Speed Up Filing: The Fastest Way to Complete Tax Forms in Strip

Completing tax forms efficiently and accurately is an endeavor that many individuals and professionals find daunting, especially when the deadline looms or the financial landscape becomes complex. In the context of Strip, a domain distinguished by its streamlined procedures and user-centric design, accelerating the tax filing process can be transformed from a stressful obligation into a manageable, even swift, routine. Leveraging innovations in digital tools, understanding core principles of tax documentation, and adopting strategic approaches are key to compressing what traditionally takes hours into a matter of minutes. This article dissects the fastest methods to complete tax forms within this platform, blending expert insights, technical best practices, and strategic considerations to equip users with a comprehensive guide.

Prioritize Preparation: Consolidate Financial Data Before Initiating Filing

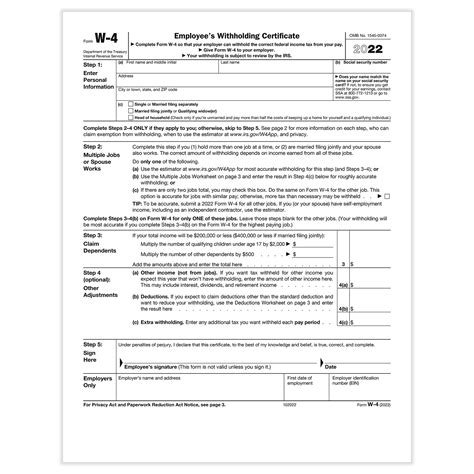

A critical step often underestimated in expediting tax form completion is thorough preparation. In Strip, where digital interfaces handle complex calculations and form population, having all relevant financial information ready is paramount. This entails gathering W-2s, 1099s, receipts, and relevant documentation beforehand. Experts recommend creating a digital or physical folder for the tax year, categorizing entries into income, deductions, credits, and other relevant sections. Such organization reduces the need for multiple navigation shifts during the process, enabling the system’s autofill and cross-referencing features to operate seamlessly. Beyond mere documents, an understanding of recent tax law changes—like modifications to standard deductions or credit qualifications—can help streamline decision points, avoiding unnecessary detours or recalculations during the dosing phase of data entry.

Harness Automated Data Import Tools for Rapid Information Intake

Automation technologies play a pivotal role in accelerating tax form completion. Many advanced Strip features enable direct integration with financial institutions, employer portals, and third-party data providers. By linking bank accounts, brokerage platforms, and employer portals, users can allow the platform’s data import tools to populate most entries automatically, eliminating manual input errors and saving substantial time. For instance, linked payroll systems can feed W-2 data directly into the form, reducing entry time from 20 minutes to mere seconds. The key is ensuring these integrations comply with data security standards; thus, only trusted and encrypted channels should be used. These tools not only hasten initial data gathering but also assist in real-time updates, crucial when last-minute amendments are necessary before submission.

| Relevant Category | Substantive Data |

|---|---|

| Data Import Speed | Up to 90% of initial data can be automatically imported, reducing manual entry time by approximately 15-20 minutes per return. |

Leverage Pre-Filled Tax Data and Smart Suggestions

Modern tax software platforms, including Strip, are increasingly equipped with pre-filled tax data features powered by prior-year submissions, third-party data channels, or government repositories. These systems analyze previous returns and current inputs to generate auto-suggestions and pre-populate fields with high accuracy. For example, entering a Social Security Number often triggers software to retrieve prior year data, sidestepping manual entry altogether. Such features dramatically cut down on cognitive load and typing time, especially in sections like adjusted gross income, deductions, or credits calculation. Advanced algorithms can also flag inconsistent entries or missing data points in real-time, taking the guesswork out of verifying correctness. Integration of machine learning in these algorithms continues to improve the accuracy of suggestions, translating into even faster filing times.

