Elon Musk Taxes

Elon Musk, the renowned entrepreneur and visionary, has been a subject of interest and speculation, especially when it comes to his financial affairs and tax strategies. With a net worth estimated to be in the hundreds of billions, understanding how he approaches taxes provides valuable insights into the world of high-net-worth individuals and their financial management.

In this comprehensive exploration, we delve into the intricate world of Elon Musk's tax strategies, shedding light on the legal and financial maneuvers that have shaped his financial landscape. From his innovative businesses to his personal wealth, we examine the tax implications and offer a unique perspective on the complexities of managing vast fortunes.

The Billionaire’s Tax Landscape: An Overview

Elon Musk’s tax journey is a fascinating one, encompassing multiple jurisdictions and a diverse portfolio of businesses. As one of the world’s richest individuals, his tax obligations are complex and multifaceted. Let’s unravel the key aspects of his tax landscape.

Residency and Tax Jurisdictions

Musk’s residency status plays a crucial role in determining his tax obligations. While he has been primarily associated with the United States, his global ventures have led to a complex web of tax jurisdictions. Here’s a breakdown:

- United States: As a U.S. citizen, Musk is subject to U.S. tax laws, which can be intricate due to the country's comprehensive tax system. He has resided in various states, each with its own tax regulations.

- Texas and California: These states have been key residences for Musk, each offering its own tax benefits and challenges. Texas, for instance, is known for its lack of income tax, while California has a progressive income tax system.

- International Presence: Musk's business ventures extend beyond U.S. borders. His companies, such as SpaceX and Tesla, operate globally, leading to international tax considerations. He has also explored tax-friendly jurisdictions for his business entities.

Tax Strategies and Legal Maneuvers

Elon Musk’s tax strategies are a testament to his entrepreneurial prowess. He has employed various legal maneuvers to optimize his tax obligations, often pushing the boundaries of tax law. Here are some key aspects:

- Stock Options and Compensation: Musk's compensation packages at Tesla have been structured in innovative ways. He has opted for stock-based compensation, allowing him to defer taxes and align his incentives with the company's performance. This strategy has been a key component of his wealth accumulation.

- Tax-Efficient Business Structures: Musk has utilized various business entities, such as LLCs and corporations, to optimize tax obligations. These structures offer flexibility in tax planning, allowing for strategic decisions on taxation.

- International Tax Planning: With his global ventures, Musk has explored tax-efficient jurisdictions for his businesses. This involves setting up entities in countries with favorable tax regimes, optimizing tax obligations on international income.

| Entity | Jurisdiction | Tax Benefit |

|---|---|---|

| Tesla, Inc. | Delaware, USA | Low corporate tax rate |

| SpaceX | Texas, USA | No state income tax |

| Giga Press | Germany | Favorable R&D tax incentives |

The Impact of Wealth and Income on Taxes

Elon Musk’s immense wealth and diverse income streams present unique tax challenges. Understanding how his wealth and income are taxed provides valuable insights into the intricacies of high-net-worth tax planning.

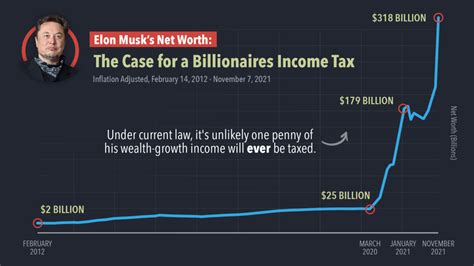

Wealth Taxation

Musk’s wealth is primarily tied to his stakes in Tesla and SpaceX, which have seen exponential growth in recent years. As a result, his wealth taxation is a key consideration. Here’s how it breaks down:

- Capital Gains Tax: The bulk of Musk's wealth is derived from his stock holdings. When he sells these stocks, he incurs capital gains tax. The tax rate depends on various factors, including the holding period and the tax jurisdiction.

- Wealth Tax: Some countries, like France and Spain, have introduced wealth taxes. Musk's global presence could subject him to these taxes, depending on his asset location and residency status.

- Estate and Inheritance Tax: Musk's estate and inheritance tax obligations are complex. His vast wealth and the potential for cross-border inheritance require careful planning to minimize tax burdens on his beneficiaries.

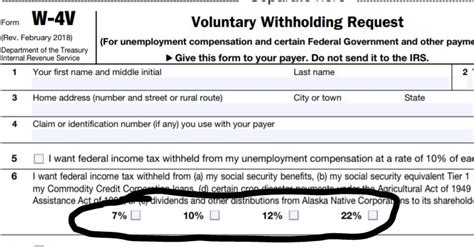

Income Taxation

Musk’s income streams are diverse, ranging from salary and bonuses to stock-based compensation. Here’s a glimpse into how his income is taxed:

- Salary and Bonuses: As a CEO, Musk's salary is subject to income tax. This includes federal, state, and local income taxes, with rates varying based on his residency and income level.

- Stock-Based Compensation: Musk's innovative compensation packages often include stock options and grants. These are taxed as income when vested or exercised, with the tax rate depending on the stock's value and the holding period.

