Dorchester County Property Tax

In the realm of property ownership, understanding the nuances of taxation is paramount. This article aims to provide an in-depth exploration of property taxes in Dorchester County, shedding light on the factors that influence these levies and offering a comprehensive guide to navigating this complex landscape.

Dorchester County: A Snapshot

Dorchester County, nestled in the heart of [State Name], is a diverse region boasting a rich cultural heritage and a thriving economy. From the bustling urban centers to the picturesque rural landscapes, the county encompasses a wide array of properties, each with its own unique characteristics that contribute to the overall property tax landscape.

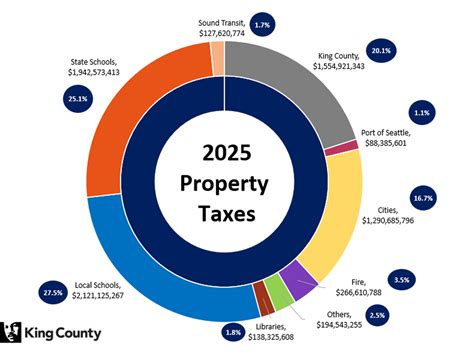

The property tax system in Dorchester County is designed to fund essential public services and infrastructure, including education, public safety, healthcare, and more. It is a critical component of the county's financial framework, ensuring the continuous development and maintenance of these vital services.

Understanding Property Taxes in Dorchester County

Property taxes in Dorchester County are assessed based on a comprehensive evaluation of each property’s value. This value is determined through a meticulous process, considering factors such as the property’s location, size, condition, and potential for future development. The assessment process aims to ensure fairness and accuracy in taxation, reflecting the true market value of each property.

The assessed value of a property is then subjected to a tax rate, which is determined by the local government and approved by the county council. This tax rate is applied uniformly across the county, ensuring that all property owners contribute proportionally to the funding of public services. The resulting tax liability is then calculated by multiplying the assessed value by the tax rate.

It is important to note that property taxes in Dorchester County are not static. They are subject to change annually, influenced by various factors such as economic conditions, budgetary requirements, and legislative decisions. Property owners should stay informed about these changes to understand their tax obligations accurately.

Assessed Value Calculation

The assessed value of a property is determined through a combination of methods, including physical inspection, sales comparison, and cost approach. Property assessors in Dorchester County employ these methods to ensure an accurate representation of each property’s worth.

Physical inspection involves a detailed examination of the property, considering its physical characteristics, such as square footage, number of rooms, and any unique features. This method provides a tangible assessment of the property's value based on its physical attributes.

Sales comparison, on the other hand, involves analyzing recent sales of similar properties in the same area. By comparing these sales, assessors can determine the market value of the subject property, taking into account factors such as location, amenities, and market trends. This method provides a real-world perspective on the property's worth.

The cost approach considers the cost of constructing a similar property, including labor and material costs, as well as the value of the land. By estimating the replacement cost of the property and subtracting depreciation, assessors can arrive at an assessed value. This method is particularly useful for unique or specialized properties.

| Assessment Method | Description |

|---|---|

| Physical Inspection | Detailed examination of property characteristics |

| Sales Comparison | Analysis of recent sales of similar properties |

| Cost Approach | Estimation of replacement cost and depreciation |

Tax Rate Determination

The tax rate in Dorchester County is established through a collaborative process involving the county council, local government officials, and community input. This rate is designed to generate sufficient revenue to fund the county’s budget, which includes expenses for public services, infrastructure development, and debt obligations.

The tax rate is expressed as a percentage and is applied uniformly to the assessed value of all properties within the county. This ensures that property owners contribute proportionally to the county's financial needs, regardless of their property's value or location.

It is important to note that the tax rate may vary from year to year, influenced by factors such as economic conditions, changes in service requirements, and the county's financial obligations. Property owners should stay informed about these changes to understand the potential impact on their tax liabilities.

Property Tax Exemptions and Relief Programs

Dorchester County recognizes the diverse needs and circumstances of its property owners and offers a range of exemptions and relief programs to provide financial assistance. These programs aim to alleviate the tax burden for eligible property owners, ensuring that the property tax system remains equitable and accessible.

