Montgomery County Md Tax Records

Welcome to our comprehensive guide on Montgomery County, Maryland's tax records. This article aims to provide an in-depth exploration of the tax landscape in this vibrant county, offering valuable insights for residents, businesses, and those curious about the financial aspects of this region.

Understanding Montgomery County's Tax Structure

Montgomery County, nestled in the heart of Maryland, boasts a diverse economy and a rich cultural tapestry. With its thriving businesses, beautiful residential areas, and vibrant community life, it is essential to understand the tax system that supports and sustains this vibrant county.

The tax structure in Montgomery County is meticulously designed to fund vital public services, infrastructure development, and community initiatives. From property taxes to income taxes, each component plays a crucial role in maintaining the county's prosperity and ensuring the well-being of its residents.

Property Taxes: A Cornerstone of County Finances

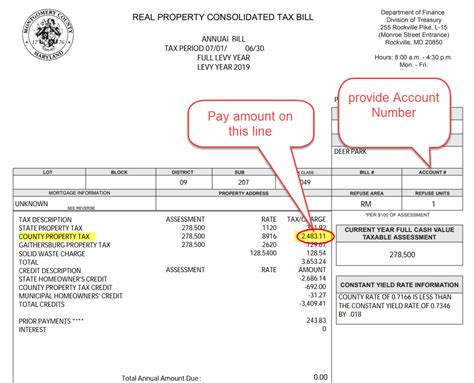

Property taxes form the backbone of Montgomery County's tax revenue. These taxes are levied on both real estate and personal property owned within the county. The assessment process, conducted by the Montgomery County Department of Finance, ensures fair and accurate valuation of properties, taking into account factors such as location, size, and recent improvements.

Here's a glimpse at the property tax rates in Montgomery County:

| Tax Rate Type | Rate per $100 of Assessed Value |

|---|---|

| Residential | 0.9735 |

| Commercial/Industrial | 1.1766 |

| Personal Property | 0.6255 |

It's important to note that these rates are subject to change annually, influenced by various factors such as budget requirements and economic conditions. Property owners can access detailed information on their tax assessments and payment schedules through the Montgomery County Property Tax Portal.

Income Taxes: Supporting County Services

In addition to property taxes, Montgomery County imposes income taxes on individuals and businesses operating within its borders. These taxes contribute significantly to funding essential services, including education, public safety, healthcare, and social programs.

The income tax rate in Montgomery County is 3.25%, which is applied to taxable income earned within the county. This rate is slightly higher than the state income tax rate of 2.8%, reflecting the county's commitment to providing high-quality services to its residents.

Businesses operating in Montgomery County are required to withhold income taxes from their employees' wages and remit these taxes to the county. Failure to comply with these obligations can result in penalties and interest charges.

Online Access to Tax Records: A Transparent System

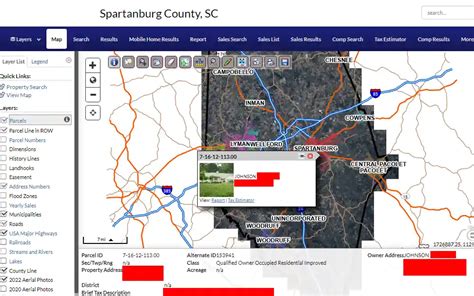

Montgomery County recognizes the importance of transparency and accessibility when it comes to tax records. To facilitate easy access, the county has developed an online platform known as the Montgomery County Tax Records Portal.

This user-friendly portal allows residents, businesses, and the general public to search and retrieve tax records with just a few clicks. Whether you're researching property tax assessments, income tax filings, or any other tax-related information, the portal provides a wealth of data at your fingertips.

Key Features of the Tax Records Portal

- Property Search: Users can search for tax records by property address, owner name, or account number. This feature is particularly useful for homebuyers, investors, and residents curious about their neighborhood's tax landscape.

- Tax Bill Information: Access detailed information on current and past tax bills, including due dates, payment amounts, and any applicable penalties or interest charges.

- Tax Payment History: Review your tax payment history, ensuring accurate record-keeping and providing a transparent overview of your tax obligations.

- Tax Assessment Details: Explore property tax assessments, including the assessed value, tax rate, and the breakdown of taxes owed.

- Income Tax Filings: Businesses and individuals can access their income tax filings, ensuring compliance and ease of reference.

The Montgomery County Tax Records Portal is a powerful tool that empowers residents and businesses to stay informed and actively participate in the county's financial ecosystem. By providing easy access to tax records, the county promotes transparency, accountability, and a sense of community involvement.

The Future of Montgomery County's Tax Landscape

As Montgomery County continues to thrive and evolve, its tax structure is likely to adapt and grow alongside it. The county's commitment to sustainable development, equitable tax policies, and community engagement will shape the future of its tax landscape.

In the coming years, we can expect to see ongoing efforts to streamline tax processes, enhance online services, and provide even greater transparency. The county's dedication to fiscal responsibility and efficient governance will ensure that tax revenues are allocated effectively, benefiting all residents and contributing to the county's continued prosperity.

Stay tuned for updates and further insights as Montgomery County navigates the dynamic landscape of taxation, always striving to create a vibrant, prosperous, and fiscally responsible community.

Frequently Asked Questions

How often are property tax assessments conducted in Montgomery County?

+Property tax assessments in Montgomery County are conducted every year to ensure fair and accurate valuations. This annual process allows for adjustments based on market conditions and property improvements.

Are there any tax incentives or exemptions available for homeowners in Montgomery County?

+Yes, Montgomery County offers various tax incentives and exemptions to eligible homeowners. These include the Homestead Tax Credit, which provides a credit on the taxable assessment of owner-occupied residential properties, and the Senior Citizen Tax Credit, which offers a reduction in property taxes for qualifying senior citizens.

How can businesses register for income tax withholding in Montgomery County?

+Businesses can register for income tax withholding by completing the appropriate forms available on the Montgomery County Department of Finance website. The process involves providing business details, employee information, and estimated tax withholdings.

What payment methods are accepted for tax payments in Montgomery County?

+Montgomery County accepts a variety of payment methods for tax payments, including online payments through the tax portal, credit card payments (with a processing fee), electronic funds transfer (EFT), and traditional methods such as checks and money orders.

Can I appeal my property tax assessment in Montgomery County?

+Yes, property owners have the right to appeal their tax assessments if they believe the valuation is inaccurate or unfair. The Montgomery County Assessment Appeals Board provides a process for appeals, allowing property owners to present their case and potentially receive a revised assessment.