Sales Tax In Atlanta

Understanding sales tax is essential for anyone living, working, or conducting business in Atlanta, Georgia. Sales tax is a crucial component of the city's economy and plays a significant role in funding various public services and infrastructure projects. In this comprehensive guide, we will delve into the intricacies of sales tax in Atlanta, exploring its rates, regulations, and real-world applications. By the end of this article, you'll have a thorough understanding of how sales tax operates in the vibrant city of Atlanta.

Sales Tax Rates in Atlanta

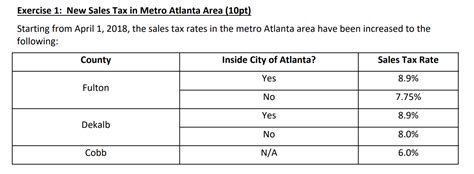

Sales tax in Atlanta is comprised of a combination of state, county, and city taxes, each contributing to the overall tax rate applied to various goods and services. As of my last update in January 2023, the sales tax rates in Atlanta are as follows:

| Tax Jurisdiction | Sales Tax Rate (%) |

|---|---|

| Georgia State | 4.00 |

| Fulton County | 2.50 |

| City of Atlanta | 1.00 |

| Total Sales Tax | 7.50 |

It's important to note that these rates are subject to change, so it's advisable to check for any updates before making significant financial decisions. The total sales tax rate in Atlanta is currently 7.5%, which is applied to most tangible goods and certain services.

Special Tax Rates and Exemptions

While the general sales tax rate applies to most transactions, there are certain categories of goods and services that are subject to different tax rates or even exempt from sales tax altogether. Here are some examples:

- Prepared Food and Meals: In Atlanta, the sales tax rate for prepared food and meals is typically 8%. This rate includes the state, county, and city taxes, along with an additional 0.5% tax dedicated to supporting local transportation.

- Groceries: Essential food items, such as non-prepared groceries, are often exempt from sales tax in Atlanta. This exemption encourages residents to access necessary food items without the added tax burden.

- Prescription Medications: Sales tax is not applied to prescription medications, ensuring that vital healthcare needs are not subject to additional costs.

- Education and Research Materials: Certain educational resources and research materials may be exempt from sales tax to support academic and scientific pursuits.

It's crucial to stay informed about these special tax rates and exemptions, as they can significantly impact your financial planning and business operations.

Sales Tax Collection and Remittance

Sales tax collection and remittance is a critical responsibility for businesses operating in Atlanta. Let’s explore the key aspects of this process:

Registering for Sales Tax

To collect and remit sales tax, businesses must first register with the appropriate tax authorities. In Georgia, this involves registering with the Georgia Department of Revenue and obtaining a sales and use tax certificate of registration. This certificate authorizes businesses to collect and remit sales tax on behalf of the state, county, and city.

Sales Tax Collection

Businesses are required to collect sales tax from customers at the point of sale. This tax is calculated based on the applicable rate and added to the purchase price. For instance, if a customer purchases an item priced at 100, and the total sales tax is <strong>7.5%</strong>, the business would collect an additional 7.50 in sales tax, resulting in a total purchase amount of $107.50.

Sales Tax Remittance

Once sales tax has been collected, businesses are responsible for remitting these funds to the appropriate tax authorities. In Atlanta, this typically involves filing sales tax returns and paying the collected taxes to the Georgia Department of Revenue on a regular basis. The frequency of filing and remittance can vary depending on the business’s sales volume and the requirements set by the state.

Sales Tax Compliance

Maintaining compliance with sales tax regulations is crucial for businesses to avoid penalties and legal issues. This includes accurately calculating and collecting sales tax, filing returns on time, and keeping detailed records of all sales transactions. Businesses should stay informed about any changes in sales tax laws and consult with tax professionals to ensure they are meeting their obligations.

Impact of Sales Tax on Atlanta’s Economy

Sales tax plays a significant role in shaping Atlanta’s economic landscape. Here are some key ways in which sales tax influences the city’s economy:

Funding Essential Services

Sales tax revenues are a primary source of funding for essential public services in Atlanta. These funds contribute to the maintenance and improvement of infrastructure, including roads, bridges, and public transportation systems. Additionally, sales tax revenues support public safety, education, and social services, ensuring the well-being of Atlanta’s residents.

Economic Development

The presence of a sales tax in Atlanta encourages economic growth and development. By generating revenue, the city can invest in initiatives that attract businesses and stimulate job creation. This, in turn, leads to a more vibrant and prosperous community, benefiting both residents and businesses alike.

Tourism and Hospitality

Sales tax collected from tourism and hospitality-related activities significantly impacts Atlanta’s economy. Visitors to the city contribute to sales tax revenues when they make purchases, stay in hotels, and dine at local restaurants. These funds support the city’s tourism industry, helping to maintain and enhance Atlanta’s reputation as a premier destination.

Fair Taxation

The sales tax system in Atlanta aims to distribute the tax burden fairly among residents and visitors. By applying a consistent tax rate to most transactions, the city ensures that everyone contributes to the funding of public services. This approach helps to create a sense of shared responsibility and fosters a positive economic environment.

Future Implications and Potential Changes

While sales tax rates and regulations are relatively stable in Atlanta, there are always potential future implications and changes to consider. Here are a few factors that could influence the sales tax landscape in the city:

Economic Conditions

Economic fluctuations can impact sales tax revenues. During periods of economic growth, increased consumer spending may lead to higher sales tax collections. Conversely, economic downturns can result in reduced sales tax revenues, necessitating adjustments to the tax system.

Policy Changes

Changes in tax policies at the state or local level can significantly affect sales tax rates and regulations. These changes could include adjustments to tax rates, the introduction of new tax categories, or the elimination of certain exemptions. Staying informed about potential policy changes is crucial for businesses and residents alike.

Technological Advancements

Advancements in technology, such as online sales and e-commerce, have the potential to impact sales tax collection and enforcement. As the landscape of retail evolves, tax authorities may need to adapt their systems and regulations to ensure fair and accurate tax collection.

Public Opinion and Political Climate

Public opinion and the political climate can also influence sales tax policies. Changes in leadership or shifts in public sentiment may lead to proposals for tax reforms or adjustments to existing tax rates. It’s important for residents and businesses to stay engaged and participate in discussions surrounding sales tax to ensure their voices are heard.

How often do businesses need to file sales tax returns in Atlanta?

+The frequency of filing sales tax returns can vary based on a business’s sales volume. Generally, businesses with higher sales volumes may need to file returns more frequently, such as monthly or quarterly. Smaller businesses may file returns on a semi-annual or annual basis. It’s important for businesses to consult with tax professionals to determine their specific filing requirements.

Are there any penalties for late sales tax filings or non-compliance?

+Yes, late filings or non-compliance with sales tax regulations can result in penalties and interest charges. These penalties can vary depending on the severity of the violation and the jurisdiction. It’s crucial for businesses to stay organized and meet their sales tax obligations to avoid any unnecessary financial burdens.

How can businesses stay updated on sales tax rate changes in Atlanta?

+Businesses can stay informed about sales tax rate changes by subscribing to updates from the Georgia Department of Revenue and local tax authorities. Additionally, consulting with tax professionals and regularly checking reliable tax information sources can help businesses stay up-to-date with any modifications to sales tax rates and regulations.