Mo State Tax Rate

Welcome to this comprehensive guide on the Missouri State Tax Rate, a critical aspect of financial planning for individuals and businesses within the state. Understanding the intricacies of state taxation is essential for making informed financial decisions and ensuring compliance with the law. This article will delve into the specifics of Missouri's tax system, providing a detailed breakdown of its various components and offering insights into its implications for taxpayers.

An Overview of Missouri’s Tax Landscape

Missouri, like many other states in the US, has a multifaceted tax system that encompasses various types of taxes. These taxes contribute to the state’s revenue and help fund essential services, infrastructure, and programs for its residents. Here’s an overview of the key tax categories in Missouri:

- Income Tax: Missouri imposes an income tax on individuals and businesses. The state's income tax structure is progressive, meaning tax rates increase as income levels rise. This ensures a fair distribution of tax burden across different income brackets.

- Sales and Use Tax: Missouri levies a sales tax on the sale of tangible goods and certain services. Additionally, a use tax is applicable when goods are purchased from out-of-state vendors, ensuring that all purchases made by Missouri residents are taxed.

- Property Tax: Property taxes are a significant source of revenue for local governments in Missouri. These taxes are assessed on real estate properties, including residential, commercial, and industrial properties.

- Franchise and Excise Taxes: Missouri imposes franchise taxes on certain business entities, such as corporations and limited liability companies. Additionally, excise taxes are levied on specific goods and services, including tobacco, alcohol, and motor fuel.

- Estate and Inheritance Tax: The state of Missouri has an estate tax and an inheritance tax. These taxes are applicable when an individual's estate is passed on to beneficiaries after their death.

Each of these tax categories plays a crucial role in Missouri's fiscal landscape, contributing to the state's ability to provide public services, maintain infrastructure, and support economic development. By understanding these tax structures, taxpayers can better navigate their financial obligations and plan their finances more effectively.

The Missouri State Tax Rate: A Detailed Analysis

Let’s now dive deeper into the heart of the matter - the Missouri state tax rate. The state’s income tax system is a key component of its overall tax landscape, and it is structured to ensure fairness and efficiency.

Progressive Income Tax Structure

Missouri’s income tax system follows a progressive model, which means that as taxable income increases, so does the tax rate. This approach aims to ensure that those with higher incomes contribute a larger share of their income to the state’s revenue.

| Income Bracket | Tax Rate |

|---|---|

| Up to $1,500 | 1.5% |

| $1,501 - $3,000 | 2.0% |

| $3,001 - $5,000 | 2.5% |

| $5,001 - $10,000 | 3.0% |

| $10,001 - $15,000 | 4.0% |

| $15,001 and above | 5.3% |

This table provides a simplified view of Missouri's income tax brackets and their corresponding rates. It's important to note that the state's tax code may include additional brackets, deductions, and credits that can impact an individual's or business's actual tax liability.

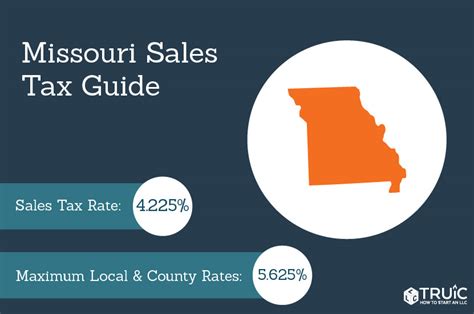

Sales and Use Tax Rates

In addition to income tax, Missouri imposes a sales and use tax on various goods and services. The sales tax is applied at the point of sale, while the use tax is applicable when goods are purchased from out-of-state vendors and used within Missouri.

| Category | Tax Rate |

|---|---|

| General Sales Tax | 4.225% |

| Food and Drugs | 1.225% |

| Energy Efficient Appliances | 1.225% |

| Certain Services (e.g., Utilities) | Varies by Service |

The above table provides a glimpse into Missouri's sales and use tax rates. However, it's important to note that these rates can vary based on the specific goods or services being taxed and the location within the state. Some localities may have additional sales tax rates on top of the state's general sales tax.

