Minnesota Tax Percentage

Understanding the tax landscape of a state is crucial for both residents and businesses, as it directly impacts financial planning and overall economic strategies. In the case of Minnesota, a diverse state with a thriving economy, its tax structure is an essential aspect to delve into.

The Minnesota Tax System: An Overview

Minnesota’s tax system is a comprehensive framework designed to generate revenue for the state’s operations and services. It comprises various taxes, each serving a specific purpose and targeting different aspects of economic activity.

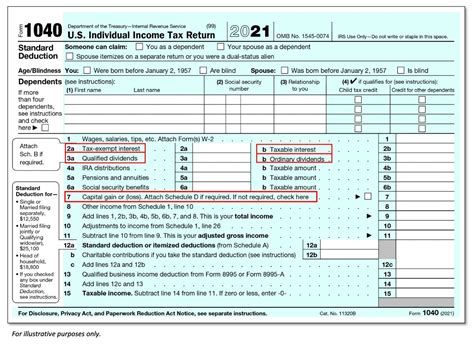

Income Tax: A Significant Revenue Stream

One of the primary taxes in Minnesota is the income tax, levied on individuals, trusts, and estates. The state’s income tax structure is progressive, meaning that higher income levels are taxed at a higher rate. This approach ensures that those with a greater ability to pay contribute a larger share to the state’s revenue.

For the tax year 2023, Minnesota has seven tax brackets, ranging from 5.35% to 9.85%. These rates are applicable to different income levels, with the highest rate kicking in for taxable incomes above 257,789 for single filers and 343,719 for joint filers.

The state also offers tax credits and deductions to help ease the tax burden on certain segments of the population. For instance, Minnesota provides a property tax refund, which can reduce the overall tax liability for homeowners.

Sales and Use Tax: Impact on Daily Life

The sales and use tax is another crucial component of Minnesota’s tax system. This tax is applied to the retail sale of tangible personal property and certain services. As of 2023, the general sales tax rate in Minnesota is 6.875%, which includes both the state and local tax rates.

However, it’s important to note that local jurisdictions can levy additional taxes, leading to variations in the sales tax rate across the state. For instance, Minneapolis has a higher sales tax rate due to city and transit taxes, resulting in a combined rate of 7.875%.

There are also specific exemptions and special rates for certain goods and services. For example, most groceries, prescription drugs, and clothing items under $100 are exempt from sales tax.

Property Tax: Local Assessments

Property tax is a significant revenue source for local governments in Minnesota. It is assessed on the value of real estate, including land and improvements. The tax rate can vary significantly depending on the location and the type of property.

Minnesota has a homestead program, which provides property tax relief to homeowners who use their property as their primary residence. This program aims to make homeownership more affordable and is an essential component of the state’s tax policy.

Other Taxes and Fees

Minnesota also levies various other taxes, such as:

- Corporate Income Tax: Applicable to businesses operating in the state, with a rate of 9.8%

- Excise Taxes: Imposed on specific goods like gasoline, tobacco, and alcohol

- Inheritance Tax: Charged on assets received by beneficiaries from the estate of a deceased person

- Estate Tax: Applicable to estates valued over a certain threshold

Impact on Businesses and Residents

The Minnesota tax system has a profound impact on both businesses and residents. For businesses, the state’s tax climate can influence investment decisions, operational costs, and overall profitability. The progressive income tax structure and local property tax assessments can be significant considerations for companies when deciding to expand or relocate.

For residents, the tax system affects their disposable income and overall financial planning. The combination of income tax, sales tax, and property tax can impact their cost of living and ability to save or invest. However, the availability of tax credits and deductions can provide much-needed relief for certain segments of the population.

Comparative Analysis

When compared to other states, Minnesota’s tax system can be characterized as moderately progressive. While it has a relatively high top income tax rate, it also offers various deductions and credits to ease the tax burden. The sales tax rate is on par with many other states, but the local variations can make a significant difference in certain areas.

In terms of property tax, Minnesota’s rates can vary widely due to the local assessments. However, the homestead program and other property tax relief measures can make it more affordable for homeowners.

Future Implications

The future of Minnesota’s tax system is an ongoing discussion, with potential reforms and adjustments being considered. There is a focus on ensuring the tax system remains fair, efficient, and able to meet the state’s revenue needs while supporting economic growth and development.

One potential area of reform is the income tax structure, with debates around simplifying the tax brackets and rates. There is also an ongoing discussion about the balance between state and local tax rates, particularly in the context of sales tax, to ensure a consistent and competitive business environment.

Additionally, with the increasing focus on sustainability and environmental initiatives, there may be discussions around introducing or adjusting taxes related to carbon emissions or other environmental factors.

What is the average income tax rate in Minnesota?

+

The average income tax rate in Minnesota varies depending on income levels. For the tax year 2023, the rates range from 5.35% to 9.85%, with the highest rate applicable to taxable incomes above 257,789 for single filers and 343,719 for joint filers.

Are there any tax breaks or incentives for businesses in Minnesota?

+

Yes, Minnesota offers several tax incentives and breaks for businesses. These include tax credits for job creation, research and development, and investment in certain industries. Additionally, there are tax deferral programs and special zones designed to encourage economic development.

How does Minnesota’s sales tax compare to other states?

+

Minnesota’s general sales tax rate of 6.875% is on par with many other states. However, it’s important to note that local jurisdictions can levy additional taxes, resulting in higher rates in certain areas. This can make Minnesota’s sales tax rate appear higher when compared to states without local tax variations.

Are there any special tax considerations for retirees in Minnesota?

+

Yes, Minnesota offers a retirement income tax exclusion, which allows a certain amount of pension and retirement income to be excluded from taxable income. This exclusion can help ease the tax burden on retirees. Additionally, social security benefits are not taxed in Minnesota.

How does Minnesota’s tax system impact its economic growth and development?

+

Minnesota’s tax system plays a crucial role in its economic growth and development. The state’s progressive income tax structure and various tax incentives can attract businesses and high-income individuals, contributing to economic growth. However, the state also needs to balance its tax policies to ensure it remains competitive and attractive to a diverse range of businesses and individuals.