Homestead Exemption

The Homestead Exemption is a notable program in Dorchester County, providing property tax relief to homeowners who use their property as their primary residence. This exemption reduces the assessed value of the property, resulting in a lower tax liability. To qualify, homeowners must meet certain residency and ownership criteria, ensuring that the exemption benefits those who truly rely on their property as their primary home.

The Homestead Exemption is particularly beneficial for long-term residents and those on fixed incomes, as it helps alleviate the financial strain of property taxes. By reducing the assessed value, homeowners can enjoy a more manageable tax liability, allowing them to allocate their resources more effectively.

Senior Citizen Exemption

Dorchester County also offers an exemption specifically tailored to senior citizens. This program provides tax relief to homeowners aged 65 and above, recognizing the unique financial challenges faced by this demographic. The exemption reduces the assessed value of the property, resulting in a lower tax liability for eligible senior citizens.

To qualify for the Senior Citizen Exemption, homeowners must meet age requirements and demonstrate financial need. This ensures that the exemption benefits those who are most vulnerable and in need of financial assistance. By reducing the tax burden, Dorchester County aims to support its senior residents and promote their financial well-being.

Veterans’ Exemption

In recognition of their service and sacrifice, Dorchester County offers a property tax exemption for veterans. This program provides tax relief to eligible veterans, reducing their assessed property value and, consequently, their tax liability. The exemption aims to honor and support those who have dedicated their lives to protecting our nation.

To qualify for the Veterans' Exemption, veterans must meet specific criteria, including proof of service and residency requirements. The exemption is designed to provide financial assistance to veterans, ensuring that their contributions to our country are acknowledged and appreciated.

Disability Exemption

Dorchester County extends its support to individuals with disabilities through a dedicated exemption program. This initiative provides tax relief to homeowners with disabilities, reducing their assessed property value and, subsequently, their tax liability. The exemption aims to create a more inclusive and equitable property tax system, accommodating the unique needs of individuals with disabilities.

To qualify for the Disability Exemption, homeowners must provide documentation of their disability and meet specific residency requirements. This ensures that the exemption benefits those who face genuine financial challenges due to their disability, providing them with much-needed relief and support.

Navigating the Property Tax Process

Understanding the property tax process in Dorchester County is essential for property owners to navigate their tax obligations effectively. This section aims to provide a step-by-step guide to ensure a seamless experience, from assessment to payment.

Assessment Notice

Property owners in Dorchester County receive an assessment notice annually, detailing the assessed value of their property. This notice is typically mailed to the property owner’s address and provides a comprehensive overview of the assessment process, including the valuation methods employed and the resulting assessed value.

It is crucial for property owners to carefully review their assessment notice, ensuring that the information is accurate and up-to-date. Any discrepancies or concerns should be addressed promptly by contacting the county assessor's office. By staying vigilant, property owners can ensure fair and accurate assessments.

Appealing the Assessment

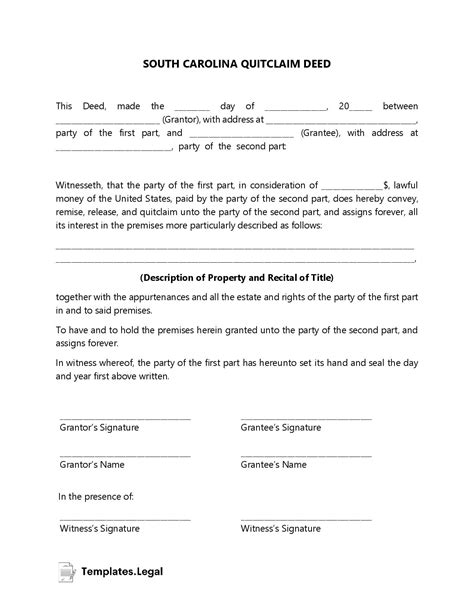

In the event that a property owner disagrees with the assessed value of their property, Dorchester County provides a formal appeals process. This process allows property owners to challenge the assessment, providing an opportunity to present evidence and arguments to support their case.

