How To Amend Tax Return

Amending a tax return is a process that allows individuals and businesses to correct errors or make changes to previously filed tax documents. It is an important procedure to ensure accurate reporting and compliance with tax regulations. Whether you realize you've made a mistake, missed a deduction, or have new information to include, amending your tax return is a necessary step to ensure you pay the correct amount of taxes and receive any refunds you are entitled to. This guide will walk you through the process, providing step-by-step instructions and valuable insights to help you navigate the amendment process with ease.

Understanding the Need to Amend

There are several scenarios that may require you to amend your tax return. Common reasons include:

- Discovering errors in calculations or data entry, such as incorrect income amounts, deductions, or credits.

- Receiving additional income or tax documents after filing, such as a 1099 form or a corrected W-2.

- Realizing you forgot to include eligible deductions or credits, such as education expenses or certain business expenses.

- Learning about new tax laws or regulations that impact your tax liability.

- Correcting errors made by tax preparers or software during the initial filing.

It's crucial to identify these issues promptly, as unaddressed errors can lead to potential penalties or interest charges. By amending your tax return, you can ensure compliance and avoid any negative consequences.

Gathering Necessary Documents

Before you begin the amendment process, it’s essential to gather all the relevant documents and information. This will ensure a smooth and accurate amendment. Here’s what you’ll need:

- Original Tax Return: Retrieve a copy of your original tax return, including all schedules and forms. This will serve as a reference for identifying the changes you need to make.

- Supporting Documents: Collect any additional documents that support the changes you plan to make. This may include pay stubs, receipts, investment statements, or other records related to your income, deductions, or credits.

- Tax Forms and Publications: Familiarize yourself with the relevant tax forms and publications for the specific changes you need to make. The IRS website provides access to these resources, ensuring you have the latest and most accurate information.

- Previous Years’ Returns: If your amendment is related to carryovers or adjustments from previous tax years, ensure you have access to those returns as well.

- Calculator: Have a calculator at hand to double-check calculations and ensure accuracy.

By gathering these documents and resources, you'll be well-prepared to tackle the amendment process with confidence.

Amending Your Tax Return: Step-by-Step Guide

Now, let’s delve into the step-by-step process of amending your tax return. This comprehensive guide will ensure you navigate each step with ease and accuracy.

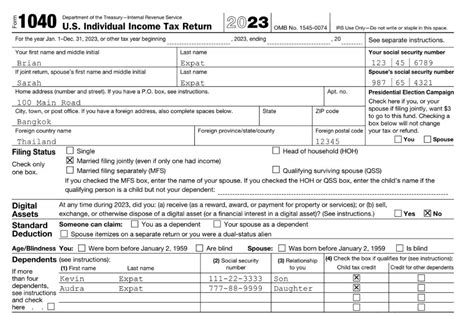

Step 1: Choose the Appropriate Form

The first step is to determine which form you need to use for your amendment. The most common form for individual taxpayers is the 1040X Amended U.S. Individual Income Tax Return. However, depending on your specific situation, you may need to use other forms, such as Form 1065 for partnerships or Form 1120 for corporations. Refer to the IRS website or consult a tax professional to ensure you select the correct form.

Step 2: Fill Out the Form

Once you have the appropriate form, carefully fill it out. Pay close attention to the instructions and ensure you provide accurate and complete information. Here’s a breakdown of the key sections you’ll need to address:

- Original Return Information: Provide details about your original tax return, including the filing status, income, and any adjustments made. This information will help the IRS identify the changes you’re making.

- Explanation of Changes: In this section, clearly explain the changes you’re making and provide supporting calculations or documentation. Be as detailed as possible to ensure the IRS understands the reason for your amendment.

- Corrected Return Information: Calculate and report the corrected figures based on the changes you’ve made. This includes adjustments to income, deductions, credits, and any resulting tax liability.

- Payments and Refunds: If your amendment results in additional tax owed, you’ll need to include a payment with your amended return. Conversely, if you’re entitled to a refund, indicate the amount on the form.

- Signatures and Dates: Sign and date the form to validate your amendment. Ensure you use the same signature as on your original return.

Step 3: Attach Supporting Documents

To support your amended return, you must attach any relevant documents that substantiate the changes you’ve made. This may include:

- Pay stubs, W-2 forms, or 1099 forms to support income adjustments.

- Receipts, invoices, or other records to substantiate deductions or credits.

- Letters or notifications from the IRS or other government agencies.

- Any other documents that provide evidence for the changes you’ve made.

By providing these supporting documents, you ensure a smoother review process and reduce the likelihood of further inquiries from the IRS.

Step 4: Submit Your Amended Return

Once you’ve completed the form and gathered all the necessary documents, it’s time to submit your amended return. You can choose from several methods:

- Mail: The traditional method involves printing and mailing your amended return to the appropriate IRS processing center. Ensure you use the correct mailing address for your state and tax year.

- Electronic Filing: Some taxpayers may be eligible to file their amended returns electronically using tax software or IRS-approved e-file providers. This method can provide faster processing and reduce the risk of errors.

Regardless of the method you choose, ensure you keep copies of your amended return and supporting documents for your records. It's also a good idea to make a note of the date you submitted your amendment.

Processing and Review

After submitting your amended return, the IRS will process it and review the changes you’ve made. The review process can vary in duration, depending on the complexity of your amendment and the volume of returns being processed. Here’s what you can expect during this stage:

- Processing Time: The IRS aims to process simple amendments within 16 weeks, but more complex returns may take longer. Keep in mind that processing times may fluctuate due to various factors, including the time of year and the number of amendments being processed.