Property Tax Assessments

Property taxes are a significant source of revenue for local governments in Missouri. These taxes are assessed on the value of real estate properties, and the tax rates can vary widely depending on the location and type of property.

Here's a breakdown of the property tax process in Missouri:

- Assessment: Properties are assessed by local assessors based on their fair market value. This value is then used to calculate the property tax liability.

- Tax Rate Calculation: The assessed value is multiplied by the tax rate, which is set by local governments. The tax rate can vary from one locality to another.

- Payment: Property owners are responsible for paying their property taxes to the appropriate taxing authority. These taxes are typically due annually.

It's important for property owners to understand the assessment process and their rights regarding property tax appeals. Missouri law provides mechanisms for challenging property assessments if they are believed to be inaccurate or unfair.

Franchise and Excise Taxes

Missouri imposes franchise taxes on certain business entities, such as corporations and limited liability companies (LLCs). These taxes are based on the entity’s capital structure and can vary depending on the specific business type and its activities.

Additionally, the state levies excise taxes on specific goods and services. These taxes are often used to fund specific programs or initiatives. For instance, Missouri imposes excise taxes on tobacco products, alcohol, and motor fuel.

Estate and Inheritance Taxes

When it comes to estate planning, Missouri residents need to consider the state’s estate and inheritance tax laws. These taxes are applicable when an individual’s estate is passed on to beneficiaries after their death.

The estate tax is a tax on the transfer of an individual's estate, while the inheritance tax is levied on the beneficiaries who receive assets from the estate. The specific tax rates and exemptions can vary, and it's crucial for individuals to consult with tax professionals or estate planners to understand their potential tax obligations.

Tax Incentives and Credits in Missouri

Missouri, like many other states, offers various tax incentives and credits to promote economic development, support specific industries, and encourage certain behaviors. These incentives can provide significant savings for businesses and individuals who meet the eligibility criteria.

Economic Development Incentives

Missouri provides several economic development incentives aimed at attracting new businesses and supporting existing ones. These incentives often take the form of tax credits or abatements, which can reduce a business’s tax liability.

For example, the Missouri Works Program offers tax credits to businesses that create new jobs and make significant investments in the state. This program is designed to encourage economic growth and job creation, making it an attractive option for businesses looking to expand their operations.

Industry-Specific Tax Credits

Missouri also offers tax credits to support specific industries, such as agriculture, manufacturing, and renewable energy. These credits can provide significant savings for businesses operating in these sectors.

One notable example is the Missouri Renewable Energy Tax Credit, which provides a tax credit for the installation of renewable energy systems, such as solar panels and wind turbines. This credit aims to encourage the adoption of clean energy technologies and reduce Missouri's reliance on fossil fuels.

Personal Tax Credits

Missouri residents may also be eligible for various personal tax credits. These credits can reduce an individual’s tax liability and provide financial relief.

For instance, the Low-Income Housing Tax Credit is designed to encourage the development of affordable housing in Missouri. This credit provides a tax incentive for developers who create housing units for low-income individuals and families. It helps address the state's affordable housing needs and promotes economic inclusivity.

The Impact of Missouri’s Tax System

Missouri’s tax system has a significant impact on the state’s economy, businesses, and individuals. It plays a crucial role in shaping investment decisions, influencing consumer behavior, and contributing to the overall fiscal health of the state.

Economic Growth and Investment

The state’s tax incentives and credits can attract new businesses and encourage existing ones to expand. By offering tax breaks for job creation and investment, Missouri can stimulate economic growth and create a more competitive business environment.

Additionally, the state's progressive income tax structure ensures that higher-income earners contribute a larger share of their income to the state's revenue. This can help fund essential public services, such as education, healthcare, and infrastructure development, which are vital for long-term economic growth.

Consumer Behavior and Spending

Missouri’s sales and use tax rates can influence consumer behavior and spending patterns. Higher tax rates on certain goods and services may encourage consumers to seek alternatives or make purchasing decisions based on tax considerations.

