5 Tips to Maximize Your Co State Tax Refund

Securing the maximum possible refund on your Colorado state taxes requires a strategic approach rooted in a comprehensive understanding of the state's tax code, careful documentation, and thoughtful planning. While many taxpayers focus on federal deductions, Colorado offers several unique credits and deductions that can significantly influence your refund. Navigating these options effectively transforms the often-daunting process of tax filing into a calculated financial move, ensuring you capitalize on every entitlement available under Colorado law.

Understanding Colorado State Tax Fundamentals and How They Impact Refunds

Colorado’s state income tax system is structured with a flat rate, currently set at 4.55%, which simplifies some aspects of tax calculations. However, the real potential for maximizing your co-state tax refund lies in understanding and leveraging specific deductions, credits, and planning strategies that are designed to reduce taxable income or directly lower your tax liability. Recognizing the interplay between federal and state filings, alongside Colorado-specific provisions, is essential in crafting an optimized tax approach.

The Step-by-Step Process of Creating a Tax Maximization Strategy in Colorado

Documenting the process of maximizing your Colorado tax refund starts with meticulous planning and detailed record-keeping. The objective is to identify all eligible deductions and credits, verify documentation accuracy, and strategically time income and expenses. The process unfolds in stages, each presenting unique challenges that demand evidence-based decisions, ongoing adjustments, and sometimes creative tax planning techniques.

Stage 1: Establishing a Solid Foundation with Accurate Income and Expense Documentation

Certain sources of income, such as wages, business earnings, or investment income, form the baseline of your taxable income calculation. Accurate recording of these figures, coupled with detailed records of expenses that might qualify as deductions or credits, is fundamental. In Colorado, for instance, deductions for charitable contributions or business expenses can considerably lower taxable income. Mistakes or omissions at this stage often result in lost refunds, making thorough documentation crucial.

| Relevant Category | Substantive Data |

|---|---|

| Payroll Income | W-2 wages reported, verified against paystubs |

| Self-Employment Income | 1099 forms, detailed expense records |

| Charitable Contributions | Receipts, bank statements |

| Investment Gains | 1099-DIV, 1099-B statements |

Stage 2: Identifying Colorado-Specific Tax Credits and Deductions

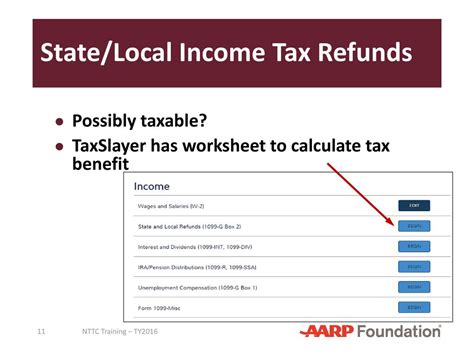

Colorado provides several noteworthy credits that can directly reduce your tax liability, thereby increasing your net refund or decreasing the amount owed. Among these, the Colorado Property Tax/Rent/Heat Credit, the Colorado Earned Income Tax Credit (EITC), and the Colorado Child Care Contribution Credit are particularly impactful for qualifying taxpayers.

For example, the Colorado EITC is a refundable credit aimed at low-to-moderate income earners. Its value can be as high as 10% of the federal EITC, offering significant additional refunds when applicable. Claiming these credits involves verifying income thresholds, residency requirements, and matching documentation such as proof of rent, heat payments, or earned income.

Stage 3: Enhancing Deductions through Strategic Timing and Planning

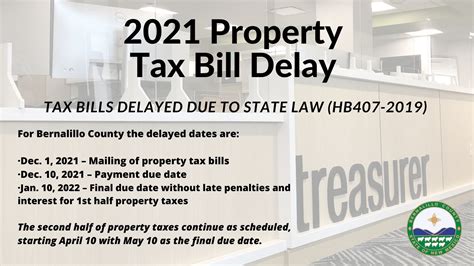

Tax planning isn’t solely about claiming credits and deductions but also involves timing income and expenses to your advantage. For example, if you’re close to a threshold for certain credits, accelerated or deferred income could make the difference in eligibility. Similarly, prepaying deductible expenses—like medical bills or property taxes—within the tax year can boost your deductions.

| Relevant Category | Potential Impact |

|---|---|

| Prepaid Property Taxes | May qualify for itemized deductions, reducing taxable income |

| Year-End Business Expenses | Accelerate expenses to maximize deductions in the current year |

| Investment Loss Harvesting | Offset gains, reducing overall tax burden |

Common Challenges and Breakthroughs in Maximizing Colorado Refunds

Several hurdles stand in the way of achieving the maximum refund, including compliance complexities, misclassification of income or expenses, and the risk of audits. Overcoming these challenges involves diligent review of each line item, legal awareness of Colorado’s unique provisions, and sometimes leveraging professional expertise—such as tax advisors familiar with Colorado’s tax nuances.

A breakthrough often occurs through the identification of overlooked credits or deductions—such as the previously underestimated heat credit or an unclaimed federal deduction that behaves favorably at the state level. Modern tax software and professional advice confirm that audit risks diminish when claims are fully supported with documentation and adhere to current regulations.

Key Points

- Meticulous documentation of income and expenses is fundamental to maximize refund potential.

- Leveraging Colorado-specific credits such as the EITC and property tax credits can substantially increase refunds.

- Strategic timing of income and expenses influences eligibility and deduction amounts.

- Professional guidance can uncover overlooked opportunities and mitigate risks of audits.

- Continual education on tax law updates ensures ongoing optimization potential.

Conclusion: A Calculated Approach to Boost Your Colorado Tax Refund

Achieving the highest possible Colorado state tax refund is a multifaceted process grounded in detailed planning, up-to-date knowledge of state-specific provisions, and disciplined record-keeping. While the state’s relatively flat income tax rate simplifies some calculations, the real gains lie in exploiting available credits, timing deductions effectively, and tailoring strategies to individual circumstances. As tax laws evolve, maintaining awareness and adopting proactive planning ensures taxpayers do not leave money on the table. The journey to maximizing your co-state tax refund is less about luck and more about informed, deliberate action backed by professional insight.

What are the most overlooked credits in Colorado that can boost my refund?

+Commonly overlooked credits include the Colorado Heat and Property Tax Credit, the Earned Income Tax Credit (EITC), and credits for contributions to foster care or educational savings accounts. Ensuring eligibility and claiming these can lead to notable increases in refunds.

How does timing influence my Colorado refund?

+By accelerating deductible expenses or deferring income, taxpayers can manipulate their taxable income and credit eligibility. Strategic timing around year-end is particularly effective to maximize deductions or credits.

Should I consult a professional to maximize my Colorado tax refund?

+Professional guidance can identify overlooked opportunities, ensure compliance with current laws, and reduce audit risks. Especially for complex tax situations or significant deductions, expert advice often pays for itself in additional refund potential.