- Other Income: Musk's income also includes dividends, royalties, and other forms of investment income. These are generally taxed at lower rates than regular income, offering tax benefits.

Tax Optimization Strategies: A Deep Dive

Elon Musk’s tax optimization strategies are a masterclass in financial engineering. He has employed a range of techniques to minimize his tax obligations while remaining compliant with tax laws. Let’s explore some of these strategies in detail.

Stock-Based Compensation

Musk’s reliance on stock-based compensation is a key tax optimization strategy. By aligning his incentives with the company’s performance, he has been able to defer taxes and benefit from the long-term growth of Tesla and SpaceX. Here’s how it works:

- Stock Options: Musk is granted stock options, which give him the right to buy company stock at a fixed price. When the stock price rises, he exercises these options, incurring a tax obligation on the gain. However, by timing the exercise, he can defer taxes and benefit from the long-term appreciation.

- Restricted Stock Units (RSUs): Musk also receives RSUs, which are granted based on performance metrics. These units vest over time, and Musk pays taxes on the fair market value when they vest. This strategy aligns his interests with the company's performance and defers taxes.

Tax-Efficient Business Structures

Musk has utilized various business entities to optimize tax obligations. Here’s a look at some of these structures and their tax benefits:

- Limited Liability Companies (LLCs): LLCs offer flexibility in tax classification, allowing Musk to choose between being taxed as a partnership or a corporation. This enables him to optimize tax obligations based on the company's profitability and growth stage.

- Corporations: Musk's companies, like Tesla, are structured as corporations. This provides tax benefits, such as deducting business expenses and deferring taxes on retained earnings. It also allows for strategic tax planning through dividend distributions and stock repurchases.

- Special Purpose Entities (SPEs): Musk has utilized SPEs for specific projects or ventures. These entities can be structured to optimize tax obligations, such as by taking advantage of tax incentives or deducting specific expenses.

The Future of Elon Musk’s Taxes: Implications and Speculations

As Elon Musk continues to innovate and expand his business empire, his tax landscape is likely to evolve. Here are some key implications and speculations for the future:

Tax Policy Changes

Tax policies are subject to change, and Musk’s tax obligations could be impacted by future reforms. Here are some potential scenarios:

- Corporate Tax Reform: Proposed reforms, such as the Corporate Minimum Tax, could impact Musk's companies. Higher corporate tax rates could affect the profitability of his businesses and their ability to optimize tax obligations.

- Wealth Tax Introduction: There have been calls for wealth taxes in various countries, including the U.S. If such taxes are implemented, Musk's wealth could be subject to additional taxation, impacting his overall tax burden.

International Expansion and Tax Planning

Musk’s global ventures are likely to continue, and his tax planning will play a crucial role in these expansions. Here’s how it could shape up:

- Setting Up Overseas Entities: Musk may explore setting up business entities in tax-friendly jurisdictions to optimize tax obligations on international income. This could involve establishing holding companies or relocating certain operations.

- Tax Treaty Benefits: Musk's companies could benefit from double tax treaties between countries. These treaties allow for reduced tax obligations on international income, providing tax advantages for his global ventures.

Long-Term Wealth Management

As Musk continues to amass wealth, his tax planning will focus on long-term wealth management. Here are some strategies he may employ:

- Estate Planning: Musk will likely prioritize estate planning to minimize tax obligations on his wealth transfer. This could involve setting up trusts, utilizing charitable contributions, and optimizing the timing of wealth transfers to beneficiaries.

- Tax-Efficient Investment Strategies: Musk may explore tax-efficient investment options, such as tax-exempt bonds or retirement accounts, to minimize taxes on investment income and capital gains.

How much tax does Elon Musk pay annually?

+Elon Musk's exact tax obligations are not publicly disclosed. However, given his vast wealth and diverse income streams, his annual tax payments are likely to be substantial. His tax obligations are influenced by factors such as his income, capital gains, and the tax jurisdictions in which he operates.

Has Elon Musk ever faced tax controversies or audits?

+While Elon Musk has not publicly disclosed any major tax controversies or audits, his complex financial affairs and tax strategies may subject him to scrutiny from tax authorities. It's important to note that innovative tax planning is not necessarily synonymous with tax evasion, and Musk's strategies are likely within the bounds of tax law.

How does Elon Musk's tax strategy differ from other billionaires?

+Elon Musk's tax strategy is unique due to his innovative approach to compensation and business structures. While other billionaires may employ tax optimization strategies, Musk's reliance on stock-based compensation and his focus on long-term wealth accumulation set him apart. His global ventures and exploration of tax-friendly jurisdictions also contribute to a distinct tax landscape.

In conclusion, Elon Musk’s tax journey is a fascinating exploration of the complexities of managing immense wealth and diverse income streams. His innovative tax strategies, coupled with his entrepreneurial spirit, have shaped his financial landscape. As he continues to shape the future, his tax obligations and planning will remain a key aspect of his financial management, offering valuable insights into the world of high-net-worth individuals.