- IRS Review: The IRS will carefully examine your amended return to ensure the changes are accurate and supported by the provided documentation. They may request additional information or clarification if needed.

- Refunds or Payments: If your amendment results in a refund, the IRS will issue it accordingly. Conversely, if you owe additional taxes, you’ll need to make the payment as directed by the IRS.

- Notice of Deficiency: In some cases, the IRS may issue a Notice of Deficiency, indicating that they disagree with your amendment. This notice will outline their findings and provide you with an opportunity to respond.

It's important to remain patient during the processing and review stage, as the IRS works diligently to ensure accurate and fair outcomes for all taxpayers.

Common Pitfalls and How to Avoid Them

While amending your tax return is a straightforward process, there are a few common pitfalls to be aware of. By understanding these potential issues, you can avoid them and ensure a smooth amendment experience.

Failing to Gather All Necessary Documents

One of the most common mistakes is submitting an amended return without all the required supporting documents. Ensure you gather all the necessary records and information before beginning the amendment process. This includes income statements, expense receipts, and any other relevant documentation. By having everything organized and readily available, you can ensure a seamless and accurate amendment.

Miscalculations and Inaccurate Data

Another pitfall to avoid is miscalculations or inaccurate data entry. Double-check all calculations and ensure they align with the changes you’re making. Use a calculator or tax software to verify the figures and reduce the risk of errors. Additionally, review your original return and compare it with the amended version to identify any discrepancies.

Overlooking Tax Law Changes

Tax laws and regulations can change from year to year, so it’s essential to stay informed. Before amending your return, research any relevant tax law changes that may impact your situation. This includes understanding new deductions, credits, or adjustments that may be applicable to your specific circumstances. By staying up-to-date with tax laws, you can ensure your amendment is compliant and takes advantage of any available benefits.

Filing Too Late

Amending your tax return within the prescribed time frame is crucial. While there is no specific deadline for amending a return, it’s generally recommended to file as soon as you become aware of the need for an amendment. Delayed amendments can result in increased interest charges or penalties, so it’s best to address any issues promptly.

Future Implications and Best Practices

Amending your tax return can have both immediate and long-term implications. By understanding these implications and adopting best practices, you can ensure a positive tax experience moving forward.

Impact on Future Returns

An amended return can impact your future tax returns in several ways. It may affect your filing status, income calculations, deductions, or credits. Therefore, it’s essential to review your amended return carefully and ensure it aligns with your future tax planning. Consider consulting a tax professional to help you navigate any potential changes and ensure compliance with tax regulations.

Learning from Past Mistakes

Amending your tax return provides an opportunity to learn from past mistakes and improve your tax filing practices. Take the time to understand why the amendment was necessary and implement measures to prevent similar errors in the future. This may involve improving your record-keeping, seeking professional guidance, or staying updated on tax laws and regulations.

Best Practices for Accurate Filing

- Stay Organized: Maintain a well-organized system for your tax-related documents and records. This will make it easier to locate information and support your filings.

- Seek Professional Advice: Consider working with a tax professional, especially if your tax situation is complex or you have concerns about accuracy. They can provide valuable guidance and ensure compliance.

- Stay Informed: Stay updated on tax laws and regulations. Subscribe to tax-related newsletters, follow reputable tax blogs, or attend workshops to stay informed about changes that may impact your tax situation.

- Double-Check Your Work: Always review your tax returns before submitting them. Use a calculator or tax software to verify calculations and ensure accuracy.

By adopting these best practices, you can minimize the need for amendments and ensure a more seamless tax filing experience.

Conclusion

Amending your tax return is a necessary process to ensure accuracy and compliance with tax regulations. By following the step-by-step guide outlined in this article, you can navigate the amendment process with confidence. Remember to gather all the necessary documents, choose the appropriate form, and provide accurate and detailed information. With patience and attention to detail, you can successfully amend your tax return and resolve any issues promptly.

Stay informed, stay organized, and don't hesitate to seek professional guidance when needed. By taking a proactive approach to your taxes, you can ensure a positive and stress-free tax experience, both now and in the future.

FAQ

How long does it take for the IRS to process an amended return?

+

The processing time for an amended return can vary depending on factors such as the complexity of the amendment and the volume of returns being processed. The IRS aims to process simple amendments within 16 weeks, but more complex returns may take longer. It’s important to note that processing times may fluctuate, so it’s best to remain patient and allow sufficient time for the IRS to review your amendment.

Can I amend my tax return electronically?

+

Yes, some taxpayers may be eligible to file their amended returns electronically using tax software or IRS-approved e-file providers. Electronic filing can provide faster processing and reduce the risk of errors. However, not all taxpayers are eligible for this option, so it’s essential to check the IRS guidelines and requirements to determine if you qualify.

What happens if I owe additional taxes after amending my return?

+

If your amendment results in additional taxes owed, you’ll need to include a payment with your amended return. The IRS will provide instructions on how to make the payment, which may include options such as direct debit, credit card, or check. It’s important to ensure you make the payment within the prescribed time frame to avoid any penalties or interest charges.

Can I amend my tax return if I’ve already received a refund?

+

Yes, you can amend your tax return even if you’ve already received a refund. If your amendment results in a reduced refund or an additional tax liability, you’ll need to make the necessary adjustments and include the appropriate payment with your amended return. The IRS will process your amendment and adjust your refund or payment accordingly.

What if the IRS disagrees with my amendment?

+

If the IRS disagrees with your amendment, they may issue a Notice of Deficiency, outlining their findings and providing you with an opportunity to respond. It’s crucial to carefully review the notice and respond within the prescribed time frame. You may need to provide additional documentation or clarification to support your amendment. If you have concerns or questions, consider seeking professional guidance to navigate this process effectively.