Wa State Capital Gains Tax

The state of Washington, known as the Evergreen State, is renowned for its diverse landscapes, ranging from majestic mountains to lush rainforests and stunning coastlines. While the state offers a plethora of natural wonders and a vibrant economy, its tax system, including the capital gains tax, plays a crucial role in shaping the financial landscape for its residents and businesses.

In this comprehensive guide, we delve into the intricacies of the Wa State Capital Gains Tax, shedding light on its unique characteristics, impact on taxpayers, and its implications for various investment strategies. Whether you're a seasoned investor, a small business owner, or simply curious about the tax landscape of this beautiful state, this article aims to provide you with an in-depth understanding of Wa State's capital gains tax regime.

Understanding Capital Gains Tax in Washington State

Capital gains tax refers to the tax levied on profits made from the sale of capital assets, which can include investments such as stocks, bonds, real estate, and certain business assets. In Washington, like many other states, capital gains tax is an essential component of the state’s revenue generation and plays a significant role in funding public services and infrastructure.

The Wa State Capital Gains Tax operates under a unique framework, differing from federal capital gains tax rules. It is essential for taxpayers to grasp these distinctions to navigate their tax obligations effectively.

Key Characteristics of Wa State Capital Gains Tax

- Progressive Tax Rates: Washington State employs a progressive tax system for capital gains, meaning that higher rates are applied to higher income brackets. This ensures that those with higher capital gains contribute a larger share of their profits to the state’s revenue.

- Long-Term vs. Short-Term Gains: Similar to the federal system, Wa State distinguishes between long-term and short-term capital gains. Long-term gains, which result from holding an asset for over a year, are generally taxed at a lower rate compared to short-term gains, providing an incentive for long-term investments.

- Exemptions and Deductions: Washington offers certain exemptions and deductions for capital gains tax. For instance, gains from the sale of a primary residence are partially or fully exempt, depending on specific circumstances. Additionally, losses from capital assets can be deducted, offering some relief to taxpayers.

- Impact on Real Estate: Given Washington’s vibrant real estate market, the capital gains tax on property sales is a significant consideration for homeowners and investors. The state’s rules regarding capital gains on real estate transactions can influence investment strategies and decision-making.

Impact on Taxpayers and Investment Strategies

The Wa State Capital Gains Tax has a profound impact on taxpayers’ financial planning and investment strategies. Here’s how it influences different aspects:

- Tax Planning: Investors and business owners must carefully consider the tax implications of their capital gains to optimize their tax liabilities. Strategies such as timing asset sales, utilizing tax-efficient investment vehicles, and understanding the state's specific rules can significantly impact their overall tax burden.

- Real Estate Investments: The tax treatment of real estate gains in Washington State can encourage or deter investment in the housing market. Taxpayers may need to assess the potential tax consequences when deciding to buy, sell, or hold onto investment properties.

- Business Operations: For businesses, especially those dealing with asset sales or investments, understanding the capital gains tax regime is crucial. It can affect decision-making related to asset management, divestments, and business expansion strategies.

Analysis of Wa State Capital Gains Tax

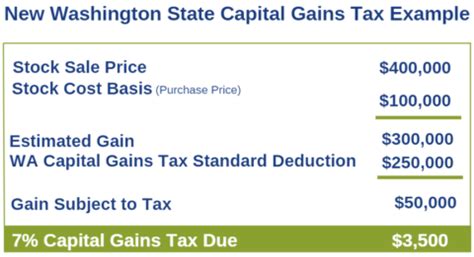

Let’s delve deeper into the specifics of the Wa State Capital Gains Tax, exploring its rates, applicable assets, and how it compares to other states’ tax regimes.

Tax Rates and Brackets

Washington State’s capital gains tax rates vary depending on the taxpayer’s income bracket. Here’s a simplified breakdown of the current tax rates:

| Income Bracket | Capital Gains Tax Rate |

|---|---|

| Up to $2,400 | 0% |

| $2,401 - $3,500 | 2.9% |

| $3,501 - $5,600 | 3.5% |

| $5,601 - $8,200 | 4.4% |

| $8,201 - $11,300 | 5.3% |

| $11,301 and above | 7.0% |

These rates are applicable to both long-term and short-term capital gains. It's important to note that these brackets are subject to change, and taxpayers should refer to the latest guidelines provided by the Washington Department of Revenue.

