Illinois State Tax Calculator

Illinois, the Land of Lincoln, is a diverse state with a vibrant economy and a rich cultural heritage. When it comes to taxes, understanding the system and having access to efficient tools can be crucial for individuals and businesses alike. This comprehensive guide aims to delve into the world of Illinois state taxes, offering an in-depth analysis and introducing a state-of-the-art tax calculator tailored to the unique tax landscape of Illinois.

Unveiling the Illinois State Tax System

The Illinois tax system, like many other states, consists of a combination of income taxes, sales taxes, and various other levies. However, Illinois has its own set of rules and regulations, which can sometimes make navigating the tax landscape a complex task. This guide aims to demystify these complexities and provide a clear understanding of how the Illinois state tax system operates.

Income Tax: A Key Component

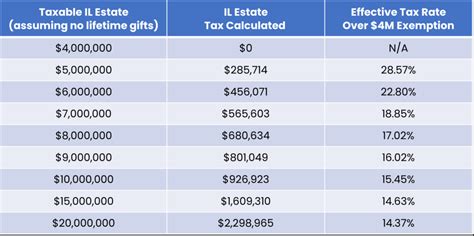

Illinois imposes an income tax on various sources of income, including wages, salaries, and investments. The state’s income tax rate stands at 4.95% for the majority of residents. However, it’s important to note that municipalities and counties might have additional income tax rates, making the effective tax rate slightly higher for some individuals.

For instance, in the city of Chicago, residents are subject to an additional 2.9% income tax, bringing the total to 7.85%. This rate is applicable for both individuals and corporations, making it a significant consideration for businesses operating within the city limits.

Sales Tax: A Diverse Landscape

Sales tax in Illinois is a multifaceted affair, with a state-wide rate of 6.25%. However, this rate can vary depending on the county and municipality. For example, Cook County, which includes Chicago, imposes an additional 1.25% sales tax, resulting in a total rate of 7.5% for most goods and services.

The state also offers exemptions and reduced rates for certain items, such as groceries and medications. These exemptions can significantly impact the total sales tax burden for individuals and businesses, making it crucial to stay informed about the latest regulations.

Other Illinois Taxes

Beyond income and sales taxes, Illinois has a range of other taxes that contribute to its overall tax landscape. These include property taxes, which are determined by the county and can vary significantly across the state, and a Use Tax, which is applied to out-of-state purchases that would have been subject to sales tax if made within Illinois.

Additionally, Illinois imposes a Personal Property Replacement Tax (PPRT) on certain types of personal property, such as vehicles and boats. The PPRT is calculated based on the value of the property and the location where it is registered.

The Illinois State Tax Calculator: A Revolutionary Tool

Navigating the intricate web of Illinois state taxes can be a daunting task, especially for those who are new to the state or those who are looking to optimize their tax strategies. This is where our innovative Illinois State Tax Calculator comes into play, offering a user-friendly and accurate solution to tax calculations.

Key Features of the Calculator

- Comprehensive Income Tax Calculation: Our calculator takes into account the varying income tax rates across Illinois, ensuring that you receive an accurate estimate of your income tax liability. Whether you’re a resident of Chicago or a rural town, our calculator has you covered.

- Sales Tax Estimation: With the ability to input the specific location of your business or residence, our calculator provides precise sales tax estimates. This feature is particularly useful for businesses looking to understand their tax obligations across different counties and municipalities.

- Property Tax Insights: While property taxes are determined locally, our calculator offers a general estimate based on your location. This can serve as a starting point for understanding your potential property tax burden.

- Use Tax Calculation: Don’t forget about the Use Tax! Our calculator takes care of this often-overlooked tax, ensuring that your calculations are complete and accurate.

User-Friendly Interface

Designed with simplicity in mind, our Illinois State Tax Calculator offers an intuitive interface that guides users through the tax calculation process step by step. Whether you’re a tax professional or a novice, you’ll find the experience straightforward and efficient.

Real-Time Data and Updates

Tax regulations are subject to change, and staying up-to-date is crucial. Our calculator is regularly updated with the latest tax rates and regulations, ensuring that you always have access to the most accurate information. This means you can trust the calculations and make informed decisions with confidence.

Benefits of Using the Illinois State Tax Calculator

The advantages of utilizing our advanced Illinois State Tax Calculator are numerous and can significantly impact your tax planning and financial strategy.

Precision and Accuracy

By factoring in the diverse tax rates and regulations across Illinois, our calculator ensures that your tax calculations are precise and accurate. This level of precision is crucial for both personal financial planning and business tax strategies.

Time Efficiency

Manually calculating taxes can be time-consuming and prone to errors. Our calculator streamlines the process, saving you valuable time and effort. With a few simple inputs, you can obtain comprehensive tax estimates, allowing you to focus on other aspects of your financial management.

Optimized Tax Planning

With accurate tax estimates at your fingertips, you can make more informed decisions about your financial future. Whether you’re an individual looking to maximize deductions or a business planning for growth, our calculator empowers you to develop strategic tax plans.

Conclusion: Empowering Illinois Residents and Businesses

Understanding and navigating the Illinois state tax system is a complex but essential task for residents and businesses alike. Our Illinois State Tax Calculator is designed to simplify this process, providing a powerful tool that delivers accurate, real-time tax calculations. With its comprehensive features and user-friendly interface, it’s an indispensable resource for anyone looking to thrive in the Land of Lincoln.

As you embark on your tax journey, remember that knowledge is power. Stay informed, utilize resources like our calculator, and take control of your financial future. Illinois is a state of opportunity, and with the right tools, you can make the most of it.

FAQs

What is the Illinois state income tax rate for individuals in 2023?

+The Illinois state income tax rate for individuals in 2023 is 4.95%. However, this rate can be higher in certain municipalities, such as Chicago, where the total rate can reach 7.85% due to additional city and county taxes.

Are there any sales tax exemptions in Illinois?

+Yes, Illinois offers sales tax exemptions for certain items. Groceries, medications, and some other specific categories are exempt from sales tax. It’s important to stay informed about these exemptions to optimize your tax obligations.

How often are the tax rates updated in the calculator?

+Our Illinois State Tax Calculator is updated regularly to reflect the latest tax rates and regulations. We aim to provide real-time data, ensuring that our users always have access to the most accurate information.

Can the calculator estimate my property tax liability in Illinois?

+While property taxes are determined locally, our calculator provides a general estimate based on your location. This estimate can serve as a starting point for understanding your potential property tax obligations.