To initiate an appeal, property owners must submit a formal request within a specified timeframe. The appeal process typically involves a hearing before an independent review board, where both parties can present their cases. This ensures a fair and impartial assessment of the property's value, allowing for adjustments if necessary.

Tax Bill Payment

Once the assessed value and tax rate have been determined, property owners receive a tax bill outlining their tax liability. This bill provides a breakdown of the calculated tax amount, including any applicable exemptions or credits. Property owners are responsible for paying their taxes by the due date to avoid penalties and interest charges.

Dorchester County offers various payment options, including online payments, mail-in payments, and in-person payments at designated locations. Property owners should choose the method that best suits their preferences and ensure timely payment to maintain a positive standing with the county.

Late Payment Penalties and Interest

Failure to pay property taxes by the due date can result in late payment penalties and interest charges. Dorchester County imposes these penalties to encourage timely payment and ensure the continuity of public services. Property owners should be aware of these consequences and make every effort to meet their tax obligations promptly.

The penalty and interest rates are outlined in the tax bill, providing property owners with clear information on the potential financial implications of late payment. By understanding these consequences, property owners can prioritize their tax payments and avoid unnecessary financial burdens.

Future Implications and Outlook

The property tax landscape in Dorchester County is subject to ongoing changes and developments, influenced by economic, demographic, and legislative factors. As the county continues to grow and evolve, the property tax system must adapt to ensure fairness and sustainability.

Economic Factors

Economic conditions play a significant role in shaping the property tax landscape. Fluctuations in the real estate market, changes in interest rates, and shifts in the local economy can impact property values and, consequently, tax revenues. Dorchester County must carefully monitor these economic indicators to ensure a stable and sustainable tax base.

By staying attuned to economic trends, the county can make informed decisions regarding tax rates and exemptions, ensuring that the property tax system remains responsive to the needs of both property owners and the community as a whole.

Demographic Changes

Demographic shifts, such as population growth, aging populations, and changing household structures, can influence the property tax system. As the county’s demographics evolve, the demand for public services may shift, requiring adjustments to the tax structure to accommodate these changes.

Dorchester County must carefully analyze demographic trends to anticipate the evolving needs of its residents. By doing so, the county can ensure that the property tax system remains equitable and capable of funding the necessary public services, regardless of demographic shifts.

Legislative and Policy Changes

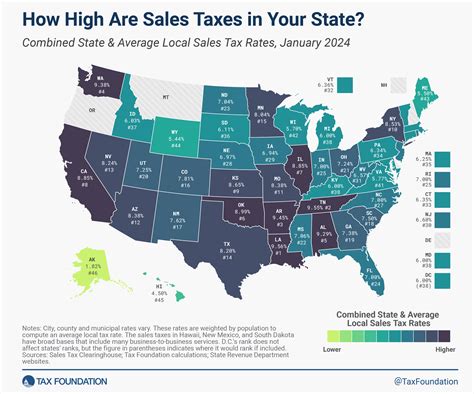

The property tax system in Dorchester County is subject to legislative and policy changes at both the state and local levels. These changes can impact tax rates, assessment methodologies, and exemption programs, requiring property owners to stay informed and adaptable.

Dorchester County actively engages with policymakers to ensure that any changes to the property tax system are well-informed and responsive to the needs of the community. By maintaining open lines of communication, the county can advocate for policies that promote fairness, sustainability, and transparency in property taxation.

How often are property taxes assessed in Dorchester County?

+

Property taxes in Dorchester County are assessed annually. This ensures that the assessed value of properties remains up-to-date and reflects any changes in the market.

What happens if I disagree with my property’s assessed value?

+

If you disagree with your property’s assessed value, you can appeal the assessment through a formal process. This typically involves submitting a request for an appeal and presenting your case before an independent review board.

Are there any online resources available to understand my tax bill?

+

Yes, Dorchester County provides online resources and tools to help property owners understand their tax bills. These resources offer detailed explanations of the tax calculation process, exemption programs, and payment options.

How can I stay informed about changes to the property tax system in Dorchester County?

+

To stay informed, it is recommended to subscribe to official county newsletters, follow local news outlets, and engage with community forums. These sources provide regular updates on any changes to the property tax system, ensuring you remain well-informed.