax Return Status is a critical aspect of financial management and compliance. By following the guidelines outlined in this article, you can navigate the tax filing process with confidence, track your return status effectively, and take advantage of the resources and incentives offered by the state. Whether you’re an individual taxpayer or a business owner, staying informed and engaged with Michigan’s tax system is essential for your financial well-being and the state’s economic success.

How long does it typically take to receive a Michigan income tax refund?

+

The processing time for Michigan income tax refunds can vary based on several factors. In most cases, simple returns with no errors or issues are processed within 4-6 weeks. However, more complex returns or those with discrepancies may take longer. It’s important to ensure the accuracy of your return to avoid delays.

Can I check my Michigan tax return status online if I filed by mail?

+

Yes, even if you filed your Michigan income tax return by mail, you can still check the status online using the official tracking system. You’ll need to provide your personal information, such as your Social Security Number and other details, to access your return status.

What should I do if I receive a notice about errors in my Michigan tax return?

+

If you receive a notice regarding errors or discrepancies in your Michigan tax return, it’s crucial to respond promptly. Review the notice carefully and gather the necessary documentation to resolve the issue. You can contact the Michigan Department of Treasury for guidance on correcting the errors and ensuring your return is processed accurately.

Are there any tax incentives or credits available for Michigan taxpayers?

+

Yes, Michigan offers a range of tax incentives and credits to support taxpayers. These can include credits for low-income individuals, dependent care expenses, renewable energy investments, and more. It’s beneficial to explore these incentives and understand their requirements to maximize your tax savings.

How can I stay informed about Michigan’s tax laws and updates?

+

To stay informed about Michigan’s tax laws and updates, you can regularly visit the official website of the Michigan Department of Treasury. They provide resources, news, and announcements regarding tax law changes, deadlines, and other important information. Additionally, consider subscribing to their email updates or following their social media channels for timely notifications.