For instance, the state's reduced tax rate on energy-efficient appliances aims to promote the adoption of environmentally friendly technologies. By offering a lower tax rate on these products, Missouri incentivizes consumers to make more sustainable choices, benefiting both the environment and the state's economy.

Tax Compliance and Administration

A well-designed tax system not only generates revenue but also ensures compliance and efficient administration. Missouri’s tax authorities play a crucial role in enforcing tax laws, collecting revenues, and providing support to taxpayers.

The state's Department of Revenue is responsible for administering and enforcing tax laws. They provide guidance, assist taxpayers with compliance, and ensure that businesses and individuals meet their tax obligations. Effective tax administration is essential for maintaining public trust and ensuring the fair and efficient collection of revenues.

Future Considerations and Trends

As Missouri’s tax landscape continues to evolve, several factors and trends will shape the state’s fiscal policies and tax system.

Changing Economic Landscape

The state’s economic growth, demographic shifts, and technological advancements will influence its tax policies. As industries evolve and new sectors emerge, Missouri may need to adapt its tax system to support these changes and ensure a competitive business environment.

Tax Reform Initiatives

There may be ongoing discussions and initiatives to reform Missouri’s tax system. These reforms could aim to simplify the tax code, reduce complexity, and provide greater transparency. Reform efforts may also focus on addressing specific issues, such as tax fairness, economic development, or environmental sustainability.

Impact of Federal Tax Policies

Changes in federal tax policies can have a ripple effect on state tax systems. Missouri’s tax authorities will need to stay informed about federal tax reforms and their potential impact on the state’s revenue and tax administration.

For instance, changes to federal tax rates or deductions could influence the state's tax structure and revenue streams. Missouri's tax authorities will need to carefully assess these changes and adjust their policies accordingly to maintain fiscal stability and fairness.

Conclusion: Navigating Missouri’s Tax Landscape

Understanding Missouri’s state tax rate and its broader tax system is essential for individuals and businesses operating within the state. The state’s progressive income tax structure, sales and use taxes, property taxes, and various incentives and credits all play a crucial role in shaping the fiscal landscape.

By staying informed about Missouri's tax policies and staying up-to-date with tax reforms and initiatives, taxpayers can make more informed financial decisions and ensure compliance with the law. Whether it's an individual filing their income tax return or a business planning its financial strategy, knowledge of Missouri's tax system is a key component of successful financial management.

How often does Missouri update its tax rates and laws?

+Missouri’s tax rates and laws are subject to change based on legislative decisions and economic factors. While there is no set schedule for updates, significant changes typically occur through the passage of new legislation or amendments to existing tax codes. It’s important for taxpayers to stay informed about any updates through official government channels and tax professional resources.

Are there any tax breaks or incentives for small businesses in Missouri?

+Yes, Missouri offers various tax incentives and credits to support small businesses. These include tax credits for job creation, investment, and specific industries. Small businesses should consult with tax professionals or refer to the Missouri Department of Economic Development’s website for more information on available incentives.

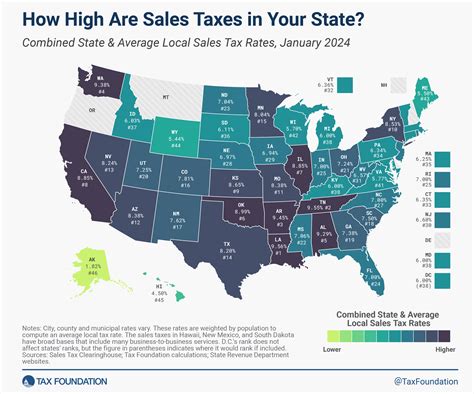

How does Missouri’s tax system compare to other states in the region?

+Missouri’s tax system can vary significantly from other states in the region. While some states may have higher income tax rates, others may rely more heavily on sales taxes. It’s essential to compare tax structures across states to understand the potential financial implications for businesses and individuals considering relocation or cross-state operations.