Tax Withholding For Social Security

Tax withholding is an essential aspect of financial management, especially when it comes to social security benefits. As an individual approaching retirement or already enjoying social security benefits, understanding the tax implications and how to optimize your financial planning is crucial. This article aims to provide a comprehensive guide on tax withholding for social security, offering expert insights and practical strategies to navigate this complex topic.

Understanding Social Security Tax Withholding

Social Security tax withholding, also known as FICA (Federal Insurance Contributions Act) tax, is a mandatory contribution made by employees and employers to fund Social Security benefits. These benefits include retirement income, disability insurance, and survivor benefits. The tax is typically deducted from an individual’s paycheck, with both the employee and employer contributing equally to the fund.

The Social Security Administration (SSA) sets the tax rates, and currently, the tax is levied at 6.2% of an employee's wages up to an annual limit, known as the Social Security wage base. For 2023, this limit is set at $160,200. Additionally, self-employed individuals are required to pay the full 12.4% (double the employee rate) as they are considered both the employer and employee.

It's important to note that tax withholding for Social Security is separate from Medicare tax withholding, which is also a component of FICA tax. Medicare tax is levied at a rate of 1.45% of all earnings, with no annual limit. In certain cases, individuals may also be subject to an additional Medicare tax of 0.9% on earnings above a certain threshold.

The Impact of Tax Withholding on Social Security Benefits

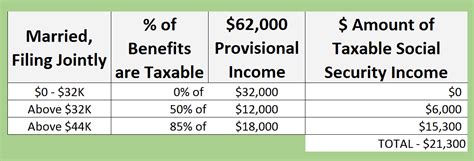

Tax withholding for Social Security has a significant impact on the benefits an individual receives. The SSA calculates an individual’s benefits based on their earnings history, which is influenced by the tax contributions made during their working years. Higher tax contributions generally result in higher benefits upon retirement.

For example, consider an individual with a 40-year work history who consistently contributed the maximum amount to Social Security each year. This individual would be eligible for the maximum Social Security benefit, which currently stands at $4,415 per month for someone who files at their full retirement age in 2023. However, if an individual's earnings history shows lower tax contributions, their monthly benefit will be proportionally lower.

It's worth mentioning that tax withholding is not the only factor that determines Social Security benefits. Other factors, such as the age at which an individual starts receiving benefits and the average wage index, also play a significant role. Nonetheless, understanding tax withholding and its impact on benefits is a crucial aspect of financial planning for retirement.

Optimizing Tax Withholding for Social Security

Optimizing tax withholding for Social Security involves a careful balance between contributing enough to maximize benefits and managing current financial obligations. Here are some strategies to consider:

1. Understanding the Wage Base

The Social Security wage base is a critical factor in tax withholding. Any earnings above this limit are not subject to Social Security tax. For 2023, earnings over $160,200 are exempt from Social Security tax. This means that individuals with higher earnings can strategically plan their tax withholding to reduce the tax burden while still maximizing their Social Security benefits.

| Year | Social Security Wage Base |

|---|---|

| 2023 | $160,200 |

| 2022 | $147,000 |

| 2021 | $142,800 |

For instance, an individual earning $200,000 per year could adjust their tax withholding to contribute only up to the wage base, reducing their tax liability without impacting their Social Security benefits.

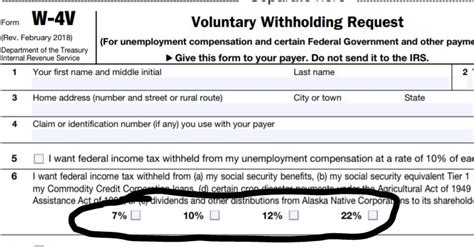

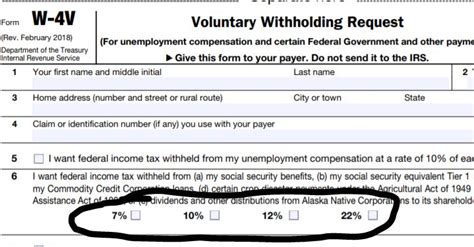

2. Adjusting Withholding for Multiple Income Streams

Individuals with multiple sources of income, such as a salary, rental income, or self-employment income, should carefully manage their tax withholding. The IRS requires individuals to pay taxes on all income, so it’s essential to ensure that tax withholding is sufficient across all income streams to avoid underpayment penalties.

For example, if an individual has a salary of $80,000 and rental income of $30,000, they should ensure that their tax withholding is adjusted to cover the tax liability on the combined income. This may involve increasing the tax withholding on their salary or making estimated tax payments for their rental income.

3. Utilizing Tax-Advantaged Retirement Accounts

Contributing to tax-advantaged retirement accounts, such as a 401(k) or IRA, can help reduce taxable income and, consequently, tax withholding. These accounts allow individuals to contribute pre-tax dollars, reducing their taxable income and potentially lowering their tax liability. This strategy can be particularly beneficial for individuals with high earnings who want to minimize their tax burden while still contributing to Social Security.

For instance, an individual earning $200,000 per year could contribute the maximum amount to their 401(k), which is $22,500 for those under 50 in 2023. This contribution would reduce their taxable income, potentially lowering their tax withholding and increasing their take-home pay.

Future Implications and Considerations

As the demographics of the United States shift, with a growing population of retirees, the sustainability of the Social Security program is a topic of ongoing debate. While the program is currently solvent, long-term projections suggest that without reforms, the Social Security trust fund may be depleted by the mid-2030s.

This uncertainty underscores the importance of individual financial planning and optimizing tax withholding strategies. By understanding the current tax landscape and the potential future changes, individuals can make informed decisions to maximize their Social Security benefits and ensure a secure financial future.

Additionally, the COVID-19 pandemic has had a significant impact on the economy and individual finances. Many individuals have experienced changes in income or employment status, which can affect their tax withholding and Social Security contributions. It's crucial for individuals to stay informed about these changes and adjust their financial planning accordingly.

Key Takeaways:

- Tax withholding for Social Security is a crucial aspect of financial planning for retirement.

- Understanding the Social Security wage base and optimizing tax withholding can help maximize benefits.

- Multiple income streams and tax-advantaged retirement accounts should be considered in tax planning.

- The future sustainability of Social Security underscores the importance of individual financial preparedness.

FAQs

How does tax withholding affect my Social Security benefits?

+

Tax withholding for Social Security directly impacts your benefits. The higher your tax contributions during your working years, the higher your benefits will be upon retirement. It’s important to strike a balance between contributing enough to maximize benefits and managing current financial obligations.

What is the Social Security wage base, and how does it affect tax withholding?

+

The Social Security wage base is the maximum amount of earnings subject to Social Security tax each year. Earnings above this limit are exempt from Social Security tax. Understanding the wage base allows individuals to strategically adjust their tax withholding to reduce their tax burden while still maximizing their Social Security benefits.

How can I optimize my tax withholding for multiple income streams?

+

If you have multiple sources of income, such as a salary and rental income, it’s important to ensure that your tax withholding is sufficient across all income streams. This may involve adjusting your tax withholding or making estimated tax payments to cover the tax liability on your combined income.

What are the long-term projections for the Social Security program?

+

Long-term projections suggest that without reforms, the Social Security trust fund may be depleted by the mid-2030s. This uncertainty highlights the importance of individual financial planning and optimizing tax withholding strategies to ensure a secure financial future.