Assets Subject to Capital Gains Tax

The Wa State Capital Gains Tax applies to a wide range of capital assets, including but not limited to:

- Stocks and bonds

- Mutual funds and exchange-traded funds (ETFs)

- Real estate properties (including residential and commercial properties)

- Business assets (such as equipment, machinery, and vehicles)

- Cryptocurrencies and digital assets

It's crucial for taxpayers to understand which assets are considered capital assets and how the tax is calculated for each asset class.

Comparison with Other States

Washington State’s capital gains tax regime differs significantly from that of many other states. While some states have no capital gains tax, others employ a flat tax rate or a system similar to federal rules. Here’s a brief comparison:

- No Capital Gains Tax: Several states, including Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington D.C., and Wyoming, do not impose a capital gains tax, making them attractive destinations for investors.

- Flat Tax Rate: States like Colorado, Illinois, Massachusetts, and New York apply a flat tax rate to capital gains, regardless of the taxpayer's income bracket.

- Similar to Federal Rules: Some states, such as California and Oregon, follow tax rules similar to the federal system, taxing long-term capital gains at a lower rate compared to short-term gains.

Washington's progressive tax system, combined with its specific exemptions and deductions, sets it apart from many other states, offering a unique tax landscape for its residents and businesses.

Future Implications and Tax Planning Strategies

As the tax landscape evolves, it’s crucial for taxpayers to stay informed about potential changes and develop effective tax planning strategies.

Potential Future Changes

The Wa State Capital Gains Tax, like any tax system, is subject to potential amendments and reforms. Here are some factors that could influence future changes:

- Legislative Changes: The state legislature may propose and pass bills that modify the capital gains tax structure, rates, or applicable assets.

- Budgetary Considerations: Washington's revenue needs and budgetary constraints can impact the tax system. In times of economic strain, the state may consider increasing tax rates or implementing new taxes.

- Political Climate: Shifts in political power and public sentiment can drive changes in the tax system. For instance, a more progressive political climate may lead to higher tax rates on capital gains.

Tax Planning Strategies for Investors and Businesses

To navigate the complexities of the Wa State Capital Gains Tax, investors and businesses can employ the following strategies:

- Timing Asset Sales: Strategically timing the sale of capital assets can help taxpayers minimize their capital gains tax liability. Selling assets when they are in a lower tax bracket or during periods of tax rate changes can be advantageous.

- Utilize Tax-Efficient Investment Vehicles: Certain investment vehicles, such as tax-free municipal bonds or retirement accounts, can provide tax advantages. Understanding these options can help investors reduce their overall tax burden.

- Consider Business Entity Structure: The choice of business entity, such as a corporation or limited liability company (LLC), can impact the tax treatment of capital gains. Consulting with tax professionals can help business owners make informed decisions.

- Stay Informed: Keeping abreast of tax law changes and updates is essential. Subscribing to tax newsletters, following reputable tax blogs, and consulting with tax professionals can ensure that taxpayers are aware of any new developments.

Frequently Asked Questions (FAQ)

What is the difference between federal and Wa State capital gains tax rates?

+

Wa State capital gains tax rates are progressive, meaning they increase with income, while federal rates have different brackets for long-term and short-term capital gains. This difference can result in varying tax liabilities for taxpayers.

Are there any exemptions or deductions for capital gains tax in Washington State?

+

Yes, Washington offers exemptions for gains from the sale of a primary residence and deductions for capital losses. These provisions can reduce the overall tax burden for certain taxpayers.

How does the capital gains tax impact real estate investments in Washington State?

+

The capital gains tax on real estate transactions can influence investment decisions. Investors may consider the tax implications when deciding to buy, sell, or hold onto investment properties.

What is the impact of the progressive tax system on higher-income taxpayers in Washington State?

+

Higher-income taxpayers in Washington face a higher capital gains tax rate, which can significantly impact their tax liability. It’s crucial for these taxpayers to carefully plan their investments and asset sales to minimize their tax burden.

Are there any tax planning strategies to reduce capital gains tax in Washington State?

+

Yes, taxpayers can employ strategies such as timing asset sales, utilizing tax-efficient investment vehicles, and considering the tax implications of business entity structure. Consulting with tax professionals can help develop tailored tax planning strategies.

The Wa State Capital Gains Tax is a crucial aspect of Washington’s tax system, impacting taxpayers, investors, and businesses alike. By understanding the unique characteristics of this tax regime and staying informed about potential changes, individuals and businesses can make informed financial decisions and optimize their tax strategies.