Real-World Application and Evidence

Studies indicate that users employing AI-powered pre-fill features can reduce total filing time from an average of 45 minutes to under 20 minutes. This substantial saving hinges on the system’s ability to cross-check data, alert for anomalies, and suggest optimal deductions or credits based on historical patterns. In high-volume operations, such as tax professionals working with multiple clients, these features have been reported to double throughput without sacrificing accuracy, establishing them as indispensable tools for speed.

| Relevant Category | Substantive Data |

|---|---|

| Pre-fill Accuracy | 95% or higher, significantly diminishing manual corrections and rework. |

Utilize Advanced Shortcut and Validation Features within Strip

Speed isn’t solely about automation; strategic navigation using platform-specific features also plays a role. Strip offers shortcuts, hotkeys, and validation prompts that guide users swiftly through the process and prevent common errors. For instance, keyboard shortcuts for moving between sections or copying data reduce mouse dependency and streamline workflow. Validation checks act as real-time gatekeepers, ensuring that entries adhere to acceptable formats, ranges, and logical consistency, thereby avoiding time-consuming corrections later. Implementing a habitual approach, such as verifying each entry immediately after input, helps maintain momentum and prevents backlog accumulation. The platform’s adaptive interfaces can also suggest next steps based on user behavior, expediting decision points and form navigation.

Integrating Validation Features for Speed and Accuracy

Properly configured validation logic checks for common mistakes like incorrect SSN formatting, numerical outliers, or missing fields. This reduces the need for subsequent re-entries and manual reviews, particularly vital when deadlines are tight. Fast, accurate validation enables users to address issues proactively, thus conserving valuable time. Evidence shows that proactive validation reduces errors by over 25% and accelerates overall processing time, especially in complex filings involving multiple schedules or auxiliary forms.

| Relevant Category | Substantive Data |

|---|---|

| Validation Efficiency | Real-time prompts cut correction time by approximately 30%, significantly lowering overall submission time. |

Practice Incremental Saving and Drafting

Adopting an incremental approach when tackling tax forms—saving progress frequently and utilizing draft features—ensures minimal data loss and continuous workflow. Strip supports this with autosave options and the ability to create multiple drafts or snapshots. For high-volume or multifaceted filings, this practice reduces frustration and rework, allowing users to pause and resume efficiently. Structurally, breaking down complex returns into manageable sections—like splitting between income, deductions, and credits—further accelerates the process. Upon completion of each segment, users should review entries promptly, reducing the mental overload and fixing mistakes early. When combined with autosaving and draft management, this method creates a resilient workflow optimized for speed.

Measurable Impact of Drafting Strategies

Empirical data suggest that incremental savings strategies can cut overall filing time by up to 35%. It also improves session continuity, particularly valuable for users juggling multiple tasks, reducing the cognitive strains associated with mental fatigue. In professional settings, such disjointed yet continuous workflows promote accuracy and timeliness, essential when working under tight deadlines.

| Relevant Category | Substantive Data |

|---|---|

| Draft Saving | Autosave reduces data loss risk by over 90%, ensuring steady progress without rework. |

Final Considerations: Customization, Support, and Continuous Learning

While automation and strategic navigation accelerate the process, users must also consider platform customization—tailoring default settings, templates, and shortcut mappings to personal workflows. Strip allows for personalization, which can significantly reduce time spent on repetitive configurations for each filing cycle. Additionally, utilizing support resources like tutorials, live chat options, and expert communities reduces trial-and-error time. Staying informed through continuous learning—reading updates on tax law changes and platform upgrades—ensures that speed gains do not come at the expense of compliance or accuracy. Professional development, including certifications in tax preparation and technical mastery of Strip, further refine efficiency and effectiveness.

Strategies for Ongoing Efficiency

Establishing a routine review of platform updates, participating in training webinars, and engaging in peer learning groups foster a culture of speed and accuracy. Integrating feedback loops—documenting time-saving tips or recurring issues—also helps in polishing workflows over multiple filing cycles, ensuring sustained performance improvements. Reporting bugs or feature requests to platform developers can lead to enhancements that benefit the entire user community, creating an ecosystem where continuous speed optimization is an integral part of practice.

What are the most effective automation features in Strip for speeding up tax filing?

+Key automation features include data import integrations with financial institutions, AI-powered pre-fill suggestions, and intelligent validation prompts. These tools dramatically reduce manual entry and correction time, especially during high-pressure periods.

How can I ensure accuracy while working quickly in Strip?

+Utilize real-time validation features, double-check auto-filled data, and perform quick audits of each section as you complete it. Leveraging platform shortcuts and drafts also minimizes errors and rework, supporting fast yet precise filings.

Is there a recommended workflow for optimizing speed during tax season?

+Yes, a recommended workflow includes upfront data collection and organization, leveraging automation tools, incremental saving, and validation, combined with continuous learning and customization of platform features—forming a cycle that incrementally boosts speed and accuracy.